Sumitomo Mitsui Card Company, Limited (Headquarters: Koto-ku, Tokyo; President & CEO: Yukihiko Onishi; hereinafter “Sumitomo Mitsui Card”) and SoftBank Corp. (Headquarters: Minato-ku, Tokyo; President & CEO: Junichi Miyakawa; hereinafter “SoftBank”) have entered into a master agreement concerning a comprehensive business alliance in the digital domain (hereinafter “Alliance”). Following this Alliance, PayPay Corporation (Headquarters: Shinjuku-ku, Tokyo; President & Representative Director, CEO, Corporate Officer: Ichiro Nakayama; hereinafter “PayPay”) and Sumitomo Mitsui Card will sequentially launch new initiatives in collaboration

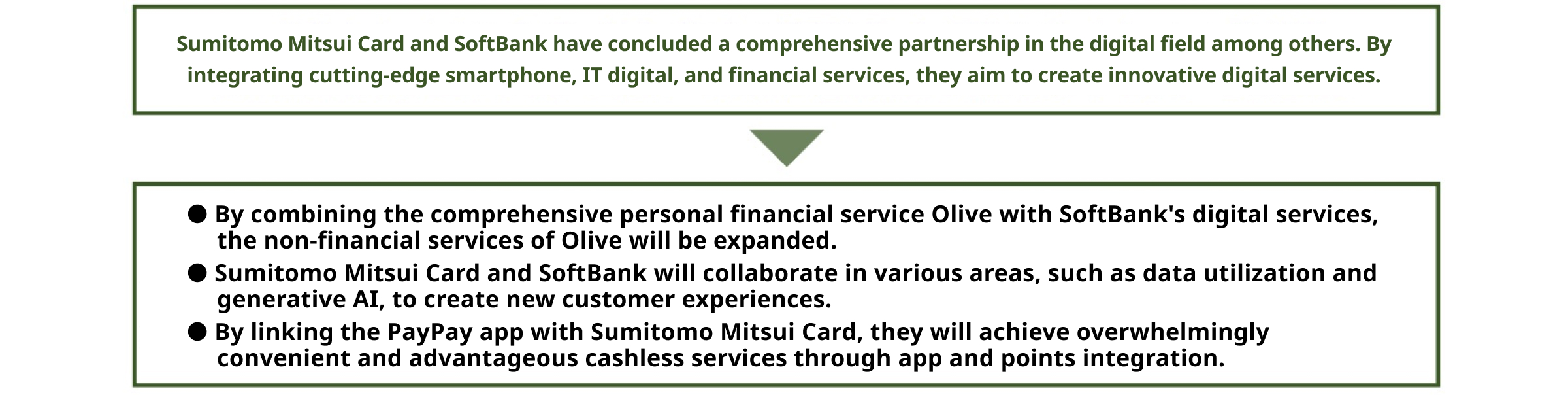

1. Purpose of the Alliance

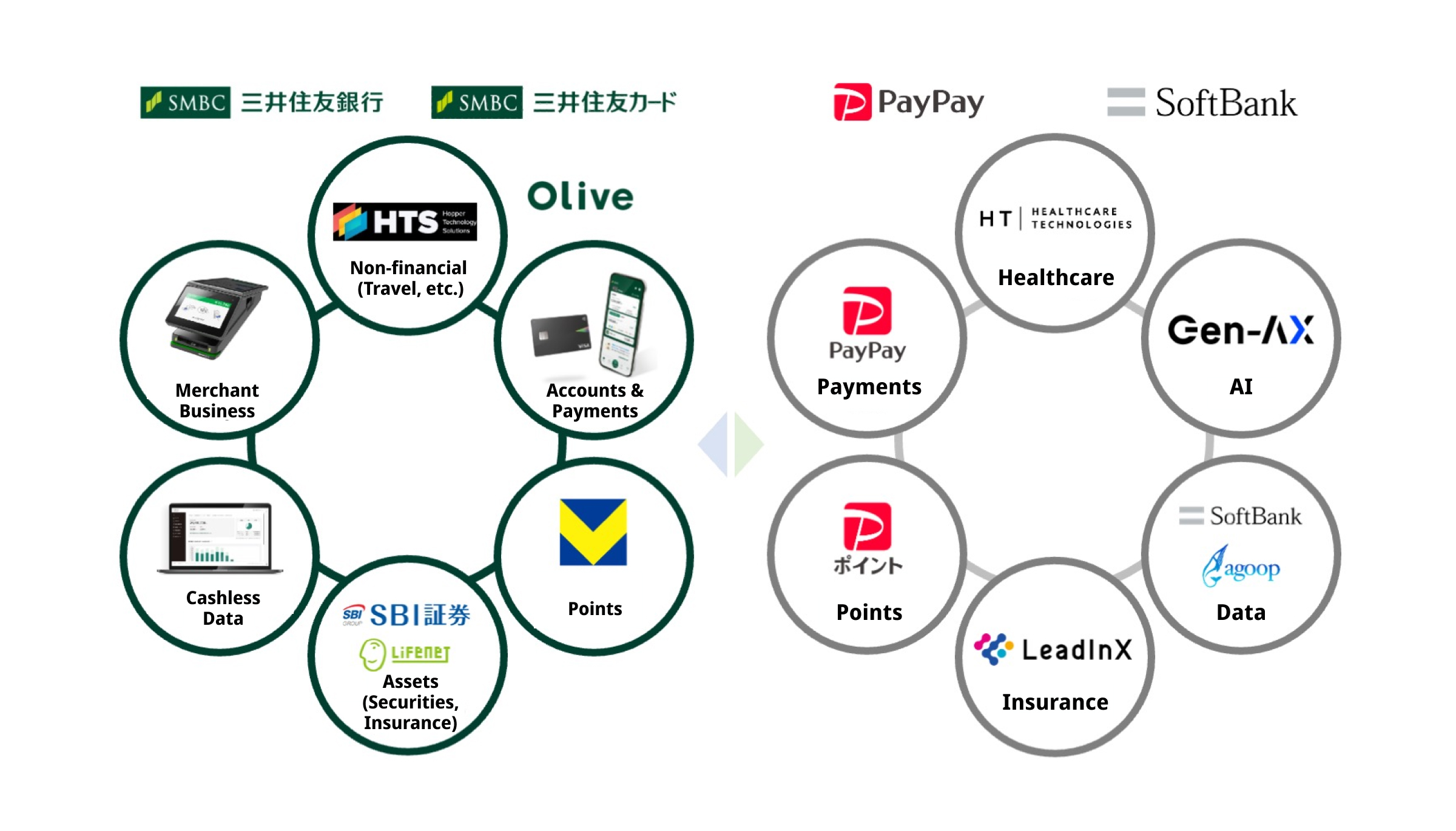

In recent years, technological and digital advancement have led to the creation of numerous innovative services, including collaborations that transcend industries and business models. The SMBC Group has been establishing an environment where it can offer digital-based touchpoints for its customers, with its comprehensive personal financial service, Olive, as its mainstay. Olive, which seamlessly provides banking accounts, card payments, securities, and insurance, continues to build partnerships with leading companies inside and outside the group. Furthermore, by March 2025, it expanded into the non-financial sector with the launch of travel services, making it increasingly convenient and comprehensive.

Meanwhile, SoftBank has been providing diverse services critical for the advancement of a digitalized society as a next-generation social infrastructure provider. In addition to telecommunication services, SoftBank is expanding various services including financial services, DX/solutions leveraging its group companies, as well as entertainment and healthcare.

By combining SoftBank’s wide range of digital technology-based services with SMBC Group’s open financial platform, both companies aim to realize advanced and superior digital services that offer greater convenience and benefits. They share a common vision in contributing to the acceleration of digitalization and the transition to a cashless society in Japan, leading to the development of new services together.

