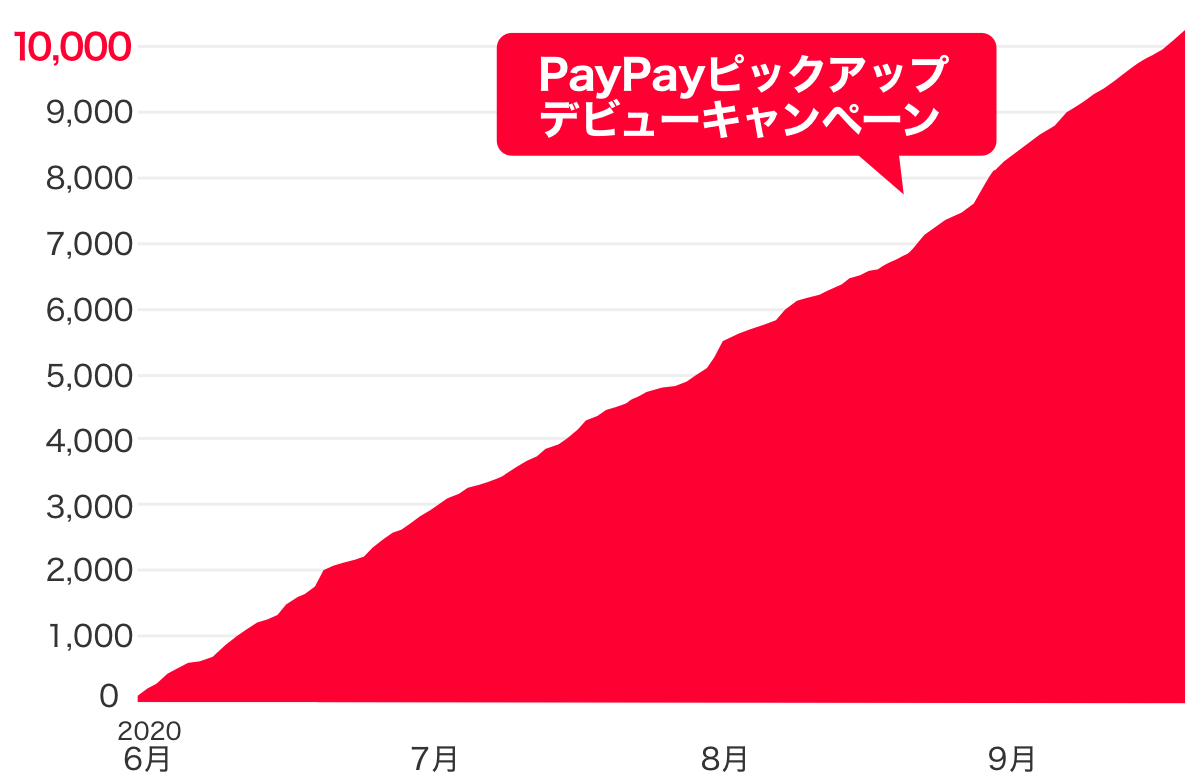

PayPay Corporation, a joint venture between Softbank Group Corp., Softbank Corp., and Yahoo Japan Corporation is pleased to announce that the number of registered stores for the pre-order service “PayPay Pickup” has exceeded 10,000 in about 100 days since it’s service launch. (*1)

PayPay Pickup is a mobile ordering service that allows users to complete their food order in advance within the PayPay app, a cashless payment service, and pick up their food at the store. The service was launched on June 1 for restaurants offering take-out, and the number of applications from member restaurants exceeded 10,000 just in 100 days after the service was launched.

PayPay pickup stores:

Marusei (left: Shibuya-ku, Tokyo), Mikyouya (right: Shinagawa-ku, Tokyo)

Users of “PayPay Pickup” can select the store and food in advance on the PayPay app, place an order and pick up their food at the right time for take-out, minimizing time spent in the store and contact with other customers. Restaurants have the advantage of being able to complete everything from taking an order to payment on the PayPay app, reducing the workload at the cashier, expanding sales opportunities, and enabling mobile ordering services without having to develop the app themselves. Another great advantage of using “PayPay Pickup” is that as stores will receive an estimated pickup time when an order is placed, they can ensure the pickup of the food and avoid the risk of not being able to collect payments.

