PayPay Corporation(hereinafter “PayPay”)will offer PayPay Shikin Chotatsu(PayPay Funding), a service that allows PayPay merchants(※1)to receive in advance up to one million yen from their prospective sales via “PayPay” in as little as a few minutes,(※2)starting from March 26, 2024. This service will be provided on an invite-only basis, according to the merchants’ actual PayPay usage.

With PayPay Shikin Chotatsu, PayPay purchases the merchants’ future rights to request PayPay to pay out their proceeds, which enables them to raise funds. Invited merchants can complete the application for the service in two steps:(1)set the amount of funding and select the percentage to be taken from their sales, and(2)confirm the application details, all through the PayPay for Business app or the web version that are exclusively used by merchants for managing PayPay-related transactions. The service requires neither collateral, guarantee, nor documents. Once the application is completed, funding is available in as little as a few minutes.(※2)

■ PayPay Shikin Chotatsu application flow

As the amount of raised funds is automatically deducted from monthly sales at a fixed ratio, merchants can continue their business activities without strain, “repaying” a lot in a strong sales month and a little in a weak month. The commission rate for the service depends on the size of funding and the percentage of sales the merchants wish to be deducted from the monthly sales amount. The maximum possible amount and monthly factoring ratio are presented based on the merchants’ future sales patterns derived by AI from a substantial amount of payments and transaction data held by PayPay. In 2023, approximately 6.1 billion payments were made through “PayPay,” which means the app was used more than once every six payments for all cashless payments, including credit cards, code payments, and e-money,(※3)and consequently PayPay has accumulated a vast amount of data. PayPay Shikin Chotatsu uses the immense amount of data to support merchants that have direct contracts with PayPay.

Since “PayPay” becomes available at stores simply by placing a QR code, it has spread since its inception in 2018 mainly among small and medium-sized businesses that handled only cash. Under such circumstances, many funding-related issues were found while there were unexpected financing needs like responding to unforeseen equipment breakdowns and damages. Getting loans, which was a common way for fundraising, lays a time and psychological burden on business owners, such as preparing and submitting documents for screening, arranging collateral and guarantees, waiting long before receiving funds, and having cash flow issues caused by repaying fixed amounts. With this service, in the event of a sudden need for funds, merchants can receive their prospective sales via “PayPay” beforehand, rather than relying on traditional financing methods.

PayPay has indirectly supported merchants in expanding their sales through customer attraction and loyalty measures, such as “PayPay Coupon” and “PayPay Stamp Card“. Now, the company offers Shikin Chotatsu, which allows merchants to raise funds without borrowing money so that they can devote all their energy to their business.

■ Outline of the Shikin Chotatsu

Start date:March 26, 2024(Tuesday)

Eligibility:PayPay merchants(※1)that PayPay determines to be eligible for being funded based on their actual usage of “PayPay”

Amount available:10,000 yen to 1,000,000 yen

Percentage to be taken from monthly sales:Merchants can choose from three plans

Time to payout:As little as a few minutes(※2)

Application:Completed all in the PayPay for Business app or the web version that are exclusively used by merchants

Collateral/guarantee:Not required because this service is based on invitation

Commission rate: 3.0 % to 18.0 %(※4)

Overview:Merchants can raise funds by PayPay buying their future sales via “PayPay”(merchants’ rights to claim payout).

※1 At the launch of the service, limited to merchants that have a direct contract with PayPay and are selected by PayPay as an eligible user.

※2 Payout in as little as a few minutes for PayPay Bank, or on the day at earliest for other financial institutions.

※3 The research was conducted by PayPay. It calculated the payment share of “PayPay” based on the total number of credit card transactions from “Monthly Survey:Credit Card Trends” published by Japan Consumer Credit Association on February 29, 2024, debit card and e-money transactions from “Payment Trends” from the documents published by Bank of Japan on February 29, 2024, and code payments from “Stats – Code Payment” published by PAYMENTS JAPAN on March 25, 2024.

※4. It depends on the amount of funds to be advanced and percentage to be taken from monthly sales, decided by the merchants.

