PayPay Corporation, LINE Corporation and LINE Pay Corporation will start supporting the exchange of “LINE POINT” provided by LINE into “PayPay Bonus” provided by PayPay as of March 16, 2021. One “LINE POINT” can be exchanged with a “PayPay Bonus” equivalent to one yen, with no exchange fee. Traditionally used to exchange with LINE Stickers or to use with LINE Pay payments, “LINE POINT” will now be exposed to a significantly wider range of scenes and use cases such as payments with PayPay’s merchants and partner services.

Also, a “Cho PayPay Matsuri: 25% Gain for Everyone to Celebrate the Launch of Points Exchange” campaign will be held between March 16 to March 31, 2021 to commemorate the launch of the points exchange. This campaign will be offered as part of the on-going mass-scale campaign “Cho PayPay Matsuri” offered in celebration of Z Holdings Corporation and LINE Corporation becoming group companies as of March 1, 2021. “Cho PayPay Matsuri” offers great deals at PayPay merchants throughout the country including online shops.

PayPay Corporation, Yahoo Japan Corporation, SoftBank Corp. and LINE Corporation have become group companies after the business integration between Z Holdings Corporation and LINE Corporation as of March 1, 2021. PayPay Corporation, LINE Corporation and LINE Pay Corporation will leverage each other’s strengths as partners within the same group to create a synergy and provide better convenience in order to achieve a world in which users can shop without cash anywhere in Japan.

<Overview of Points Exchange>

Available From: 11 a.m. on March 16, 2021

Minimum Exchange: 25 points or more

Units of exchange: 4 units of exchange supported. 25 pts, 100 pts, 1,000 pts, 5,000 pts.

Exchange fee: Free of charge

Ratio of exchange: A “PayPay Bonus” equivalent to one yen for every one “LINE POINT”

*Exchanging “PayPay Bonus” for “LINE POINT” will not be supported

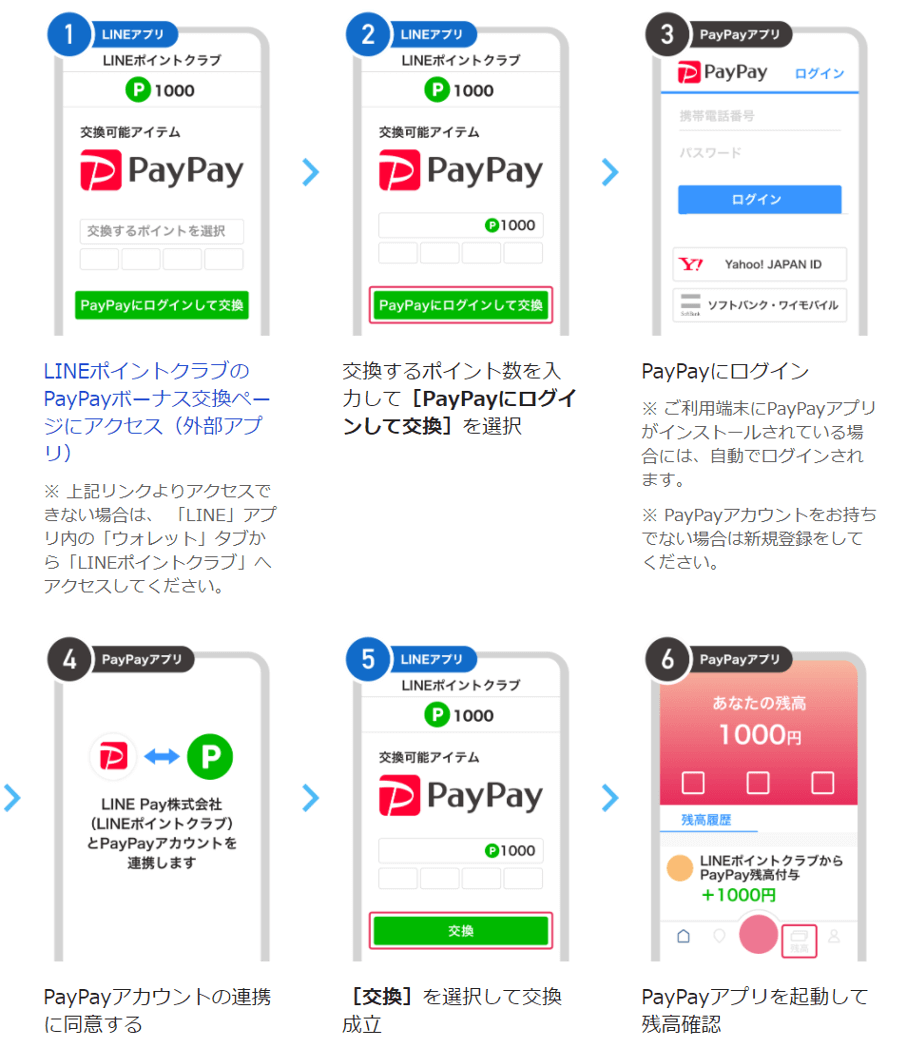

<Exchange Process>

Access the “exchange to PayPay Bonus” page via LINE POINT CLUB

Enter the number of points to be exchanged and select “Log in to PayPay and exchange”

Input the account information registered with “PayPay” in the “PayPay” log in screen and log in

Provide permission on linking LINE Pay Corporation (LINE POINT CLUB) with the “PayPay account”

Tap on “Exchange” in the following LINE POINT CLUB page and complete the exchange

Check the updated balance from the “Balance” screen in “PayPay”

<Overview of the “Cho PayPay Matsuri: 25% Gain for Everyone to Celebrate the Launch of Points Exchange” Campaign>

Campaign Website:https://paypay.ne.jp/event/matsuri202103-line-pointclub/

1. Campaign Period:

11:00 a.m. on March 16, 2021 ~ 11:59 p.m. on March 31, 2021

2. Campaign Details:

By exchanging “LINE POINT” to “PayPay Bonus” during the campaign period, the “PayPay Bonus” that is exchanged will be up to 25% more than the “LINE POINT” equivalent.

