PayPay Corporation (hereinafter PayPay) is pleased to announce that users will now be able to earn PayPay Points at physical “Extra PayPay Points Stores,” regardless of their payment method, such as cash, credit card, or other forms of code payment. At these stores, users receive additional points in addition to the regular points from the payment. In conjunction with this launch, Yakuodo, a drugstore chain with approximately 400 locations across the Tohoku region, Tochigi, and Ibaraki prefectures, will become an Extra PayPay Points Store. Starting June 23, 2025, users will be able to earn PayPay Points with every purchase at Yakuodo, no matter how they choose to pay.

PayPay launched the “Extra PayPay Points Stores” program in September 2023, allowing merchants to design the timing and conditions for granting PayPay Points according to their own marketing strategies, thereby enabling a consistent points experience to users. A variety of merchants, including supermarkets, electronics retailers, drugstores, and online services are already part of this program, by which they reward PayPay Points tailored to their specific issues and promotional strategies. By specifying conditions for the granting of points, such as day of the week, time of day, or customer age, and later analyzing its effectiveness, the program can be utilized to acquire new customers, increase retention of existing customers, and boost sales.

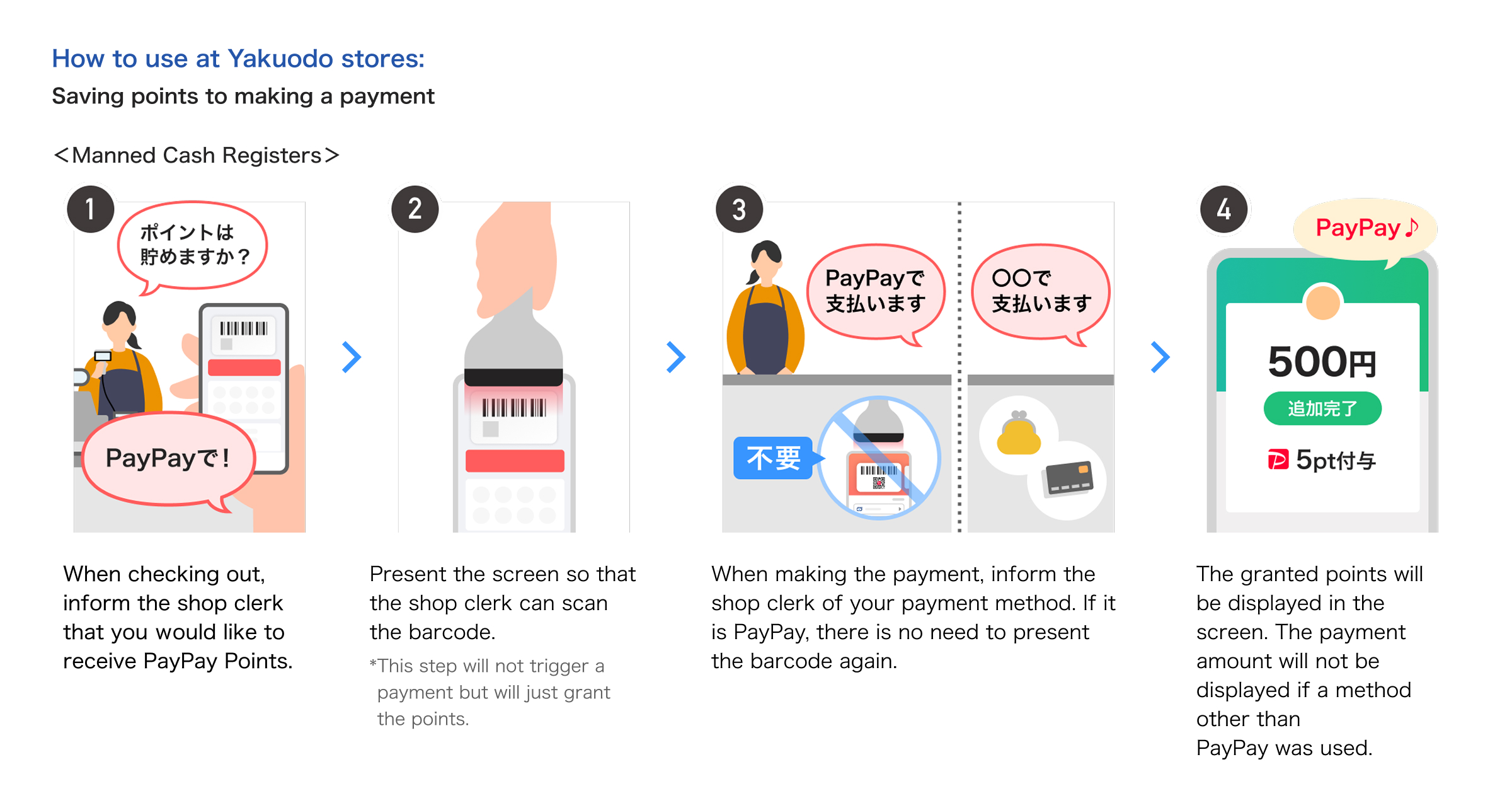

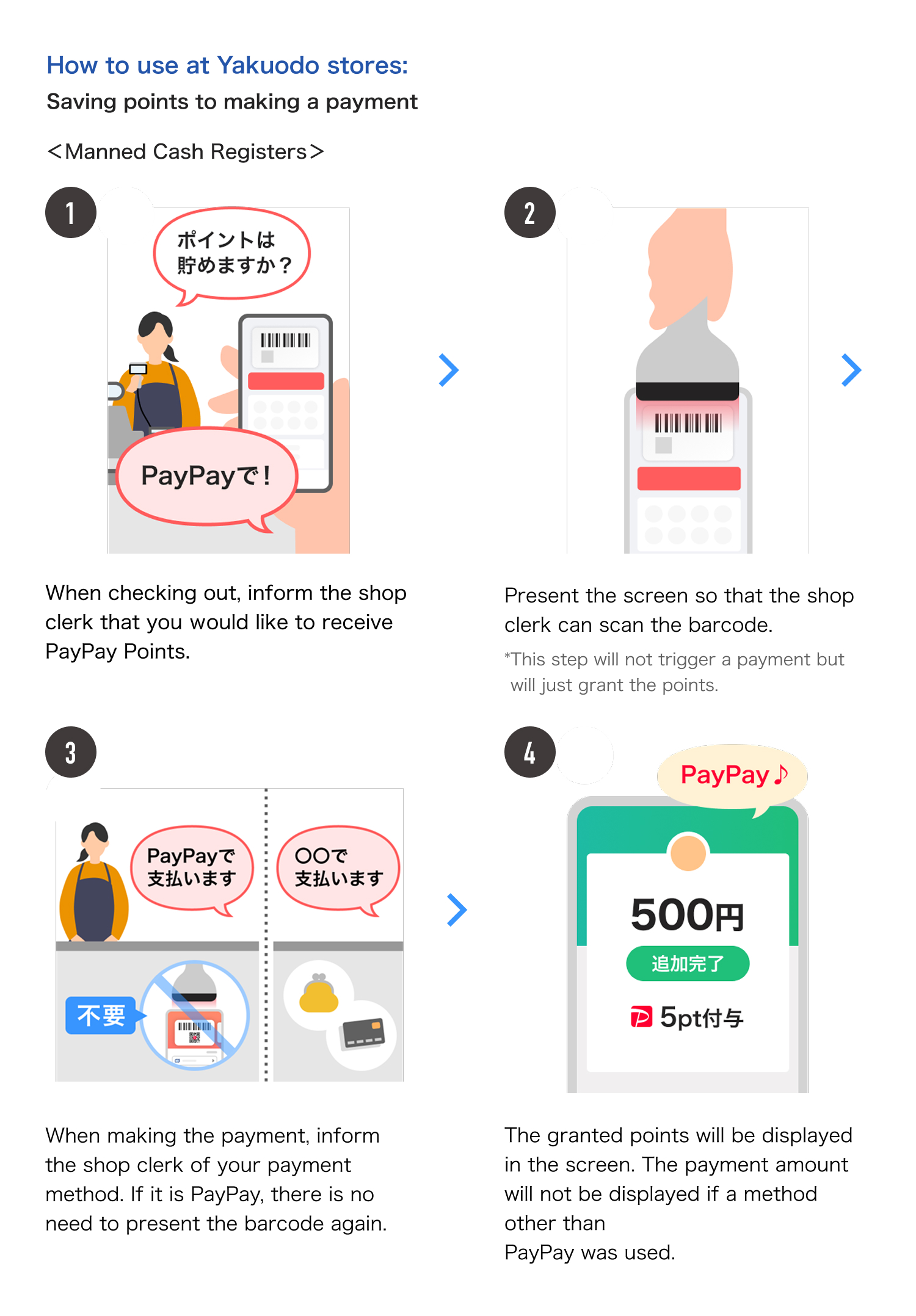

