Campaign page:https://paypay.ne.jp/event/paypay-matsuri202507/

PayPay Corporation (hereinafter “PayPay”), PayPay Card Corporation (hereinafter “PayPay Card”), and PayPay Bank Corporation (hereinafter “PayPay Bank”) will hold a large-scale campaign, the Cho PayPay Matsuri (Super PayPay Festival), starting from July 1, 2025. This event allows users to enjoy dining and shopping benefits when using “PayPay” or “PayPay Card” (including PayPay Card Gold) at stores and online. Furthermore, making payments with “PayPay Card” or “PayPay Credit,” or setting up banking functions in “PayPay” (1. Owning an account with PayPay Bank and 2. Agreeing to share information with PayPay) will increase the chances of winning in the PayPay Scratch Lottery.

■ PayPay Scratch Lottery

・Period: July 1 – 28, 2025

・PayPay Scratch Lottery campaign page: https://paypay.ne.jp/event/matsuri202507-paypay-scratch/

*The official name of the campaign is “PayPay Scratch Lottery (July 2025).”

The PayPay Scratch Lottery will be conducted for users who have completed identity verification (eKYC). When these users make a payment of 200 yen or more,*1 including tax, using “PayPay” or “PayPay Card” at eligible stores (including credit card merchants), they will be given a scratch-off lottery ticket. Users will have a chance of winning from first to third prize, with probabilities varying based on payment methods and conditions. Different colored scratchcards will appear on the screen after making a payment, and first-prize winners will receive PayPay Points equivalent to up to 100% of the paid amount.*2

For payments conducted via PayPay Balance (including PayPay Balance Cards) which comes with a red screen, there is a one-in-four chance of winning one of the prizes from first to third. For payments made with “PayPay Credit” or “PayPay Card” on a blue screen, the probability of winning increases to one in two. Payments made with “PayPay Card” include not only those using the physical card but also payments made with “PayPay Card” set up in Apple Pay or Google Pay, which are also eligible for the campaign. Users can immediately scratch off the card via the payment notification received in the PayPay app.

Furthermore, to commemorate PayPay Bank becoming a subsidiary of PayPay Corporation as of April 2025, users who set up banking functions within “PayPay”*3 will receive preferential benefits. Such users will have their chances of winning increased to one in two when making payments using PayPay Balance or PayPay Debit (formerly PayPay Bank Balance). When payments are made with PayPay Credit or “PayPay Card,” the user is guaranteed to win either the first, second, or third prize in the PayPay Scratch Lottery. Please note that the winning probability refers to the chance per each lottery attempt and does not guarantee a win per specified probability.

PayPay Bank, which is participating in this campaign, offers the convenience of completing account opening from the PayPay app as quickly as within the same day. Moreover, if the account is opened via the PayPay app, users can check their balance within the app without having to link accounts and can make unlimited free deposits and withdrawals from ATMs at major convenience stores for amounts of 30,000 yen or more, all without requiring an ATM card. For detailed information regarding conditions for eligibility in the PayPay Scratch Lottery and banking function setup methods, please refer to the campaign page. PayPay and PayPay Bank will continue to strengthen their cooperation and consistently update their services and applications to provide users with a convenient and user-friendly environment.

*1. The eligible payment methods in PayPay include PayPay Balance (including PayPay Balance Card transactions), PayPay Credit, PayPay Points, and PayPay Debit (formerly PayPay Bank Balance). PayPay Debit (formerly PayPay Bank Balance) is a payment service provided by PayPay. PayPay Balance Card can be used only for web services. When using PayPay Points for split payments, the chances of winning are the same as those for PayPay Balance, PayPay Credit, or PayPay Debit, whichever the user chooses to pay with. When making a split payment with PayPay Gift Vouchers, only the non-voucher portion is eligible, and the winning probability of the other payment method will be applied. Furthermore, to participate in this campaign using PayPay Credit or “PayPay Card,” it is necessary to set up PayPay Credit within the PayPay app beforehand.

