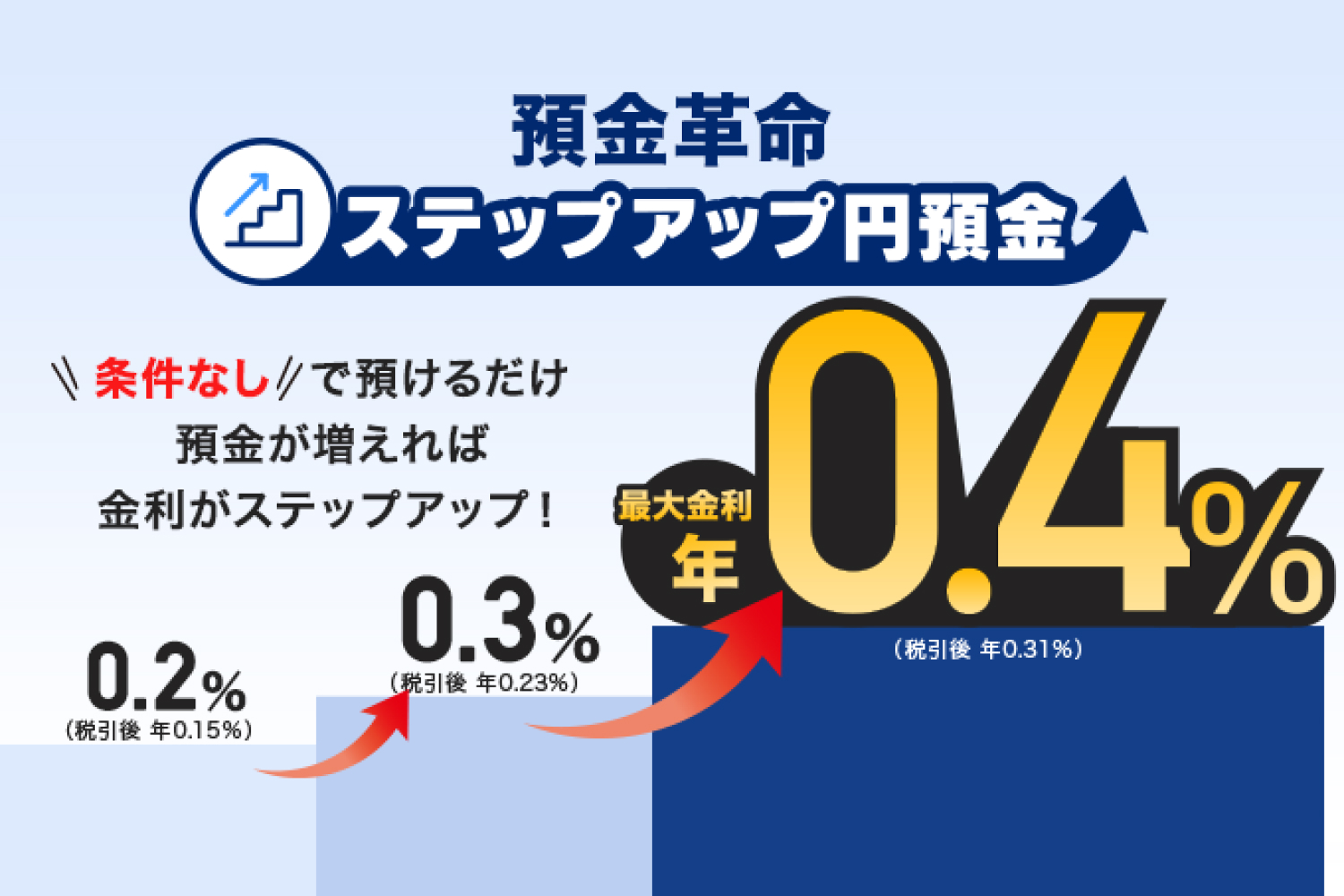

PayPay Bank Corporation (Shinjuku-ku, Tokyo; President & Representative Director: Tomohito Takusari; hereinafter “PayPay Bank”) is pleased to announce that it will launch a new regular program, Step-Up Yen Savings Deposit, from March 2025, offering a special interest rate of up to 0.4% per annum (0.31% after tax)*1, *2 on yen ordinary deposits.

The interest rate will change by meeting the yen ordinary deposit balance requirements set for each age bracket, and the highest rate is 0.4% per annum (0.31% after tax), which is approximately twice the industry standard for ordinary deposits.*3 This special interest rate for the Step-Up Yen Savings Deposit will be applied retroactively from March 1, 2025.

In addition, customers 29 years old or younger*4 have lighter requirements, making it easier for them to avail of the special interest rates. Through this program, PayPay Bank aims to become a bank that can be a long-term partner for students, newcomers to the workforce, and other young customers well into the future.

*1. Interest rates are variable and subject to review based on interest rate environments and other factors.

