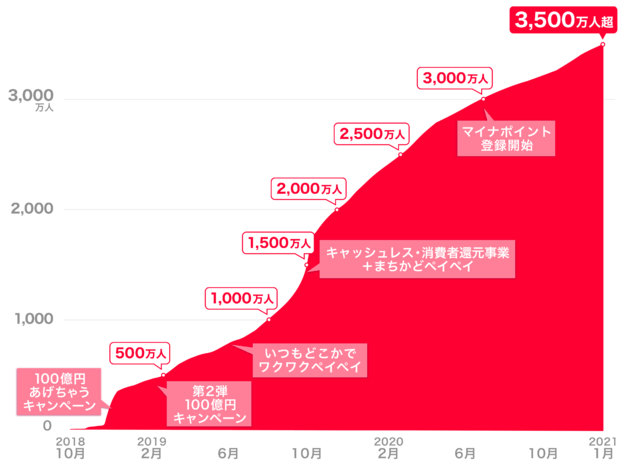

PayPay Corporation, a joint venture of SoftBank Group Corp., SoftBank Corp. and Yahoo Japan Corporation, is pleased to announce that the number of users of its cashless payment service, “PayPay”, has topped 35 million (* 1) as of January 4, 2021. This is equivalent to approximately 30% of Japan’s population, almost matching the total population of Tokyo plus the 3 surrounding prefectures (Saitama, Chiba and Kanagawa) (* 2). This means that there have been an average 42,000 signups per day since the service was launched on October 5, 2018, even after which, the numbers of users are continuing to grow.

PayPay has been promoting cashless services nationwide through a number of campaigns unique to mobile payments, starting with the “10 Billion Yen Give Away Campaign”, followed by the “WakuWaku PayPay” and “PayPay Jumbo” campaigns, as well as the “Machikado PayPay” campaign, to encourage use at local stores throughout the country. In addition, “PayPay” is in the midst of evolving into a “super app” from a “payment app” to make user’s lives richer and more convenient by adding “mini apps” such as “Taxi” and “Bonus Management” (* 3), to allow users access to services provided by partner companies within the “PayPay” app. In particular, last year, amidst the widespread impact of the new coronavirus infection (COVID19), PayPay launched services such as “PayPay Pickup” to meet the needs of users and merchants and to stimulate economic activity, in line with the ‘new normal’. In just 2 years and 3 months, the number of PayPay users has topped 35 million. We believe this is the result of our initiatives and special campaigns that have

made cashless payments accessible to more people.

* 1 Number of users who have signed up for an account.

* 2 From “Chapter 2 – 2 Population and Population Growth Rate by Prefecture” in Statistics of Japan 2020, Statistics Bureau,

Ministry of Internal Affairs and Communications.

* 3 “PayPay Bonus” can be exchanged to the original points provided by One Tap BUY and experience the simulated operation.

In 2021, the names of 6 companies with Z Holdings Corporation (“ZHD”) as the parent company or shareholder will be unified under the “PayPay” brand. PayPay will grow as a financial platform by enhancing synergies with other companies and services under the “PayPay” brand to provide more convenient services for users and merchants.

PayPay will continue to strive to offer the convenience of smartphone payments to users as well as all kinds of retailers and service providers, with the goal of creating an environment that ensures a safe cashless shopping experience across Japan as an “alternative to cash”. “PayPay” will continue on the path to evolve from a “payment app” to a “super app” that makes users’ lives richer and more convenient, fostering a world view of “Anytime, Anywhere with PayPay”.

■About “PayPay,” the cashless payment service provided by PayPay Corporation

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis and even public transportation. It can also be used in a variety of other scenes, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay balance (PayPay Money and PayPay Money Lite) between each other for free, or “bonus management”, a service that allows users access to a simulated investment experience involving the exchange of PayPay Bonus with points provided by a Type 1 Financial Instruments Business Operator that PayPay partners with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay Corporation is registered as follows:

Prepaid Payment Instruments (third party type) Issuer, registration Number : Director-General of the Kanto Finance Bureau, No. 00710

Fund Transfer Operator, registration number : Director-General of the Kanto Finance Bureau, No. 00068

Bank Agency Business, License Number : Director-General of the Kanto Finance Bureau (Gindai) No. 396

* PayPay provides 4 types of PayPay balance: PayPay Money, PayPay Money Lite, PayPay Bonus and PayPay Bonus Lite. PayPay money can be used for payments at partner services and merchants as long as the amount is within the amount deposited into the PayPay account opened after verifying your identity. It can also be used for sending and receiving money between PayPay users free of charge. PayPay can also be cashed out to a designated bank account (no withdrawal fee if using Japan Net Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and other services, and can be remitted or cashed out, issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Act on Fund payment. PayPay Money Lite is an e-money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). In addition, PayPay Bonus and PayPay Bonus Lite, which are granted through campaigns and promotions when using PayPay, can be used for partner services and merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Bonus and PayPay Bonus Lite cannot be sent or transferred between PayPay users or be cashed out. PayPay Bonus Lite has an expiration date.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see“Applying for compensation”for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.