PayPay Corporation (hereinafter “PayPay”), a joint venture of SoftBank Group Corp., SoftBank Corp., and Yahoo Japan Corporation, is pleased to announce the performance of its KPIs, including the number of users, as well as the large-scale initiatives in carried out in the first half of FY 2021.

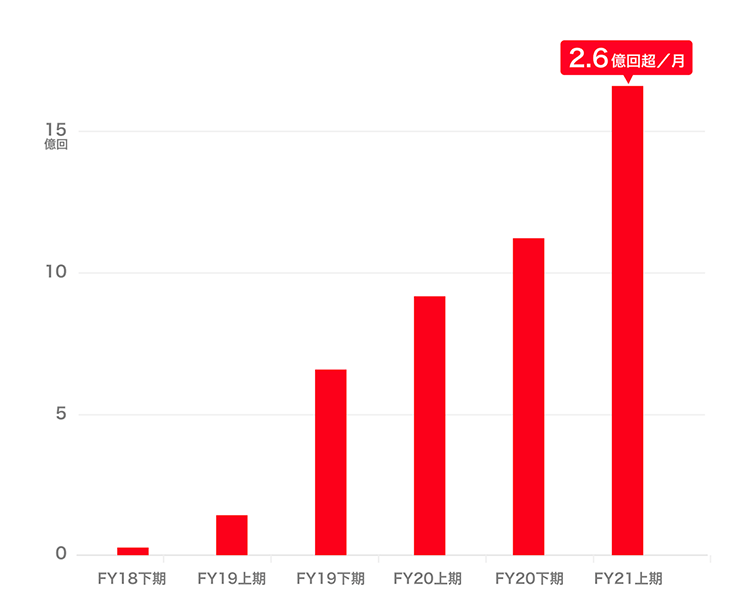

PayPay’s number of registered users, merchants, and payments grew steadily despite the effects of the spread of Covid-19. The number of payments exceeded 1.6 billion in the six-month period from April 2021 to September 2021, approximately 1.8 times the number of payments year-on-year.

[Number of Users, Merchants, and Payments]

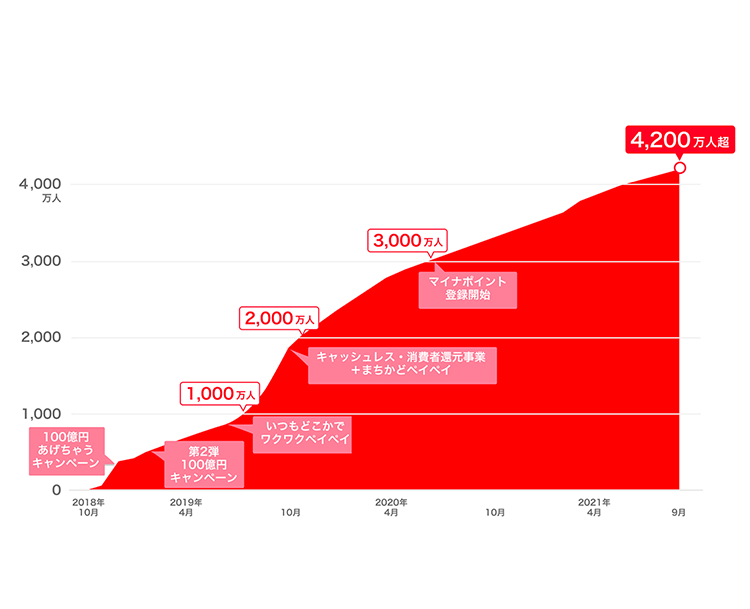

- Users: Over 42 million (*1)