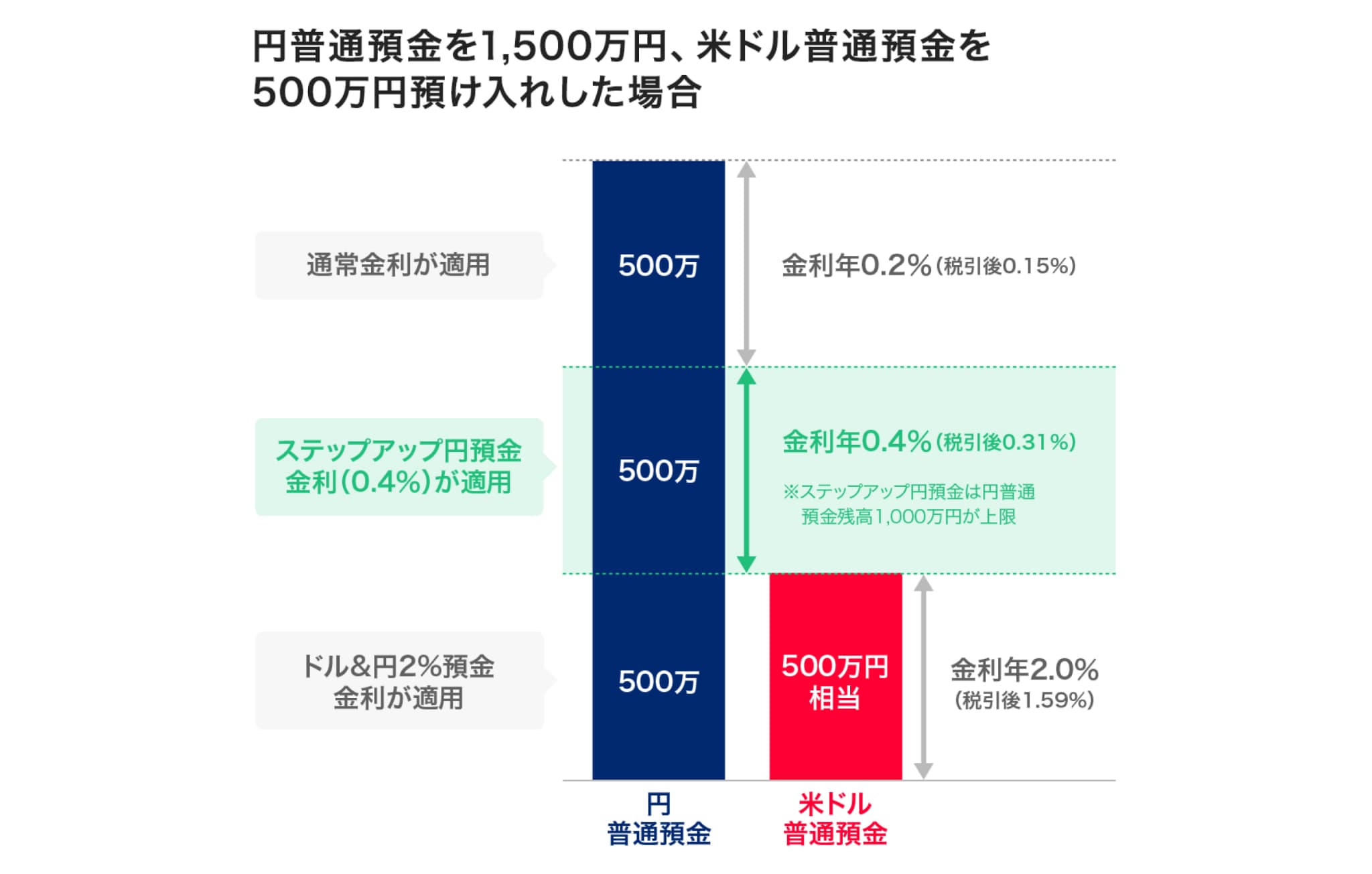

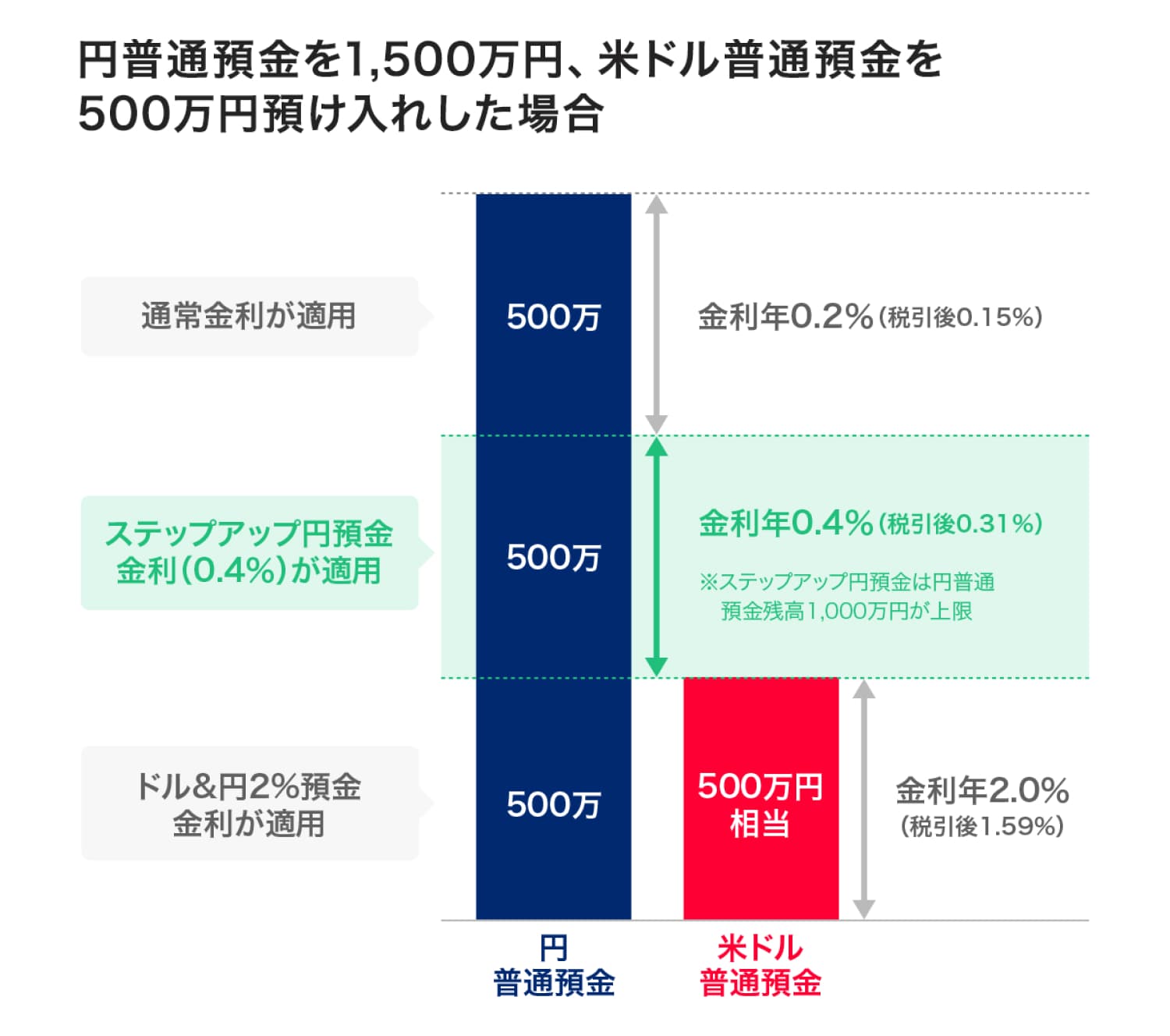

*2. The maximum amount to which the special interest rate of Step-Up Yen Savings Deposit applies is 10 million yen. The regular interest rate of 0.2% per annum (0.15% after tax) will be applied to balances exceeding 10 million yen. Interest is subject to a 20.315% tax (15.315% national tax (including special reconstruction income tax) and 5% resident tax; rounded to two decimal places).

*3. Compared with the regular interest rate of 0.2% (before tax) on yen ordinary deposits at three megabanks (Mizuho Bank, Sumitomo Mitsui Banking Corporation, MUFG Bank), seven internet banks (Shinhan Bank Japan, GMO Aozora Net Bank, SBI Sumishin Net Bank, Sony Bank, Daiwa Next Bank, UI Bank, Rakuten Bank), Japan Post Bank, and 60 traditional regional banks. Excluding promotional interest rates. (Based on PayPay Bank research as of March 2025. The banks compared are only those that have announced by February 11, 2025, an increase in their yen ordinary deposit interest rates in February or March 2025 or later.)

*4. The interest rate conditions for customers 29 years old or younger will apply until the end of their birthday month in which they turn 30.

