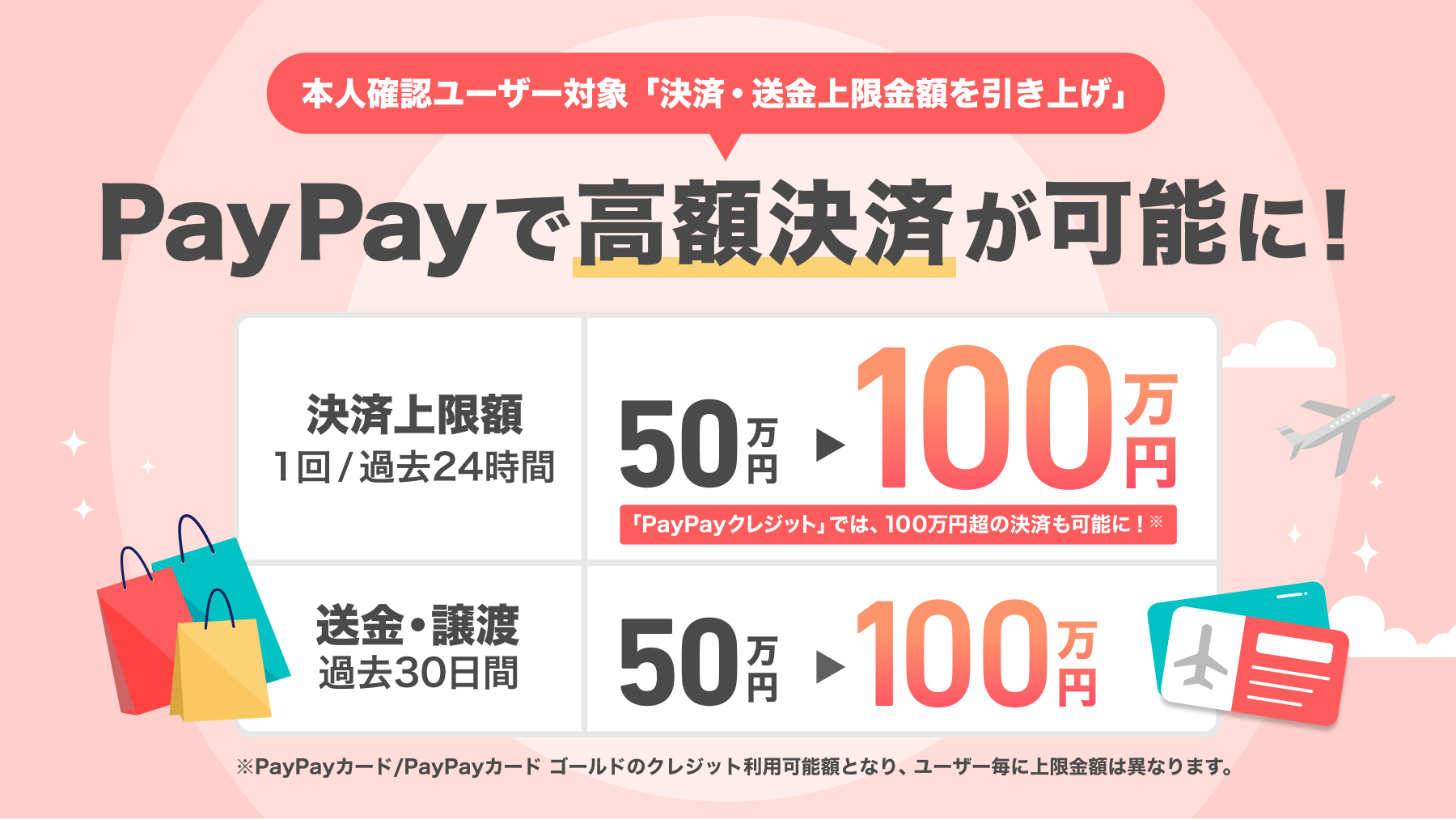

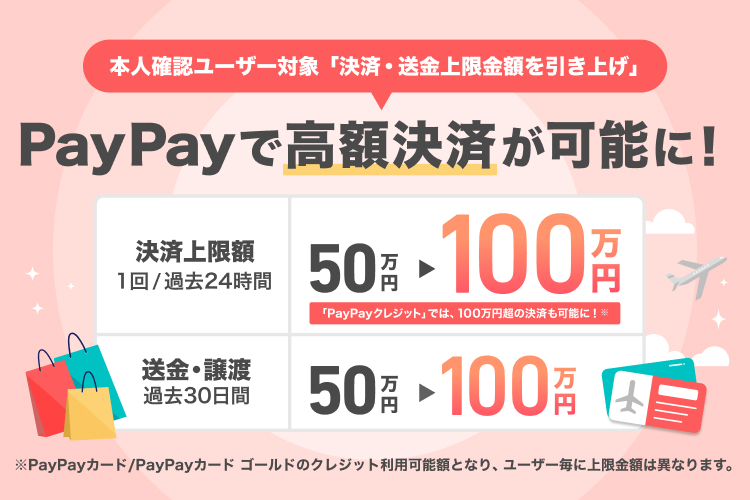

PayPay Corporation (hereinafter PayPay) is pleased to announce that starting November 2024 it has raised the maximum amount for a single transaction as well as for total transactions over a 24-hour period in the cashless payment service “PayPay” from 500,000 yen to 1,000,000 yen(*1)(*2). Additionally, until now the maximum payment (per one transaction and within 24 hours) was set to 500,000 yen for payments made with “PayPay Credit” using the blue screen, but with this change, the maximum transaction amount for PayPay Cards (including PayPay Card Gold) will be set to the total available amount, with payments exceeding 1,000,000 yen also becoming available, similar to credit cards.

