“Koredake Rent” service page:

https://www.paypay-insurance.co.jp/promotion/renters-fire/app/

PayPay Insurance Service Corporation (hereinafter “PayPay Insurance Service”), a group company of LY Corporation (hereinafter “LY”), Z Financial Corporation, and PayPay Corporation (hereinafter “PayPay”) are pleased to announce that renters’ fire insurance “Koredake Rent” (hereinafter “Insurance”) has been released and is available from the PayPay Insurance mini app*1 within the cashless payment service “PayPay” starting today. The insurance is designed to suit each user’s lifestyle and offers several plans, including one that can be purchased for as little as 220 yen per month for those who do not require coverage for household goods and wish to keep premiums low.

*1. A feature that allows users to smoothly make reservations, order products, and make payments for services provided by PayPay’s partner companies from the PayPay app

This insurance covers damage to household goods caused by fire, lightning, water leakage, etc., or accidental damage to the landlord or others in the rented house.

PayPay Insurance Service believes that it has become a mere custom to purchase conventional renters’ fire insurance policies at the time of moving into a rental home, and that there are not many opportunities to consider insurance policies and coverage that fit one’s own lifestyle.

Against this backdrop, the company will begin offering “Koredake Rent,” a simple and easy-to-understand renters’ fire insurance policy that allows policyholders to choose a plan that suits their lifestyle.

The policy offers a range of plans, from those that only cover personal and tenant liability for policyholders who want to keep premiums low and do not need coverage for household goods, to plans that provide coverage for more costly damages and expensive household goods. The insurance is intended to meet the needs of not only those who newly purchase renters’ fire insurance but who review the ones they currently have or who are renewing their rental contract.

