PayPay Corporation (hereinafter PayPay) and LINE Pay Corporation (hereinafter LINE Pay) are pleased to announce that, in response to the scheduled termination of the LINE Pay service at the end of April 2025, users can now transfer their LINE Pay Balance※1 to PayPay Balance.※2 The transfer period will be from Monday, January 27, 2025, to Wednesday, April 23, 2025. There will be no fees charged for the transfer.

*1. LINE Pay Balance refers to both LINE Pay Balance and LINE Pay Light Balance.

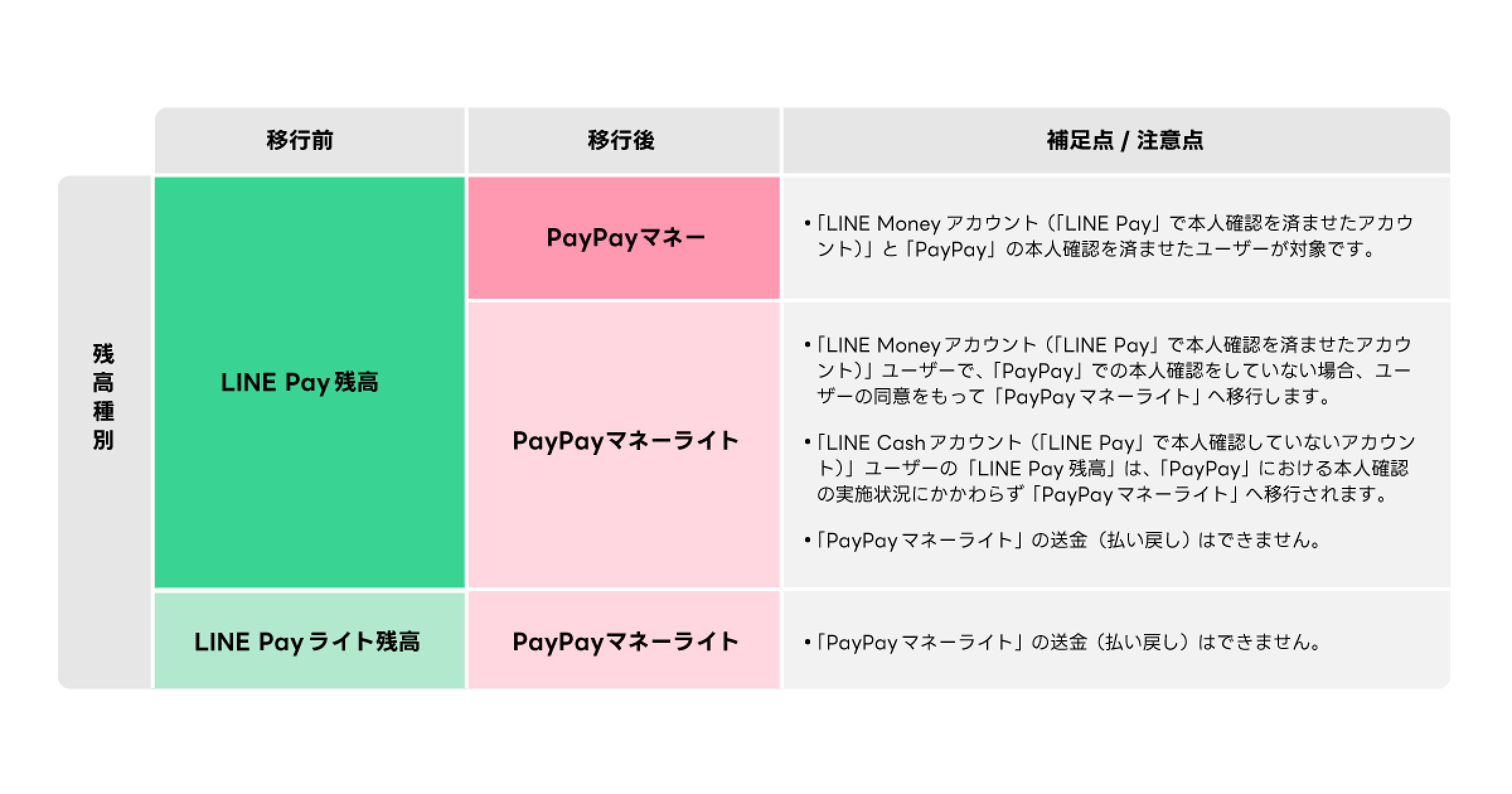

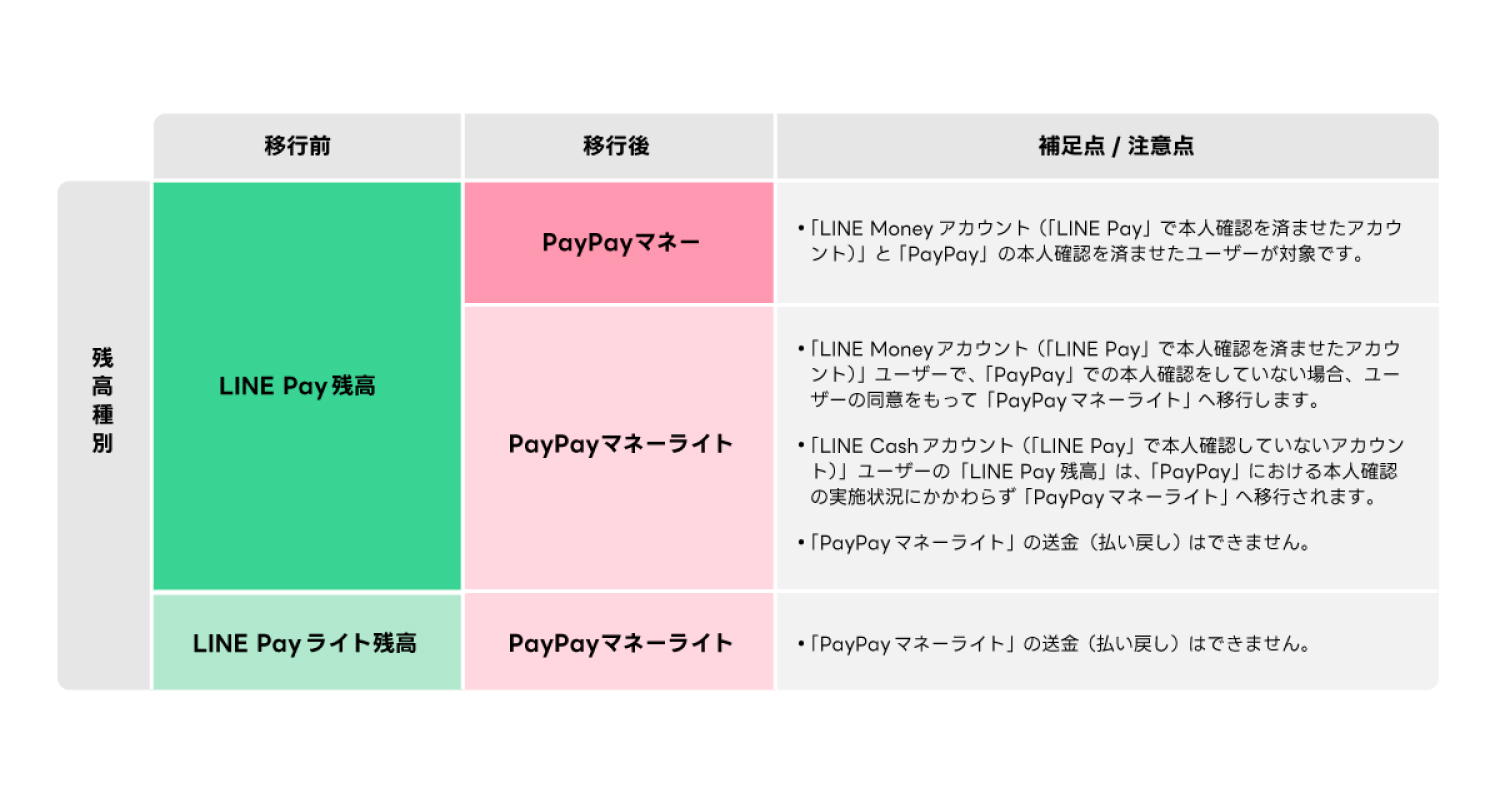

*2: PayPay Balance consists of PayPay Money, available to users who have completed identity verification (eKYC) with PayPay, and PayPay Money Lite, available without identity verification.

