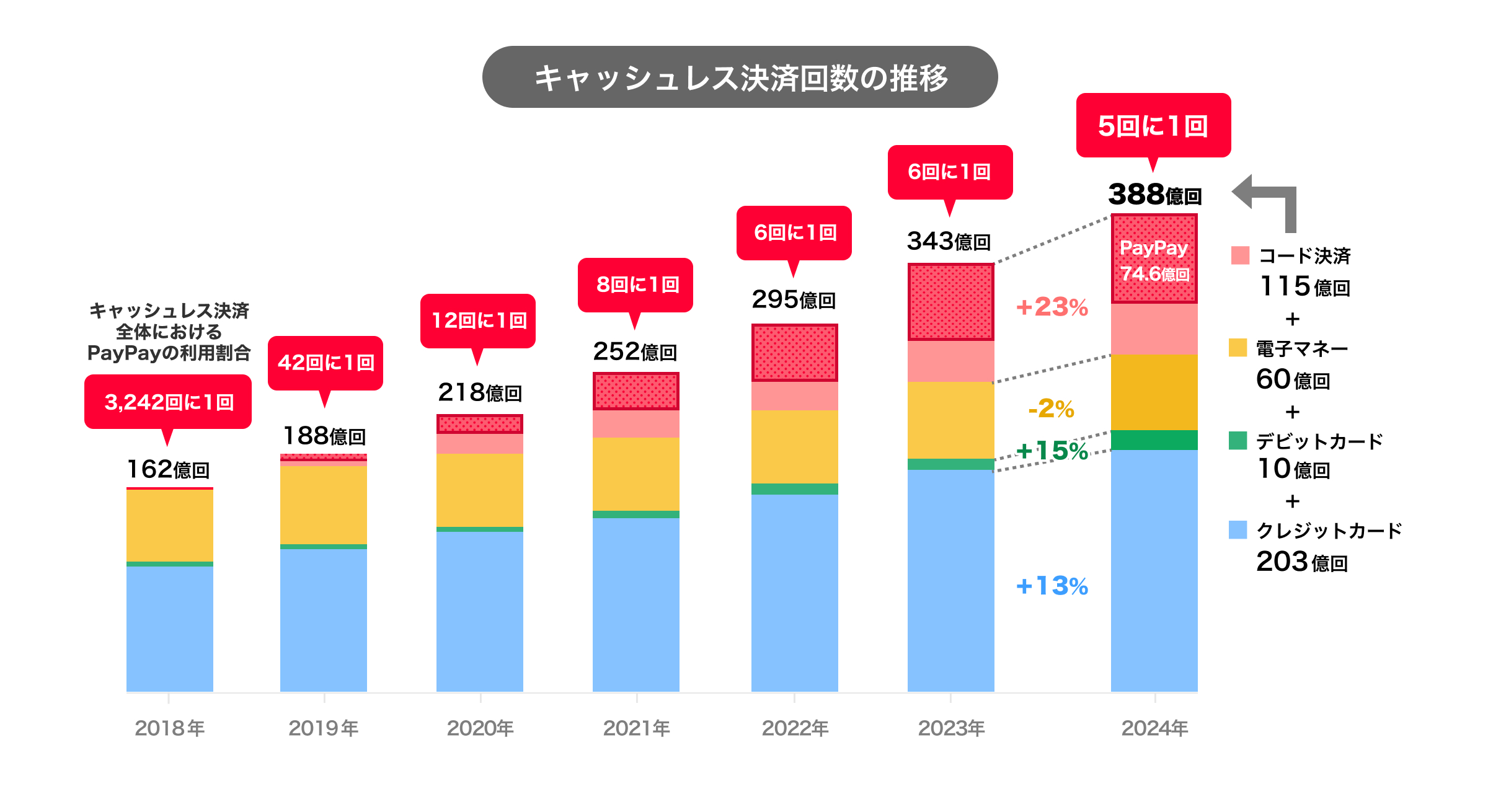

PayPay Corporation is pleased to announce that the total number of “PayPay” transactions in 2024 surpassed 7.46 billion, resulting in “PayPay” accounting for approximately 1 in every 5 of the 38.8 billion cashless transactions overall.*1 Furthermore, the total number of domestic code-based transactions increased by 23% from the previous year, reaching 11.5 billion, with “PayPay” maintaining its position by holding approximately two-thirds*2 of the market share since 2020, establishing itself as the number one code-based payment service in Japan.