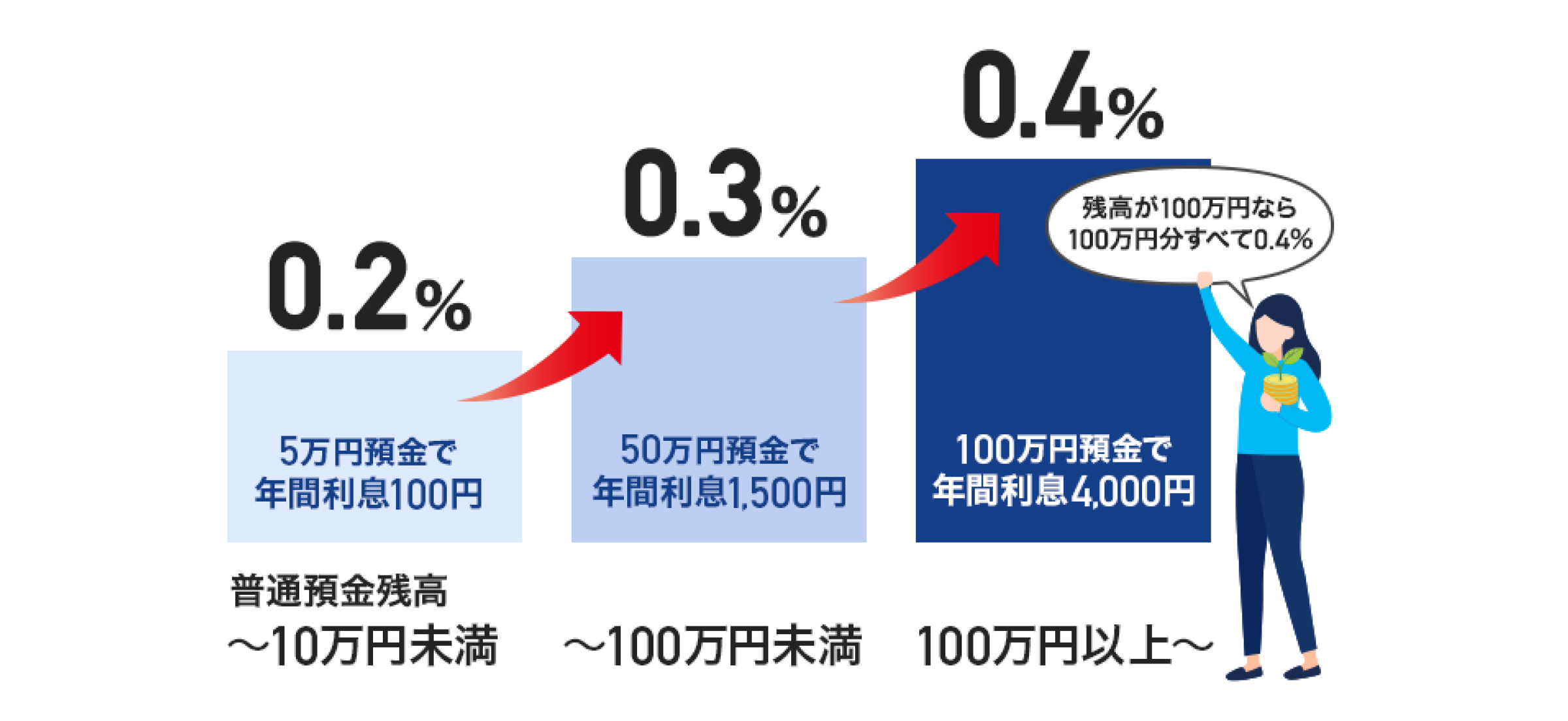

Ages 29 and Below:

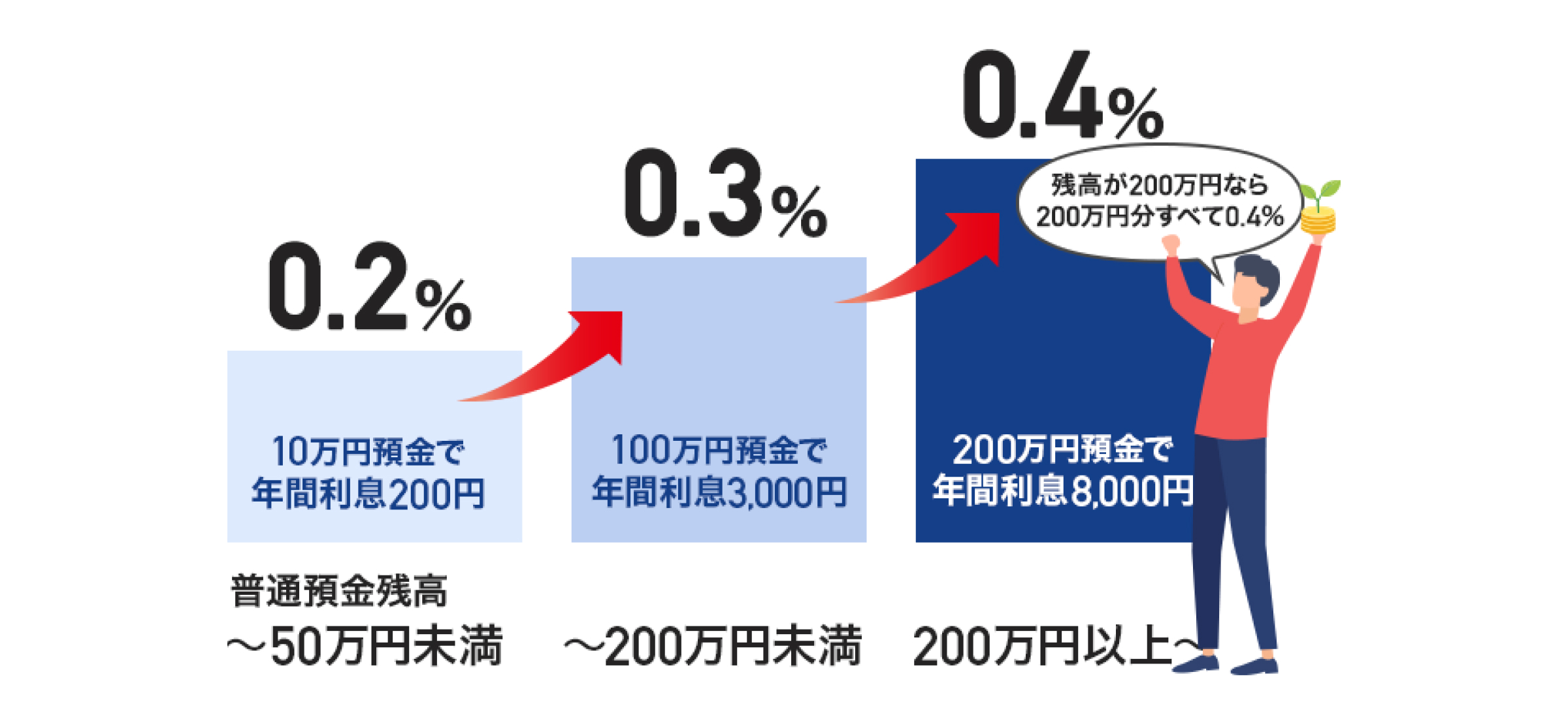

Ages 30 and Above:

Ages 29 and Below:

*Annual interest of 100 yen = Ordinary deposit balance of 50,000 yen × 0.2% per annum (0.15% after tax)

*Annual interest of 1,500 yen = Ordinary deposit balance of 500,000 yen × 0.3% per annum (0.23% after tax)

*Annual interest of 4,000 yen = Ordinary deposit balance of 1,000,000 yen × 0.4% per annum (0.31% after tax)

*The lowest balance bracket is subject to the regular interest rate of 0.2% per annum, which is included in the special interest rates of 0.3% and 0.4%.

Ages 30 and Above:

*Annual interest of 200 yen = Ordinary deposit balance of 100,000 yen × 0.2% per annum (0.15% after tax)

*Annual interest of 3,000 yen = Ordinary deposit balance of 1,000,000 yen × 0.3% per annum (0.23% after tax)

*Annual interest of 8,000 yen = Ordinary deposit balance of 2,000,000 yen × 0.4% per annum (0.31% after tax)

*The lowest balance bracket is subject to the regular interest rate of 0.2% per annum, which is included in the special interest rates of 0.3% and 0.4%.