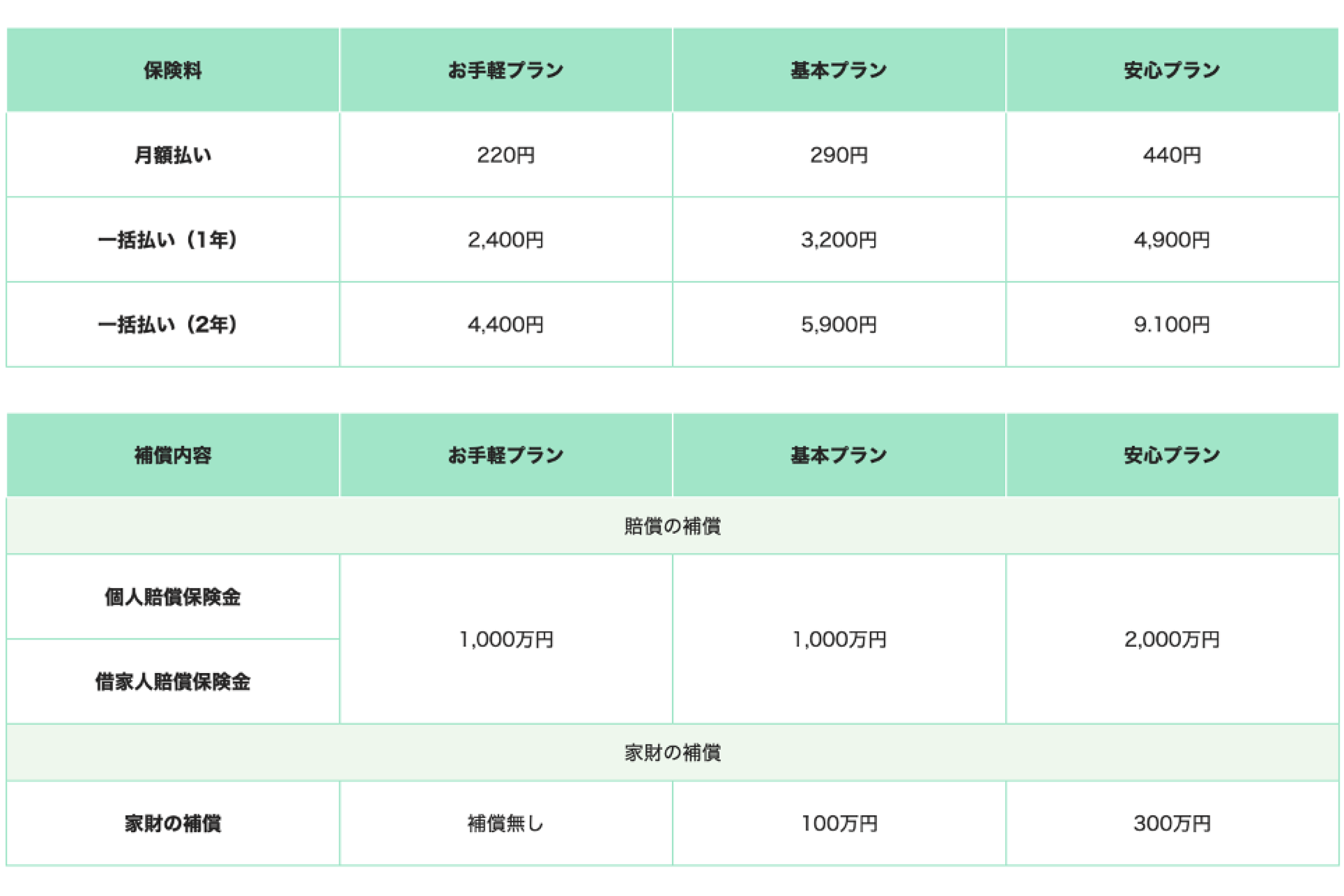

One can choose from three plans (Easy Plan, Basic Plan, and Safety Plan) according to their needs, and can either pay monthly, annually, or biannually. The most economical Easy Plan is 220 yen per month, 2,400 yen per year, and 4,400 yen for two years (premiums and coverage for the three plans are shown below).

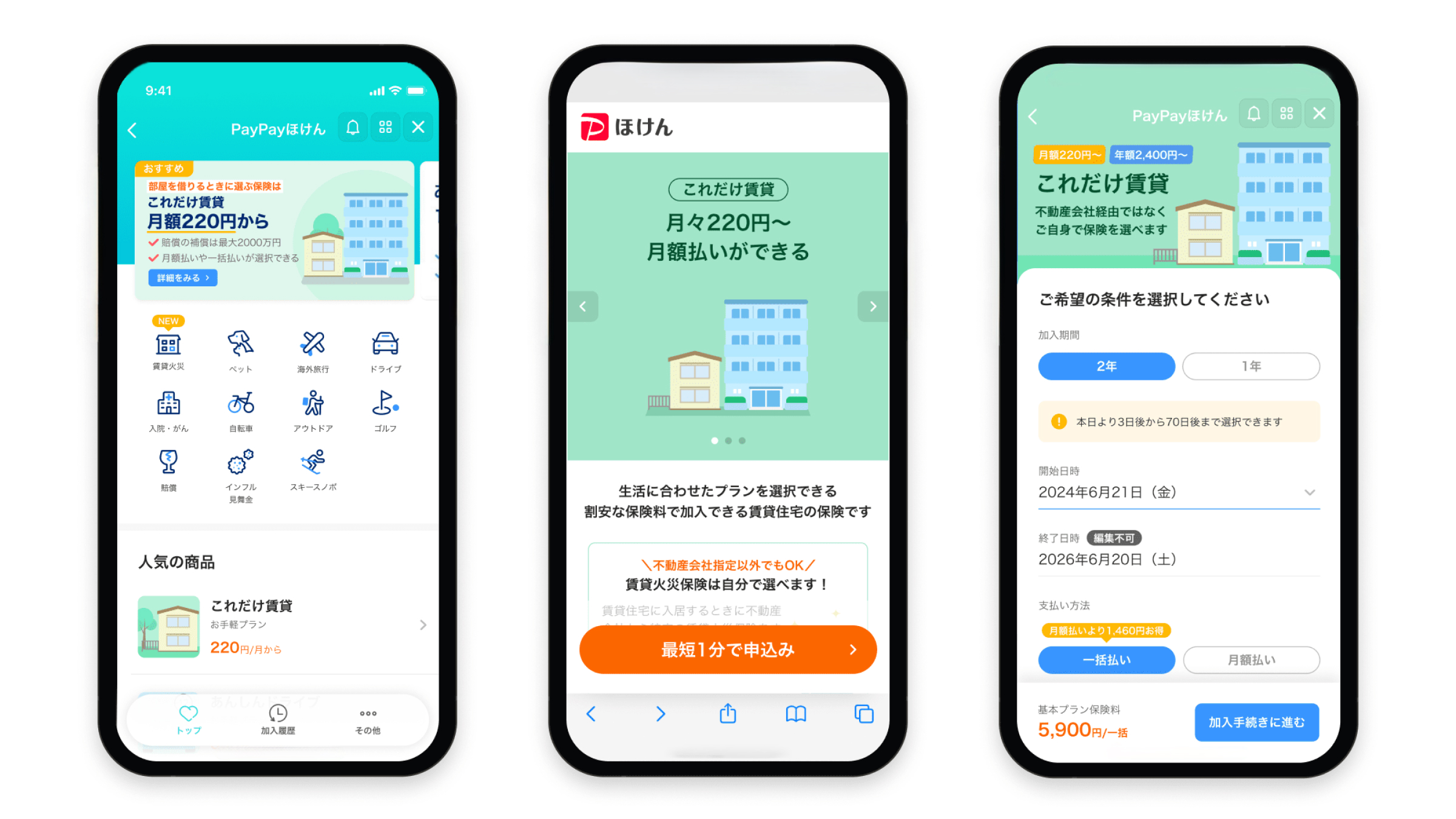

Users can easily subscribe to the Insurance through the PayPay app, and premiums can be paid with PayPay Balance including PayPay Points or PayPay Credit.

