PayPay Corporation (hereinafter “PayPay”) is pleased to announce that 100 companies have now adopted PayPay Paycheck, a digital payroll service*¹, Companies that have introduced this system include Sakai Moving Service Co. Ltd, Mitsui Sumitomo Insurance Co., Ltd., Limited, and Yoshinoya Co., Ltd.

*¹Labor-management agreements and other such contracts have been revised and agreed upon with employees (labor representatives). Further, only companies that have reported to PayPay that they have already informed their employees about digital payroll and PayPay Paycheck are counted.

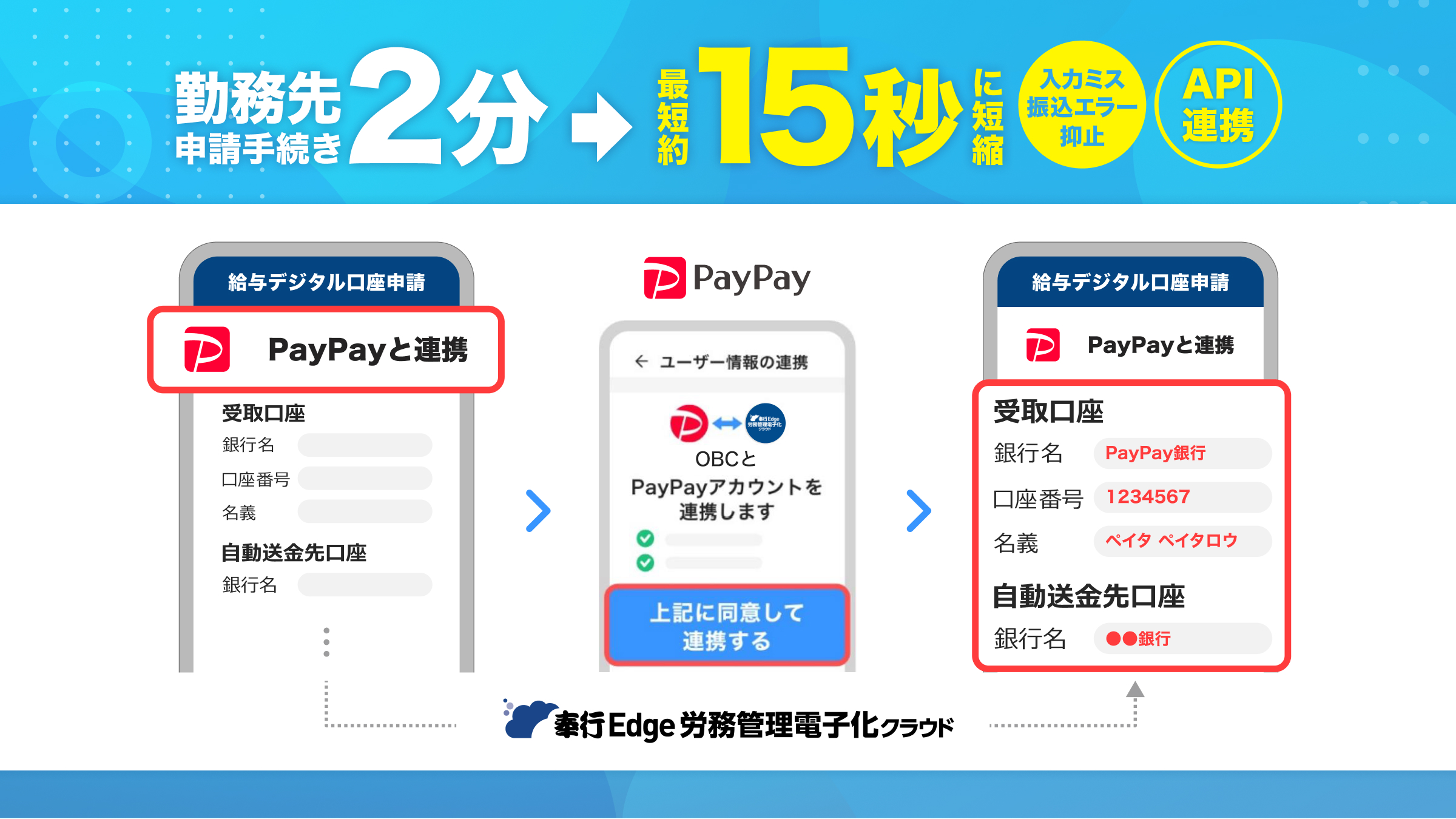

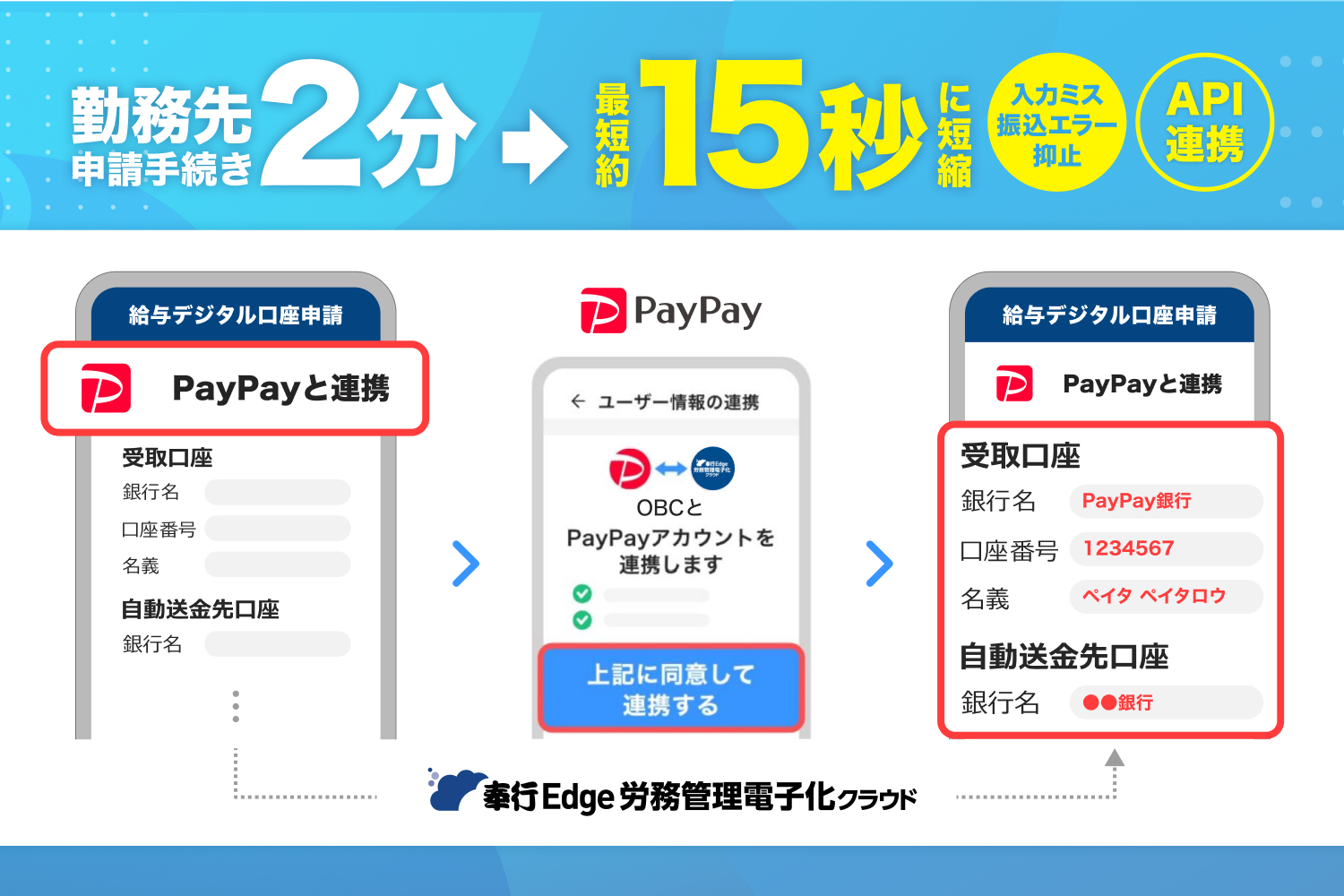

In addition, API integration with Bugyo Edge Digital Labor Management Cloud, provided by Obic Business Consultants Co., Ltd. (hereinafter “OBC”), has also started. This is the first case of a cashless payment service and HR payroll system linking information to enable the smooth collection of information such as account information for payout required for digital payment of salaries*², in the HR service industry and the cashless payment industry combined.

By tapping the “Link with PayPay” button, employees of companies using Bugyo Edge Digital Labor Management Cloud can complete the entry of necessary information, such as account information for deposits, in as little as 15 seconds, enabling smoother use of PayPay Paycheck.

Back-office departments, such as HR and accounting, can also improve the efficiency of their payroll operations by preventing deposit errors due to human error.

*² Based on PayPay research (as of April 10, 2025).

■ Integration with Bugyo Edge Digital Labor Management Cloud provided by OBC

Until now, employees of companies using Bugyo Edge Digital Labor Management Cloud were required to manually enter information, such as the bank account to which PayPay Paycheck deposits would go, into their employer’s labor management system (Bugyo Edge Digital Labor Management Cloud).

This process took approximately two minutes to complete, and for the companies’ back-office employees, the burden of dealing with deposit errors caused by human error became an issue. PayPay newly developed an “account number reference API for salary deposits” for PayPay Paycheck, which is now used to link information between PayPay Paycheck and Bugyo Edge Digital Labor Management Cloud offered by OBC.

