PayPay Bank Corporation (Head office: Shinjuku-ku, Tokyo; President & Representative Director: Tomohito Takusari; hereinafter PayPay Bank) is pleased to announce that it will revise and significantly reduce online banking transfer fees for corporate and sole proprietor accounts, effective May 26, 2025. As a result, transfers can be made at industry-low levels* as part of the company’s efforts to strengthen its support of customers’ businesses.

*Based on PayPay Bank’s research as of May 23, 2025

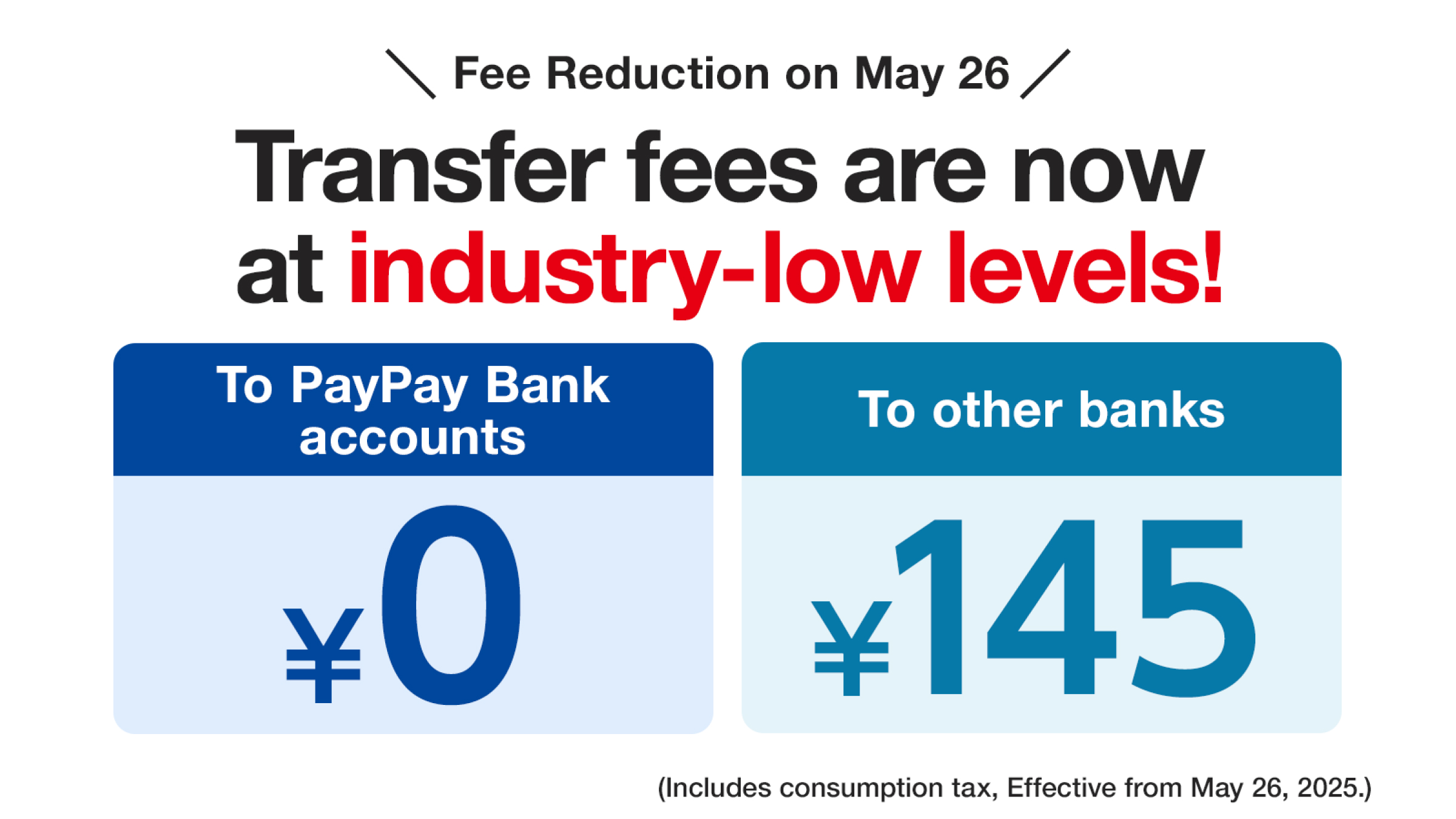

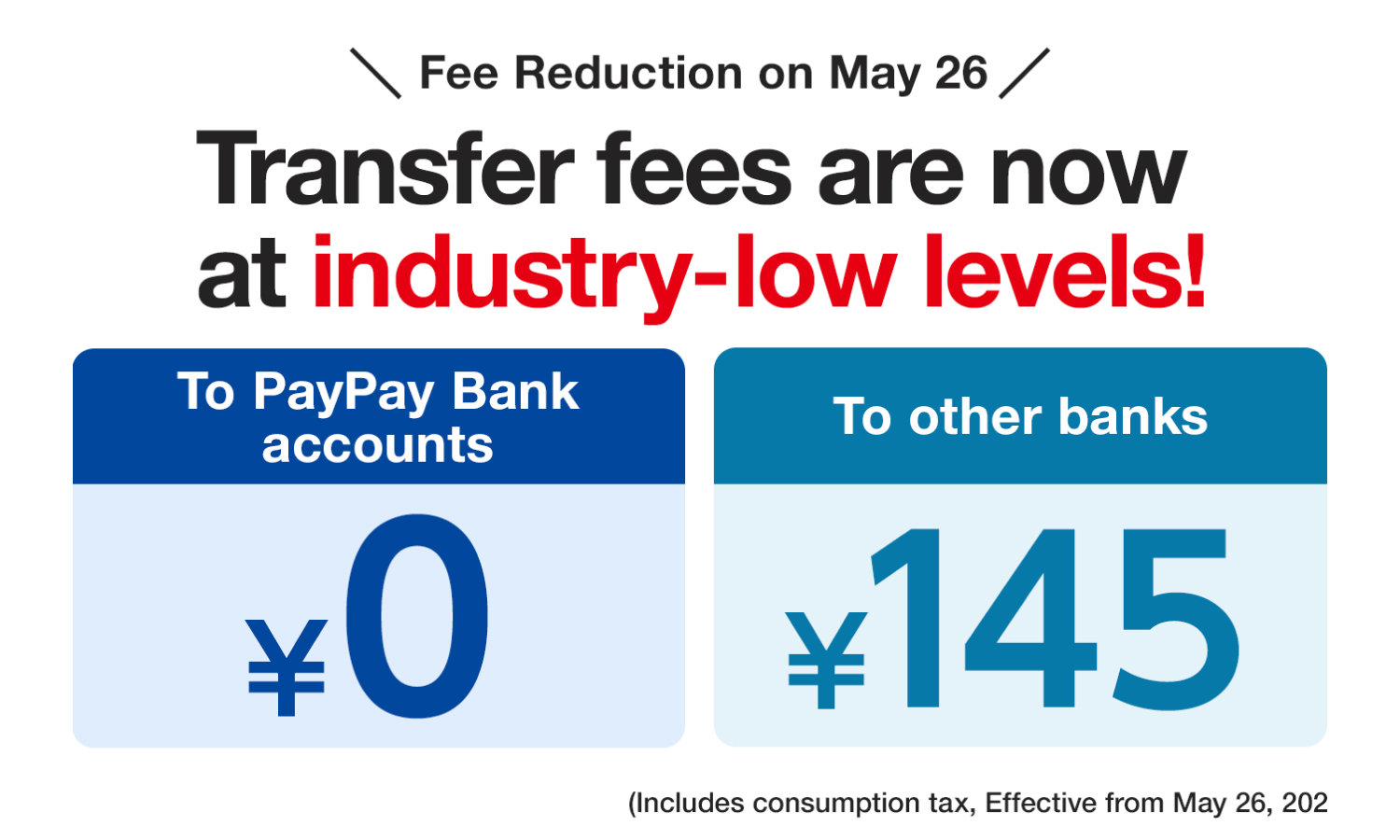

■ Overview of the Revision

| Before the Revision | After the Revision on May 26 | |

|---|---|---|

| To PayPay Bank accounts | 55 yen | 0 yen |

| To other financial institutions | 160 yen | 145 yen |

(Consumption tax included)

*The revision applies also to transfers reserved in advance, scheduled for May 26, 2025, or later.

*The transfer fee prior to revision may still be displayed when reserving a transfer.

*There will be no changes to transfer fees for transfers made from the main branch or partner ATMs.

■ Benefits of Using a PayPay Bank Business Account

1. Value for money fees, including an industry-low transfer fee!

2. Transactions can be made anytime, anywhere with the business app.

3. The Visa Business Debit Card, with no annual fee or issuance fee, allows for immediate payment or payment in the following month.

4. Business loans with no restrictions on the use of funds are easily available without a visit to the counter. Borrowing and repayment can be completed online.

For more details about the services of business accounts, please refer to the website for businesses provided by PayPay Bank.

■ Background of the Revision

With the general increase in cashless payments including “PayPay,” offered by PayPay Corporation (Head office: Shinjuku-ku, Tokyo; President & Representative Director, CEO, Corporate Officer: Ichiro Nakayama; hereinafter PayPay), the need for fund transfers among corporations and sole proprietors grows each year. The company aims to robustly support the reduction of business costs and speedy fund management with industry-low fees and benefits unique to PayPay merchants within the PayPay group.

■ Benefits for PayPay Merchants

