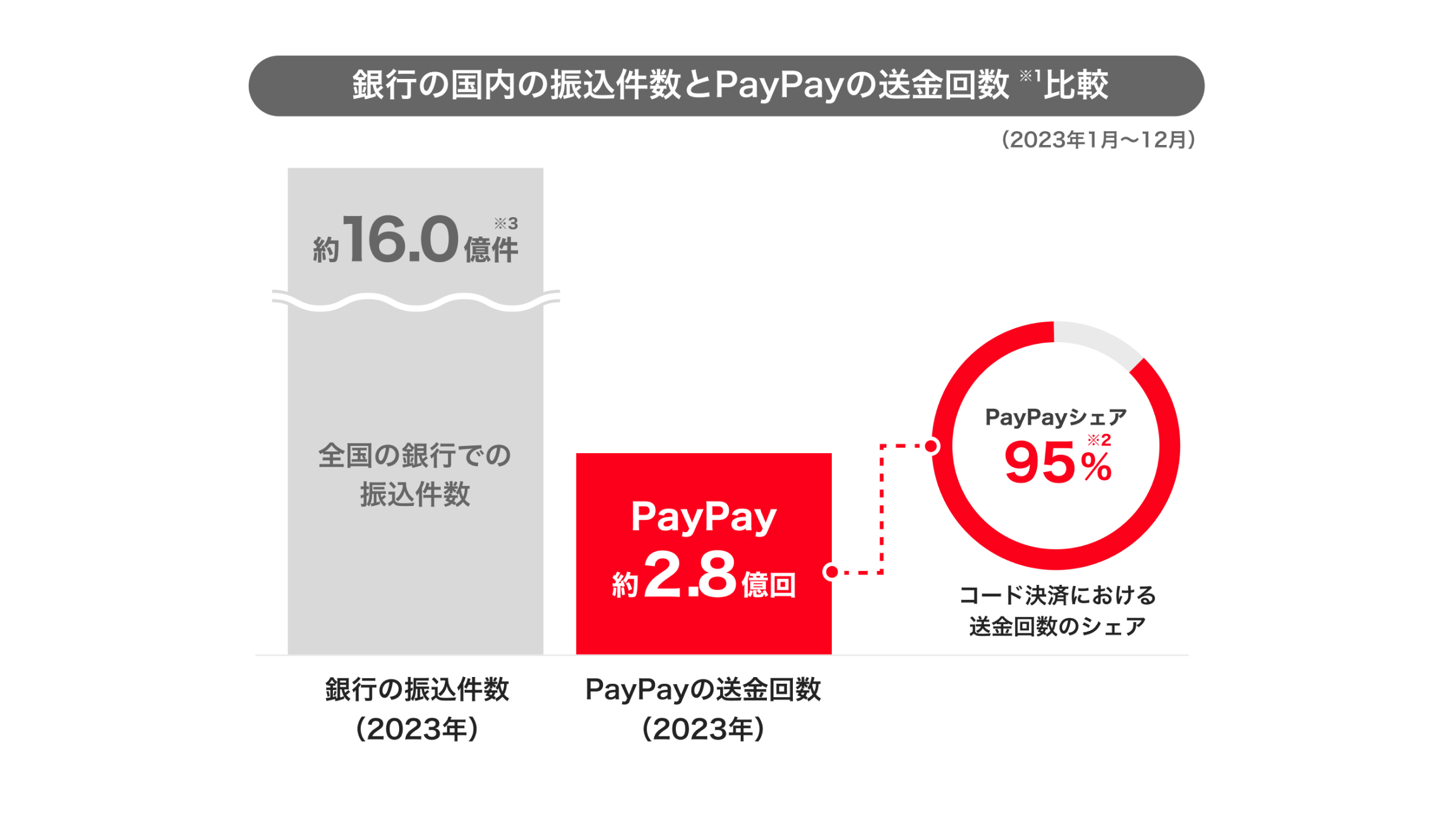

PayPay Corporation(hereinafter PayPay)is pleased to announce that the Send/Receive feature was used approximately 280 million times during 2023 to make remittances(※1), a 65.5% increase compared to the previous year. This represents a share of over 95%(※2)of remittances in the code payments industry. This number is one-sixth of the 1.6 billion domestic bank transfers conducted nationwide(※3) reported by the Japanese Bankers Association. This indicates that PayPay remittances are used for an increasingly wide range of purposes, from splitting bills to sending family members pocket money. Still growing at a pace of 1.4 times year over year with the average number of remittances per day surpassing one million in March 2024, the demand for PayPay remittances is expected to increase even further.