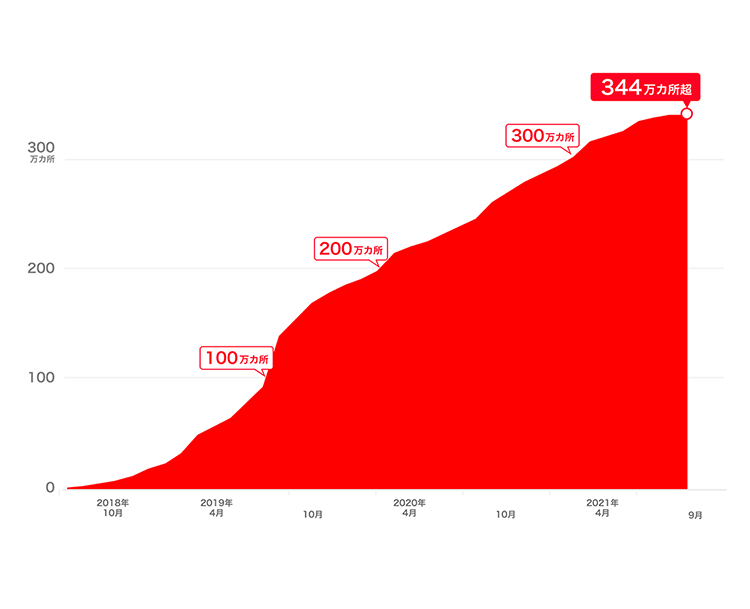

- Merchants: Over 3.44 million (*2)

- Payments: Over 1.6 billion times in the first half of FY 2021 (monthly average of over 260 million) (*3)

【Growth Chart of Number of users】

【Growth Chart of Number of users】 【Number of merchants】

【Number of merchants】 【Number of payments】

【Number of payments】

*1. Total number of users who have registered for an account as of September 2021.

*2. Total number of locations registered with “PayPay,” including stores and taxis, as of September 2021.

*3. Does not include the number of times users used the “Send / Receive” PayPay Balance feature for between users or the number of times users made payments using the Alipay app.

As Covid continues to have a major impact across the country, PayPay has enhanced the number of merchants and users by playing the role of a platform that promotes digital payments recommended for the new normal. In addition, the company also announced that it will support the DX (*4) of merchants by promoting the use of PayPay My Store to improve their operations and accelerate the efficiency of their sales activities. PayPay will strive to improve user convenience and social productivity by continuing to promote cashless payments, as well as add and expand services.

*4. Digital Transformation. It refers to the transformation of products, services, and business models based on the needs of customers and society, using data and digital technology to respond to the rapid changes in the business environment. It also includes the transformation of business operations, organizations, processes, and both corporate culture and climate to establish a competitive edge. (Ministry of Economy, Trade and Industry, “DX Promotion Guidelines”)

[PayPay’s Initiatives in the First Half of FY 2021]

<Addition of new services and broadening of existing services>

- Promoted subscription to the “PayPay My Store Lite Plan” and provided support for merchant DX

- Added new services, such as “ChargeSPOT” and “PCR test kit,” to the list of mini apps. Number of people using “Earn Bonus” exceeded 4 million

<Initiatives utilizing PayPay’s payment platform>

- Expanded use of the “Send / Receive” feature

- PayPay’s Bill Payment adopted by approximately two-thirds of local governments in Japan and increase in number of times it was used

- More than 7 million users linked the Seven-Eleven App with PayPay

- LINE Pay available at PayPay merchants

- Expanded the “Support Your Town Project,” carried out by collaborating with local governments. Implemented over 340 campaigns to date

<Campaigns with special offers>

- Launched a new large-scale campaign, “Summer PayPay Matsuri”

- Carrying out “Machi-no PayPay Matsuri” to support local stores

<Efforts in pursuit of safety and security>

- Initiatives to provide stable payment services

- Countermeasures against unauthorized use for a safer “PayPay”

Promoted subscription to the “PayPay My Store Lite Plan” and provided support for merchant DX

PayPay announced that merchants can use PayPay’s services for a system fee rate of 1.60% if they subscribe to the “PayPay My Store Lite Plan” starting from October 1. Since this announcement, the number of “PayPay” merchants and subscriptions to the “PayPay My Store Lite Plan” have been growing steadily. By subscribing to the said plan, merchants can utilize the “PayPay” payment platform to promote their sales activities, such as issuing “PayPay Coupons,” and use “PayPay” at a lower payment system fee. In addition to the “PayPay Coupon,” the company plans to add other functions that stores can use to increase sales activities and further promote DX in the future. Moreover, PayPay will support merchants’ businesses and promote DX with “Shop Consultants” who belong to over 30 base organizations nationwide.