PayPay Bank offers a preferential transfer cycle of sales proceedings for PayPay merchants compared to other financial institutions, enabling speedy fund management when using PayPay Bank.

| PayPay Bank | Other financial institutions | |

|---|---|---|

| Transfer Cycle | End of current month closing, next day transfer | End of current month closing, transfer on the second following business day *In the case of Japan Post Bank, transfer occurs on the fourth business day. |

Additionally, in the “Early Transfer Service“, which allows merchants to receive their sales earlier than the usual transfer cycle, PayPay Bank receives preferential treatment over other financial institutions. This includes handling deposits on weekends and public holidays and reduced transfer fees (one-tenth of other financial institutions), offering substantial differences in cash flow and convenience.

| PayPay Bank | Other financial institutions | |

|---|---|---|

| Early Transfer Deposit Schedule | Next day | Transfer on the second following business day *In the case of Japan Post Bank, transfer occurs on the fourth business day. |

| Transfer Usage Fee (both on-demand and automatic) |

0.38% of the deposit amount | 0.38% of the deposit amount |

| Transfer Fee | 20 yen | 200 yen |

(Excluding consumption tax)

PayPay Bank’s mission is “to make financial services as accessible as air,” aiming to provide indispensable yet invisible financial services that are naturally used. The company will continue to offer services with high convenience and cost benefits as a partner supporting customers’ businesses.

Moreover, PayPay will further strengthen its collaboration with PayPay Bank to accelerate various initiatives to support PayPay merchants’ businesses.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labor and Welfare No. 00001 / Date of designation: August 9, 2024)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) refers to PayPay Money that can only be purchased with wages received by the PayPay user in their Paycheck Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. Until the customer’s identity verification is completed, issued PayPay Money Lite (including previously issued ones) is distinguished as PayPay Money Lite (Low Value), and for those customers who have completed identity verification (including previously issued ones), it is classified as PayPay Money Lite (High Value). In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.