PayPay Card Corporation(Chiyoda-ku, Tokyo; President & Representative Director: Tomoaki Tanida; hereinafter “PayPay Card”)and PayPay Corporation(Minato-ku, Tokyo; President & Representative Director, CEO, Corporate Officer: Ichiro Nakayama; hereinafter “PayPay”)will implement updates for the mini app(※1)”PayPay Card,” which is offered as part of the cashless payment service “PayPay.” These updates will be rolled out sequentially in June 2024. They include the addition of PayPay Points information on the home screen of the mini app for PayPay Card-holders, and the introduction of a feature that allows users to register store names in the transaction history of “PayPay” when the store name paid with PayPay Card(including PayPay Card Gold)is not displayed.

※1 The mini app functionality allows services such as booking appointments and ordering products from partner companies of PayPay to be seamlessly conducted through the PayPay app.

Display of PayPay Points in the PayPay Card mini app updated

With this update, the home screen of “PayPay Card” will now display the number of points granted for the billing amount of the current month, as well as the points scheduled to be granted for the billing amounts of subsequent months.(※2)Additionally, the points grant rate applied to the use of PayPay Card will be shown.(※3)This allows users to check their usage amount, the number of points accumulated, the points scheduled to be granted, and the current points grant rate all on one screen, making it easier to see the benefits.

※2 The displayed points total includes points from the use of PayPay Card, PayPay Credit, and various promotional campaigns. Points from the use of PayPay Balance are not included. For more details, please refer here.

※3 The displayed grant rate is the rate applied at the time of display for the use of PayPay Card. The grant rate varies based on the achievement status of PayPay STEP in the previous month. For details on PayPay STEP, please refer here.

