PayPay Corporation (hereinafter PayPay) is pleased to announce that the Offline Payment Mode, which allows users to complete payments with their smartphones without internet connection, is supported in the Seven-Eleven App as of February 20, 2025. This will allow users to smoothly complete payments when using PayPay in the Seven-Eleven App*1, even if a network outage has occurred or the signal reception is poor.

*1. See here for how to use PayPay on the Seven-Eleven App.

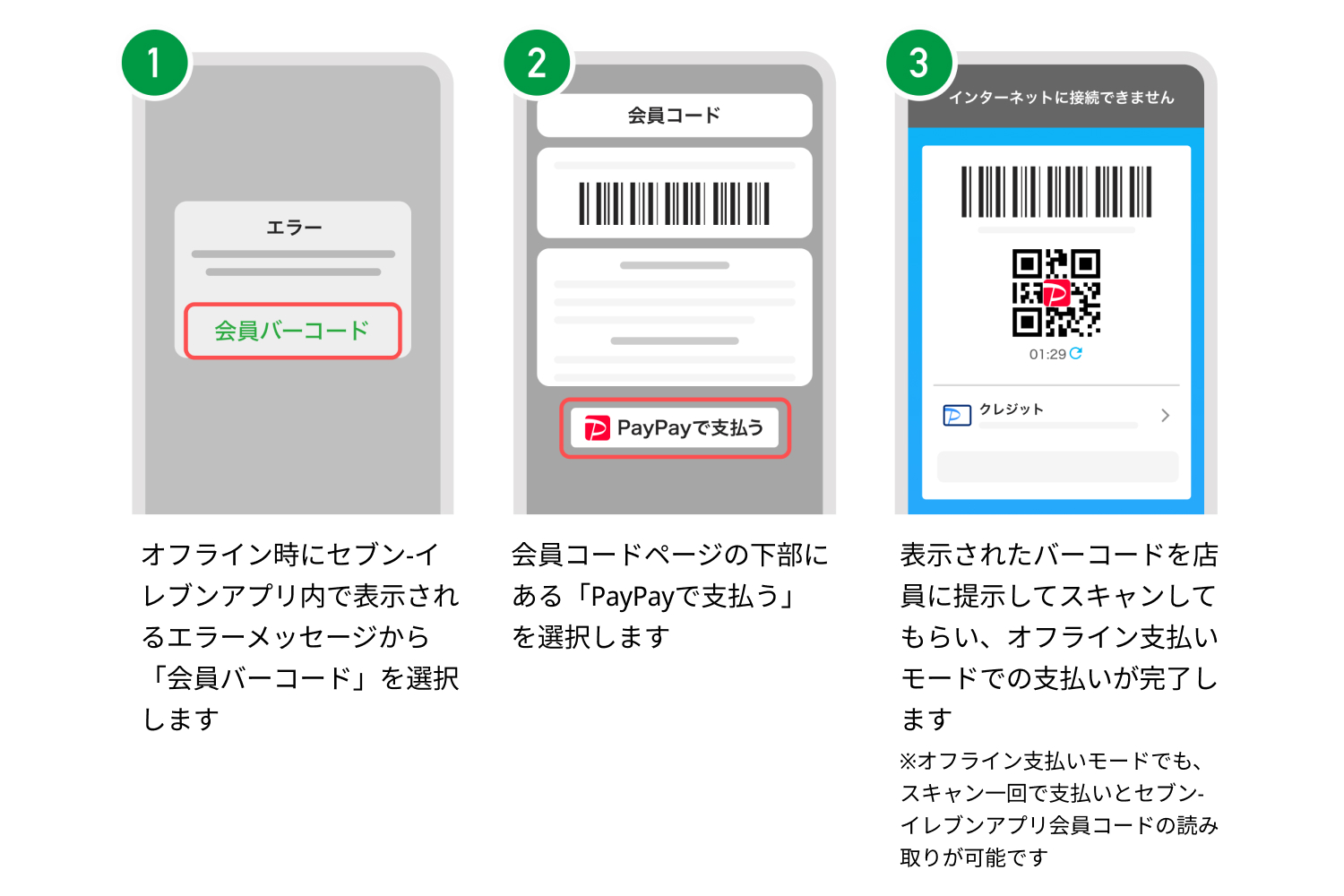

How to complete a payment using PayPay in the Offline Payment Mode when using the Seven-Eleven App, for illustrative purposes only

More than 67 million users*2, or every two out of three smartphone users in Japan*3, have registered to use PayPay, making it even more crucial for the payment service to be available without hindrance as a social payment infrastructure. The Offline Payment Mode, which was introduced to PayPay in July 2023, allows users to complete payments in the event of a network outage, as well as when connection to the internet is unstable such as when underground or at extremely crowded venues or events. Since its introduction, the Offline Payment Mode has supported an average of 120 thousand offline payments per day*4.

The same Offline Payment Mode is now also supported in the Seven-Eleven App, in which users can choose PayPay as a payment method. Seven-Eleven has 21,651 stores in Japan (*5), some of which are located underground or in solid buildings where signal receptions may become unstable. Now, with the addition of the new feature, customers can smoothly pay using PayPay even without internet connection. The Offline Payment Mode will also be rolled out across other apps offered by PayPay merchants in which PayPay’s payment feature is supported.

■ Payment limits when using the Offline Payment Mode

| Payment limit | 50,000 yen per payment |

|---|---|

| Cap on number of payments*6 | 5 payments within 24 hours 20 payments within 30 days |

The Offline Payment Mode also serves to provide aid in the event of a natural disaster such as an earthquake. After the Noto Earthquake which occurred in January 2024, the rate of payments made using the Offline Payment Mode increased in the northern parts of Ishikawa Prefecture, the affected area, increasing to up to 8.5 times compared to the rest of the country (in prefectures excluding Ishikawa). In addition, a feature improvement was released in August 2024 that also activates the Offline Payment Mode when a system failure occurs in the PayPay app*7.

PayPay will continue to strive for a world where users and all types of restaurants and service providers can enjoy the convenience of cashless payment and use the cashless payment service with confidence anywhere in Japan. Furthermore, PayPay aims to evolve from a payment app into a super app that enriches users’ lives and makes them more convenient, fostering a world where paying “Anytime, Anywhere with PayPay” is a reality. As the company was designated by the Financial Services Agency as a Specified Essential Infrastructure Service Provider in November 2023, PayPay is committed to continue providing an even safer and more secure environment for users.

*2. As of December 2024

*3. Calculated by PayPay based on “Population Projections – October 2023 Report” published by the Statics Bureau of Japan and “1. Information Communication Devices Ownership” in “2023 Telecommunications Usage Trends Survey” published by the Ministry of Internal Affairs and Communications.

*4. Based on actual usage of the feature between July 20, 2023, and January 31, 2025.

*5. As of December 2024 https://www.sej.co.jp/company/tenpo.html

*6. Total number of Offline Payment Mode payments including payments made from the Seven-Eleven App and the PayPay app.

*7. The feature may not be activated in certain cases.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labor and Welfare No. 00001 / Date of designation: August 9, 2024)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money as part of its services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) refers to PayPay Money that can only be purchased with wages received by the PayPay user in their Paycheck Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Points (Time Limited) can only be used for payments with certain services provided by LY Corporation and its group companies. It cannot be transferred between PayPay users or cashed out. Additionally, PayPay Points (Time Limited) have an expiry date. For the exact date of expiry, please confirm the information provided by LY Corporation or group company regarding the promotional campaign or measure. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.