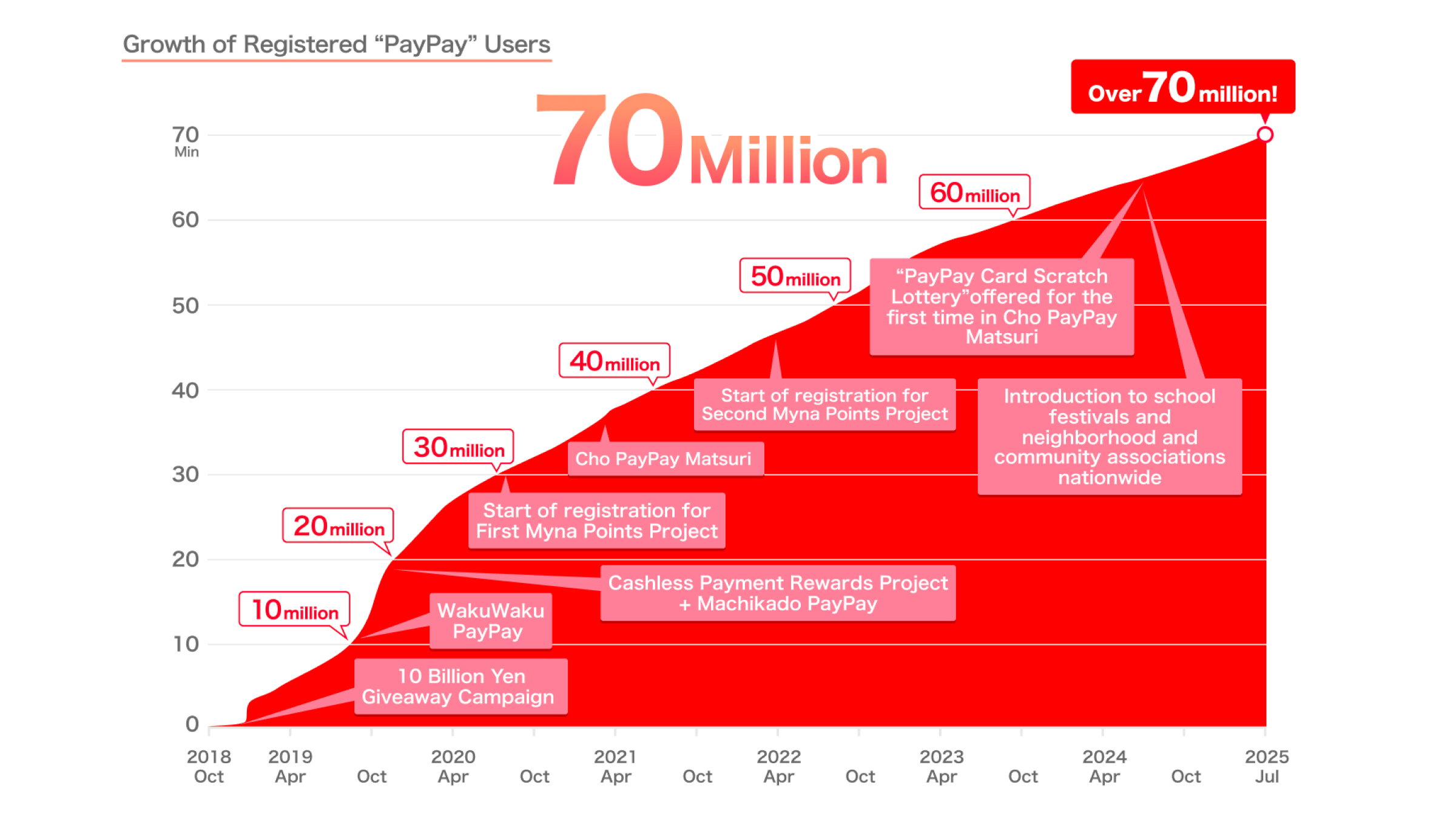

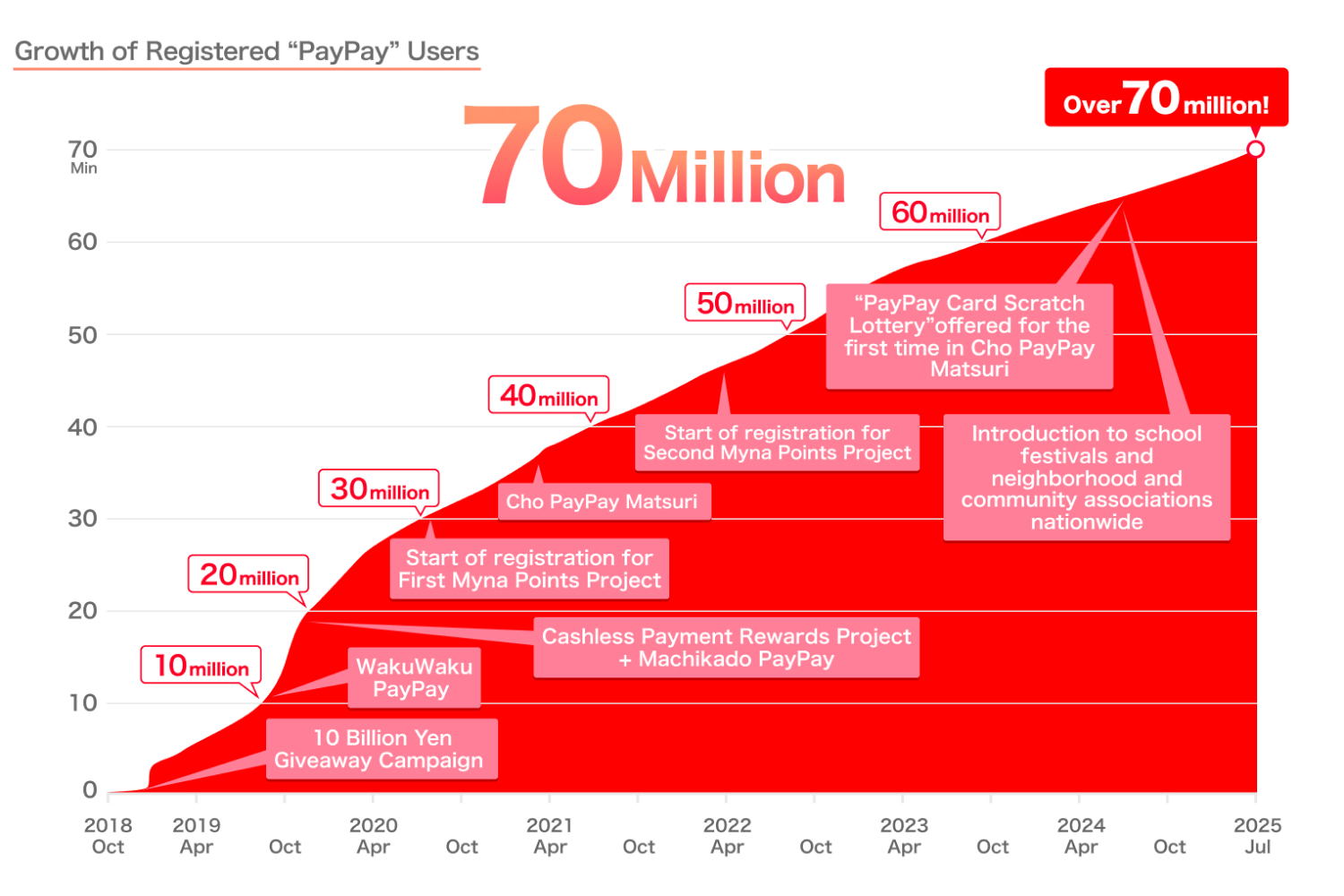

PayPay Corporation is pleased to announce that the number of registered users*1 of its cashless payment service, “PayPay,” has surpassed 70 million as of July 15, 2025. This implies that more than one in every two people in Japan*2, and approximately two out of every three smartphone users in Japan*3, are utilizing the service. Additionally, PayPay facilitates a range of financial services more smoothly for users who have verified their identity (eKYC), such as top-ups and withdrawals from banks, higher limits for payments and remittances, and other financial services. More than 36 million users, representing over half of the registered users, have completed identity verification*4.

