“PayPay Coupon” service page:https://paypay.ne.jp/guide/coupon/

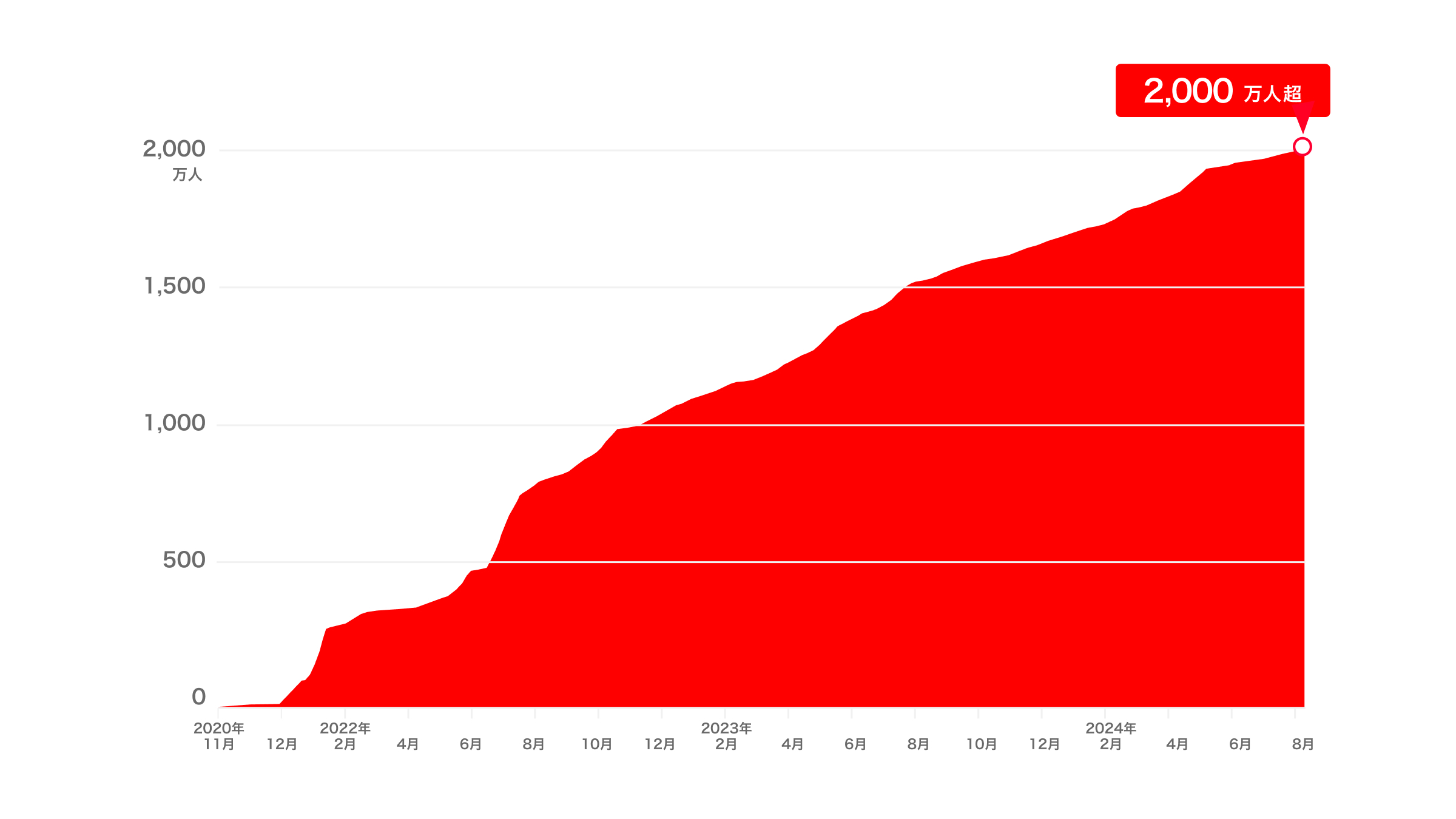

PayPay Corporation(hereinafter “PayPay”)is pleased to announce that as of August 2024 more than 20 million people in total have used PayPay Coupons since the launch of the service in November 2020.(※1)

※1 Total number of users who have claimed PayPay Coupons as of August 2024.

