PayPay Corporation (hereinafter PayPay) and SoftBank Corp. are pleased to announce a joint campaign “Increased Allowances for One Year” that will begin as of December 19, 2024, where allowances sent using cashless payment service PayPay(*1) will increase for one year(*2).

The “Increased Allowances For One Year” promotion involves granting users receiving allowances sent by the “Send Allowance” or “Recurring Transfer” features in PayPay(*3) an additional 10% worth of PayPay Points (grant limit: 250 yen/month) based on the amount sent over a period of one year.

In addition, SoftBank Corp. will grant 10% (grant limit: 250 yen/month) to the sender if both sender and receiver are either SoftBank or Y!mobile users(*4), or, 20% (with a doubled limit of 500 yen/month) to both sender and receiver if they are both SoftBank users and the sender is subscribed to the Pay-toku plan. See here for details on SoftBank’s benefits.

Upon the launch of the campaign, a new “Allowance” icon will be added to the PayPay app(*5), which can be used to request for an allowance from other users or set up regular allowance transfers in just three steps. This setup is available only when both the sender and receiver have completed their identity verification (eKYC).

*1. The sending of PayPay Money is defined as a remittance, and the sending of PayPay Money Lite a transfer. See PayPay Balance Terms of Use for details. For more information on the difference between PayPay Money and PayPay Money Lite, see About PayPay Balance and PayPay Points.

*2. During the campaign, PayPay Points are granted each month for 12 months from the month the receiver first completes receiving an allowance. The end date of the campaign is currently not decided.

*3. There may be some cases in which the campaign is not applied if the initial allowance is sent on the same day that the recurring allowance is set up.

*4. Both the sender and receiver need to link their contracted line with their PayPay app account or set up smart login. For more details, please click here. In addition, if the sender is a Pay-toku subscriber, the contracted line and PayPay app account must be linked.

*5. Available with PayPay version 4.47.0 or higher.

■Overview of Increased Allowances for One Year

Campaign period:

December 19, 2024 – End date TBD

Eligibility

| Sender | Those who are 18 years old or older and have verified their identity (eKYC) |

|---|---|

| Receiver | Those who are 12 to 18 years old and have verified their identity (eKYC) |

* The sender must be at least 18 years old at the time the first allowance is sent, and the receiver must be between 12 and 18 years old at the time the first allowance is received.

* Users who already make regular remittances using the “Send Allowance” or “Recurring Transfer” feature from before the launch of this campaign will also be eligible.

* Users who participated as a in the previously held “10% Increase in Allowance” promotion, a region-limited campaign held up to March 31, 2024, will not be eligible to the grant rates 1, 2, and 3 in the table below, with a maximum 10% grant rate for 4 (grant limit: 250 yen/month).

Details:

When using PayPay’s “Send Allowance” or “Recurring Transfer” feature for regular remittances, the receiver will be granted an additional 10% worth of PayPay Points (grant limit: 250 yen/month), based on the amount sent. If both sender and receiver are SoftBank or Y!mobile users(*4), the sender will also receive 10% (grant limit: 250 yen/month). Additionally, if both sender and receiver are SoftBank users and the sender is a Pay-toku subscriber, they will each receive 20% (grant limit: 500 yen/month) in PayPay Points for one year. Points will be granted for one year after the sender begins regularly transferring allowances post-launch of the campaign.

* Although it is possible to send or receive allowances to/from multiple people, the grant limit of points per user for both sender and receiver will not increase.

List of grant rates

Grant date:

Granted on the same day that the remittance is completed

*The timing of the grant may be delayed due to the usage conditions or system constraints.

*The granted PayPay Points can be used at the official PayPay and PayPay Card stores They cannot be cashed out or transferred.

<How to use the allowance feature for regular remittances>

~ Sender’s settings ~

~ Receiver’s settings ~

■ Background of Increased Allowances for One Year

PayPay has attracted young users through being available in popular online shopping sites and events such as school festivals. PayPay has also hosted promotional campaigns such as the New Year’s Lottery and 10% Increase in Allowance (limited to certain regions) involving the use of the remittance feature to facilitate parents’ use of PayPay in sending allowances to their children, considering that teenagers usually manage their budgets using their allowances. The 10% Increase in Allowance promotion saw approximately fourfold growth(*6) in the number of remittances using the “Recurring Transfer” feature compared to before the campaign.

Aiming to capture more young users, it was decided to expand the region-limited promotion nationwide into the current Increased Allowances for One Year campaign.

