LY Corporation(hereinafter LY)and PayPay Corporation(hereinafter PayPay)are pleased to announce that an entry point to the “Send/Receive” feature of the cashless payments app “PayPay” has been made on the communication app “LINE,” enabling its use from LINE Chats.

Usage Guide For All on “How to Send/Receive PayPay Balance” :

https://lin.ee/ejfvEOq/xssq

Users can send “PayPay Balance” via the “Send/Receive” feature on “PayPay” for free 24 hours a day, 365 days a year. The feature holds approximately 95% of the share of number of transfers*1 in code payments. *2 Already, users can send “PayPay Balance” and requests for a specified balance to “LINE” friends from “PayPay,” which is used for settling restaurant bills with friends and coworkers and sending allowances to family members. Now, users can send a payment request for a specified amount of “PayPay Balance” to friends through the “+” icon menu in “LINE” Chats free of charge. *3 Also, when using the “PayPay Balance” or “Send/Receive” features in Group Chats, only requests for the same amount to members of the group chat are supported. Details are available on the official website.

※1 Source: PayPay research tallying “PayPay” percentage in “Code Payments Usage Trends Survey Published 22 August 2024” by Payments Japan Association.

※2 Includes transfers of both “PayPay Money” and “PayPay Money Lite.”

※3 When using the “Send/Receive” feature of “PayPay” from “LINE” Chats, use version 14.16.0 or above of “LINE” and version 4.64.0 above of “PayPay.” Also, the feature is not supported in OpenChats, LINE Official Account, or the desktop version of “LINE.”

As already announced, the sending and transfer features of “LINE Pay” available in “LINE” Chats since December 2014 will be closed on Tuesday, 22 October. *4 The sending and transfer features of “LINE Pay” were utilized by many users, as they enabled exchange as an extension of “LINE” conversations with friends and family. To enable equivalent money-related communication on “LINE,” an entry point to the “Send/Receive” feature of “PayPay Balance” will be provided in “LINE” Chats through integration with PayPay. Users do not need to link their “LINE” and “PayPay” IDs, nor will any account information be shared. As long as users have a PayPay account, they can continue to exchange money with speed and ease, without the trouble of preparing bills or change.

※4 Reference:LINE Pay Service Closure Announcement https://line-pay-info.landpress.line.me/payment-info/

