PayPay Corporation (Shinjuku-ku, Tokyo; President & Representative Director, CEO, Corporate Officer: Ichiro Nakayama; hereinafter “PayPay”) is pleased to announce the launch of a new payment method, “PayPay Bank Balance,”*1 starting April 15, 2025. This payment option is available through the PayPay Bank app provided by PayPay Bank Corporation (Shinjuku-ku, Tokyo; President & Representative Director: Tomohito Takusari; hereinafter “PayPay Bank”).*2 Payments made through the PayPay interface within the PayPay Bank app will be directly debited from the Japanese yen savings deposit balance at PayPay Bank.*3

■ The new payment method: “PayPay Bank Balance”

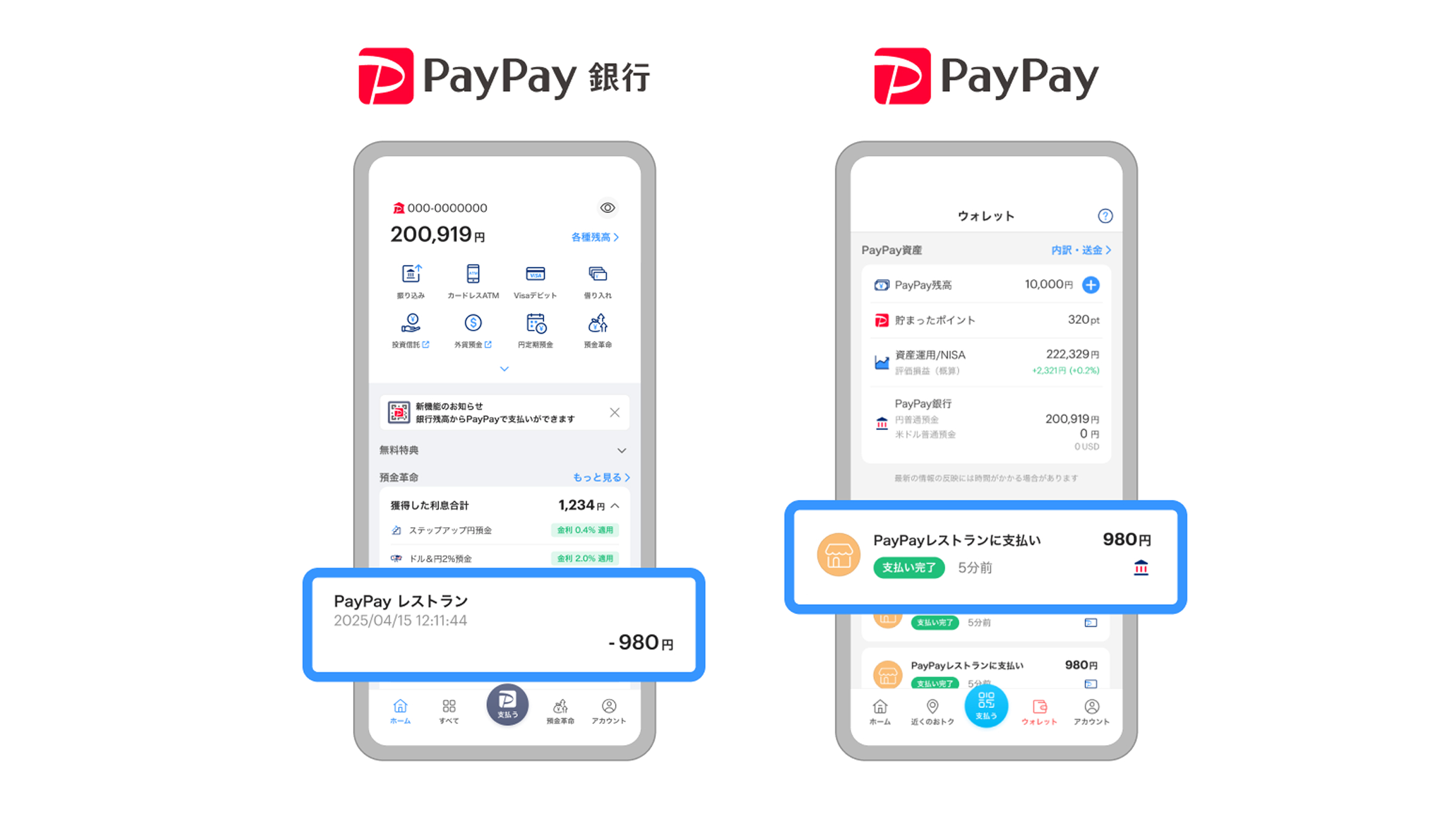

With the introduction of “PayPay Bank Balance,” a new PayPay payment icon will appear in the PayPay Bank app. Simply tap the icon, and a navy-colored payment screen will pop up. Users can make payments either by presenting their code for the store to scan or by scanning a QR code displayed at the store.*4 There is no need for top-ups beforehand, as the payment amount is immediately deducted from the yen savings deposit balance at PayPay Bank, making it a highly convenient way to pay. Please note that this payment method will not be eligible for the PayPay STEP program.*5