■ Overview

– Transfer period: 10:00 A.M. Monday, January 27 to 11:59 P.M. Wednesday, April 23, 2025.

– Transfer cap: Up to 20,000 yen per transfer per day, with a total limit of 100,000 yen during the transfer period.

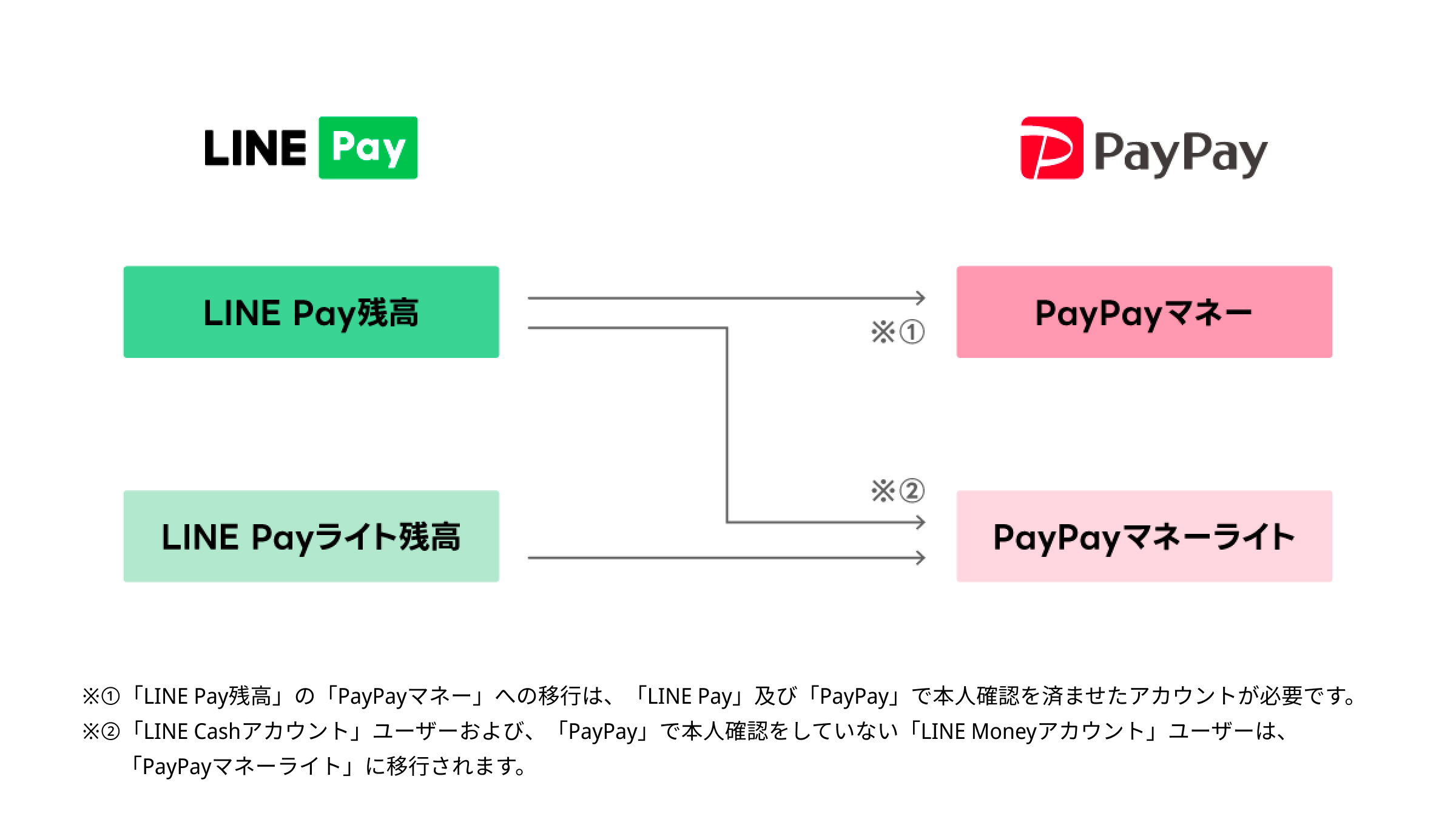

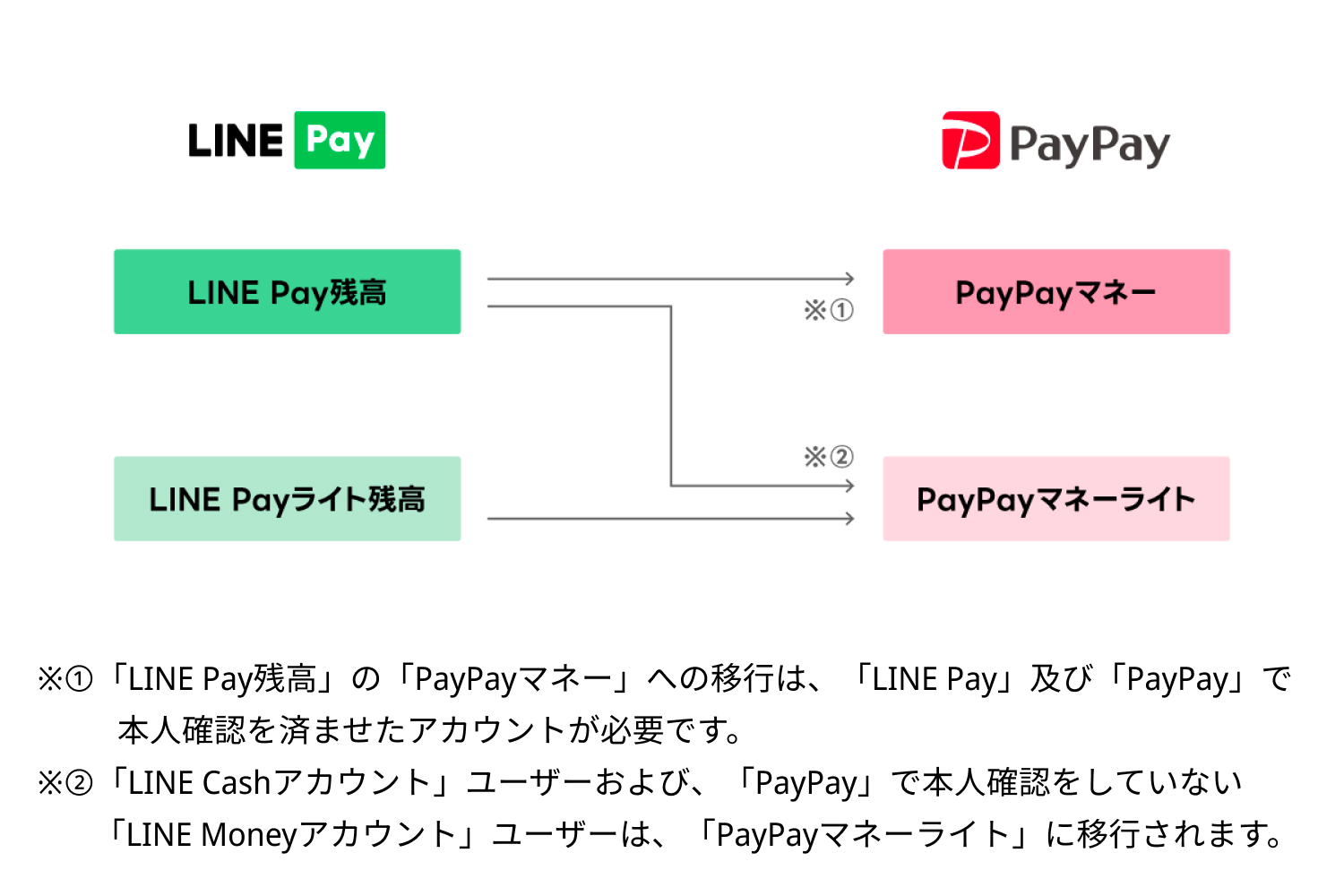

The type of PayPay Balance after the transfer will vary based on the type of LINE Pay Balance held by the user and whether identity verification has been completed for LINE Pay※3 and PayPay. Regarding the difference between PayPay Money and PayPay Money Lite, click here. See Verify Identity (eKYC) for more details on the identity verification procedure in PayPay.

*3. LINE Pay offers a LINE Cash Account, which can be set up by agreeing to terms without identity verification, and a LINE Money Account, which requires identity verification. Functions and limits vary between the two account types.

■ Important notes

– LINE Pay users are required to disable the auto top-up feature, if enabled, before transferring their LINE Pay Balance.

– Specific amounts cannot be designated for transfer. If the balance is less than 20,000 yen, the entire amount will be transferred.

– If a LINE Pay user has both LINE Pay Balance and LINE Pay Light Balance, the LINE Pay Light Balance will be prioritized for transfer.

– Once the transfer to PayPay Balance is complete, it cannot be transferred back to LINE Pay Balance.

– Identity verification services for LINE Pay concluded on January 6, 2025. Therefore, it is no longer possible to change the LINE Pay account type. Transfers will be based on the current LINE Pay account and balance types.

For more details, please click here.