2. Details of the Alliance

By constructing a comprehensive partnership in the digital domain, the alliance aims to integrate Olive’s diverse functionalities such as banking accounts, card payments, finance, and online securities with the wide range of products and services provided by SoftBank and its group companies, including healthcare, AI-driven demand forecasting for retail and dining industries, generative AI, and finance. Additionally, by facilitating mutual integration between Vpass, Olive, and the PayPay app, the alliance seeks to create overwhelmingly convenient and advantageous cashless services.

(1) Alliance with SoftBank

1. Expansion of Non-Financial Services such as Healthcare within the Comprehensive Financial Service Olive

By integrating various digital services offered by Olive and SoftBank, the scope of non-financial services within Olive will be further expanded, evolving it into a super app that goes beyond financial boundaries.

As the first step, within fiscal year 2025, Sumitomo Mitsui Card will introduce a new healthcare portal for its credit card members, in collaboration with SoftBank’s subsidiary, Healthcare Technologies Corp., which promotes health improvement through data utilization. This will enable Olive members to seamlessly access health and medical services through the app, allowing them to receive support from healthcare professionals anytime and anywhere. Furthermore, tailored to the needs of Olive members, a wide range of services to support health maintenance and improvement will be offered, contributing not only to health enhancement but also to the optimization of medical costs.

Additionally, as a proactive measure for health, Sumitomo Mitsui Card will renew its insurance portal and expand its product lineup to make it easier for customers to apply for insurance products through its digital channels. This will be done in collaboration with LeadInX Corp., a SoftBank subsidiary offering InsurTech services, to provide insurance products that meet customer demand.

Moreover, healthcare services will also be made available to Sumitomo Mitsui Card’s corporate members, offering packages that include a healthcare app for employees, mental counseling, and group insurance, thereby supporting corporate members in their health management initiatives.

2.Advancement of Data Utilization by Combining Payment Data and Human Flow Statistical Data

Sumitomo Mitsui Card and SoftBank are collaboratively exploring the provision of new customer analysis tools*1 that combine payment data owned by Sumitomo Mitsui Card with human flow statistical data and other external data held by SoftBank and its group companies.

As part of its merchant business offerings, Sumitomo Mitsui Card provides marketing support utilizing payment data. This data has the unique feature of capturing both the attributes of credit card members and those of merchants, offering potential for detailed understanding of purchasing behavior.

By integrating this payment data with high-granularity human flow statistical data from Agoop Corp., a SoftBank subsidiary specializing in big data business utilizing location information, the analysis can encompass both visit and purchase trends for a store and its surrounding area. This enables businesses to identify untapped customer segments by analyzing the differences in attributes between their own customers and surrounding shops. Moreover, companies can confirm the impact of various initiatives on attracting customers and driving purchases.

Furthermore, by analyzing the combination of payment data from Sumitomo Mitsui Card, human flow statistical data from SoftBank, along with external data such as weather and calendar information using AI algorithms developed by SoftBank, future demand forecasts can be made for retail and dining establishments and their surrounding areas

Additionally, Sumitomo Mitsui Card offers a merchant referral service leveraging its V Points, and by combining these services, the company aims to provide more advanced marketing insights and execution support centered around its network of merchants. Through more multidimensional marketing support, Sumitomo Mitsui Card will contribute further to solving business challenges related to management strategies, customer analyses, and promotions

3. Business Creation Using Generative AI

As the generative AI era approaches, SoftBank is constructing AI data centers and developing a domestic large language model (LLM) as part of the infrastructure supporting the AI age.

Sumitomo Mitsui Card is also exploring the use of generative AI to fundamentally enhance UI/UX and to offer personalized services, with a focus on further evolution of digital-based services such as Olive.

Seizing this collaboration opportunity, Sumitomo Mitsui Card aims to significantly enhance customer experiences across daily usage scenarios by providing SoftBank’s advanced AI services to its customer base and merging them with its assets. Both companies will explore cooperations that utilize AI in various domains to achieve this goal.

