As of today, May 28, 2020 (Thu), The Japan Net Bank, Limited (hereinafter Japan Net Bank) and PayPay Corporation (hereinafter PayPay) will offer Japan Net Bank card loans (*1) from the mini app, which can be easily accessed from the top screen of the cashless payment service “PayPay” app. From the “Loan” icon you will be redirected to the Japan Net Bank’s card loan page, where you can apply for a loan. (There will be a screening process after the application).

With this mini-app, PayPay users will be able to immediately receive loans through their Japan Net Bank account linked to PayPay after linking a bank account and completing the screening procedures with Japan Net Bank.

【Terms & Conditions and account login screens are displayed only when the account is linked.】

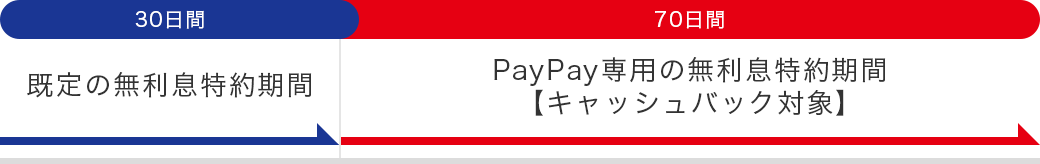

In addition, Japan Net Bank is offering a 100-day interest-free campaign for those who apply for a card loan via PayPays “Loan” mini-app.

●100-Day Interest-Free Campaign, only with PayPay

| Eligible Customers | Customers who were redirected from PayPay’s “Loan” icon and who have signed up for a Japan Net Bank card loan for the first time. |

|---|---|

| Details: | Interest paid for repayments made within 100 days from the first loan date, will be returned as a cashback to your savings account. This will not be eligible for interest paid at the time of additional repayment when changes are made to the repayment date. |

| Cashback Period | Cashback is scheduled to be around the middle of the month following the repayment. However, as no interest will accrue due to the interest-free special clause there is no cash back for 30 days from the first loan date.

|

| Special Provisions | The following cases will be excluded from the campaign.

If it was delayed even once during the period. If you have cancelled the card loan at the time of cashback. If you had a loan with an extreme loan contract in the past. If you have cancelled the card loan after the first loan during the period and signed When it is judged to be ineligible based on an overall judgment. |

Japan Net Bank and PayPay have been working together to enhance the convenience of both services.

For PayPay merchants, we strongly support stores to become more cashless by specifying a Japan Net Bank account as the account for depositing PayPay sales to provide free deposit fees and next-day sales deposits.

Japan Net Bank and PayPay will continue to provide services that are easier to use and more convenient to users, to make their lives more convenient and enriching.

*1 The official product name of the card loan is “Net Cashing”.

*2 For PayPay balance, click here Please note that the only PayPay balance that can be paid out to your bank account is PayPay Money.

*3 For more information on payout, please clickhere.

【About Japan Net Banks Card Loan 】

It is a loan that you can loan repeatedly and repaid 24 hours a day, 365 days a year, within the loan amount limit. It can be used freely up to 10 million yen. Applications can be completed online, and the screening results will be informed in 60 minutes. As the loan will be deposited immediately, once applied, you can use it right away whenever needed.

【About PayPay】

“PayPay”, a smart phone payment service provided by PayPay Corporation, allows users to pay by either topping-up their PayPay balance in advance or by using their credit card, and can be used in both brick-and-mortar stores and with online services. Users can top-up their PayPay balance using their bank account, online, or from a nearby Seven Bank ATM. There are a variety of features provided in addition, such as to “send/receive” PayPay balance (PayPay Money, PayPay Money Light) between users, or to split the bill (“Warikan”), convenient in a social meal setting.