Added new services, such as “ChargeSPOT” and “PCR test kit,” to the list of mini apps. Number of people using “Earn Bonus” exceeded 4 million

“ChargeSPOT,” provided by INFORICH INC., and “PCR test kit,” provided by HEALTHCARE TECHNOLOGIES Corp., are now available as mini apps (*5) in “PayPay.” In addition, “Earn Bonus,” provided by PayPay Securities Corporation, surpassed 4 million users in July 2021, in one year and three months after the service was launched in April 2020. PayPay will continue to augment the mini apps in the second half of FY 2021 to further the transformation of “PayPay” into a super app.

*5. A “mini app” is a feature that allows users to smoothly make reservations, order products, and purchase services provided by PayPay Corporation’s partner companies from the PayPay app.

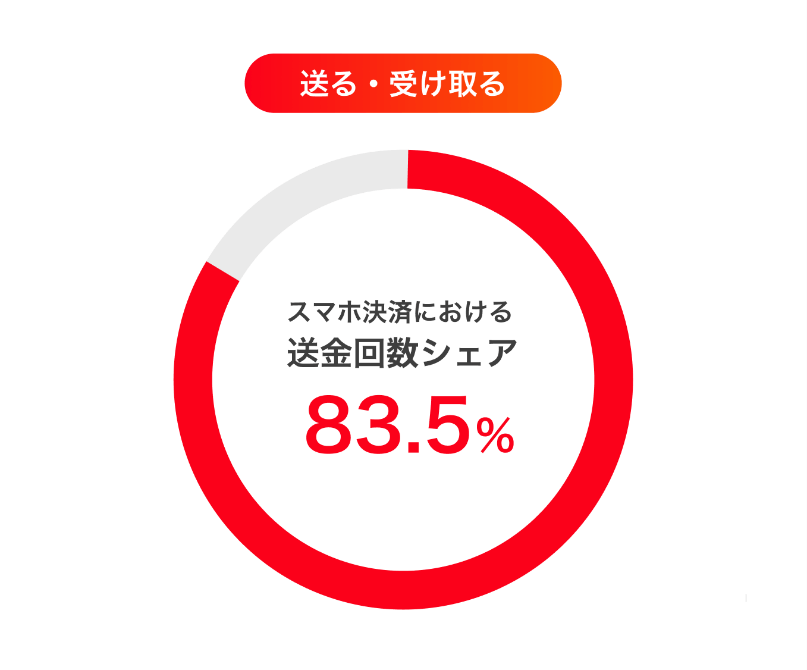

Expanded use of the “Send / Receive” feature

The use of the “Send / Receive” feature for PayPay Balance on the PayPay app is increasing. According to the “Survey on Code Payment Trends” released on September 10, 2021 by PAYMENTS JAPAN, the number of remittances via mobile payment apps from January to March 2021 was over 18 million. Moreover, the number of times balances were sent using “PayPay” was approximately 15 million (*6), which means that over 80% of the transfers were through “PayPay.” The surge in usage of the “Send / Receive” feature is primarily due to the growth in the number of merchants and PayPay registrants, which in turn caused PayPay’s payment platform to further expand. Therefore, the use of this function is expected to continue increasing in the future.

*6. Number of times PayPay Balance was sent using the “Send / Receive” feature between January 1, 2021 and March 31, 2021. Researched by PayPay. Researched by PayPay.

