Guide page : https://paypay.ne.jp/guide/bonus-usage-settings/

PayPay Corporation has launched a new feature “Bonus Usage Settings” (hereinafter, the feature) as of March 31, 2021, allowing users to save their PayPay Bonus that they receive as benefits from various campaigns. Until now, the use of PayPay Bonus was prioritized in payments using “PayPay” in consideration of the user’s convenience, but from now on, it will be up to the user to choose whether to save or use their PayPay Bonus.

The feature was developed in response to a large number of requests to have the freedom to choose when to use the PayPay Bonus or save it without spending it. The settings can now be easily changed from within the PayPay app at any time (*1), where the user is offered the option to save the PayPay Bonus, use it in payments, or automatically add it to the “Earn Bonus” mini-app which offers a simulated investment experience, powered by “PayPay Securities.” This will enable users to use the PayPay Bonus they have saved at any given time whether it be towards “Earn Bonus,” everyday shopping or for other various purposes including occasions planned in advance (*2).

<Bonus Usage Settings Feature>

- The settings can be updated from the “Balance” screen in the PayPay app. The current PayPay Bonus settings will be displayed first. The usage settings screen will be displayed after tapping on Change, where the type of use can be selected. (“Use PayPay Bonus” is the default option selected. “Auto-sweep” will be selected by default for users who have the auto-add settings enabled in “Earn Bonus.”)