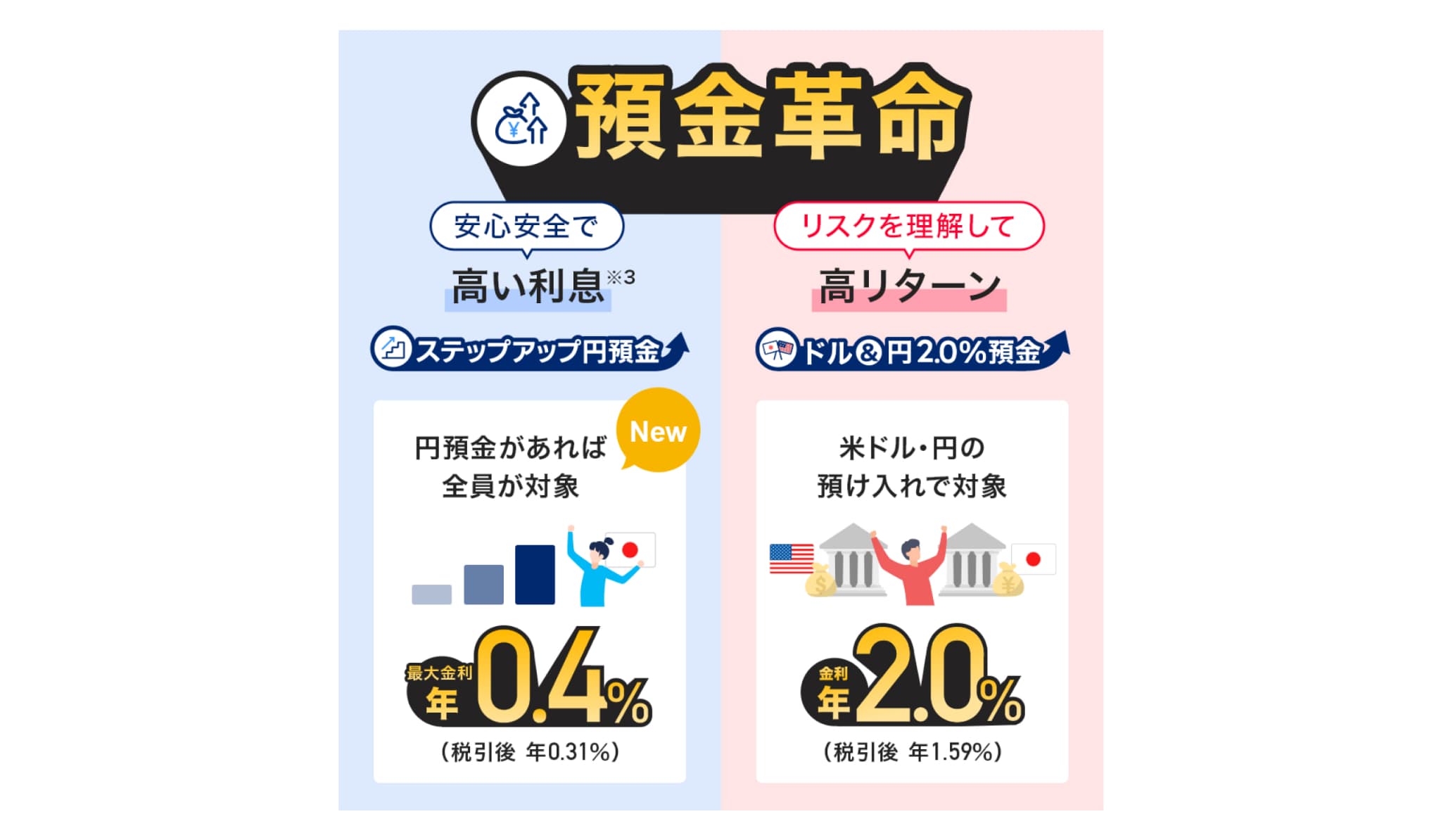

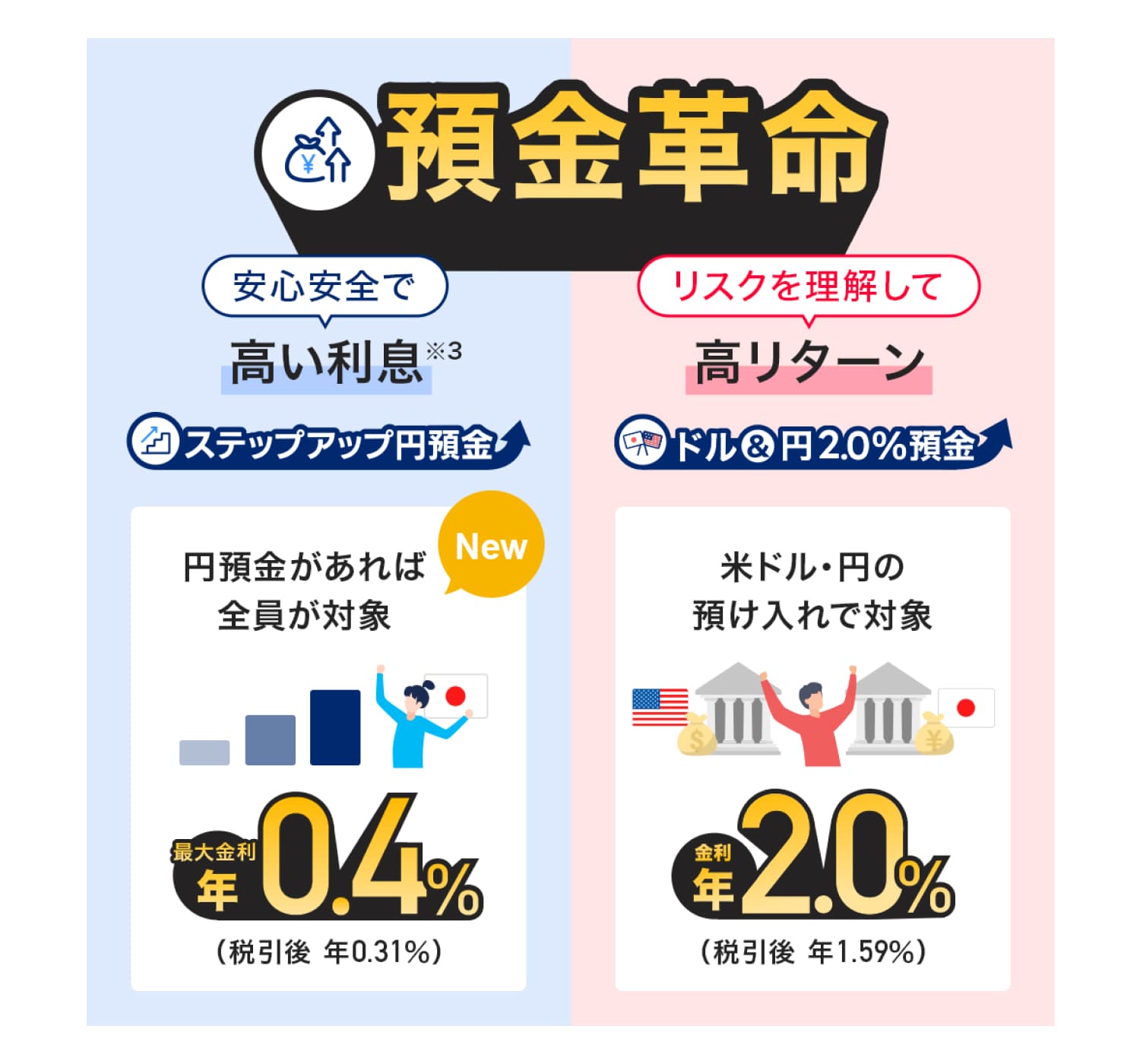

The newly launched Step-Up Yen Savings Deposit offers a special interest rate to account holders simply by having money in a yen ordinary deposit account. Many customers can benefit from higher interest rates because there are no complicated procedures or additional services to use, and the conditions are simple and easy to understand.

For more details, please visit PayPay Bank’s website below:

▽Deposit Revolution

https://login.paypay-bank.co.jp/wctx/CAentry.do?B_ID=1&CampaignId=C250200945

In conjunction with the launch of the Step-Up Yen Savings Deposit, the interest earned through the program, the user’s interest rate, and the interest payment schedule can be viewed immediately with a single tap from the PayPay Bank app, as well as the PayPay Bank mini app in “PayPay” provided by PayPay Corporation (Shinjuku-ku, Tokyo; President & Representative Director, CEO, Corporate Officer, PayPay Corporation: Ichiro Nakayama; hereinafter “PayPay”).

■ PayPay Bank ordinary deposit interest rates

To ensure that more customers can benefit from higher interest rates, PayPay Bank will offer a regular program that meets the demands of many customers, in addition to revising the interest rate on ordinary deposits.