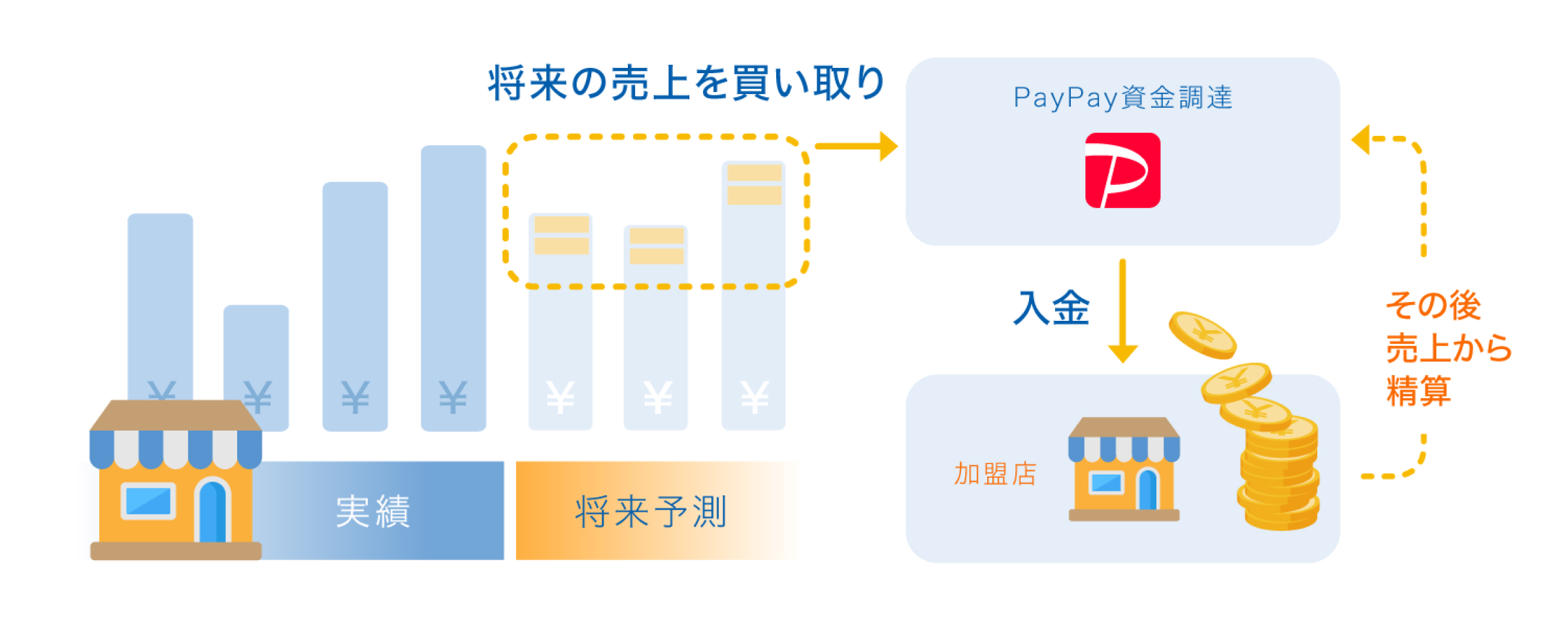

■ The mechanism of Shikin Chotatsu

PayPay is registered as follows:

・Prepaid Payment Instruments(third party type)Issuer(Registration number: Director-General of the Kanto Finance Bureau, No. 00710/Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc.(Registration number: Kanto(K)No. 106/Registration date: July 1, 2019)

・Telecommunications Carrier(Filing number: A-02-17943/Date filed: July 2, 2019)

・Fund Transfer Operator(Registration number: Director-General of the Kanto Finance Bureau, No. 00068/Registration date: September 25, 2019)

・Notified Person Entrusted with Intermediation(Filing number: C1907980/Date filed: December 18, 2019)

・Bank Agency Services(License: Director-General of the Kanto Finance Bureau(Gindai)No. 396/Registration date: November 26, 2020)

・Financial Instruments Intermediary Services(Registration number: Kanto Finance Bureau Director(Kinchu)No. 942/Registration date: June 25, 2021)

・Electronic Payment Agency Services(License: Director-General of the Kanto Finance Bureau(Dendai)No. 109/Registration date: February 14, 2023)

・Japan Payment Service Association(https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association(https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

※ “PayPay” provides 4 types of PayPay balance: PayPay Money, PayPay Money Lite, PayPay Points, and Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account(no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay(Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Points cannot be sent or transferred between PayPay users or be cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered(the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

※ Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.