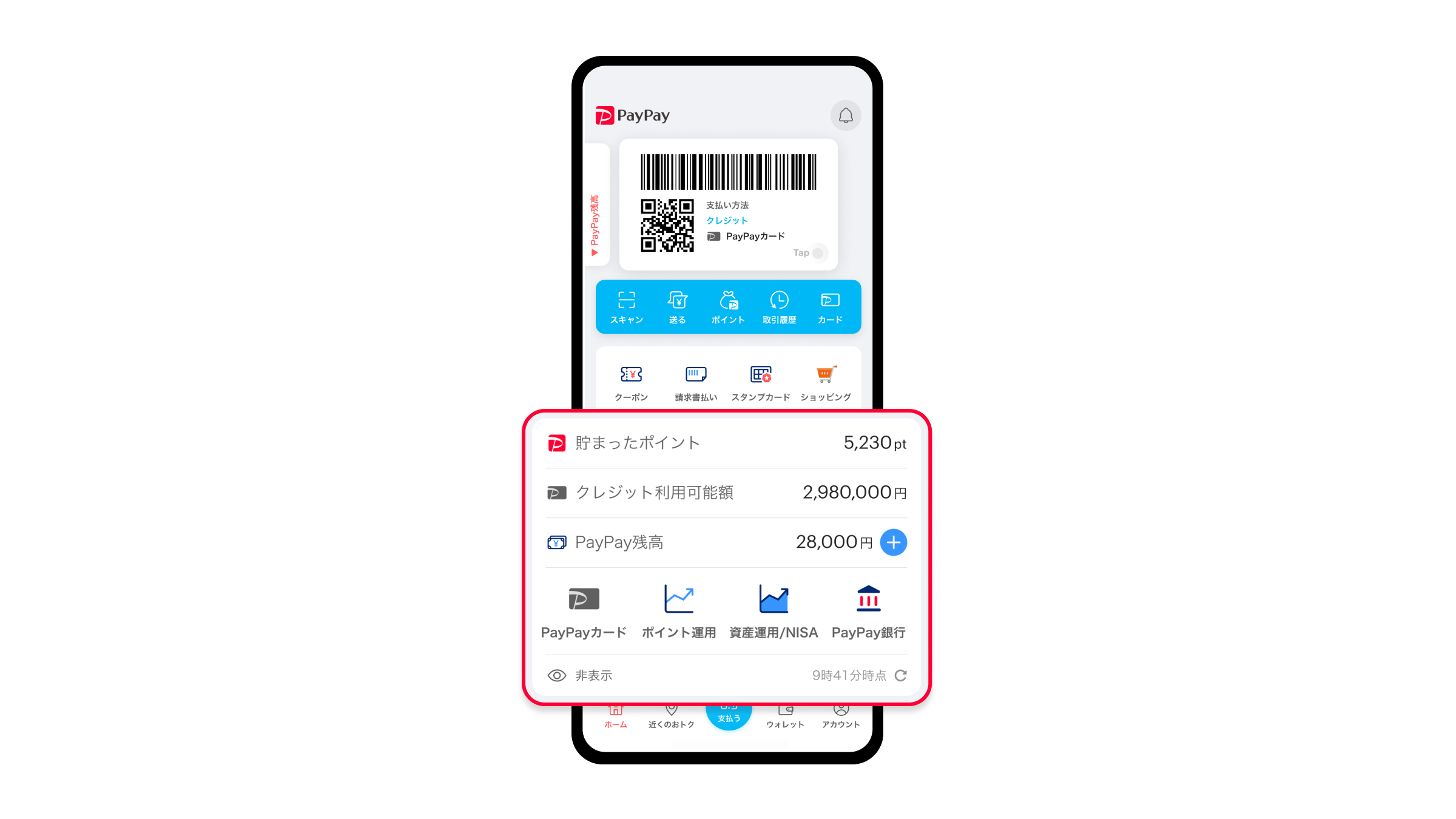

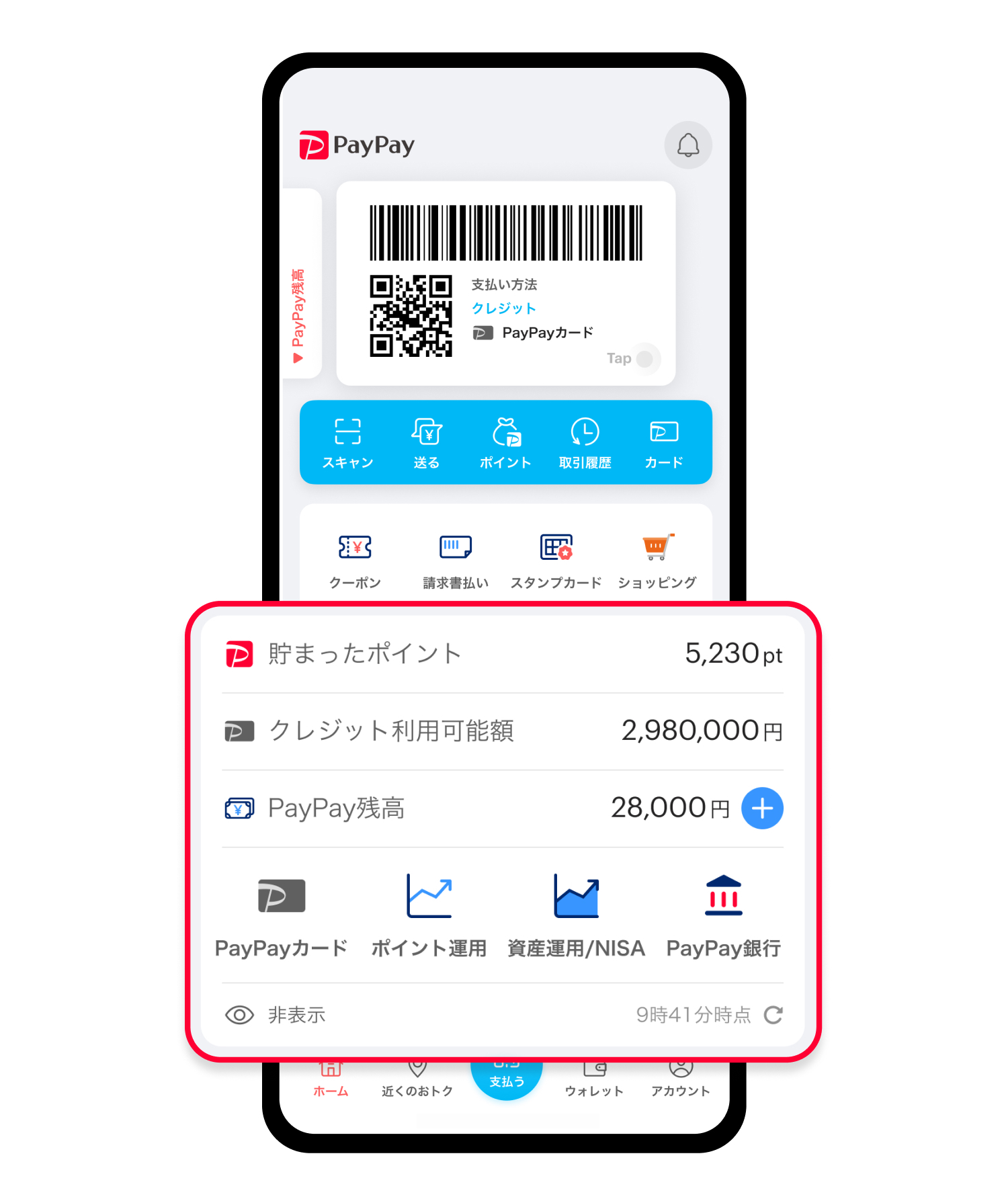

PayPay Corporation(hereinafter “PayPay”)is pleased to announce a major renewal of the PayPay app home screen, to encourage further use of its financial services and make asset management more convenient. With this revamp, users can swipe to switch to “Credit”(blue screen), which enables making a lump-sum payment the following month. In addition, as soon as the app is launched, users will be able to check in real time the status of PayPay Points that they have accumulated or invested(in “Earn Points”), the amount available on PayPay Card, and their PayPay Balance.* Furthermore, the icons for “PayPay Card,” “Earn Points,” “Invest/NISA,” and “PayPay Bank” will be included in the home screen, allowing users to access various financial services with a single tap.。

※ The amount of points, available credit, and PayPay Balance displayed on the home screen can either be shown or hidden.

New app home screen

※ Please use the latest version of the PayPay app.

「Since service launch, “PayPay” has continued evolving from a payment app to a super app that brings together various convenient features for everyday life. In addition to such services, users can leverage various financial services such as “PayPay Card,” “PayPay Points,” “PayPay Invest,” and “PayPay Bank.” With these services, users will not be redirected to other apps or websites, and everything from checking information to making transactions can be completed within the PayPay app.

One of the greatest characteristics of the app is the stress-free integration of multiple financial services with a consistent user experience to boot.

The renewal will also increase convenience for users of financial services by enabling them to check their assets at a glance on the home screen, each time they open the app to make a purchase. Furthermore, in response to requests from many users, the “History” icon will be placed at the top of the home screen to allow users to easily check their “PayPay” and “PayPay Card” transaction history.