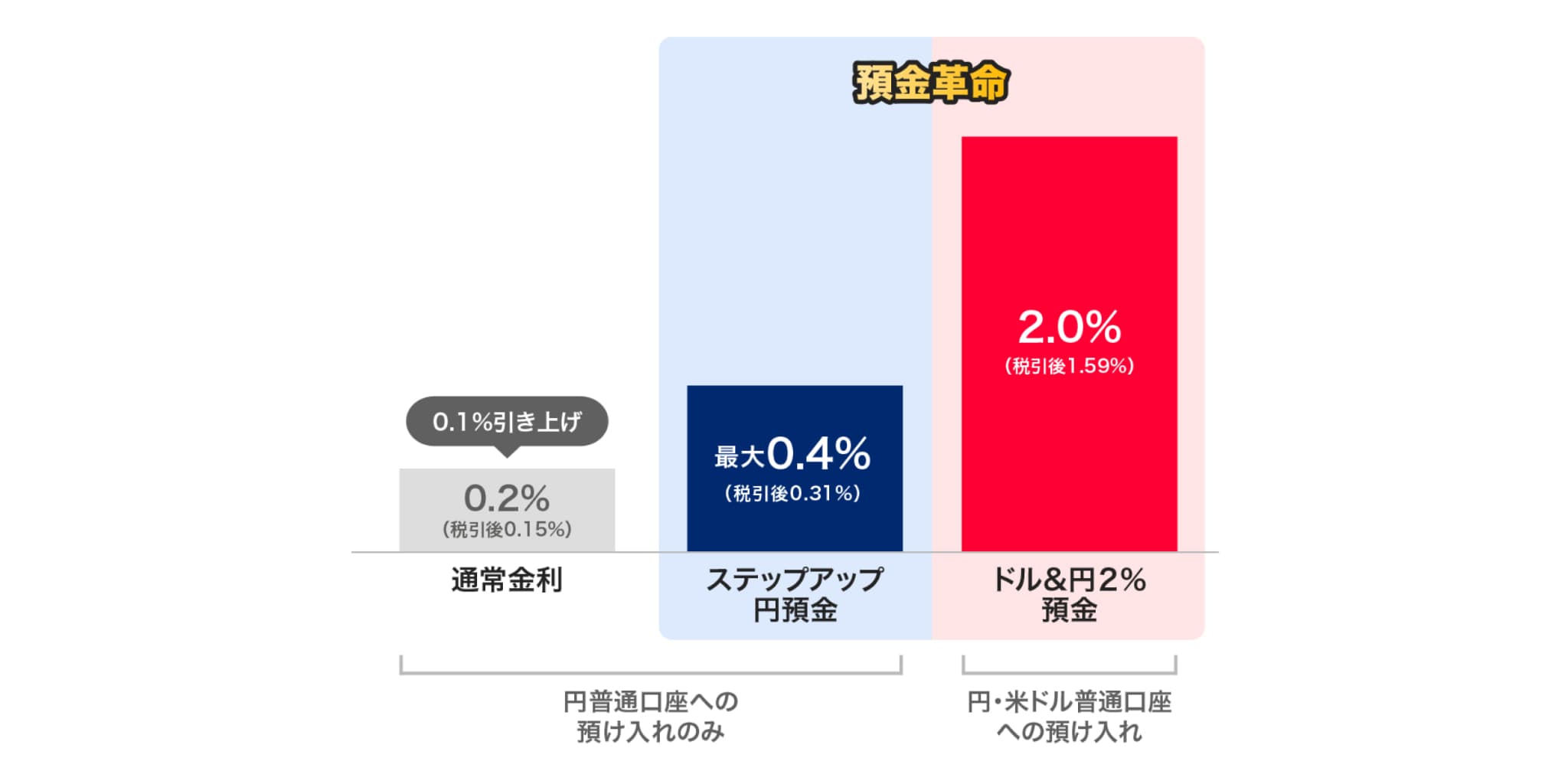

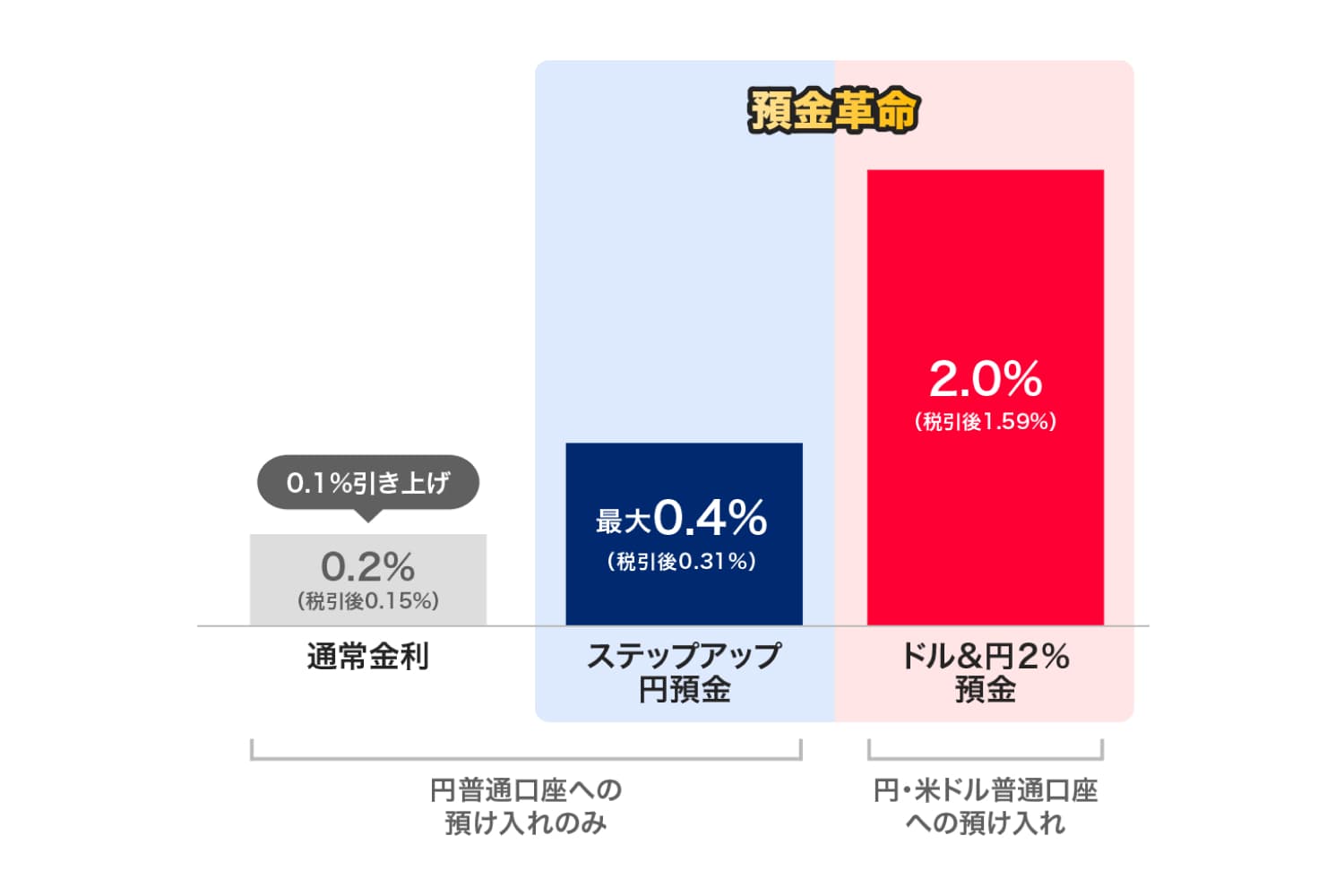

– Regular interest rate

The regular interest rate on yen ordinary deposits will be increased from 0.1% per annum to 0.2% per annum (0.15% after tax) starting March 1, 2025, in light of market interest rate fluctuations following the Bank of Japan’s policy rate hike, to provide all customers with a yen ordinary deposit account the industry-standard interest rate.

– Step-Up Yen Savings Deposit

The Step-Up Yen Savings Deposit program, launched in March 2025, offers a special interest rate of up to 0.4% per annum (0.31% after tax) by simply depositing more funds, while having no risk of losing principal.