PayPay is offering the “PayPay Pickup Debut Campaign” until September 30, where customers who use “PayPay Pickup” and order take-out (in-store takeaway) items at participating restaurants will receive a PayPay bonus of up to 30% of the amount paid. In addition, the “Autumn PayPay Pickup Campaign” will run from October 17 to November 15, 2020. Merchants can also use PayPay Pickup to their advantage by using PayPay Pickup in conjunction with this campaign period, as the PayPay Pickup usage fee and platform usage fee (monthly fee) are virtually free until October 2020. It can also be used as one of the “PayPay Pickup” marketing methods to meet the needs of users who want to take advantage of the “PayPay Pickup Debut Campaign” and to attract new customers.

PayPay will continue to offer the convenience of cashless payments to users as well as all kinds of retailers and service providers, with the goal of creating a world in which a safe cashless shopping experience can be enjoyed anywhere in Japan. “PayPay” will continue on the path to evolve from a “payment app” into a “super app” that will make users’ lives richer and more convenient, fostering a culture of “Anytime, Anywhere with PayPay.”

■ PayPay Pickup application page for https://paypay.ne.jp/store/pickup/

■ How to use PayPay Pickup: https://paypay.ne.jp/guide/pickup/

*1 As of September 16, 2020.

■ About “PayPay,” the cashless payment service provided by PayPay Corporation

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis and even public transportation. It can also be used in a variety of other scenes, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay balance (PayPay Money and PayPay Money Lite) between each other for free, or “bonus management”, a service that allows users access to a simulated investment experience involving the exchange of PayPay Bonus with points provided by a Type 1 Financial Instruments Business Operator that PayPay partners with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay Corporation has the following Business operator, service provider registration.

Prepaid Payment Instruments (third party type) Issuer, Registration#: Director-General of the Kanto Finance Bureau, No. 00710

Fund Transfer Operator, registration number : Director-General of the Kanto Finance Bureau, No. 00068

* There are four types of “PayPay” (PayPay balance): PayPay Money, PayPay Money Lite, PayPay Bonus, and PayPay Bonus Lite. PayPay Money can be used for payments at affiliated services and affiliated stores within the amount of money deposited to the PayPay account opened through the identity verification procedure prescribed by the Company, and remittances can be made between PayPay users with no fees. You can pick it up. You can also withdraw PayPay money and deposit it into the specified bank account (if you specify Japan Net Bank, the withdrawal fee is free). This legal property is an electromagnetic record that can be used to repay the price of goods, etc., and can be remitted and withdrawn, and the funds registered under Article 37 of the Funds Settlement Law. It is issued by our company, which is a remittance company. PayPay Money Lite is electronic money issued by our company, which can be purchased and used for payments at affiliated services and affiliated stores, and can be transferred or transferred between PayPay users at no charge. This legal nature refers to the prepaid payment method (Article 3, Paragraph 1 of the Law Concerning Settlement of Funds) issued by the Company. In addition, PayPay Bonus and PayPay Bonus Lite, which are given free of charge for benefits and campaigns when using “PayPay”, can also be used for payments at affiliated services and affiliated stores, just like PayPay Money and PayPay Money Lite. I will. However, you cannot transfer, transfer or withdraw money between PayPay users. The PayPay Bonus Lite has an expiration date, which expires after the expiration date.

In addition, we are creating an environment where users can use it with peace of mind. If the PayPay account you are using has an unfamiliar claim due to third party use, or if you do not have a PayPay account but have been billed by PayPay, the prescribed compensation conditions will be applied. Assuming that you meet the requirements, you can receive compensation for the amount of damage (if you receive compensation from a third party, the amount after deducting the compensation amount). For more information, please click here.

* The company name, trade name, and product/service in this press release are registered trademarks or trademarks of their respective companies.