*1. The number of users who have registered an account with PayPay.

*2. Calculation based on the “Population Estimates – June 2025” by the Statistics Bureau of the Ministry of Internal Affairs and Communications.

*3. Calculation based on the “Population Estimates – June 2025” by the Statistics Bureau of the Ministry of Internal Affairs and Communications and the “2024 Survey on the Usage of Information and Communication Devices” by the Ministry of Internal Affairs and Communications, specifically “1. Ownership Status of Information and Communication Devices.”

*4. As of June 2025.

PayPay Corporation’s gross merchandise volume for fiscal year 2024 is projected to reach 12.5 trillion yen, with over 7.8 billion payments. This accounts for approximately two-thirds of the market share in domestic code payments*5. In terms of number of payments, one in every five cashless payments, including credit cards and electronic money, was made via PayPay*6 in 2024, indicating its widespread adoption as a payment method used every day.

Furthermore, PayPay has evolved into a financial app that offers seamless access to financial services such as PayPay Card, PayPay Bank, PayPay Securities, and PayPay Insurance. In April 2025, PayPay Bank became a consolidated subsidiary and PayPay’s payment feature was made available in the PayPay Bank app. Moving forward, further initiatives will be taken to enhance user convenience by strengthening collaboration with various financial services.

*5. Researched by PayPay, based on calculating PayPay’s share using data from the “Code Payment Usage Trend Survey” published by the PAYMENTS JAPAN on March 14, 2025.

*6. The calculation is based on data from the “Monthly Survey: Credit Card Trend Survey” by the Japan Credit Association on the number of credit card transactions, the “Payment Trends January 2025” report by the Bank of Japan for debit cards and electronic money transactions, and the “Code Payment Usage Trend Survey” by PAYMENTS JAPAN published on March 14, 2025, combining these figures with PayPay’s payments count for the period from January to December 2024.