– Dollar & Yen 2% Deposit

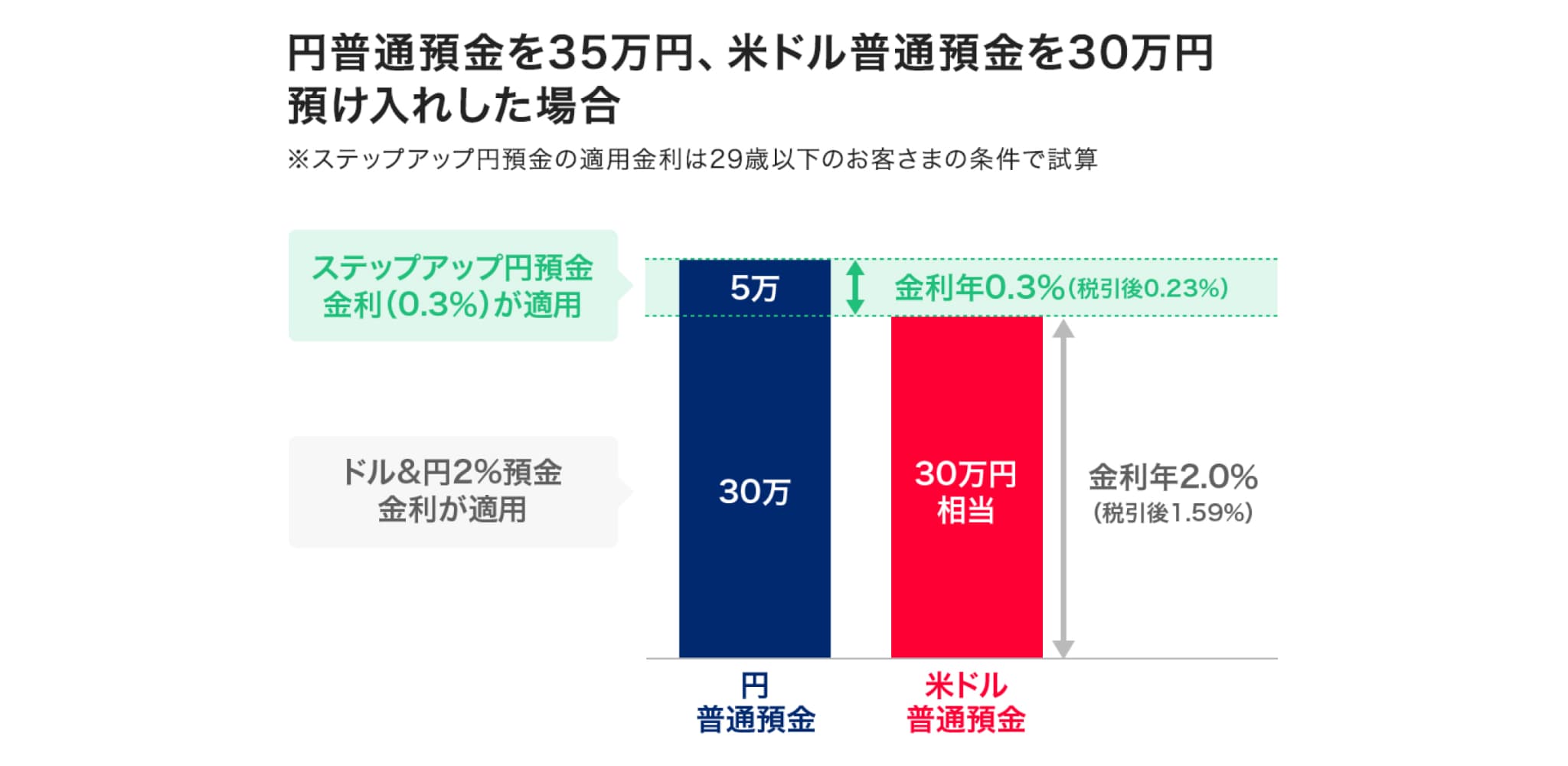

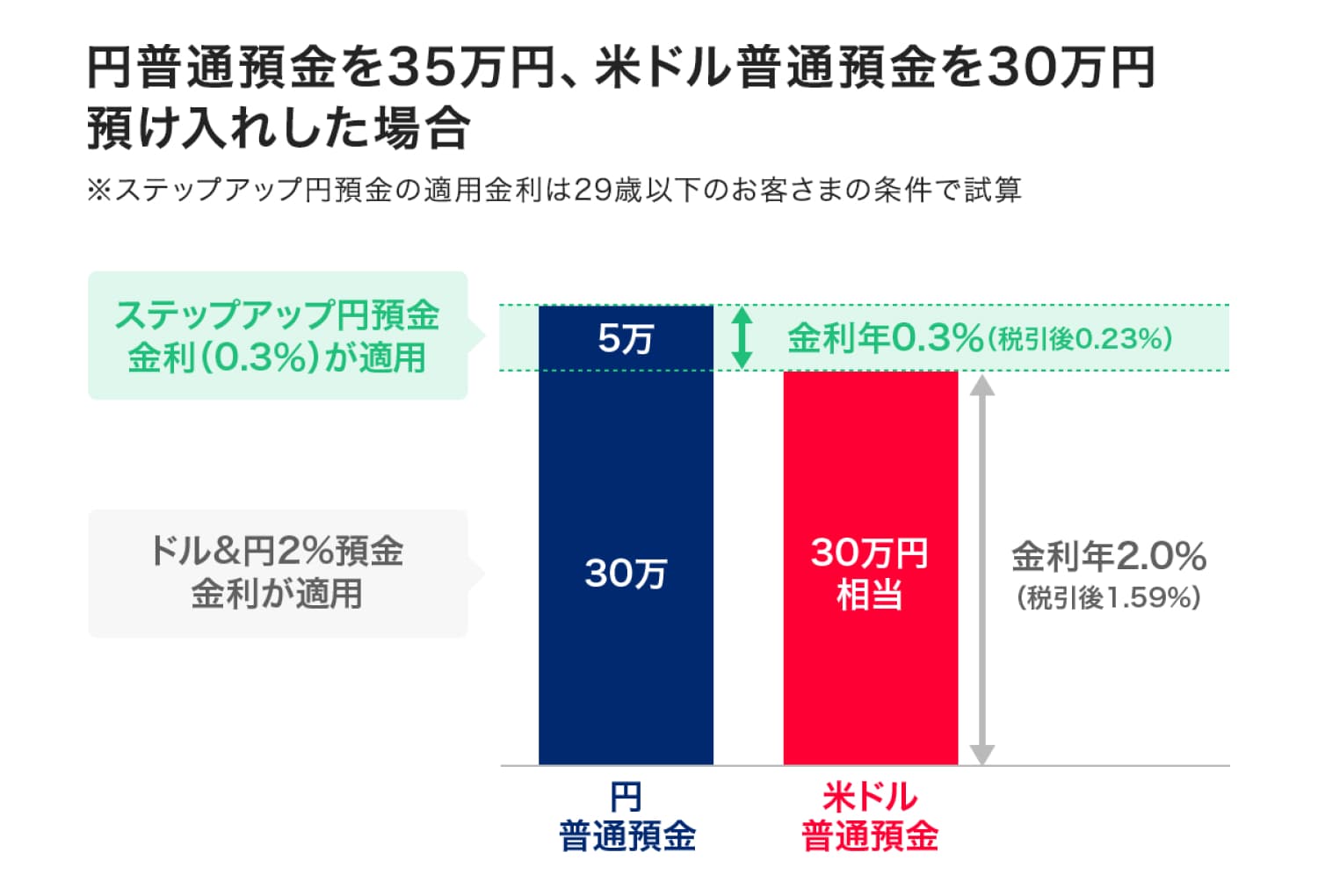

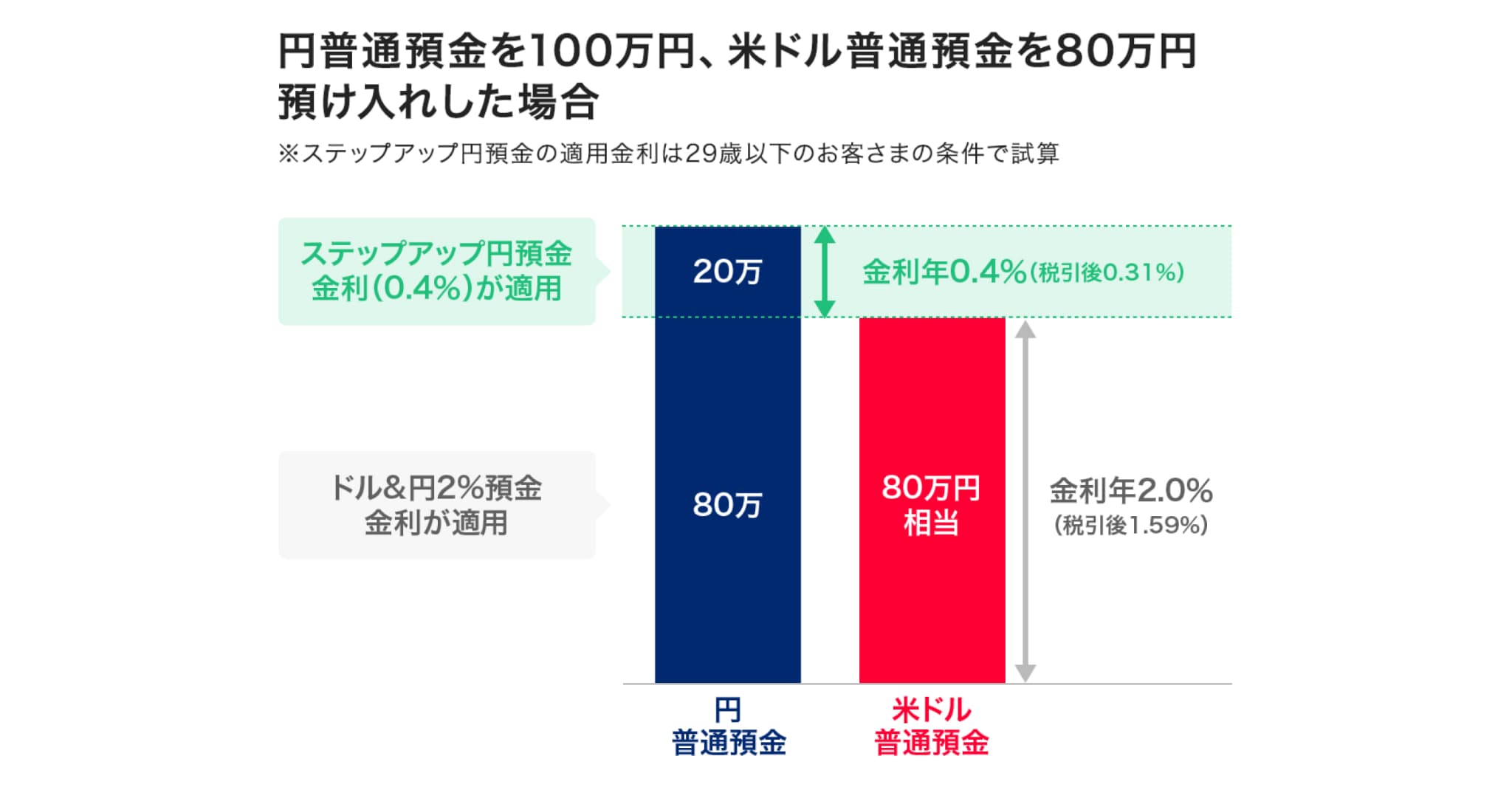

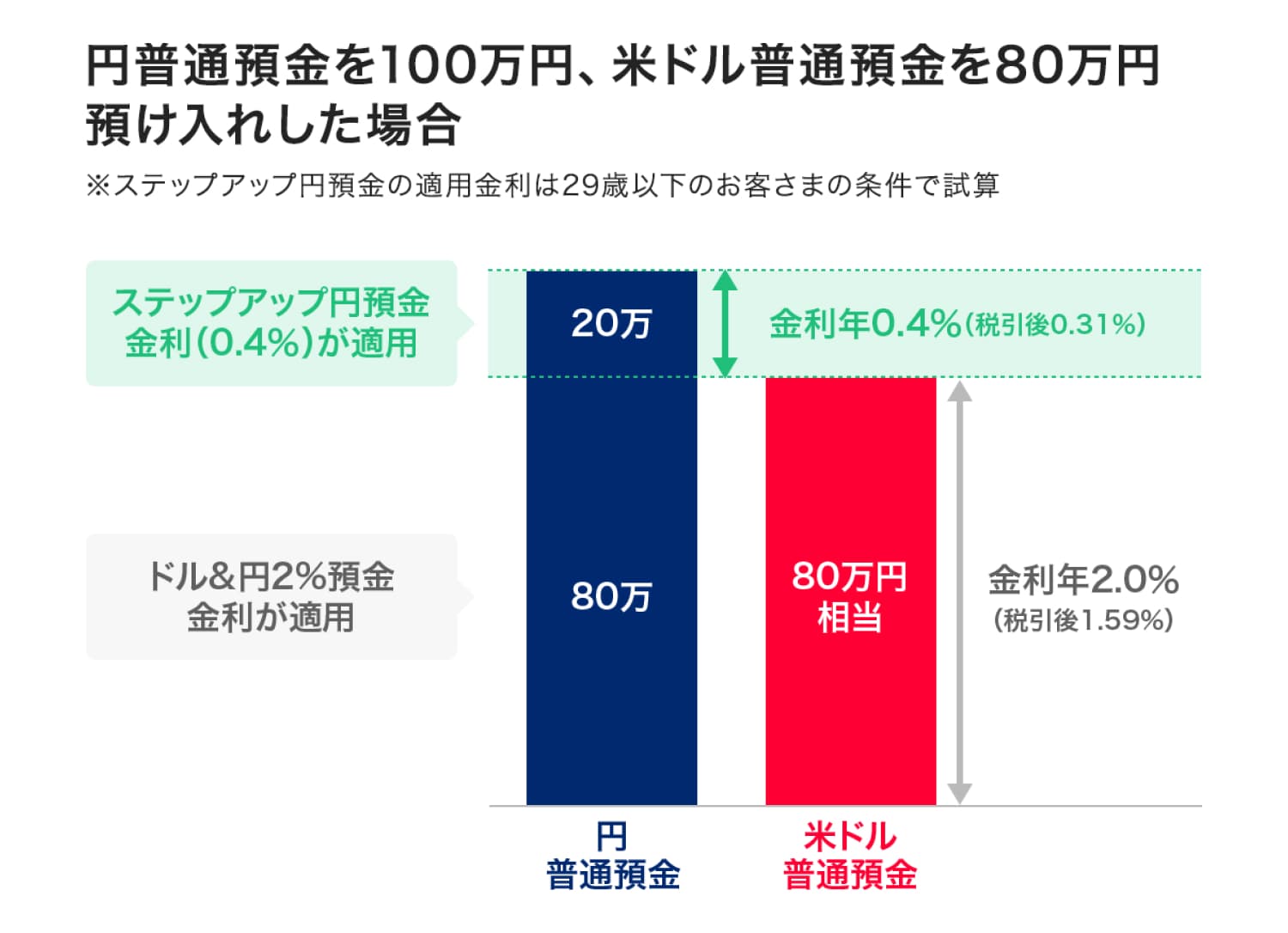

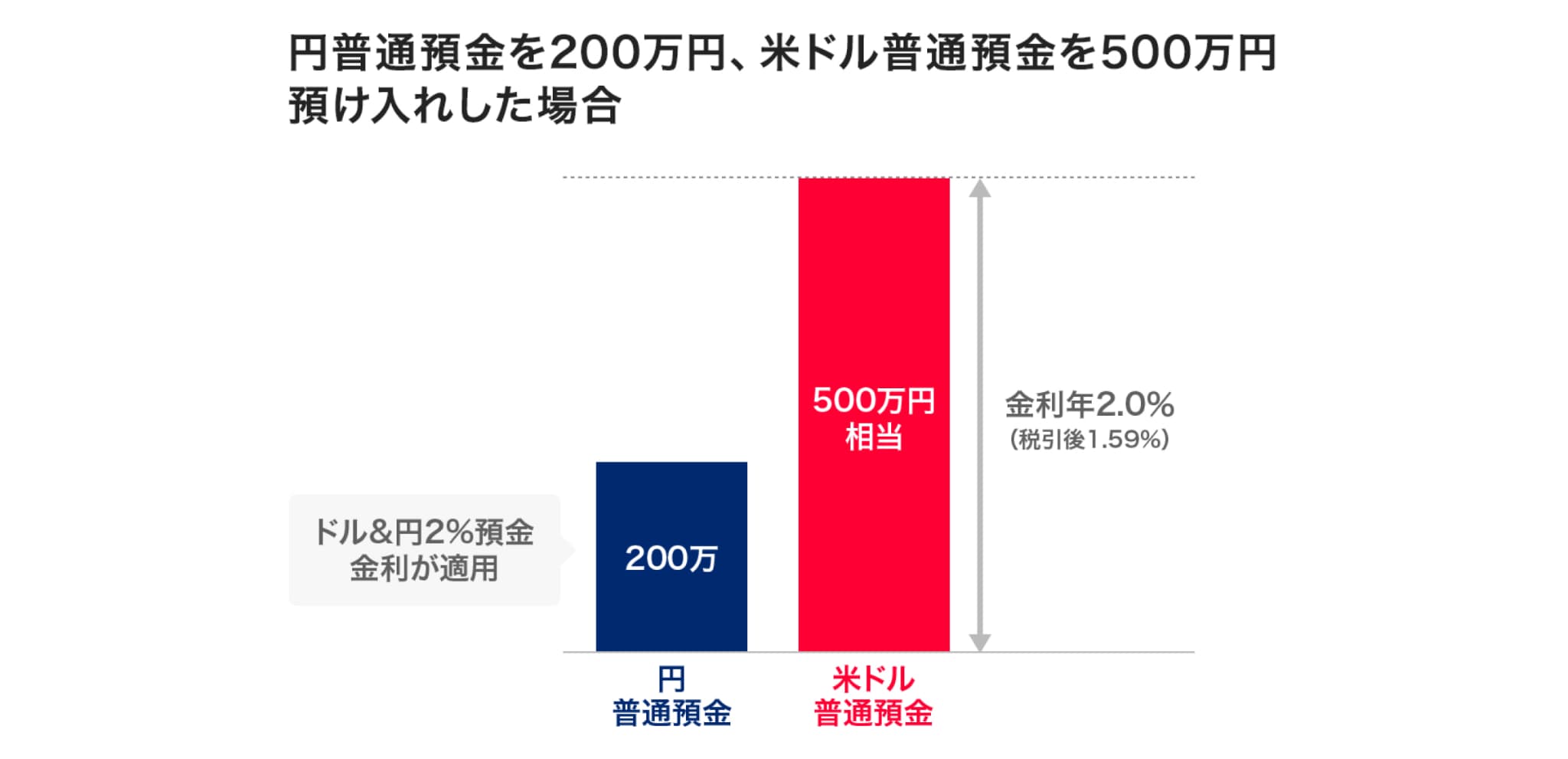

In December 2024 PayPay Bank launched a regular program, Deposit Revolution, which offers an interest rate of 2.0% per annum (1.59% after tax)*1, *5, *6 on both yen ordinary deposits and dollar ordinary deposits if customers deposit funds in both. With the addition of the Step-Up Yen Savings Deposit, the name of this program will be changed from “Deposit Revolution” to “Dollar & Yen 2% Deposit,” and both regular programs will be collectively referred to as “Deposit Revolution.”

*5. The interest rate for the U.S. dollar ordinary deposit is the regular rate, and the interest rate for the yen ordinary deposit is a special interest rate has been added to the regular interest rate of 0.2% per annum.

*6. The maximum balance of yen ordinary deposits to which the special interest rate of the Dollar & Yen 2% Deposit can be applied is the monthly average balance of U.S. dollar ordinary deposits (the dollar deposit balance at the end of each day is converted to its yen-equivalent according to the final USD/JPY rate of the day; however, the limit for yen ordinary deposits is 5 million yen). There is no upper limit for U.S. dollar ordinary deposits.

■ Conditions for Dollar & Yen 2% Deposit and special interest rates

The special interest rate of 2.0% per annum (1.59% after tax) for the Dollar & Yen 2% Deposit program will be preferentially applied to yen ordinary deposits when customers deposit into both U.S. dollar ordinary deposits and yen ordinary deposits. If a customer has 5 million yen in a yen ordinary deposit account and 3 million yen worth of balance in the U.S. dollar ordinary deposit account, the special interest rate of 2.0% per annum (1.59% after tax) from Dollar & Yen 2% Deposit will be applied to 3 million yen out of the 5 million in the yen ordinary deposit, and 0.4% (0.31% after tax) will be applied to the remaining 2 million yen through the Step-Up Yen Savings Deposit program.