Going forward, PayPay will continue to be user-centric and will work to provide various convenient functionalities and services in “PayPay” to further enhance financial services in line with the demand of users. The company will evolve “PayPay” from a payment app into a super app that enriches users’ lives and makes them more convenient, fostering a world where paying “Anytime, Anywhere with PayPay” is a reality.

PayPay is registered as follows:

・Prepaid Payment Instruments(third party type)Issuer(Registration number: Director-General of the Kanto Finance Bureau, No. 00710/Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc.(Registration number: Kanto(K)No. 106/Registration date: July 1, 2019)

・Telecommunications Carrier(Filing number: A-02-17943/Date filed: July 2, 2019)

・Fund Transfer Operator(Registration number:Director-General of the Kanto Finance Bureau, No. 00068/Registration date: September 25, 2019)

・Notified Person Entrusted with Intermediation(Filing number: C1907980/Date filed: December 18, 2019)

・Bank Agency Services(License: Director-General of the Kanto Finance Bureau(Gindai)No. 396/Registration date: November 26, 2020)

・Financial Instruments Intermediary Services(Registration number: Kanto Finance Bureau Director(Kinchu)No. 942/Registration date: June 25, 2021)

・Electronic Payment Agency Services(License: Director-General of the Kanto Finance Bureau(Dendai)No. 109/Registration date: February 14, 2023)

・Japan Payment Service Association(https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association(https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

※ “PayPay” provides 3 types of PayPay balance: PayPay Money, PayPay Money Lite, and Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account(no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay(Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Points cannot be sent or transferred between PayPay users or be cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered(the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

※ Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.