PayPay Corporation, a joint venture between Softbank Group Corp., Softbank Corp., and Yahoo Japan Corporation, has strengthened the security of the SMS authentication feature used when signing-up to cashless payment service “PayPay” or when logging in using a new device.

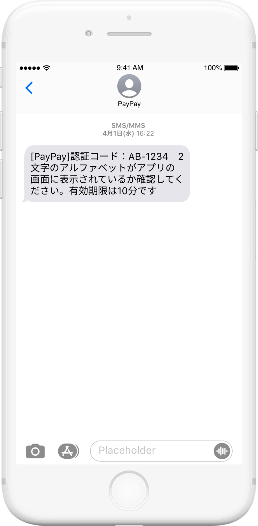

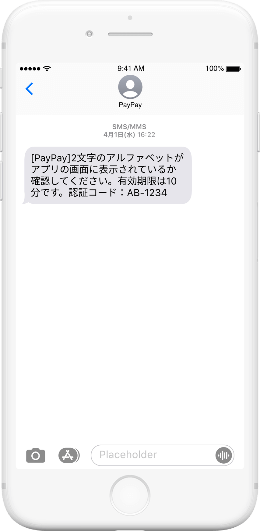

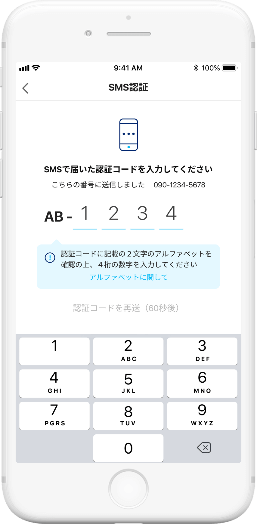

The new SMS authentication feature which PayPay has implemented entails a combination of numbers and alphabet letters; 2 random alphabet letters will be displayed at the head of the 4 digit authentication code sent via SMS. The screen in which the authentication code is to be entered will also have the 2 letters displayed, whereby the user can compare the 2 letters sent to them via SMS and the letters displayed on the screen to assess whether the entry screen is fake, and is therefore a phishing site or not.

There has been a recent increase in scams where imposters illegally obtain the SMS authentication code for a particular cashless payment service the user is registered with through phishing sites or emails impersonating the cashless payment provider. PayPay has strengthened the security of the SMS authentication feature as border control to prevent unauthorized individuals from logging-in.

In addition, PayPay has filed for a patent on the newly developed authentication feature which combines numbers and alphabet letters. It is the first time this feature has been implemented amongst the main QR code payment services () as a safety measure upon account registration.

■New SMS Authentication Feature Screen

-

SMS when signing-up

SMS when logging-in from a new device

-

User cross-checks with the 2 alphabet letters sent via SMS

-

User inputs the authentication code sent via SMS

PayPay has, up until now, already enforced various other security measures to ensure users can use “PayPay” safely such as 2 factor authentication using SMS when logging-in again after logging-out, counter-fraud measuers including regular monitoring enacted not only by a edicated team but also with the help of technology, a hotline available 24 hours a day 365 days a year to answer any questions about “PayPay”, and a full-compensation scheme where PayPay, in principle, compensates any damages caused by the theft and unauthorized use of the account itself, bank account information, or credit card information.

See the safety measures PayPay has in place here. PayPay will continue

to focus on strengthening security, to ensure users have a safe & secure experience when using our service.

Out of the 18 payment providers participating in JPQR, the unified QR code issued by the

Ministry of General Affairs (as of June 5, 2020)

■Main features of “PayPay”

“PayPay”, a smart phone payment service provided by PayPay Corporation, allows users to pay by either topping-up their PayPay balance in advance or by using their credit card, and can be used in both brick-and-mortar stores and with online services. PayPay is supported not only by major chain businesses, but is rapidly becoming available in smaller shops all across Japan. Users can top-up their PayPay balance using their bank account, online, or from a nearby Seven Bank ATM. There are a variety of features provided in addition, such as to “send/receive” PayPay balance (PayPay Money, PayPay Money Light) between users, or to split the bill(“Warikan”), convenient in a social meal setting.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.