PayPay has members from about 50 countries and regions. We dare think that we do not need a clear vision a clear vision to create a future beyond our imagination. PayPay will always be true to our roots and materialize a vision (future) that no one else can imagine.

PayPay 5 senses

PayPay Group's organizational culture that creates a future beyond imagination.

What we value about our work.

-

01

Believes in our

PRODUCT & TEAMEnjoy growing together, believing in the product, our teams and that we will be the No.1 FinTech company in the world.

-

02

SPEED is our bet on the market

Contribute to our users and the company by achieving results at an amazing speed.

-

03

Ego is not welcome,

Communication is necessaryValue communications and respect the diversity of our colleagues. Work together and tackle tasks as one.

-

04

Be Sincere To be Professional

Be sincere and work as a professional without making any compromise. Create new opportunities and values. See it through until the end.

-

05

Work for LIFE, or Work for Rice -What is your real purpose?-

Don’t forget the Day1 mindset. Take action, looking for essential objectives and values. Try to take risks again and again and never stop challenging.

Job Category

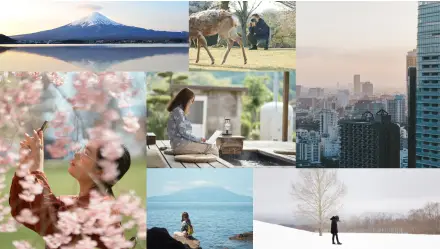

Building up your lifestyle in Japan and exploring its beauty and uniqueness

View Experience life in Japan

Interview

Our Corporate Blog

Intertwining People and Culture

Through PayPay Inside-Out, we will keep you up to date on what's happening in the unique and diverse environment of PayPay.

View PayPay Inside-Out