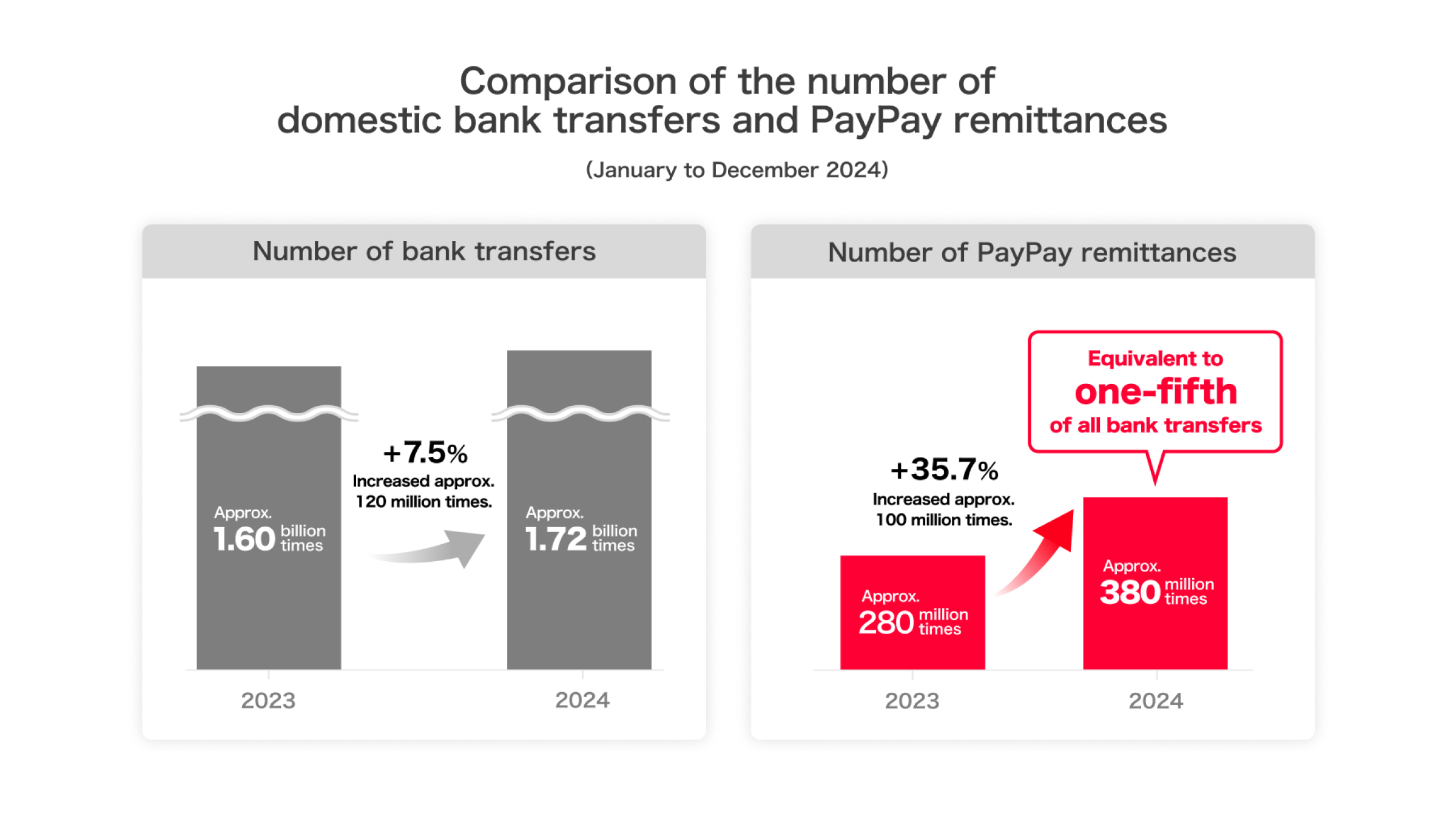

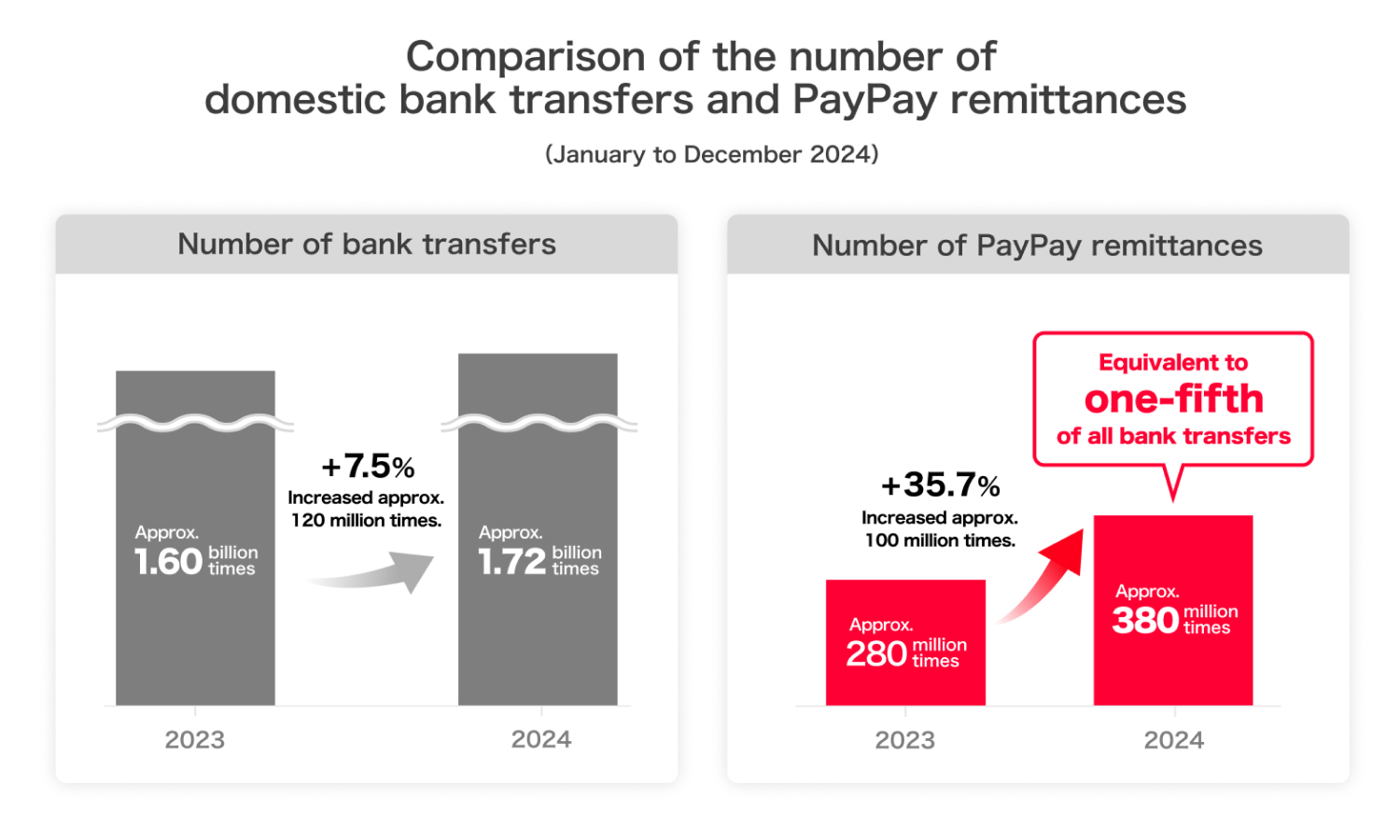

In the domain of remittances, PayPay processed over 380 million remittances*7 in 2024, marking an increase of 100 million from the prior year. This volume is now equivalent to about one-fifth of the approximately 1.72 billion domestic money transfers conducted by all banks in Japan*8.

A recent trend shows that about half of new users*9 first came to hold balance in their PayPay account not through their own top-ups but by receiving PayPay Money or PayPay Money Lite through remittances. This trend has expanded the user base, as more people are prompted to start using PayPay for splitting bills or sending allowances within families. PayPay boasts a share of approximately 96% in remittances by code payment providers*10 and is leveraging this to strengthen adoption among younger users, including teenagers. As young users receive allowances on the app, PayPay becomes an integral part of their financial lives. As they grow, PayPay will strive to evolve alongside them, becoming an indispensable daily app that provides long-term value by connecting them to services like banking, investments, credit cards, and loans.

Notes about the chart: Bank transfer related figures are based on materials disclosed by the Japanese Bankers Association (2024 edition Payment Statistics Annual Report for domestic exchanges), including remittances among individuals, between individuals and corporations, and among corporations (excluding salary payments). The number of PayPay remittances also includes transfers of PayPay Money Lite (sending PayPay Money is classified as a remittance, while sending PayPay Money Lite is classified as a transfer). Figures are rounded to the nearest whole number.

*7. Sending PayPay Money is classified as a remittance, while sending PayPay Money Lite is classified as a transfer. For details, please refer to the PayPay Balance Terms of Use. The remittance count in this press release includes PayPay Money Lite transfers.

*8. Based on the materials disclosed by the Japanese Bankers Association (2024 edition Payment Statistics Annual Report for domestic exchanges), including remittances among individuals, between individuals and corporations, and among corporations (excluding salary payments).

*9. New users who had balance in their account during the period from January to June 2025.

*10. Researched by PayPay, based on calculating PayPay’s share using data from the “Code Payment Usage Trend Survey” published by the PAYMENTS JAPAN on March 14, 2025.