※1 When sending PayPay Money, it is a “remittance,” and when sending PayPay Money Lite, it is a “transfer.” See PayPay Balance Terms of Use for details. The number of remittances announced in this press release includes transfers of PayPay Money Lite.

※2 Researched by PayPay, by comparing PayPay transactions to the statistics published by PAYMENTS JAPAN(Code Payment Trends, published March 25, 2024).

※3 From the statistics published by the Japanese Bankers Association(Domestic Exchange Transactions, etc., in the Annual Report on Payment Statistics for 2023), which include not only consumer-to-consumer, but also consumer-business and business-to-business transfers excluding salary payments.

PayPay launched its cashless payment service “PayPay” in October 2018, and released the “Send/Receive” feature the following month, which enabled PayPay Balance remittances between users. Many users have since enjoyed the feature, as in addition to being able to remit PayPay Balance immediately 24/7 and free of charge, it also offers group functionalities for multiple users to split a single bill such as when eating out or buying a present.

A scheduling feature was also added in October 2022 to set up regular recurring transfers. The number of remittances using the scheduling feature in March 2024 was 2.6 times that of the same period in the previous year, and the number of people using PayPay to send their family pocket money continues to increase. In light of such increasing demand, the daily limit for remittances was raised from 100,000 yen to 300,000 yen in April 2024 for users who have verified their identity.

Furthermore, as a fund transfer service with a broad user base, PayPay continuously enhances its security measures to ensure that the remittance feature can be used safely and with confidence. In addition to employing an AI system and dedicated team that monitors for fraud around the clock, a feature designed to alert users about potential scams was released in November 2023. A warning is displayed when someone receives a remittance request from a user they have never interacted with on PayPay, or when they attempt to make a remittance is being made to a user who is considered suspicious based on their usage activities. PayPay will continue to strengthen its security measures to prevent damages resulting from fraudulent use.

[Overview of the Send/Receive feature]

Availability:Send or receive immediately around the clock(24 hours a day, 365 days a year)

Limit:300,000 yen(within past 24 hours)or 500,000 yen(within past 30 days)

Fees:None

How to remit:Scan the My Code of the recipient or input their phone number, PayPay ID, or display name to send; no bank account information is required.

Features:

・Scheduling feature: Specify a date or weekday to set up an automatic recurring transfer.

・Group payment feature: Create a group from multiple users and request them to contribute to a payment in equal or differing amounts, and check payment completion status once the request is sent.

Financial institutions integrated:Top-ups to PayPay can be made for free from over 1,000 financial institutions, which can then be sent to other users.

Withdrawals:Users who have verified their identity can withdraw their PayPay Money to a bank account for free if it is a PayPay Bank account, or for 100 yen(tax included)to accounts of other banks.

PayPay will continue to strive for a world where users and all types of restaurants and service providers can enjoy the convenience of cashless payments and confidently use the cashless payment service, evolving “PayPay” from a payment app into a super app that enriches users’ lives and makes them more convenient, fostering a world where paying “Anytime, Anywhere with PayPay” is a reality. As the company was designated by the Financial Services Agency as a Specified Essential Infrastructure Service Provider in November 2023, PayPay is committed to continue providing an even safer and more secure environment for users.

PayPay is registered as follows:

・Prepaid Payment Instruments(third party type)Issuer(Registration number: Director-General of the Kanto Finance Bureau, No. 00710/Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards(Registration number: Kanto(Ku)No. 106/Registration date: July 1, 2019)

・Telecommunications Carrier(Filing number: A-02-17943/Date filed: July 2, 2019)

・Fund Transfer Operator(Registration number: Director-General of the Kanto Finance Bureau, No. 00068/Registration date: September 25, 2019)

・Notified Entity Entrusted with Intermediation(Filing number: C1907980/Date filed: December 18, 2019)

・Bank Agency Services(License: Director-General of the Kanto Finance Bureau(Gindai)No. 396/Registration date: November 26, 2020)

・Financial Instruments Intermediary Services(Registration number: Kanto Finance Bureau Director(Kinchu)No. 942/Registration date: June 25, 2021)

・Electronic Payment Agency Services(License: Director-General of the Kanto Finance Bureau(Dendai)No. 109/Registration date: February 14, 2023)

・Japan Payment Service Association(https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association(https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

※ “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Certificates.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account(no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay(Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Points cannot be sent or transferred between PayPay users or be cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered(the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

※ Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.