As the first initiative in this AI collaboration, Sumitomo Mitsui Card will introduce a self-thinking AI service to its contact center, which leverages a voice generation AI developed by Gen-AX Corp., a SoftBank subsidiary supporting corporate operational reforms with generative AI. By utilizing the company’s cutting-edge technology and expertise, this self-thinking AI will provide optimal responses tailored to each customer, delivering a customer support experience that ensures the peace of mind and convenience of being able to connect at any time.

※1 Data handling will be appropriately conducted in compliance with each company’s privacy policy

(2) Customer-Centric Collaboration between PayPay, Sumitomo Mitsui Card’s Vpass, and Olive

In 2024, Japan’s cashless payment ratio surpassed the government’s target of 40%, reaching 42.8%.*2 Particularly, code payments saw a 23% increase in annual payment frequency year-on-year, exceeding 11.5 billion transactions, which is more than half the number of credit card transactions.*3 The annual transaction volume reached 13.5 trillion yen, evincing a rapid expansion within the six and a half years since the introduction of PayPay. Moreover, the annual transaction volume for credit cards is approaching 120 trillion yen, covering 80% of all transactions, solidifying its role as the core of cashless payments in Japan.

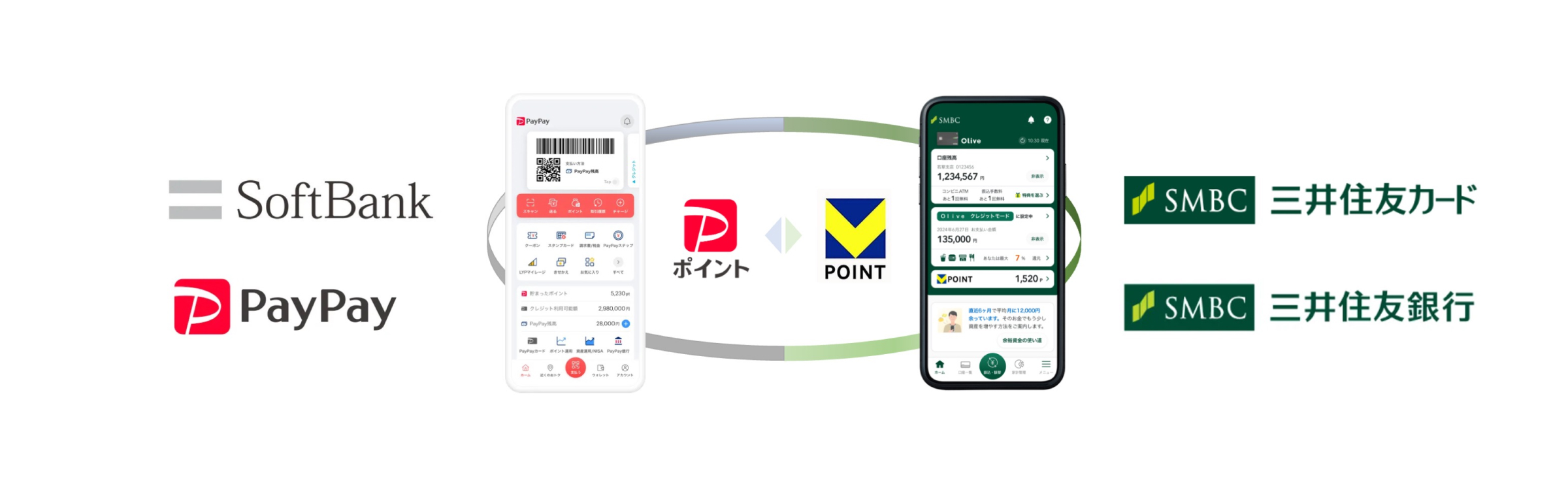

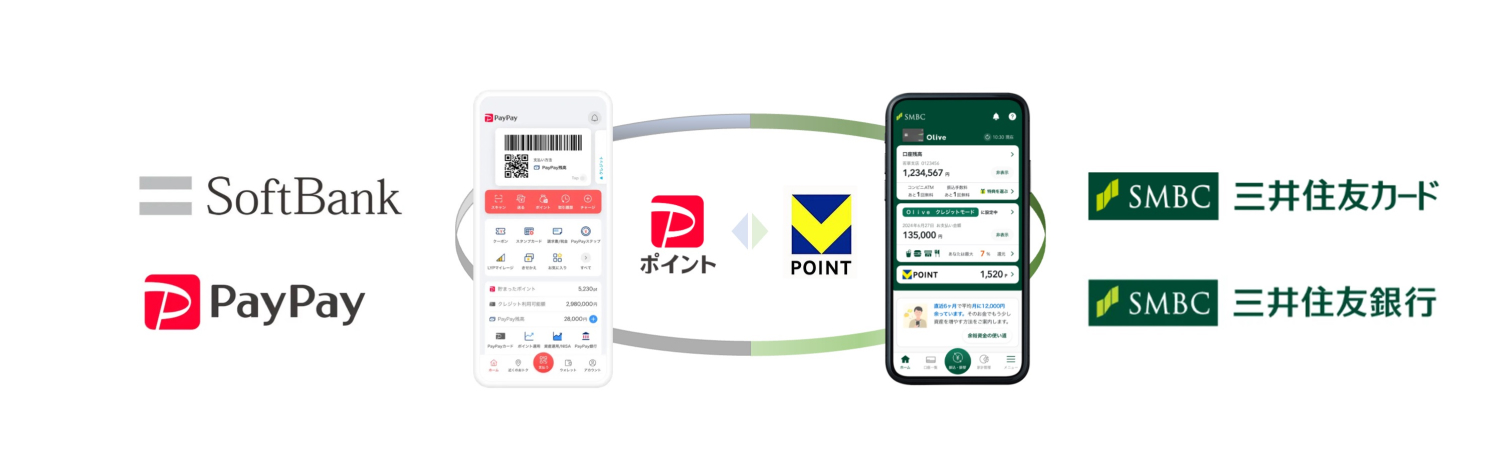

Recently, PayPay, with over 69 million users (as of May 2025) and holding the No.1 share in the code payment market, and Sumitomo Mitsui Card, which holds the top share in the domestic credit card market, have decided to collaborate by integrating their respective mobile apps. Additionally, they aim to enable mutual exchange between PayPay Points and V Points. This partnership aspires to offer incredibly convenient and cost-effective cashless payment services through the combined efforts of PayPay and Sumitomo Mitsui Card.