*1. Calculated by PayPay based on data from the Japan Consumer Credit Association’s publication “Credit Statistics in Japan 2024” for the number of credit card transactions, the Bank of Japan’s report “Payment and Settlement Statistics (January 2025)” for the number of debit card and electronic money transactions, and PAYMENTS JAPAN’s publication “Stats – Code Payment” released on March 14, 2025 for the number of code-based transactions. Figures are rounded to the lowest decimal place displayed.

*2. The share of “PayPay” calculated based on data from PAYMENTS JAPAN’s publication “Stats – Code Payment” released on March 14, 2025, and PayPay’s research.

Figures in the graph: Figures from 2018 to 2021 were taken from “Summary of the Study Group on the Future of Cashless Payments” published by the Ministry of Economy, Trade and Industry. Figures from 2022 onward were calculated by PayPay based on the total number of credit card transactions in “Monthly Survey: Credit Card Trends” published by Japan Consumer Credit Association, the number of debit card and e-money transactions in “Payment and Settlement Statistics (January 2025)” published by the Bank of Japan, and the number of code payments in “Stats – Code Payment” published by PAYMENTS JAPAN on March 14, 2025. All decimal numbers are rounded to the nearest whole number.

The target for Japan’s cashless payment ratio, set by the Ministry of Economy, Trade and Industry, was to achieve 40% by 2025 and aim for 80% in the long term. The ratio was 39.3% in 2023 and 42.8%*3 in 2024, achieving the 2025 goal a year ahead of schedule. While credit cards, characterized by higher average spend per payment, hold a significant share amongst cashless payment methods by transaction amount, in terms of transaction frequency in 2024, code-based payments exceeded half of credit card transactions, with the number of credit card transactions amounting to 20.3 billion and code-based transactions reaching 11.5 billion. By 2022, code-based payments surpassed electronic money in both transaction frequency and amount, establishing itself as the second most popular method of cashless payment after credit cards.

“PayPay,” which accounts for around 20% of the domestic cashless transaction count, holds a large amount of transaction data compared to other cashless services, which has begun to be utilized in marketing strategies and credit screening for “PayPay Card.” For financial support to merchants, PayPay provides a same-day financing solution in which transaction data is used to determine, via AI, the amount of funds that can be procured and the repayment ratio. By leveraging transaction data, PayPay aims to create new businesses that will provide more efficient and convenient services for both users and merchants.

Since PayPay launched the PayPay app in October 2018, over two-thirds,*4 or over 68 million smartphone users in Japan, have used it, with the annual transaction count reaching 7.46 billion in 2024. Throughout 2024, PayPay continued to expand its merchant network, including online services, enabling usage in even more diverse scenarios, such as donations and offerings. Initially popularized by small-value transactions, PayPay now supports transactions of up to 1 million yen per purchase, accommodating high-value payments for travel, airline reservations, department stores, and more. By creating an environment where “PayPay,” daily used by numerous users, can be employed for both small and large transactions, an increase in both transaction frequency and amounts is anticipated.

*3. “2024 Ratio of Cashless Payments Among the Total Amount Paid by Consumers Calculated,” published by the Ministry of Economy, Trade and Industry on March 31, 2025.

*4. Calculated by PayPay based on “Population Projections – October 2023 Report” published by the Statics Bureau of Japan and “1. Information Communication Devices Ownership” in “2023 Telecommunications Usage Trends Survey” published by the Ministry of Internal Affairs and Communications

*5. Number of users who have registered a PayPay account as of March 2025.

PayPay will continue to strive for a world where users and all types of restaurants and service providers can enjoy the convenience of cashless payment and use the cashless payment service with confidence anywhere in Japan. Furthermore, PayPay aims to evolve from a payment app into a super app that enriches users’ lives and makes them more convenient, fostering a world where paying “Anytime, Anywhere with PayPay” is a reality. As the company was designated by the Financial Services Agency as a Specified Essential Infrastructure Service Provider in November 2023, PayPay is committed to continue providing an even safer and more secure environment for users.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labor and Welfare No. 00001 / Date of designation: August 9, 2024)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out and transferred to a designated bank account (no transfer fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) means PayPay Money that can only be purchased with wages received by the PayPay user in their Salary Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount related to the funds transfer balance. PayPay Money Lite is a type of electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, Time-Limited PayPay Points are restricted to payments for certain services provided by LY Group. They cannot be transferred between PayPay users or be cashed out. Time-Limited PayPay Points have an expiration date, which can be confirmed in the details or conditions of the LY Group measures or promotional campaigns. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, PayPay Bonus and PayPay Bonus Lite cannot be transferred between PayPay users or be cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued. PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see applying for compensation for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.