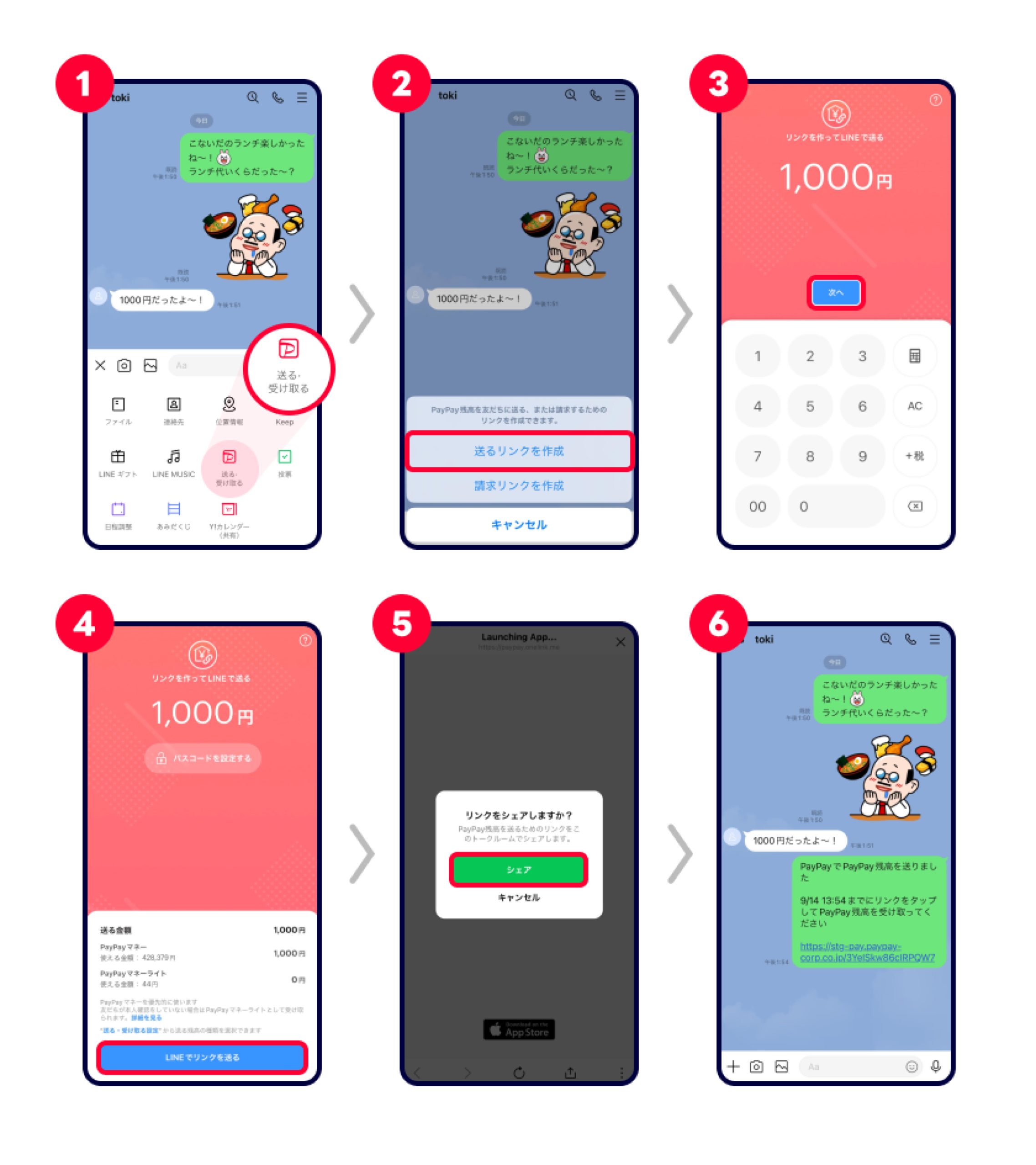

■ How to Send “PayPay Balance” from “LINE” Chats

Select the Chat with the friend you want to send “PayPay Balance” to and tap the “+” menu to the right of the message box then “Send/Receive”

Tap “Create Send Link”

Navigate to the PayPay app, input the amount you want to send and tap “Next”

Tap “Send Link on LINE” in the PayPay app

Tap “Share” the link and send the link to send “PayPay Balance”

※ The scope of features available differs between Chats and Group Chats.

※ If your “PayPay Balance” is insufficient to send the amount of money you specify, you must top it up.

※ You can send “PayPay Balance” to a receiver even if they have not set up a PayPay account, but they must set one up in order to receive and use the “PayPay Balance” set.

※ Users who receive the receive link in the Chat can tap it, then “Receive” on the PayPay app screen to add it to their “PayPay Balance.”