On top of that, in response to the recent increase in demand for P2P money transfers, the upper limit (for the past 30 days) for transfers using the “Send/Receive” feature(*3) has also been raised from 500,000 yen to 1,000,000 yen(*2). This increase for both payment and money transfer is applicable only to users who have completed the identity verification (eKYC) procedure(*4).

” feature(*3) has also been raised from 500,000 yen to 1,000,000 yen(*2). This increase for both payment and money transfer is applicable only to users who have completed the identity verification (eKYC) procedure(*4).

*2 The PayPay app must be updated to the latest version (4.69.0 or above).

*3 Sending PayPay Money, is defined as “remittance,” and sending PayPay Money Lite as “transfer.” See PayPay Balance Terms of Use for details. For more information on the difference between PayPay Money and PayPay Money Lite, see About PayPay Balance and PayPay Points.

*4 For more information on identity verification (eKYC), see Identity verification using identification documents (eKYC).

PayPay has so far been widely used mainly in daily payment scenarios such as in convenience stores, supermarkets and drugstores, but recently, its use has been increasing for high value payments at department stores, travel sites, and online shopping. Moreover, with the launch of PayPay Paycheck, which allows users to receive their salaries into their PayPay accounts, the demand for high value payments is expected to grow further, as the use cases of users’ “PayPay Balance” expand. This increase in the maximum transaction amounts will enable customers to handle not only everyday shopping, but also more high value payment demands, such as buying furniture, home appliances, airline tickets and luxury brand products. Additionally, starting in November 2024, PayPay will gradually become available on Trip.com, one of the world’s largest online travel sites where airline tickets and hotel reservations can be made, and we will continue to promote the introduction of PayPay to the high value payment scene. In late November, “PayPay Asset Management,” which allows users to buy and sell securities with the PayPay app, will also increase the single purchase and 24-hour limits to 1 million yen using PayPay Money, making asset management more convenient than ever.

The upper limit for P2P transfers within the past 30 days has also been raised from 500,000 yen to 1,000,000 yen in response to increased demand. PayPay’s “Send/Receive” feature allows customers to send and receive PayPay balances instantly, 24 hours a day, 365 days a year, for free. This feature offers support to its users as a transfer platform – it is used mainly when splitting the bill in restaurants and sending pocket money to family members, and has approximately a 95% market share among smartphone payments(*5) based on the number of transfers(*6). The total amount transferred during one year, between October 2023 and September 2024, exceeded 1 trillion yen. In addition, since the introduction of PayPay as a payment method for online donations(*7) to donation organizations and companies operating donation services in August 2024, we have decided to raise the transaction limit in anticipation of a further increase in demand PayPay transfers.

For details, see the table below.

■ Payment and transfer limits

| Limit before change | Limit after change | ||||

|---|---|---|---|---|---|

| Per transaction/within the past 24 hours | Within the past 30 days | Per transaction/within the past 24 hours | Within the past 30 days | ||

| Payments | PayPay Balance | 500,000 yen | 2,000,000 yen | 1,000,000 yen | 2,000,000 yen |

| PayPay Credit | 500,000 yen | 2,000,000 yen | Full PayPay Card available balance | ||

| Transfers | 300,000 yen | 500,000 yen | 300,000 yen | 1,000,000 yen | |

※横にスクロールできます

* For users without identity verification (eKYC), the maximum transaction amount is 500,000 yen per transaction/within the past 24 hours and 2,000,000 yen within the past 30 days, and the maximum transfer amount is 100,000 yen per transaction/within the past 24 hours and 500,000 yen within the past 30 days.

While the convenience is improved through each limit increase, PayPay is also implementing multiple security measures. PayPay has enacted various security measures to ensure that users can use PayPay with peace of mind, such as enhanced authentication and login management features, fraud prevention measures that involve constant monitoring using cutting-edge technology as well as dedicated staff, 24/7 all-year PayPay telephone hotline to answer any questions. Additionally, for P2P money transfers, PayPay offers user-set transfer limits as well as warning messages to prevent money transfer fraud, and full compensation (in principle) in case users become victims of unauthorized use due to their app accounts, bank accounts, or credit card information getting stolen and misused by third parties(*8). PayPay aims to provide safe and secure services, actively promoting identity verification(*9) and will continuously keep raising the bar against money laundering and financing of terrorism to prevent the app’s misuse in criminal activities and by terrorist organizations.

*5 Including both PayPay Money remittances and PayPay Money Lite transfers.

*6 The share for PayPay is calculated by PayPay based on the “Survey of Domestic Code Payment Usage Trends (published on August 22, 2024)” disclosed by PAYMENTS JAPAN.

*7 Only “PayPay Money” available as payment method. Donations are not eligible for PayPay Points or PayPay STEP.

*8 See here or more information on fraud prevention measures.

*9 For more details on the identity verification procedures in “PayPay,” click here.

■ About “PayPay,” the cashless payment service provided by PayPay Corporation

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis, and even public transportation. It can also be used in a variety of other situations, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay Balance (PayPay Money and PayPay Money Lite) between each other for free, or “point management,” a service that allows users access to a simulated investment experience involving the exchange of PayPay Points with points provided by a service provider that PayPay is partnered with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Notified Entity Entrusted with Intermediation (Filing number: C1907980 / Date filed: December 18, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labor and Welfare No. 00001 / Date of designation: August 9, 2024)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Certificates.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) refers to PayPay Money that can only be purchased with wages received by the PayPay user in their Paycheck Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see Applying for compensation for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.