| Collaboration Details between PayPay, Sumitomo Mitsui Banking Corporation, and Sumitomo Mitsui Card |

| ①Preferred Treatment for Sumitomo Mitsui Card on PayPay*4 ・When making credit card-linked payments via the PayPay app, credit cards issued by Sumitomo Mitsui Card will continue to be available without any usage fees. |

| ② Advantages for PayPay Users on Olive ・Users can check their PayPay balance and perform top-up and withdrawal transactions between their Sumitomo Mitsui Banking Corporation (SMBC) account and PayPay balance via the Olive app. ・Withdrawal fees from PayPay balance to SMBC accounts will be free of charge.*5 ・PayPay balance can be added as a payment method under Olive’s Flexible Pay mode.Payments using PayPay balance at Visa-affiliated merchants worldwide are possible via Olive. |

| ③ Mutual Exchange between PayPay Points and V Points*6 ・Users can earn and use points at both PayPay and Visa-affiliated merchants, making both point services the leaders in Japan. |

※2 Referenced from the Ministry of Economy, Trade and Industry’s report “2024 Ratio of Cashless Payment Among the Total Amount Paid by Consumers Calculated“.

※3 Referenced from the “Code Payment Trend Survey” published by Payments Japan on March 14, 2025.

※4 Reference: “Usage of other company credit cards from 2025” announced by PayPay Corporation on December 5, 2024.

※5 For users utilizing the “PayPay Paycheck” service, the fee might also be 0 yen even for financial institutions other than PayPay Bank. For details, please click here.

Note that only PayPay Money and PayPay Money (Salary) balances can be withdrawn. eKYC is required to use PayPay Money and PayPay Money (Salary).