Until now, the user was required to complete a payment using PayPay to receive additional points from a physical Extra PayPay Points Store, but going forward, it will be possible for the merchant to offer PayPay Points regardless of the payment method, even in physical stores. If the user chooses to pay with PayPay, they can receive the PayPay Points without having to present the barcode again*1. For other methods, the user can receive the PayPay Points by presenting the barcode on the PayPay app to the merchant. Furthermore, while it is possible to grant PayPay Points for any type of product, merchants also have the flexibility to grant points just for certain products, allowing for a more adaptable strategy to address challenges and promotional requirements.

At Yakuodo, starting from June 23, 2025, when customers present the PayPay barcode during in-store purchases, they will earn PayPay Points at a rate of 1.0%, regardless of the payment method*2. If the payment is made with PayPay, users will receive up to 2.0%*3 of the transaction amount in points, in addition to the 1.0% benefit from the merchant*4.

*1. In principle, PayPay Points are granted 30 days from the day following the payment, which may be delayed due to the user’s usage status or system reasons.

*2. Some products and services are not eligible for points. Details are provided at the stores.

*3. Depending on the “PayPay STEP” program conditions that are achieved and payment method, etc., the basic grant rate of 0.5% will increase to 1.0%, 1.5%, or 2.0%. The grant rate is defined based on usage in the previous month.

*4. The merchant will grant one point for every 100 yen (excluding tax).

~ Example of how to use ~

Comment from Yakuodo on becoming an Extra PayPay Points Store.

<Comment from Yakuodo>

For some time, our company has been exploring ways to expand our point services to improve convenience and provide more options for our customers. When we learned that PayPay was starting a new initiative to grant PayPay Points at physical stores regardless of the payment method, we immediately expressed our desire to be the first to participate. As this is the inaugural case for this program, we worked together carefully over a long period to plan its operation. We hope this service leads to greater customer satisfaction and gives shoppers a new reason to visit Yakuodo.

PayPay will continue to evolve the PayPay app into a convenient tool not only for individuals but also for businesses.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labor and Welfare No. 00001 / Date of designation: August 9, 2024)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out and transferred to a designated bank account (no transfer fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) means PayPay Money that can only be purchased with wages received by the PayPay user in their Salary Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount related to the funds transfer balance. PayPay Money Lite is a type of electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, Time-Limited PayPay Points are restricted to payments for certain services provided by LY Group. They cannot be transferred between PayPay users or be cashed out. Time-Limited PayPay Points have an expiration date, which can be confirmed in the details or conditions of the LY Group measures or promotional campaigns. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, PayPay Bonus and PayPay Bonus Lite cannot be transferred between PayPay users or be cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued. PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see applying for compensation for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.