PayPay Insurance Service will continue to help users by providing high-quality insurance products that suit their needs to make insurance even more accessible.

■ Features and Overview of “Koredake Rent”

Date of launch and commencement of coverage

Distribution date: from January 7, 2025

Compensation: Possible to designate any date 3 to 70 days after the application date

Coverage

Policyholders will be compensated for damages they have caused to the landlord or a third party in their rental home, or if furniture or appliances in the rental home are damaged by fire, water leakage, or other accidents.

Plans (features, premiums, and benefits)

■Plan Features

●Easy Plan

Minimum indemnity insurance for rental contracts.

●Basic Plan

Indemnity insurance and coverage for household goods.

●Safety plan

For those who need higher indemnity coverage and coverage for household goods.

Other characteristics

Easy to apply

The purchase can be easily made through “PayPay” and the premium is also paid through “PayPay.” Users who have already verified their identity on “PayPay” can smoothly apply for in as little as one minute without entering their name or other information.

Earn PayPay Points (*)

In addition to PayPay Points for payments with “PayPay,” 1% of the transaction amount will be granted by the underwriting insurance company.

*PayPay Points earned can be used from one point (equivalent to one yen) at stores where “PayPay” is available. They cannot be cashed out or transferred.

How to use

Users can complete the purchase of an insurance policy with simple steps all within the PayPay app.

These insurance plans are provided by PayPay Insurance Service and Aiaru syougakutankihoken Corporation, a subsidiary of Sumitomo Life Insurance (President and Representative Director: Katsuyuki Ando). For the Safety Plan, the liability coverage portion is offered as a co-insurance agreement, with Aiaru syougakutankihoken Corporation serving as the lead insurance company and Ansin SSI Inc as the subordinate insurance company. The underwriting ratio is split equally at 50% between the two companies.

* “PayPay” offers four types of electronic money as part of its services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) refers to PayPay Money that can only be purchased with wages received by the PayPay user in their Paycheck Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued. PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. For more details, please visit application for compensation.

Overview of PayPay Insurance Service Corporation

Name: PayPay Insurance Service Corporation

Location: Tokyo Garden Terrace Kioicho Kioi Tower, 1-3 Kioicho, Chiyoda-ku, Tokyo

Representative: Yutaka Hyodo, President and Representative Director, CEO

Business description: Damage insurance agency services, life insurance solicitation services, and small amount short-term insurance solicitation services

Overview of LY Corporation

Name: LY Corporation

Location: Tokyo Garden Terrace Kioicho Kioi Tower, 1-3 Kioicho, Chiyoda-ku, Tokyo

Representative: Takeshi Idezawa, President and Representative Director, CEO

Business description: Development of online advertising business, e-commerce business, subscription services, and management of group companies

Overview of Z Financial Corporation

Name: Z Financial Corporation

Location: Tokyo Garden Terrace Kioicho Kioi Tower, 1-3 Kioicho, Chiyoda-ku, Tokyo

Representative: Shingo Ogasawara, Representative Director, President, Corporate Officer, CEO

Business description: Business management of group companies and related operations

Overview of PayPay Corporation

Name: PayPay Corporation

Location: Tokyo Port City Takeshiba Office Tower, 1-7-1 Kaigan, Minato-ku, Tokyo

Representative: Ichiro Nakayama, President & Representative Director, CEO, Corporate Officer

Business description: Development and provision of mobile payment and other electronic payment services

Overview of Aiaru syougakutankihoken Corporation

Name: Aiaru syougakutankihoken Corporation

Location: 15-18 Nihonbashi-Kodenmacho, Chuo-ku, Tokyo

Representative: Katsuyuki Ando, President

Business description: Provision of small amount and short-term insurances

Overview of Ansin SSI Inc

Name: Ansin SSI Inc

Location: 4-261 Sakuragi-cho, Omiya-ku, Saitama-shi, Saitama

Representative: Kenju Yamamoto, Representative Director

Business description: Provision of small amount and short-term insurances

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.