Merchants who have subscribed to the “PayPay My Store Lite Plan”(※2)can issue PayPay Coupons suiting their needs and offer it in the PayPay app to be used at their stores. Users need only to claim the PayPay Coupon in advance in the PayPay app, which will be automatically applied to the payment at an applicable merchant, granting usually between 5% to 20% worth of the payment as “PayPay Points.” PayPay Coupons can be used not only in physical stores, but also for online shopping and services.

Due to the convenience and savings they offer, PayPay Coupons have been used approximately 240 million times by more than 20 million users to date. In total these payment add up to approximately 612 billion yen(※3), with the average user spending more than 30,000 yen and using coupons approximately 12 times(※4).

For merchants, PayPay Coupons provide not only the ability to market to more than 64 million PayPay users(※5), but also other benefits, such as increasing average spend and frequency of store visits, as well as attracting new customers. The number of merchants issuing PayPay Coupons is growing, with many major chains, including Seven-Eleven, McDonald’s, and Daiso, offering coupons.

In addition, “Coupon Monday” is held every Monday to deliver bargain coupons. Users can also check the latest status of PayPay Coupons issued by a wide range of stores and companies, from famous brands to stores near their homes(※6).

※2 “PayPay My Store Lite Plan” is a paid service for merchants that allows them to issue PayPay Coupons and PayPay Stamp Cards to promote sales(1,980 yen/month(tax excluded)per store). In addition to the existing features, new functionality to promote digitalization and DX(digital transformation)are planned to be added to the lineup. Merchants who subscribe to the Lite Plan can enjoy further convenience of “PayPay,” with a payment system fee of 1.60%(if not subscribed to the “PayPay My Store Lite Plan,” the payment system usage fee is 1.98%).

※3 Payment amounts and counts are cumulative totals from the launch of the “PayPay Coupon” service in November 2020 until July 2024.

※4 Average payment amount and number of times “PayPay Coupon” users(approximately 20 million people)have used coupons to make payments.

※5 The number of registered PayPay users as of June 2024.

※6 See here for the latest status of merchants issuing PayPay Coupons and other information.