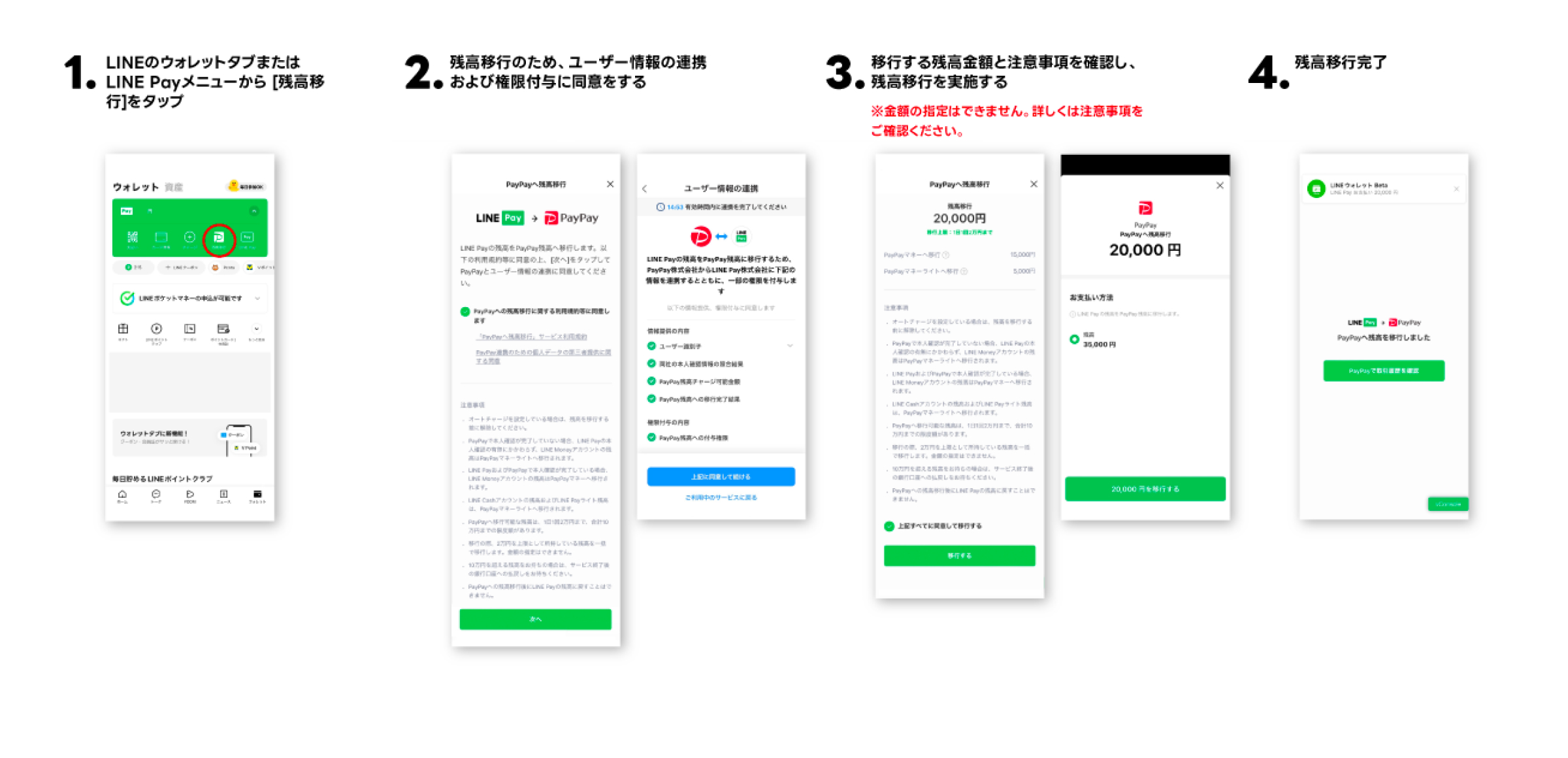

■ How to transfer LINE Pay Balance to PayPay Balance

Please note that LINE Pay Balance can no longer be used for payments after Wednesday, April 23, 2025, as previously announced.

For any amount in excess of the stipulated 100,000 yen transfer limit or any LINE Pay Balance remaining after the termination of the service, refunds to users (with no transfer fees) will be processed based on Article 20, Paragraph 1 or Article 61, Paragraph 5 of the Payment Services Act, regardless of the type of LINE Pay account. Further details on registering a financial institution necessary for the refund will be separately announced on the dedicated website below. The schedule regarding the termination of various LINE Pay services and the contact information for customer support are also available on the website.

– Dedicated website: https://line-pay-info.landpress.line.me/payment-info/

PayPay will strive to improve user convenience, social productivity, and sustainable business practices by continuing to promote cashless payments, alongside adding and enhancing its services.

<Updated on January 30, 2025, 5:00 PM> The image of the consent screen on the left, regarding user information linkage and authorization, under “2.” of “How to transfer LINE Pay Balance to PayPay Balance,” has been updated to the latest version. The image is for illustrative purposes only.

■ About PayPay

In the fiscal year 2023, PayPay’s consolidated gross merchandise volume with PayPay Card surpassed 12.5 trillion yen, while its standalone volume exceeded 10.0 trillion yen from a total of 6.36 billion payments. PayPay holds approximately two-thirds of the domestic market share in code payments. Furthermore, more than one out of every six cashless payments in 2023—including credit cards, electronic money, and more—involved PayPay,※4 signifying its entrenched role as an everyday payment method.

*4. Research by PayPay, by comparing PayPay’s transactions to the statistics published by PAYMENTS JAPAN (Code Payment Trends, published March 25, 2024).

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labor and Welfare No. 00001 / Date of designation: August 9, 2024)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) refers to PayPay Money that can only be purchased with wages received by the PayPay user in their Paycheck Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.

LINE Pay Corporation is registered as follows, including association memberships.

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00669 / Registration date: October 1, 2014)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00036 / Registration date: October 1, 2014)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: August 6, 2014)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 10 / Registration date: December 20, 2018)