* PayPay Bonus can be used in the official PayPay Store and official YJ Card Store. It is not however withdrawable or transferable.

* The fraction of the grant after the decimal point will be disregarded.

3. Grant Limit:

Up to worth 500 yen per time and during the period

4. Grant Date

Late April 2021 onwards

* The date on which the increment offered by the campaign is granted.

The PayPay Bonus that is exchanged with LINE POINT will be granted immediately after the exchange.

* The details and conditions of the campaign are subject to change without notice.

◼ About “LINE POINT”

Points are granted as “LINE POINT” as a reward for using various services provided by LINE such as “LINE SHOPPING” and “LINE TRAVEL” as well as payments made using LINE Pay. “LINE POINT” can also be used to purchase “LINE Stickers,” “LINE Themes” and “LINE GIFT”.

A “LINE POINT Matsuri” will be hosted between March 19 to March 31, offering the opportunity to earn more LINE POINT than usual. There will be more “missions” during this period to earn points, such as playing games or reading comics. Some “missions” will offer more points than usual. There will also be bonus points rewarded for participation in multiple “missions”. “LINE POINT” will continue to strive to increase its use cases, including the integration with “PayPay Bonus,” for better convenience.

■ About PayPay https://paypay.ne.jp/

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis and even public transportation. It can also be used in a variety of other scenes, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay balance (PayPay Money and PayPay Money Lite) between each other for free, or “bonus management”, a service that allows users access to a simulated investment experience involving the exchange of PayPay Bonus with points provided by a Type 1 Financial Instruments Business Operator that PayPay partners with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay will continue to strengthen security to ensure users can enjoy an even safer & secure service, while continuing on the path to evolve from a “payment app” into a “super app” that makes users’ lives richer and more convenient, fostering a world view of “Anytime, Anywhere with PayPay”.

PayPay Corporation is registered under the following businesses and associations:

・ Prepaid Payment Instruments (third party type) Issuer (Registration: Director-General of the Kanto Finance Bureau, No. 00710/ Registration date: October 5,2018)

・ Fund Transfer Operator (Registration: Director-General of the Kanto Finance Bureau, No. 00068/ Registration date: September 25, 2019)

・ Japan Payment Service Association (http://www.s-kessai.jp/ , Date of admission: September 12, 2018)

・ Bank Agency Operator (License: Director-General of the Kanto Finance Bureau, No. 396/ Registration date: November 26, 2020)

・ Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc. (Registration: Kanto (K) No.106/ Registration date: July 1, 2019)

・ Japan Consumer Credit Association (https://www.j-credit.or.jp/ , Date of admission: July 1,2019)

・ Telecommunications Carrier Registration: A-02-17943

* “PayPay” provides 4 types of PayPay balance: PayPay Money, PayPay Money Lite, PayPay Bonus and PayPay Bonus Lite. PayPay Money can be used to pay for partner services and merchants as long as it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using The Japan Net Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and other services, and can be remitted or cashed out, issued by the Company who is a Fund Transfer Operator registered under Article 37 of the Act on Fund payment. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). In addition, PayPay Bonus and PayPay Bonus Lite, which are granted through campaigns and promotions when using PayPay, can be used for partner services and merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Bonus and PayPay Bonus Lite cannot be sent or transferred between PayPay users or be cashed out. PayPay Bonus Lite has an expiration date, after which date it will expire.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third person using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation in the event that compensation if also provided by another third party), given the prescribed conditions are met. Please see applying for compensationfor details.

■ About LINE Pay https://pay.line.me/portal/jp/main

With LINE Corporation’s “CLOSING THE DISTANCE” as its corporate mission, LINE Pay aims to bring people, businesses and money closer together. In December 2014, the mobile money transfer and payment service “LINE Pay” was launched on the communication app “LINE” and since then, more than 56.7 million people (as of November 2020) have registered for the service globally. LINE Pay supports a wide range of payment methods from street shops to online websites, allowing users to choose the method that best suits their lifestyle from a diverse lineup of services including prepaid methods and credit cards. A further range of smart & convenient, money-related features are also available, such as peer-to-peer payments or split payments with “LINE” friends and easy expenditure management using the “Usage Report”. In addition to the high level of security that has been developed through the “LINE” business to date, LINE Pay will continue to provide users with even more accessible and innovative Fintech services.

LINE Pay will bring people, money and services closer together as the mobile payment platform of “LINE” by eliminating friction in the circulation of money including time and effort. It is LINE Pay’s goal to become the leading mobile payment service in a cashless and wallet-less society.

LINE Pay Corporation is registered under the following businesses and associations:

・ Prepaid Payment Instruments (third party type) Issuer (Registration Number: Director-General of the Kanto Local Finance Bureau No. 00669 / Registration Date: October 1, 2014)

・ Fund Transfer Operator (Registration Number: Director-General of Kanto Local Finance Bureau No. 00036 / Registration date: October 1, 2014)

・ Japan Payment Service Association (http://www.s-kessai.jp/ , Date of admission: August 6, 2014)

・ Electronic Payment Service Provider (Registration Number: Director-General of the Kanto Local Finance Bureau (Dendai) No. 10 / Date of registration: December 20, 2018)

・ Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc. (Registration Number: Kanto (K) No. 80 / Registration Date: April 1, 2019)

・ Japan Consumer Credit Association (https://www.j-credit.or.jp/ , Date of admission: April 1, 2019)

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.