PayPay Corporation, a joint venture of SoftBank Group Corp., SoftBank Corp., and Yahoo Japan Corporation, is pleased to announce the launch of the “Cho PayPay Matsuri: Special Offers at National Chain Drugstores Campaign” to be held from March 19th to 28th, 2021, which will offer a PayPay Bonus of up to 10% of the amount paid for payments using the cashless payment service “PayPay” at eligible drugstores nationwide. This campaign will be implemented as part of the large-scale campaign “Cho PayPay Matsuri” which will provide special offers to users so that they may enjoy shopping at merchants across the country as well as online shops.

Drugstores nationwide are applicable to this campaign. Eligible stores can be found by tapping “Nearby” on the PayPay app.

When used in combination with the “Cho PayPay Matsuri: 20% cashback! (worth up to 1,000 yen)” campaign between March 1st to 28th which will grant users a PayPay Bonus of up to 20% of the amount paid by using “PayPay” at eligible stores, users will be able to receive a total PayPay Bonus of up to 30%.

PayPay will continue to strive to offer the convenience of smartphone payments to users as well as all kinds of retailers and service providers, with the goal of creating an environment that ensures a safe cashless shopping experience across Japan as an “alternative to cash”. “PayPay” will continue on the path to evolve from a “payment app” to a “super app” that makes users’ lives richer and more convenient, fostering a world view of “Anytime, Anywhere with PayPay”.

<Overview of “Cho PayPay Matsuri: Special Offers at National Chain Drugstores>

Campaign page:https://paypay.ne.jp/event/matsuri202103-drugstore/

Campaign period:

From midnight (0:00) of March 19th to 23:59 of March 28th, 2021

※The campaign will commence and end according to the business hours of the respective stores. The business hours vary by store.

Eligible Drugstores (in Japanese alphabetical order)

Welcia Group

Cocokara fine

Sundrug Group

Sugi Pharmacy Group

Tsuruha Holdings (excluding dispensing pharmacies and Drug Eleven)

Fujiyakuhin Drugstore Group

Matsumotokiyoshi Group

*Target stores and selling areas may be added or changed. Also, there are some stores and selling areas that are not covered. Details will be communicated on the campaign website before the campaign starts.

Campaign details:

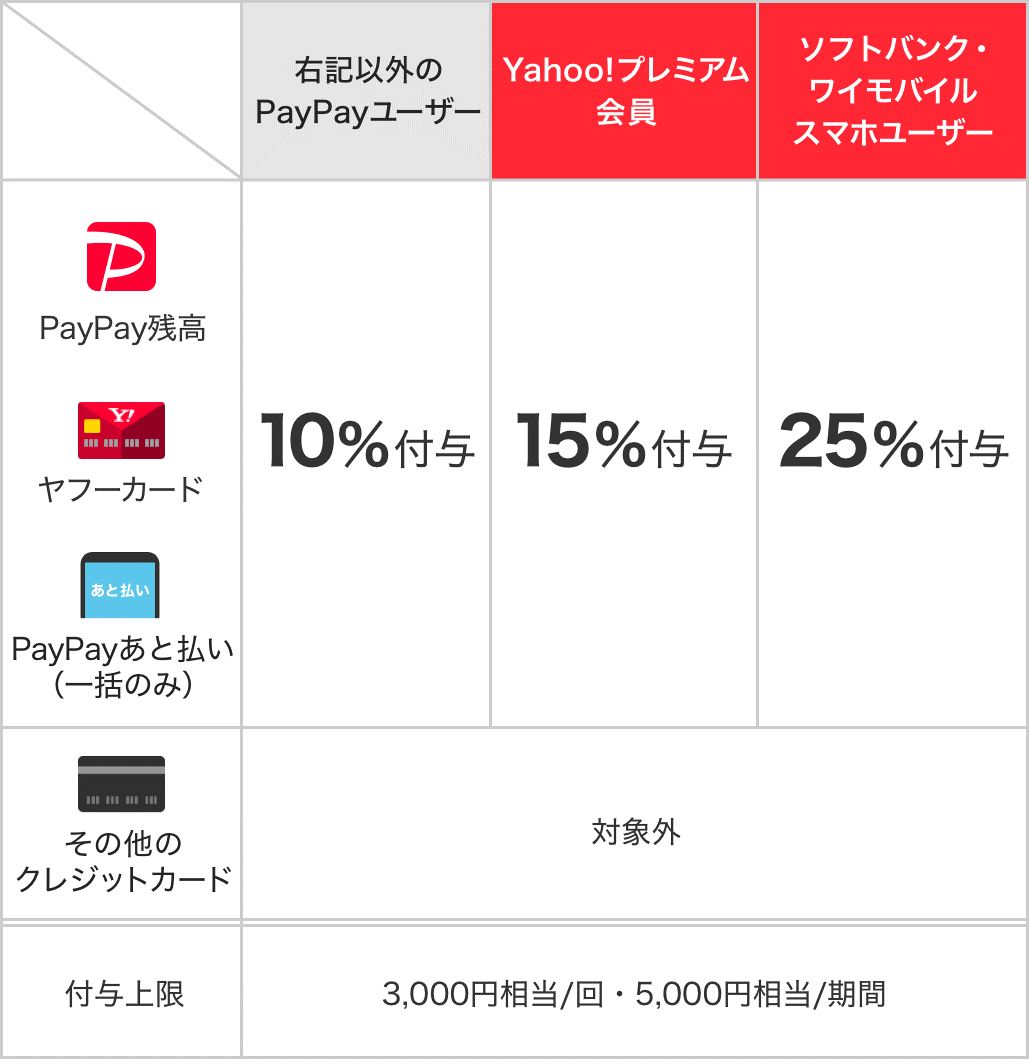

During the campaign period, users will receive a PayPay Bonus of up to 10% of the paid amount when making a payment with “PayPay” at participating stores throughout the country. In addition, a PayPay Bonus of up to 15% will be granted to “Yahoo! JAPAN Premium Members” and up to 25% to users of “SoftBank” or “Y!mobile” smartphones.

* The

* The PayPay Bonus that is granted can be used in the official PayPay Store and official YJ Card Store. It is not however withdrawable or transferable. As a general rule, PayPay Bonus will be granted 30 days after the day following the payment date. However, the actual grant date may be delayed depending on the user’s usage condition and system circumstances.

* “Yahoo! Card” is a byname for “Yahoo! JAPAN Card.”

* “SoftBank” smartphone users who have linked their PayPay account with a Yahoo! JAPAN ID and have set up Smart Login. “Y!mobile” smartphone users must have their PayPay account linked with a Y!mobile phone number and Yahoo! JAPAN ID. This service is not available to corporate customers or customers using certain devices not eligible for Smart Login or initial registration for the Y!mobile service. Please note that certain plans are also not applicable.

Grant limit:

Maximum grant per payment: 3,000 yen equivalent

Maximum grant for the campaign period: Total 5,000 yen equivalent

Grant date:

30 days from the day following the payment date.

* The terms and conditions are subject to change without notice. Also, the campaign itself may be postponed or cancelled without notice depending on the COVID-19 situation.

*When there are other campaigns hosted by PayPay or co-hosted with third parties during the campaign period, the most advantageous campaign will be applied, depending on the status of each individual “PayPay” user.

■ About “PayPay”, the cashless payment service provided by PayPay Corporation

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis and even public transportation. It can also be used in a variety of other scenes, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay balance (PayPay Money and PayPay Money Lite) between each other for free, or “bonus management”, a service that allows users access to a simulated investment experience involving the exchange of PayPay Bonus with points provided by a Type 1 Financial Instruments Business Operator that PayPay partners with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay Corporation is registered as follows:

・ Prepaid Payment Instruments (third party type) Issuer, Registration#: Director-General of the Kanto Finance Bureau, No. 00710

・ Fund Transfer Operator, Registration#: Director-General of the Kanto Finance Bureau, No. 00068

・ Bank Agency Operator, License#: Director-General of the Kanto Finance Bureau, No. 396

* “PayPay” provides 4 types of PayPay balance: PayPay Money, PayPay Money Lite, PayPay Bonus and PayPay Bonus Lite. PayPay Money can be used to pay for partner services and merchants as long as it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using The Japan Net Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and other services, and can be remitted or cashed out, issued by the Company who is a Fund Transfer Operator registered under Article 37 of the Act on Fund payment. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). In addition, PayPay Bonus and PayPay Bonus Lite, which are granted through campaigns and promotions when using PayPay, can be used for partner services and merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Bonus and PayPay Bonus Lite cannot be sent or transferred between PayPay users or be cashed out. PayPay Bonus Lite has an expiration date, after which date it will expire.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third person using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation in the event that compensation if also provided by another third party), given the prescribed conditions are met. Please see applying for compensationfor details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.