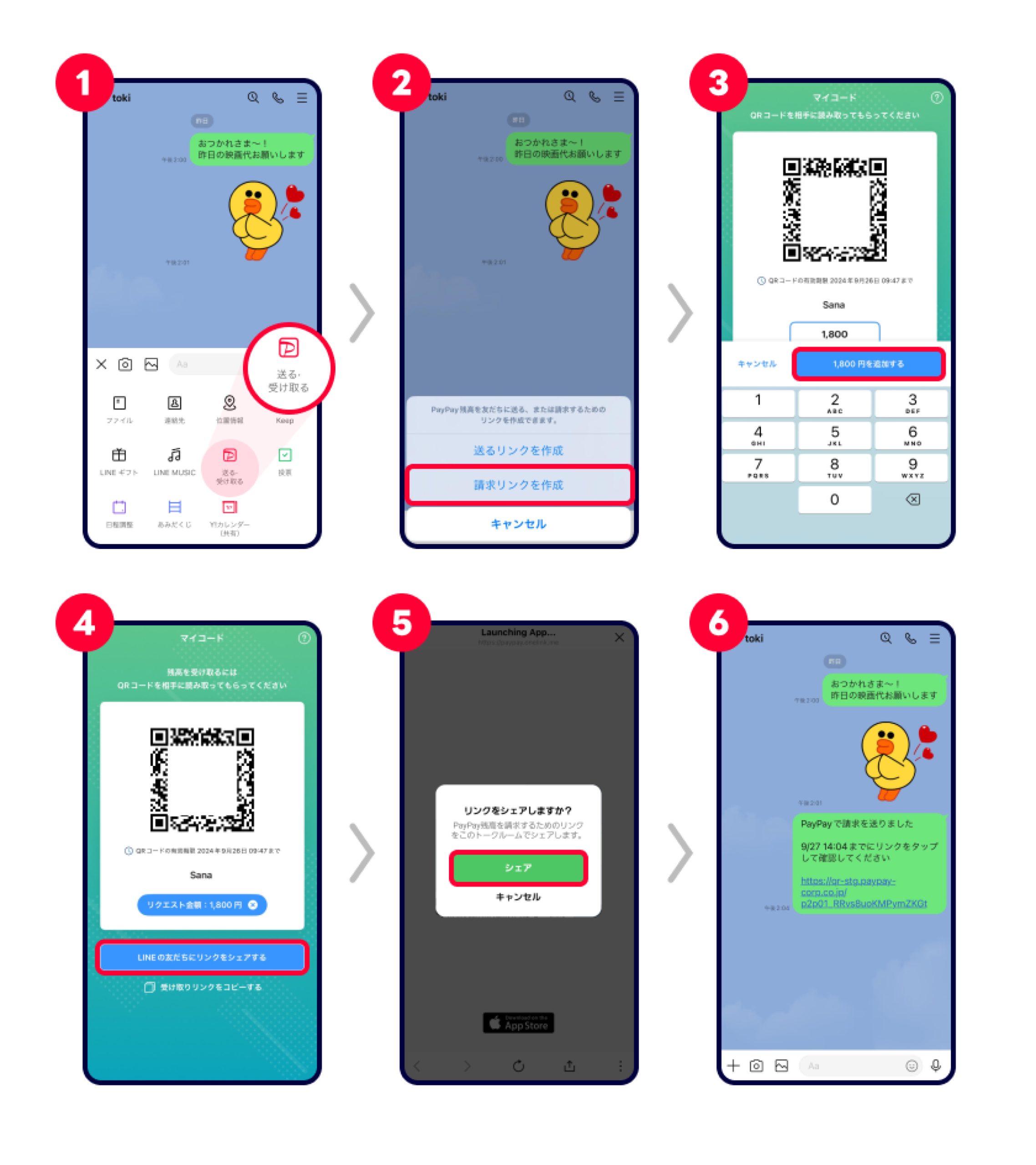

■ How to Make a Payment Request from “LINE” Chats

Select the Chat with the friend you want to send a request to, then tap “Send/Receive” from the “+” menuto the right of the message bar

Tap “Create Link””

Navigate to the PayPay app, input the amount you want the friend to pay, and tap “Add(amount)yen”

Tap “Share Link With LINE Friend” on the PayPay app

Tap “Share” the link to send the “PayPay Balance” request link

※ Users can make a payment request in Group Chats by tapping “Request” from the “+” menu.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments(third party type)Issuer(Registration number: Director-General of the Kanto Finance Bureau, No. 00710/ Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards(Registration number: Kanto(Ku)No. 106/Registration date: July 1, 2019)

・Telecommunications Carrier(Filing number: A-02-17943/Date filed: July 2, 2019)

・Fund Transfer Operator(Registration number: Director-General of the Kanto Finance Bureau, No. 000683/Registration date: September 25, 2019)

・Notified Entity Entrusted with Intermediation(Filing number: C1907980/Date filed: December 18, 2019)

・Bank Agency Services(License: Director-General of the Kanto Finance Bureau(Gindai)No. 396/Registration date: November 26, 2020)

・Financial Instruments Intermediary Services(Registration number: Kanto Finance Bureau Director(Kinchu)No. 942/Registration date: June 25, 2021)

・Electronic Payment Agency Services(License: Director-General of the Kanto Finance Bureau(Dendai)No. 109/Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labor and Welfare(No. 00001/Date of designation: August 9, 2024)

・Japan Payment Service Association(https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association(https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

※ “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Certificates.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account(no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay(Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered(the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see Applying for compensation for details.