■ Easily check in an app the current interest rate and interest earned through the Deposit Revolution

In the PayPay Bank app, as well as the PayPay Bank mini app in the PayPay app, users can see at a glance the interest earned from Dollar & Yen 2% Deposit and Step-Up Yen Savings Deposit. Details regarding applicable interest rates and interest earned from each regular program are also available for an even more convenient experience.

PayPay Bank and PayPay will continue to strengthen inter-corporate collaboration through continuously updating services and applications together to provide strong support in making customers’ asset building more convenient.

■ About this press release

This press release is for informational purposes only. Foreign currency deposits are foreign currency denominated deposits (deposits not covered by deposit insurance), and there is the risk of losing principal, such as the yen-equivalent at the time of withdrawal being less than the yen-equivalent at the time of deposit, depending on foreign exchange rates. In addition, foreign exchange fees will be charged at the time of deposit and withdrawal. The deposit rate (the rate applied when converting yen to a foreign currency) and the withdrawal rate (the rate applied when converting a foreign currency to yen) include exchange fees, and deposit rates are usually higher than withdrawal rates. Therefore, even in the absence of fluctuations in foreign exchange rates, the amount of yen at the time of withdrawal may be less than the amount at the time of deposit, resulting in a loss of principal. If a user wishes to start trading or wishes to continue trading, please read the Terms and Conditions and the product information carefully to fully understand the structure and risks, and trade at one’s own risk. Please check the following PayPay Bank webpage for the latest interest rates and important information on foreign currency deposits.

▽ Interest rates

https://www.paypay-bank.co.jp/interest/index.html

▽ Important information on foreign currency deposits

https://www.paypay-bank.co.jp/fcd/attention.html

■ About PayPay Bank