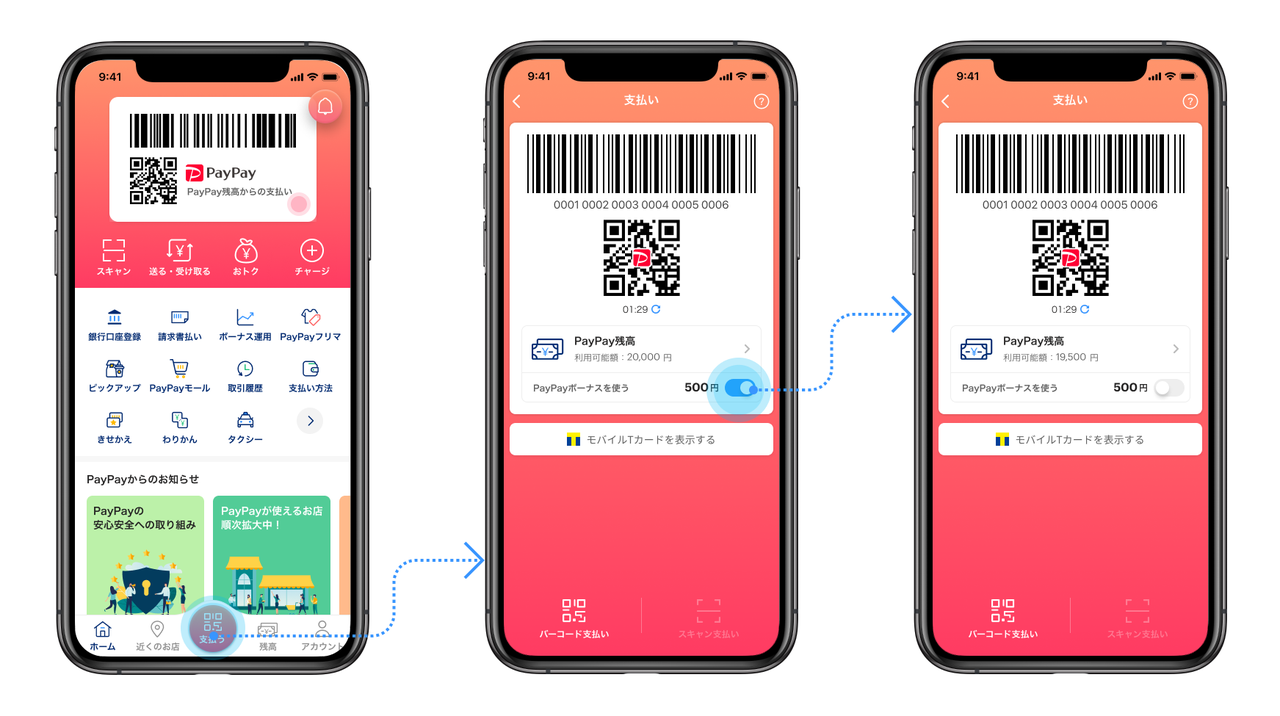

- The settings can also be changed from the “Pay” screen. This applies to “user scan” payments where the user scans the merchant’s QR code as well. The user will be able to select whether to use their PayPay Bonus at the time of payment (*2).

*1 The settings will be carried over to the next time and onwards by changing it in the payment screen or barcode screen.

*2 The feature is available in the latest version of the PayPay app (v.2.69.0). “Use PayPay Bonus” is selected by default. “Auto-sweep” will be selected by default for users who have the auto-add settings enabled in “Earn Bonus.”

From April 1, it will also be possible to select whether to “use” or “save” the PayPay Bonus in services provided by Yahoo Japan Corporation (hereinafter Yahoo! JAPAN). For example, users will be able to use their PayPay Bonus they have saved to make a large purchase at online shopping services such as “Yahoo! JAPAN Shopping” and “PayPay Mall” whenever they choose to do so. Online auction services such as “YAHUOKU!” and services such as “PayPay Fleamarket” will be supported soon as well. (*3)

*3 Changing the settings in Yahoo! JAPAN related services such as “Yahoo! JAPAN Shopping” or “PayPay Mall” will reflect in the PayPay account setting as well. This means that the settings will be carried over to all following payments made using “PayPay” regardless of whether it is for a Yahoo! JAPAN related service.

<Sample of PayPay Bonus settings in Yahoo! JAPAN Shopping>

* The “Save ⇔ Use” switch will not be displayed if PayPay Bonus is set to be automatically added to “Earn Bonus” in “PayPay”.

PayPay will continue to offer the convenience of cashless payments to users as well as all kinds of retailers and service providers, with the goal of creating a world in which a safe cashless shopping experience can be enjoyed anywhere in Japan. “PayPay” will continue on the path to evolve from a “payment app” into a “super app” that will make users’ lives richer and more convenient, fostering a culture of “Anytime, Anywhere with PayPay.”

Yahoo! JAPAN will continue to strive to provide great offers through various services for users to save & use their PayPay Balance.

■About “PayPay,” the cashless payment service provided by PayPay Corporation

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis and even public transportation. It can also be used in a variety of other scenes, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay balance (PayPay Money and PayPay Money Lite) between each other for free, or “bonus management”, a service that allows users access to a simulated investment experience involving the exchange of PayPay Bonus with points provided by a Type 1 Financial Instruments Business Operator that PayPay partners with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer, Registration#: Director-General of the Kanto Finance Bureau, No. 00710

・Fund Transfer Operator, Registration#: Director-General of the Kanto Finance Bureau, No. 00068

・Bank Agency Operator, License#: Director-General of the Kanto Finance Bureau, No. 396

・Telecommunications Carrier Registration: A-02-17943

* “PayPay” provides 4 types of PayPay balance: PayPay Money, PayPay Money Lite, PayPay Bonus and PayPay Bonus Lite. PayPay Money can be used to pay for partner services and merchants as long as it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using The Japan Net Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and other services, and can be remitted or cashed out, issued by the Company who is a Fund Transfer Operator registered under Article 37 of the Act on Fund payment. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). In addition, PayPay Bonus and PayPay Bonus Lite, which are granted through campaigns and promotions when using PayPay, can be used for partner services and merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Bonus and PayPay Bonus Lite cannot be sent or transferred between PayPay users or be cashed out. PayPay Bonus Lite has an expiration date, after which date it will expire.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third person using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation in the event that compensation if also provided by another third party), given the prescribed conditions are met. Please see applying for compensation for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.