※6 V Points is a point service operated by CCC MK Holdings Co., Ltd.

(3) Exploring Collaborations across Various Business Domains, Including Other Group Companies

In addition to the initiatives outlined above, efforts are being made to create new businesses beyond the financial sector by connecting SoftBank’s various domains, such as mobility services (bicycle sharing and taxi dispatch), with Sumitomo Mitsui Card customers.

Moving forward, Sumitomo Mitsui Card and SoftBank will explore collaborations across diverse fields centered on the aforementioned initiatives, aiming to solve societal challenges and provide social value.

3. Overview of Each Company

■ Sumitomo Mitsui Card

| Company Name | Sumitomo Mitsui Card Company, Limited |

| Established | December 1967 |

| Headquarters | Tokyo Headquarters: 2-2-31 Toyosu, Koto-ku, Tokyo, SMBC Toyosu Building Osaka Headquarters: 4-5-15 Imabashi, Chuo-ku, Osaka-shi, Osaka |

| Capital | 34.03 billion yen |

| Representative | President and Representative Director, CEO, Yukihiko Onishi |

| Business Activities | Credit card operations, debit card, prepaid card, and other payment operations |

| Payment operation | loan operations, guarantee operations, consumer credit operations, transaction operations, and other incidental operations |

Sumitomo Mitsui Card, in collaboration with Sumitomo Mitsui Banking Corporation and others, has been providing the comprehensive financial service Olive for individual customers since March 2023. This service allows seamless use of bank accounts, card payments, finance, online securities, and online insurance functions on a mobile app. With over 5 million accounts opened within two years of its launch, Olive has been praised as the “New Standard” in financial services. Efforts to enhance services are being made through collaboration and partnerships with top players in both the financial and non-financial sectors, beyond the SMBC Group.

■ SoftBank

| Company Name | SoftBank Corp. |

| Established | December 1986 |

| Headquarters | 1-7-1 Kaigan, Minato-ku, Tokyo |

| Capital | 214.394 billion yen |

| Representative | President & CEO, Junichi Miyakawa |

| Business Activities | Provision of mobile communication services, sales of mobile devices, provision of fixed-line communication services, and provision of internet connection services. |

Under the “Beyond Carrier” strategy, SoftBank seeks to transcend the traditional boundaries of a telecommunications company by leveraging advanced technologies such as AI, IoT (Internet of Things), and 5G (fifth-generation mobile communication systems). The company is focused on creating new businesses across a broad range of industries and promoting digital transformation (DX) for its future growth.

■ PayPay

| Company Name | PayPay Corporation |

| Established | June 2018 |

| Headquarters | YOTSUYA TOWER, 1-6-1 Yotsuya, Shinjuku-ku, Tokyo |

| Representative | President & Representative Director, CEO, Corporate Officer, Ichiro Nakayama |

| Business Activities | Development and provision of mobile payment and other electronic payment services. |

Since 2018, PayPay has been offering the “PayPay” code payment service. In the fiscal year 2024, PayPay’s gross merchandise volume reached 15.4 trillion yen on a consolidated basis with PayPay Card and 12.5 trillion yen on a standalone basis, from a total of 7.8 billion payments. PayPay accounts for about two-thirds of the domestic code payment market, establishing itself as a widely used payment method. PayPay will continue to strive for a world where users and all types of restaurants and service providers can enjoy the convenience of cashless payments and use the cashless payment service with confidence anywhere in Japan. As the company was designated by the Financial Services Agency as a Specified Essential Infrastructure Service Provider in November 2023, PayPay is committed to continue providing an even safer and more secure environment for users.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labor and Welfare No. 00001 / Date of designation: August 9, 2024)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

※ “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) refers to PayPay Money that can only be purchased with wages received by the PayPay user in their Paycheck Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. Until the customer’s identity verification is completed, issued PayPay Money Lite (including previously issued ones) is distinguished as PayPay Money Lite (Low Value), and for those customers who have completed identity verification (including previously issued ones), it is classified as PayPay Money Lite (High Value). In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.