With this, employees no longer need to manually enter the required information, and back-office personnel can reduce the burden of checking the entered information and handling deposit errors.

*Patent application submitted (application number: 2025-002102)

*This new feature is provided based on the contract reported in the press release on August 21, 2024.

*The use of this feature requires prior configuration at the place of work. In addition, employees must first confirm that their employer supports digital payroll and then apply for PayPay Paycheck through the PayPay app beforehand.

*Using Bugyo Edge Digital Labor Management Cloud on smartphone

PayPay will continue to promote the smooth introduction of PayPay Paycheck to companies and further improve convenience for both employees using this service (PayPay users) and back-office personnel.

▼ About PayPay Paycheck

https://paypay.ne.jp/guide/paycheck-employer/

▼ OBC’s Bugyo Edge Digital Labor Management Cloud

https://www.obc.co.jp/bugyo-edge/labor

PayPay Corporation is registered as follows: ・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018) ・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019) ・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019) ・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019) ・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020) ・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021) ・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023) ・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labour and Welfare No. 00001 / Date of designation: August 9, 2024) ・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018) ・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money as part of its services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers. PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) refers to PayPay Money that can only be purchased with wages received by the PayPay user in their Paycheck Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, Time-Limited PayPay Points are restricted to payments for certain services provided by LY Group. It cannot be transferred between PayPay users or cashed out. Additionally, PayPay Points (Time Limited) have an expiry date. which can be confirmed in the details or conditions of the LY Group measures or promotional campaigns. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued. PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.