PayPay Bank (formerly Japan Net Bank) was established in 2000 as Japan’s first bank specializing in internet banking, and currently serves over 8.62 million accounts (as of December 2024). After rebranding to “PayPay Bank” in April 2021, it has further strengthened its partnership with PayPay, launching the PayPay Bank mini app within the PayPay app in August 2022.

PayPay Bank’s mission is to “Make financial services as accessible as air,” and the company will continue to work toward the goal of providing financial services that are unseen yet indispensable, and that people happen to be using by the time they notice.

To that end, it is the bank’s mission to continue providing products that meet various needs and offer services that make people’s lives more convenient.

■ About “PayPay,” the cashless payment service provided by PayPay Corporation

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis, and even public transportation. It can also be used in a variety of other situations, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay Balance (PayPay Money and PayPay Money Lite) between each other for free, or “point management,” a service that allows users access to a simulated investment experience involving the exchange of PayPay Points with points provided by a service provider that PayPay is partnered with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labor and Welfare No. 00001 / Date of designation: August 9, 2024)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) refers to PayPay Money that can only be purchased with wages received by the PayPay user in their Paycheck Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. Note that PayPay Points (Time Limited) can only be used for payments with certain services provided by LY Corporation and its group companies. It cannot be transferred between PayPay users or withdrawn. Additionally, PayPay Points (Time Limited) have an expiry date. For the exact date of expiry, please confirm the information provided by LY Corporation or group company regarding the promotional campaign or measure. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.