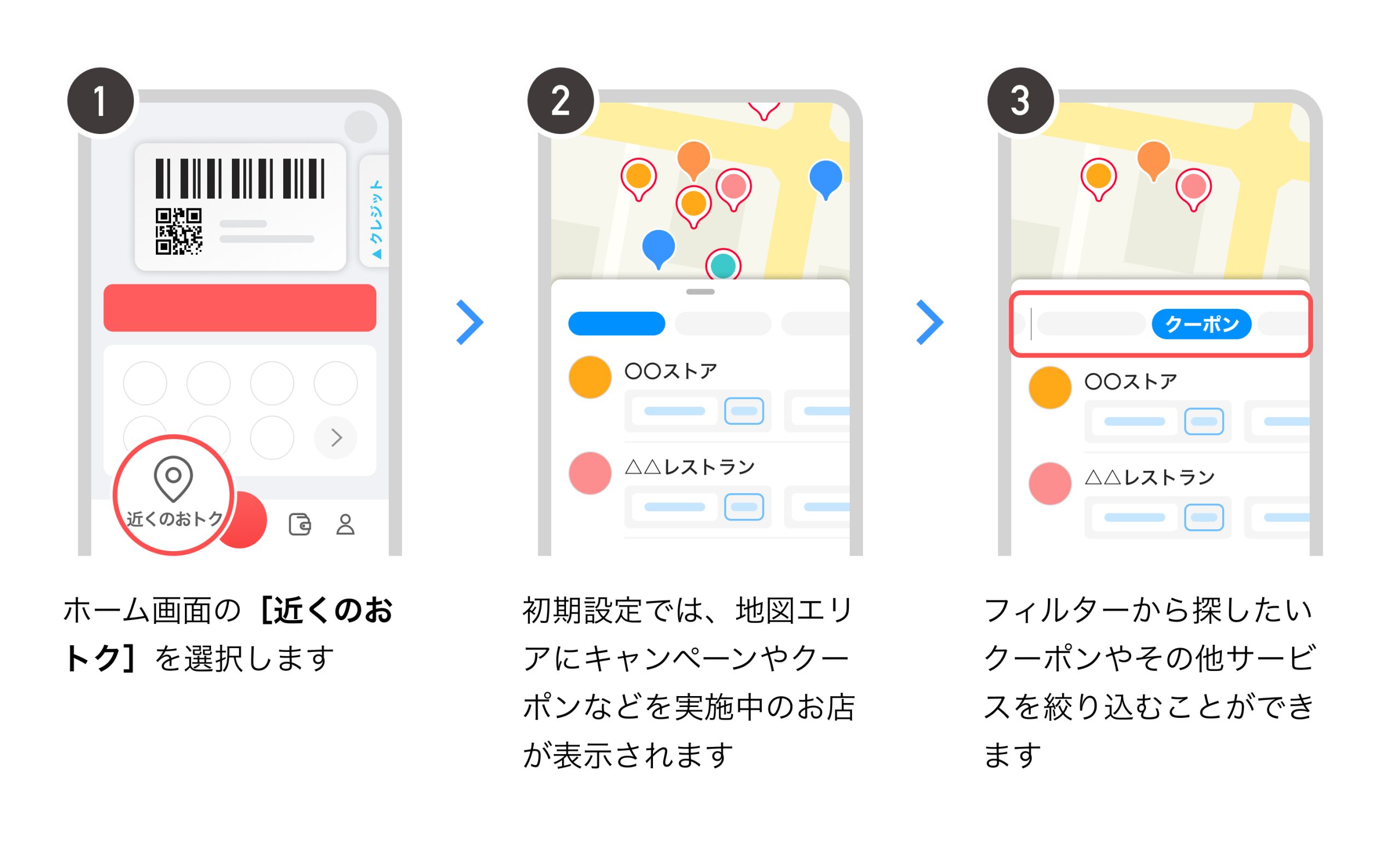

■ How to claim and check PayPay Coupons

Simply select “Coupons” from the home screen of the PayPay app and tap the “Claim” button displayed on the merchant or product to claim a “PayPay Coupon”(Fig.1).

Merchants that issue PayPay Coupons can also be found by selecting “>Deals” from the PayPay app home screen and using the map. Users who have enabled access to location information can search from their current location, while those who have not can search by address or station name(Fig.2).

Claimed PayPay Coupons and PayPay Points earned from coupons can be viewed by switching to the “My Coupons” tab at the top of the “PayPay Coupons” screen(Fig.3).

PayPay has been indirectly helping merchants to increase their sales through initiatives attracting more customers and encouraging repeat visits, such as PayPay Stamp Cards and PayPay Coupons. In addition, on March 26, 2024, PayPay started offering “PayPay Shikin Chotatsu(PayPay Funding),” which allows merchants to receive up to one million yen lump sum financing via PayPay based on future sales. Going forward, PayPay will strive to continue providing an environment conducive to doing business for merchants.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments(third party type)Issuer(Registration number: Director-General of the Kanto Finance Bureau, No. 00710/Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc.(Registration number: Kanto(Ku)No. 106/Registration date: July 1, 2019)

・Telecommunications Carrier(Filing number: A-02-17943/Date filed: July 2, 2019)

・Fund Transfer Operator(Registration number: Director-General of the Kanto Finance Bureau, No. 00068/Registration date: September 25, 2019)

・Notified Entity Entrusted with Intermediation(Filing number: C1907980/Date filed: December 18, 2019)

・Bank Agency Services(License: Director-General of the Kanto Finance Bureau(Gindai)No. 396/Registration date: November 26, 2020)

・Financial Instruments Intermediary Services(Registration number: Kanto Finance Bureau Director(Kinchu)No. 942/Registration date: June 25, 2021)

・Electronic Payment Agency Services(License: Director-General of the Kanto Finance Bureau(Dendai)No. 109/Registration date: February 14, 2023)

・Japan Payment Service Association( https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association( https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

※”PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account(no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay(Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered(the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see Applying for compensation for details.

※ Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.