<PayPay Points information displayed on the PayPay Card mini app home screen>

Addition of store name registration feature in “PayPay” transaction history

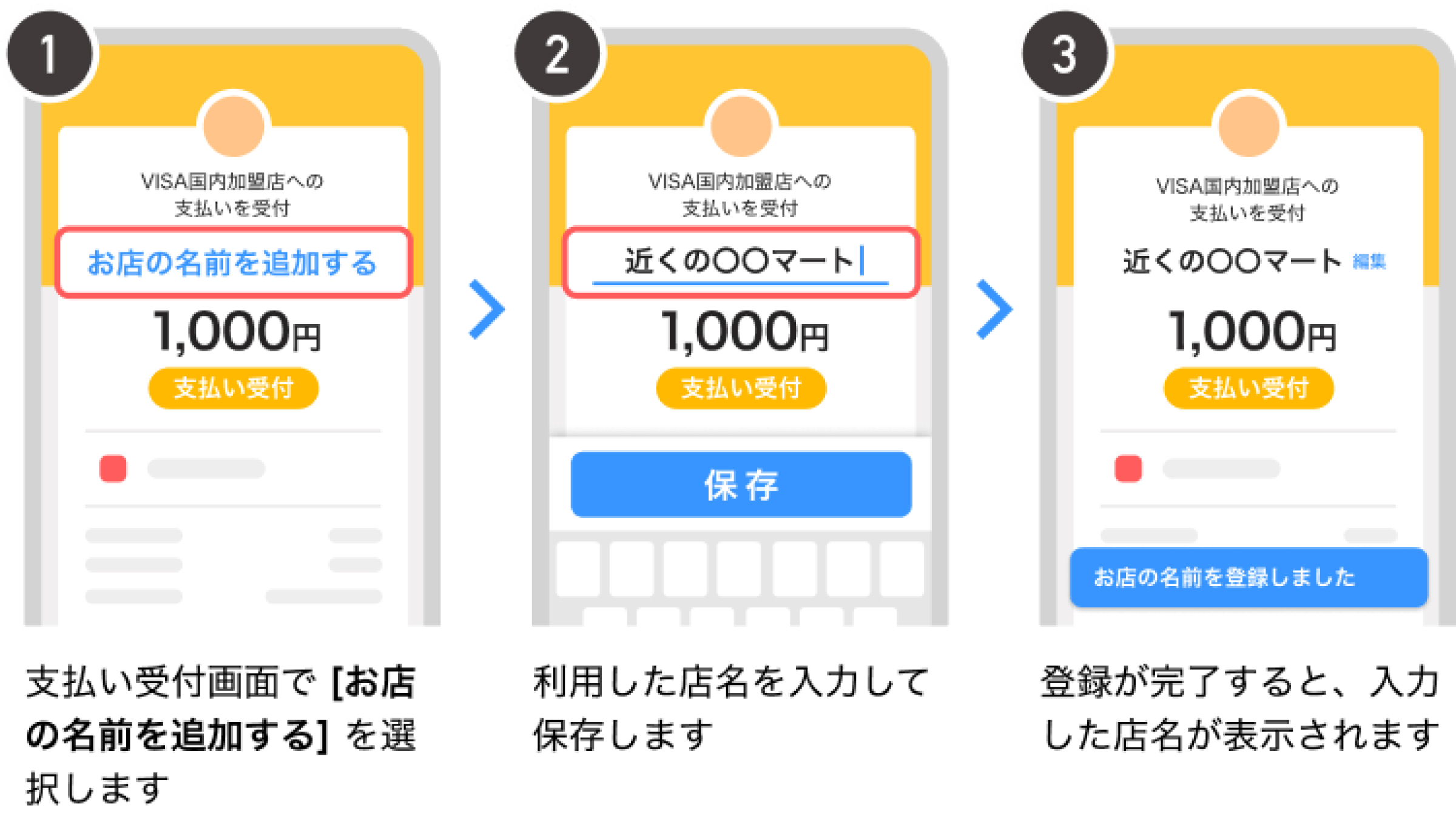

Addition of store name registration feature in “PayPay” transaction history When using PayPay Card, the transaction history in the PayPay app will immediately show the status as “Payment Accepted(yellow screen),” allowing real-time confirmation of transaction details such as when and where the payment was made. However, for some payments, the store name may not be displayed until the status is “Payment Completed(green screen).” With the addition of this feature, if the store name is not displayed in the “Payment Accepted” screen, users can now register the store name themselves. This helps users prevent ambiguity regarding where they used their PayPay Card, making payment management easier.

※ Display in the PayPay app transaction history is available for those who have set up “PayPay Credit.” It will appear in the transaction history for payments made after setting up “PayPay Credit.” For more details on setting up, please refer here.

※ Please update the PayPay app to the latest version(4.49.0 or later).

<How to register store names>

※ This feature is only available for registration and editing in the “Payment Accepted” screen.

※ Once the status changes to “Payment Completed,” the officially registered store name will be displayed, and any user-registered store names will be deleted. If a user pays at the same store again with PayPay Card in the future, the registered store name will be displayed in the “Payment Accepted” screen.

PayPay Card and PayPay will continue efforts to display official store names and logos in the “Payment Accepted” screen in the transaction history of the PayPay app.

Moreover, if users wish to continue managing stores where they used PayPay Card with names they have designated even after the payment is completed, they can utilize the memo feature in the billing statement of the PayPay Card mini app. The memo allows users to enter notes about store names and purpose of purchase in the billing statement and filter the statement based on these notes. For more details on the memo function, please refer here.

PayPay Card and PayPay are committed to enhancing user satisfaction and delivering convenient and rewarding experiences with a user-first approach, aiming to establish a leading standard for cashless services in Japan.

■ About PayPay Card

PayPay Card Corporation changed its name from YJ Card Corporation on October 1, 2021, and began operations under the new name with the aim of becoming the leading card company in Japan. In October 2022, the company became a wholly owned subsidiary of PayPay Corporation and further strengthened its synergy with the cashless payment service “PayPay.” PayPay Card will continue to expand its services to make them available in a broad range of payment scenarios, as well as to provide further convenience to users.

■ About “PayPay,” the cashless payment service provided by PayPay Corporation

“PayPay” is a cashless payment service that continues to expand throughout Japan, facilitating transactions at large chain stores, small to medium-sized shops, vending machines, taxis, and public transportation. It is also available for a variety of payment scenarios, including online services and bill payments for utilities. Additionally, the service offers convenient features beyond payments, such as the ability to “Send/Receive” PayPay Balance (PayPay Money and PayPay Money Lite) between users without any fees. The “Earn Points” feature allows users to exchange PayPay Points for points with a partner service provider to simulate investment experiences offered by the providers. Furthermore, PayPay Corporation has established a 24/7 telephone support line and a compensation system to ensure user safety, providing peace of mind in case of any incidents.

PayPay is registered as follows:

・Prepaid Payment Instruments(third party type)Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710/Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc.(Registration number: Kanto(K)No. 106/Registration date: July 1, 2019)

・Telecommunications Carrier(Filing number: A-02-17943/Date filed: July 2, 2019)

・Fund Transfer Operator(Registration number: Director-General of the Kanto Finance Bureau, No. 00068/Registration date: September 25, 2019)

・Notified Person Entrusted with Intermediation(Filing number: C1907980/Date filed: December 18, 2019)

・Bank Agency Services(License: Director-General of the Kanto Finance Bureau(Gindai)No. 396/Registration date: November 26, 2020)

・Financial Instruments Intermediary Services(Registration number: Kanto Finance Bureau Director(Kinchu)No. 942/Registration date: June 25, 2021)

・Electronic Payment Agency Services(License: Director-General of the Kanto Finance Bureau(Dendai)No. 109/Registration date: February 14, 2023)

・Japan Payment Service Association(https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association(https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” provides 3 types of PayPay balance: PayPay Money, PayPay Money Lite, and Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Points cannot be sent or transferred between PayPay users or be cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

※ Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.