Furthermore, PayPay will launch the following promotional campaigns in celebration of reaching over 70 million registered users.

■ Overview of the “70 Million User Celebration: Follow, Repost, or Reply to Win on X!” Campaign

Campaign Page: https://paypay.ne.jp/event/twitter-paypay-matsuri20250619/

Campaign Period

From 3:00 p.m. on Tuesday, July 15, 2025, to 11:59 p.m. on Sunday, July 20, 2025.

Campaign Details

PayPay will host two simultaneous campaigns where users can earn PayPay Points by following the official PayPay X account (@PayPayOfficial) and either repost the designated post or reply to the designated post. In each campaign, seven participants will be selected by lottery to receive PayPay Points equivalent to 7,000 yen.

Grant Date

PayPay Points are scheduled to be granted at the end of September 2025.

*The grant date may be delayed due to customer usage conditions or system-related reasons.

■ Overview of the “Refer-a-Friend & Bank Account Registration” Campaign

Campaign Period

From 12 a.m. on Friday, August 1, 2025, to 11:59 p.m. on Sunday, August 24, 2025.

Campaign Details

During the campaign period, when a new user referred by a friend or family member completes the conditions for the standard referral program*11 and also registers a bank account for topping up*12, both the referrer*13 and the referred user will each receive a maximum of 600 points*14. For more details, please refer to the campaign page, which will be published at a later date.

*11. During the campaign period, the referred user must: (1) register for the PayPay app for the first time, (2) register the referral code in the PayPay app, and (3) make a payment of 1,000 yen or more.

*12. To register a bank account, the referred user must complete identity verification using an official identification document.

*13. A referral is made by sharing a referral code. To issue a referral code, the referrer must have completed identity verification using an official identification document.

*14. This consists of 300 points each from the standard referral program and the “Refer-a-Friend & Bank Account Registration Campaign,” for a combined total of 600 points, both for the referrer and the referred.

Eligible Participants for the Campaign

– Referrer:

Users who have completed identity verification using official identification documents.

– The referred:

Users who newly register for an account with PayPay during the campaign period.

Conditions

Both the referrer and the referred user will each receive 300 points if the referred user achieves all of the following conditions during the campaign period:

– Newly registers for an account with PayPay

– Enters the referral code in PayPay

– Registers a bank account for topping up*

*Identity verification is required to register a bank account. The verification process may take some time after an application is submitted. Applications using an IC (My Number Card) can be processed on the same day at the earliest, while applications via document submission may take up to a week. For more details regarding identity verification, please check here.

Grant Limit

– Referrer: 300 points per referral (up to 10 people during the campaign, a total of 3,000 points)

– The referred: 300 points (once only)

Grant Date

PayPay Points are scheduled to be granted around mid-September 2025.

*The grant date may be delayed due to customer usage conditions or system-related reasons.

In addition, PayPay will host a promotional campaign from 3:00 p.m. on Friday 1, 2025 to 11:59 p.m. on Sunday, August 10, 2025, rewarding points to users who follow PayPay’s Official X account (@PayPayOfficial) and repost the designated post. During the campaign period, 7 winners will be selected via a random drawing from all participants who followed the account and reposted the post. Each winner will receive PayPay Points equivalent to 7,000 yen. Furthermore, if the number of reposts exceeds 70,000, an additional 10 winners will be selected, for a total of 17 people receiving 7,000 yen worth of PayPay Points. The points are scheduled to be granted at the end of October 2025*.

*The grant date may be delayed due to customer usage conditions or system-related reasons.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labor and Welfare No. 00001 / Date of designation: August 9, 2024)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) refers to PayPay Money that can only be purchased with wages received by the PayPay user in their Paycheck Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. Until the customer’s identity verification is completed, issued PayPay Money Lite (including previously issued ones) is distinguished as PayPay Money Lite (Low Value), and for those customers who have completed identity verification (including previously issued ones), it is classified as PayPay Money Lite (High Value). In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.