*2. PayPay Scratch Lottery has a combined grant limit of 100,000 points per payment and period for both PayPay and PayPay Card (all purchases at eligible stores will be combined). PayPay Points will be granted at a later date. These points cannot be cashed out or transferred. PayPay Points can be used at the PayPay official store and PayPay Card official store. The scratch-off lottery ticket is valid until 11:59 p.m., 30 days after receiving it. The ticket cannot be scratched off outside Japan.

*3. This constitutes having a PayPay Bank account and agreeing to share information with PayPay. After completing the setup of the banking function, it may take up to a day and a half for the conditions to be applied.

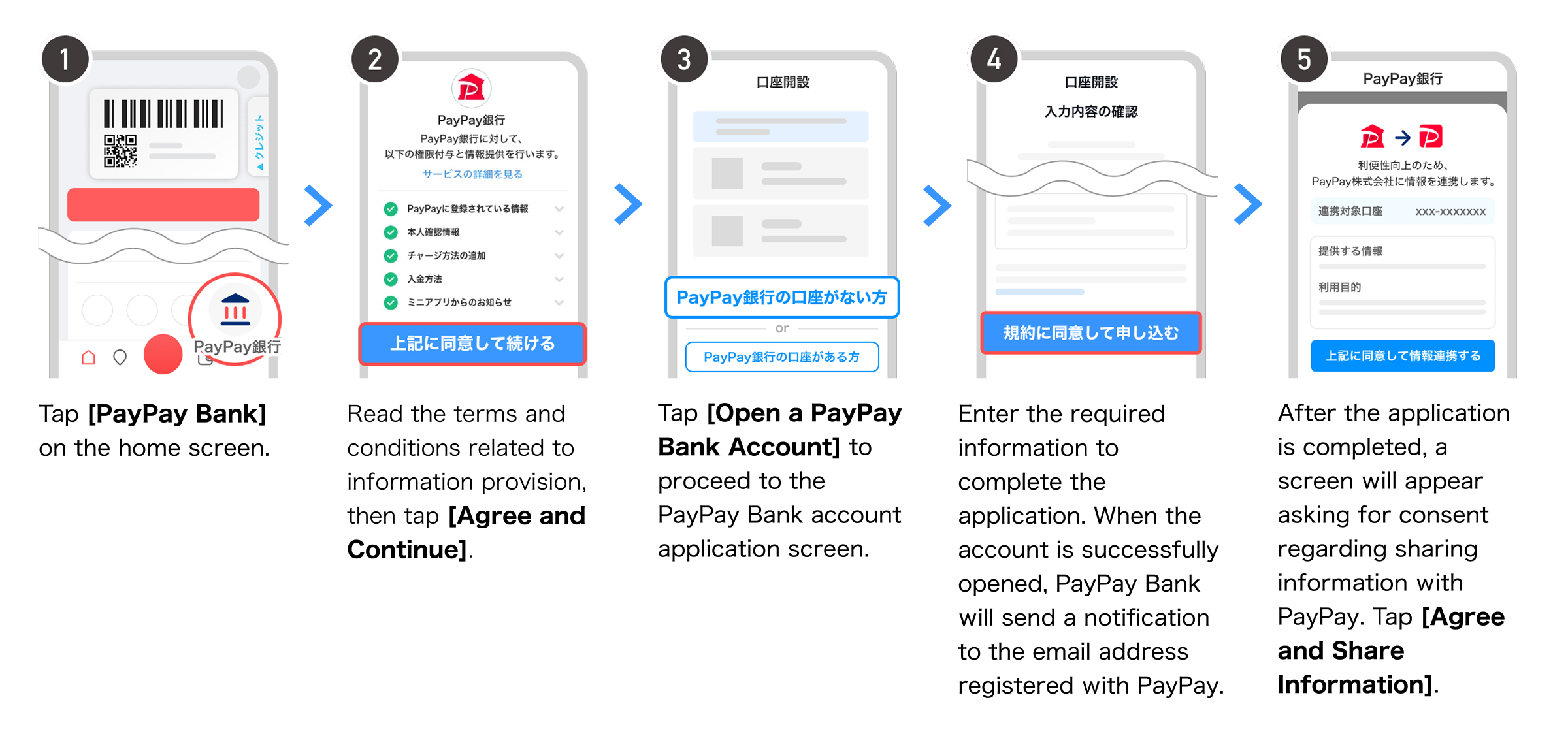

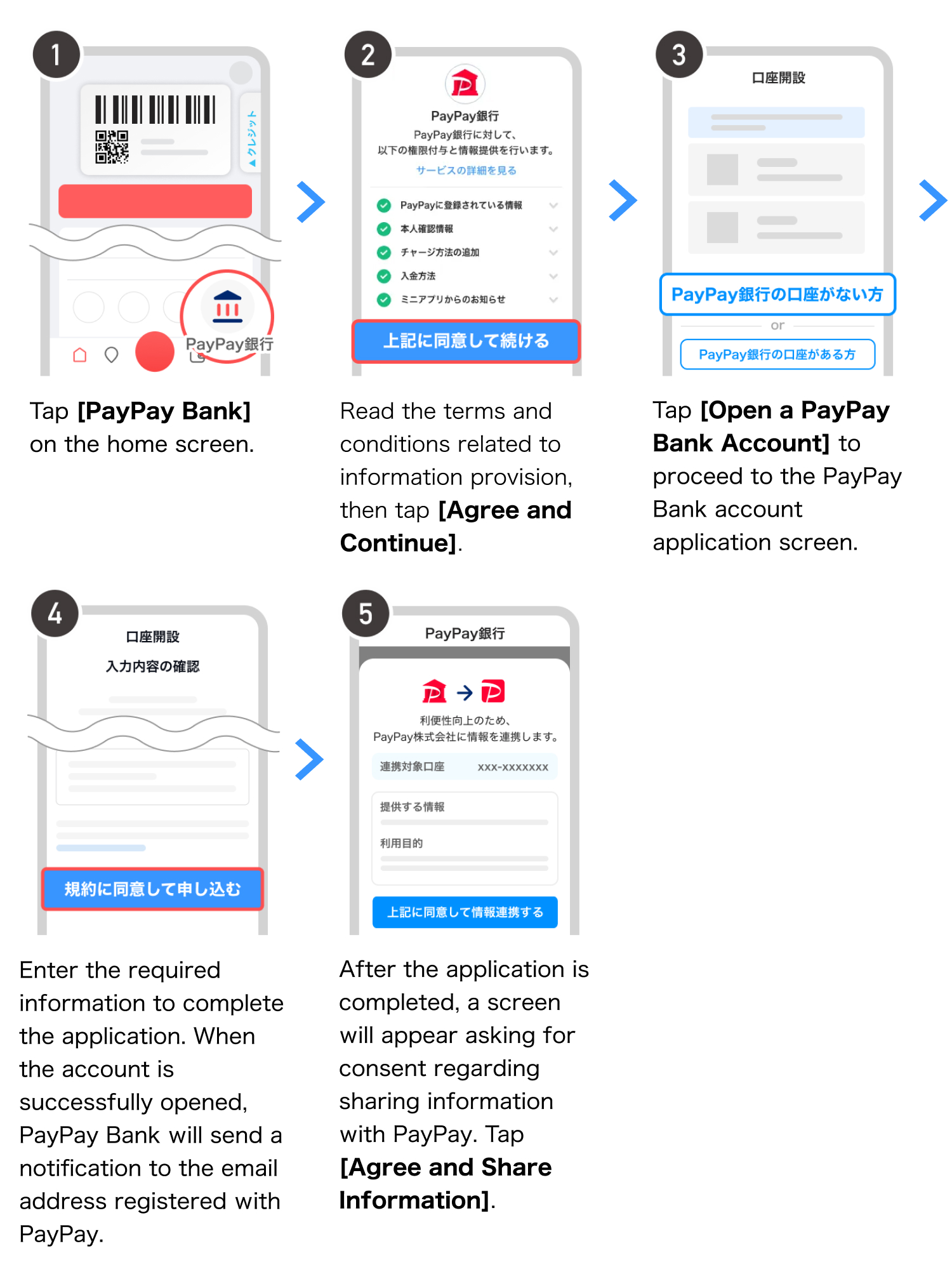

<Steps to set up the banking function>

*If a user already has a PayPay Bank account and agreed to share information with PayPay, the screen in step 5 will not appear.