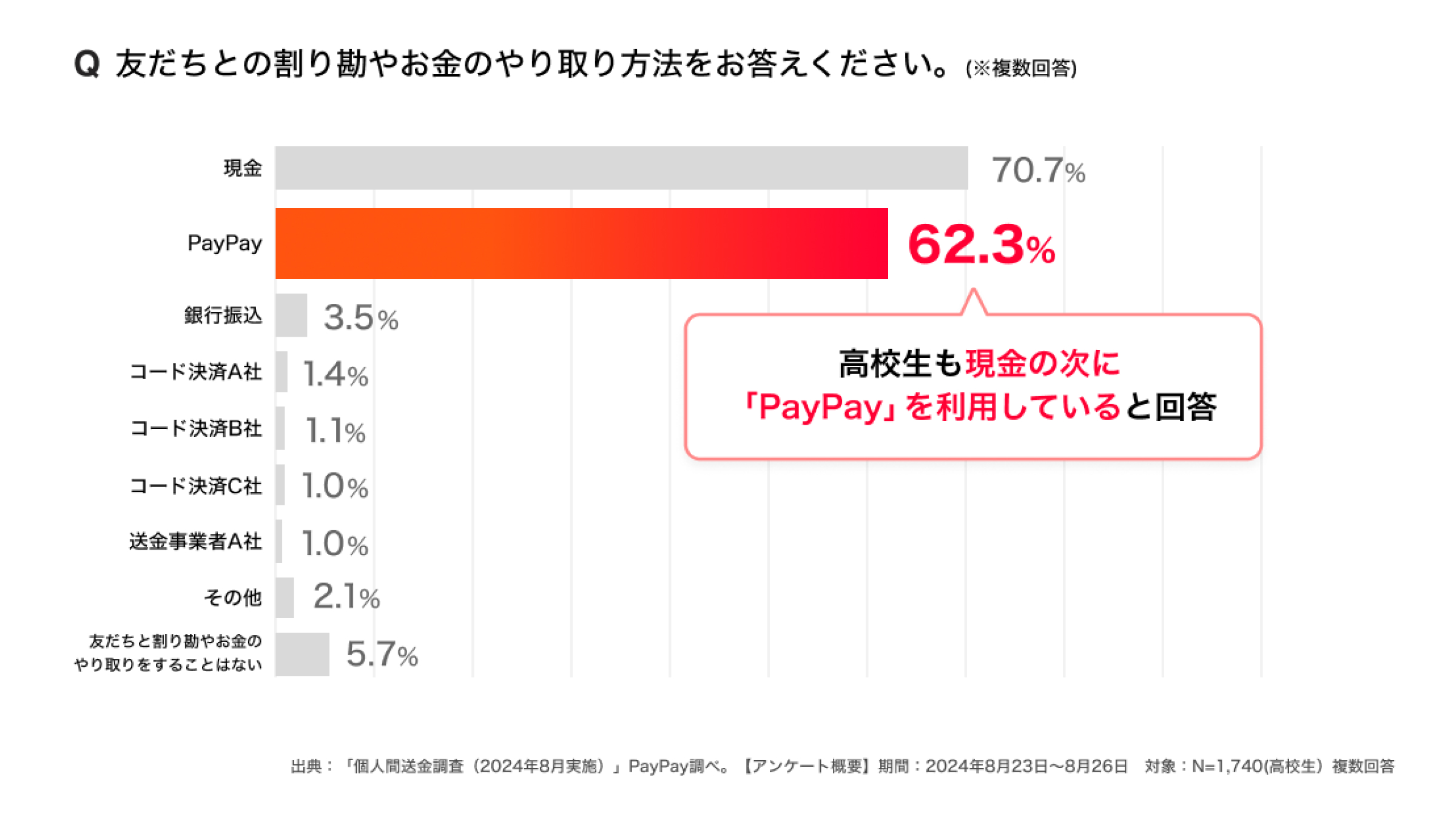

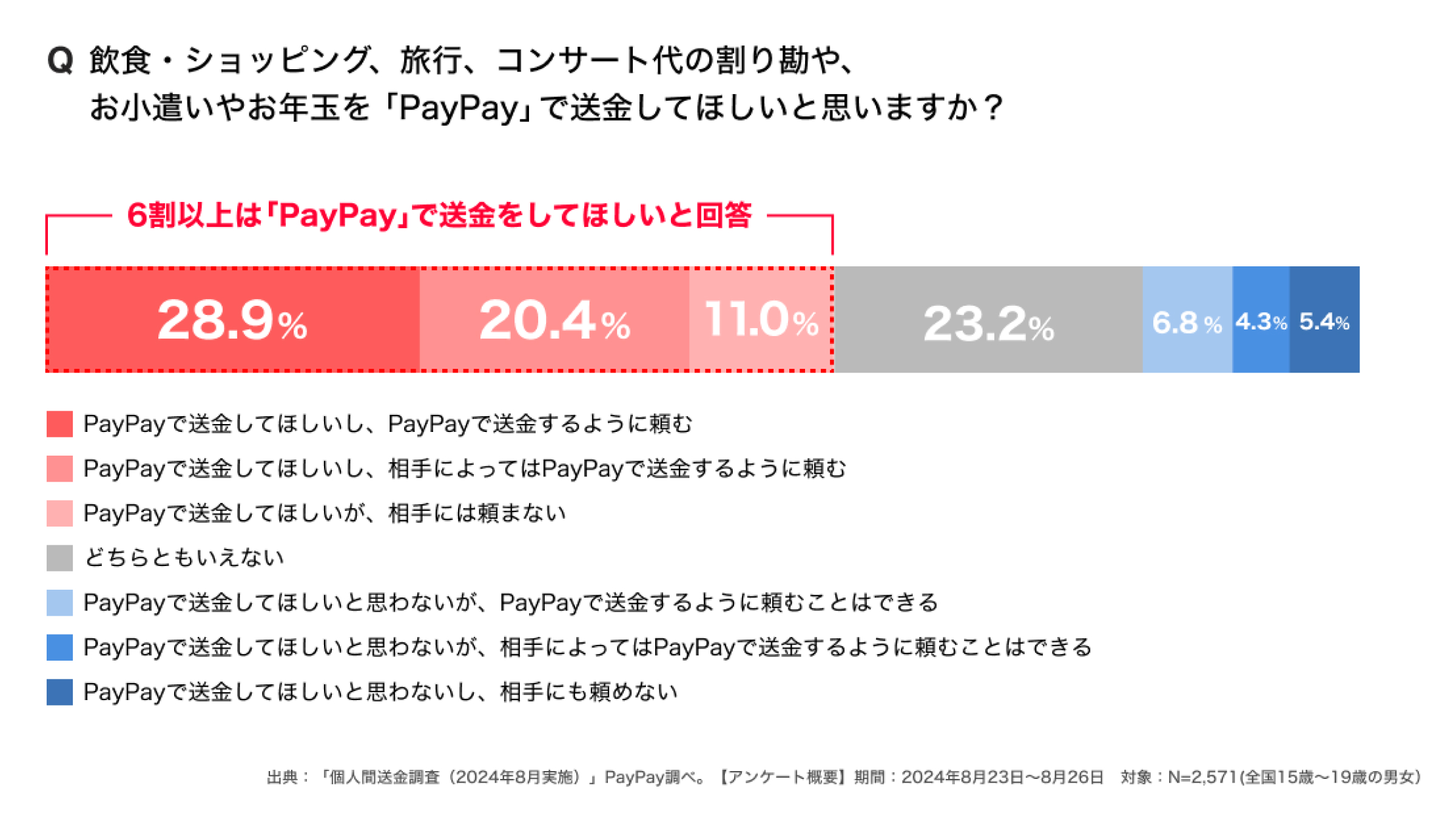

With the Send/Receive feature in PayPay, users can send their PayPay Balance 24/7 to any PayPay user. Users who have verified their identity can withdraw PayPay Money from an ATM when cash is needed. Users can also set spending limits to prevent overspending and track spending from the transaction history. According to a survey conducted by PayPay on personal remittances [Reference], next to cash, PayPay ranks as the second-most-used method among young people aged 15-19 for handling money exchange with friends. Over 60% of respondents in this age group want money sent via PayPay, indicating the growing familiarity of cashless payments among young people.

PayPay is committed to continuous improvements to offer an appealing service where both senders and receivers find more value in the “Send/Receive” feature than using cash.

*6. Based on a comparison of the number of remittances using the “Recurring Transfer” feature in the area where the 10% Increase in Allowance promotion was held. October 2023, before the campaign, was compared with March 2024, after the launch of the campaign.

[Reference] Survey on Peer-to-Peer Remittances

Subject matter: Actual usage of peer-to-peer remittances

Audience: 10,897 males and females aged 15 to 69 nationwide

Period: August 23-26, 2024

Method: Online research

Conducted by: PayPay Corporation

Executed by: Macromill, Inc.

Method used for exchanging money with friends

When asked how they exchange money, such as with friends or for splitting bills (multiple answers allowed), over 60% reported using PayPay.

Preference of receiving money via PayPay

When asked about sending money for dining, purchasing items, or allowances, over 60% responded that they prefer PayPay for receiving money.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Notified Entity Entrusted with Intermediation (Filing number: C1907980 / Date filed: December 18, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labor and Welfare No. 00001 / Date of designation: August 9, 2024)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) refers to PayPay Money that can only be purchased with wages received by the PayPay user in their Paycheck Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.