■ Earn interest on unused money with PayPay Bank*6

By meeting balance requirements based on age, PayPay Bank offers a special interest rate of 0.4% per annum (0.31% after tax),*7 roughly twice the industry standard for yen savings deposit interest rates.*8 By leveraging this program, users can efficiently manage their finances by depositing unused funds into PayPay Bank to earn interest and paying directly through their PayPay Bank account using PayPay when shopping. This unique benefit and ease of use are exclusive to PayPay Bank.*9

■ Transaction history can be viewed on either PayPay app or PayPay Bank app

After payments, users can check transaction histories via both the PayPay app and the PayPay Bank app, confirming merchant names, transaction dates, and amounts. Users concerned about overspending with cashless transactions can confidently monitor their spending by checking their PayPay Bank balance. Please note that “PayPay Bank Balance” is available to users who have verified their identity with PayPay (eKYC) and hold a yen savings deposit account with PayPay Bank.

PayPay and PayPay Bank are committed to strengthening collaboration and will continue to update its services and apps to provide a convenient and user-friendly experience.

*1. “PayPay Bank Balance” is a new payment service provided by PayPay.

*2. The PayPay Bank app must be updated to the latest version (6.0.0 or above).

*3. The usage limit for “PayPay Bank Balance” is 1 million yen per day, including top-ups made from PayPay Bank to PayPay Balance. This limit is subject to change at the discretion of PayPay Bank and PayPay. The limit can also be changed by users in the PayPay Bank app or PayPay Bank website.

*4. Currently unavailable for online merchants, but expansion is planned.

*5. Please check individual campaign conditions to know if “PayPay Bank Balance” payments qualify for benefit grants.

*6. PayPay Corporation acts as a banking agency (external website), with PayPay Bank Corporation as its principal bank, and intermediates (solicits) the conclusion of contracts for “acceptance of yen savings deposits,” “acceptance of foreign currency savings deposits,” “yen loan,” and “exchange transactions.” However, the intermediation (solicitation) of contracts for “acceptance of foreign currency savings deposits” and “exchange transactions” is limited to individual customers.

*7. Includes a regular interest rate of 0.2% per annum (0.15% after tax). For more details, please refer to the following: https://about.paypay.ne.jp/pr/20250317/01/

*8. Compared with the regular interest rate of 0.2% per annum (before tax)—excluding promotional interest rates—on yen savings deposits at three megabanks (Mizuho Bank, Sumitomo Mitsui Banking Corporation, MUFG Bank), six internet banks (Shinhan Bank Japan, SBI Sumishin Net Bank, Sony Bank, Daiwa Next Bank, UI Bank, Rakuten Bank), Japan Post Bank, and 60 traditional regional banks. (Based on PayPay Bank research as of April 2025. The banks compared are only those that have announced by April 4, 2025, an increase in their yen savings deposit interest rates from February 2025.)

*9. “Benefit” refers to the interest rate double the industry-standard for savings deposits.*8 “Ease of use” indicates the unique provision of “PayPay Bank Balance” by PayPay Bank.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labour and Welfare No. 00001 / Date of designation: August 9, 2024)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Certificates.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) refers to PayPay Money that can only be purchased with wages received by the PayPay user in their Paycheck Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Points (Time Limited) can only be used for payments with certain services provided by LY Corporation and its group companies. It cannot be transferred between PayPay users or cashed out. Additionally, PayPay Points (Time Limited) have an expiry date. For the exact date of expiry, please confirm the information provided by LY Corporation or group company regarding the promotional campaign or measure. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.

————————————————————————————

PayPay Bank Corporation

Registered Financial Institution: Director-General of the Kanto Finance Bureau (Tokin) No. 624

Member of the following financial instruments associations: Japan Securities Dealers Association, Financial Futures Association of Japan

————————————————————————————