*PayPay Corporation operates as a bank agent, affiliated with PayPay Bank Corporation, (https://about.paypay.ne.jp/terms/consumer/legal/bank-agency/)and conducts intermediary services (solicitation) for concluding contracts involving “acceptance of yen ordinary deposits,” “acceptance of foreign currency ordinary deposits,” “Provision of yen funds,” and ” exchange transactions.” The intermediary services (solicitation) for contracts involving “acceptance of foreign currency ordinary deposits” and “exchange transactions” are limited to individual customers. Banking agent license number: Director-General of the Kanto Finance Bureau (Gindai) No. 396.

<List of probability of winning>

■ “Cho PayPay Matsuri: PayPay Coupons”

・Period: July 1 – 31, 2025

・Details: During Cho PayPay Matsuri, a variety of participating merchants are scheduled to distribute PayPay Coupons. Details about the eligible merchants will be announced later on the campaign page. PayPay Coupon is a service that automatically offers discounts to users when they acquire coupons in the PayPay app and make payments at eligible stores using “PayPay.” For detailed instructions on how to use PayPay Coupons, please refer to this link.

■ “PayPay Credit Referral Program”

・Period: July 1 – 28, 2025

・Details: Individuals who meet the following conditions will be granted 500 PayPay Points each.

1. The person referring sends a referral code to a friend.

2. The referred individual registers the referral code and newly applies for a “PayPay Card.”

3. The referred individual makes one transaction using PayPay Credit or a “PayPay Card” within the program period.

*Conditions 1 and 2 must be completed between July 1 (Tuesday) and July 28 (Monday).

*Condition 3 requires the user to make a payment within the program period, with the payment completion screen (transaction history displayed in green) appearing within 30 days after the program ends.

・Eligible payment methods: PayPay Credit, PayPay Card

・Grant limits:

<Referrer> 500 points per referral (maximum 10 people, total 5,000 points for the period)

<Referred> 500 points (one-time only)

For more details, please visit the”PayPay Credit Referral Program” page, or tap the “Points” icon on the PayPay app home screen, tap on “View All Offers,” and check the “Upcoming” section for the “PayPay Credit Referral Program.”

■ “Split 3 Million Points Using a Second PayPay Card”

・Period: July 1 – 28, 2025

・Details: During the campaign period, individuals who make payments totaling 2,000 yen or more (including tax) with their second or subsequent cards will be eligible to receive a share from a total of 3 million PayPay Points.

*Cards added before the campaign period are also eligible. For details on applying for a second or subsequent PayPay Card, please refer to this link.

*A combined total of 2,000 yen using multiple additional cards during the period will also be eligible. Transactions made with the first card do not count towards this total. Additionally, only transactions made within the campaign period and recorded as a sale by PayPay Card Corporation by the end of August 2025 are eligible.

・Eligible payment methods: Payments made using the second or subsequent added cards with “PayPay Card” or PayPay Credit.

・Grant limit: 100 points per user.

*If the number of eligible users exceeds 3 million, each person will receive 1 point.

*Points for distribution are rounded down to the nearest whole number, potentially resulting in a total grant below 3 million points.

For more details, please visit the “Split 3 Million Points Using a Second PayPay Card” campaign page.

■ “First-timers Only! Get Back up to 10% When Paying with PayPay on Satofull Campaign”

・Period: July 1 -31, 2025

Details: This campaign targets users making their first payment with PayPay on the “Satofull” hometown tax site, granting up to 10% of the payment amount back in PayPay Points (limit of 500 points per transaction and period). Furthermore, during the campaign period, users subscribed to SoftBank will also receive Super PayPay Coupons, which will repeatedly provide up to 10% of the paid amount (limit of 500 points) in PayPay Points.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labor and Welfare No. 00001 / Date of designation: August 9, 2024)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) refers to PayPay Money that can only be purchased with wages received by the PayPay user in their Paycheck Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. Until the customer’s identity verification is completed, issued PayPay Money Lite (including previously issued ones) is distinguished as PayPay Money Lite (Low Value), and for those customers who have completed identity verification (including previously issued ones), it is classified as PayPay Money Lite (High Value). In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.