PayPay’s “Bill Payment” adopted by approximately two-thirds of local governments in Japan and increase in number of times it was used

PayPay’s “Bill Payment,” a service that allows users to pay utility bills and for deliveries by scanning the barcode on the bill (payment slip) with the PayPay app, is continuing to grow in its number of clients and payment frequency. As of August 2021, “Bill Payment” can be used for the bills of 1,796 local governments and businesses (1,059 municipalities and 737 waterworks bureaus), 205 electricity and gas companies, and 954 private companies, including sales of goods and services, e-commerce, and broadcasting subscription fees. In particular, more than 1,100 municipalities, or approximately two-thirds of all municipalities in Japan, have adopted “Bill Payment” as of October 2021.

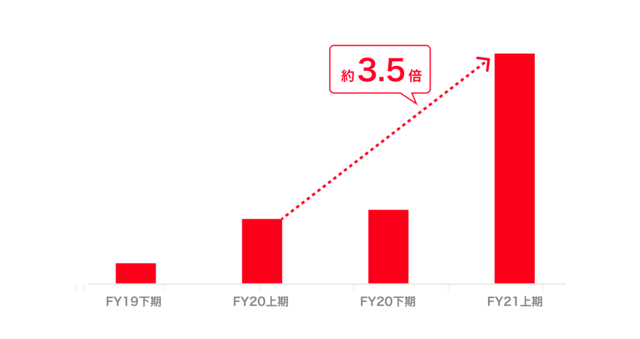

In addition, the number of payments made using “Bill Payment” in the first half of 2021 (April to September) was more than 3.5 times higher year-on-year. Users can pay their taxes and utility bills 24/7 wherever they please, reducing the time and effort required to go out and withdraw cash, as well as saving on withdrawal fees. Plus, by introducing “Bill Payment,” local governments and businesses can make life more convenient for citizens and users of their services, reduce delayed payments, and prevent users from forgetting to pay.

【Increase in the number of payments with “Bill Payment”】

More than 7 million users linked the Seven-Eleven App with PayPay

The number of users who linked the “Seven-Eleven App” with “PayPay” has surpassed 7 million (*7). When users link the “Seven-Eleven App” with “PayPay,” they can make payments and earn rewards at the same time by simply presenting the “PayPay” payment barcode displayed on the screen. This is the first in a series of initiatives to provide the “PayPay” payment platform to the apps of partner companies. By introducing “PayPay” to their apps, partner companies can improve user convenience by incorporating the payment function into their apps without having to develop it from scratch. Users who already use “PayPay” can link their apps with just a simple initial setup, and since “PayPay” is used by over 42 million users, it can be expected for a large number of users to link their apps. PayPay will continue to strive to have as many partner companies as possible adopt the “PayPay” payment platform.

*7. As of September 2021

LINE Pay available at PayPay merchants

Starting from August 2021, “LINE Pay” became available in applicable PayPay merchants (*8). In addition to the more than 42 million PayPay users, PayPay merchants can expect to attract 40 million LINE Pay users (*9) nationwide without the hassle of introducing LINE’s payment system. This initiative was the first step in the management integration (*10) of Z Holdings Corporation and LINE Corporation, in order to strengthen cooperation between cashless payment providers under the same group. As members of the same group, both PayPay and LINE will continue to work together toward the same goals, creating synergies by leveraging their strengths.

*8. These are PayPay merchants that use the user scan method (MPM, Merchant Presented Mode).

*9. As of June 2021.

*10. For details, please see to the press release “Completion of the Business Integration Between Z Holdings and LINE“.

Expanded the “Support Your Town Project,” carried out by collaborating with local governments. Implemented over 340 campaigns to date

In response to the significant impact of Covid on the local economy, the “Support Your Town Project,” which is being implemented jointly with local governments using the “PayPay” payment platform, has been further expanded. As of October 2021, a total of 366 campaigns will be held in 255 municipalities spanning 43 prefectures across Japan. Additionally, the campaign is not only contained in regional areas but spreading in the Tokyo Metropolitan Area, with 16 municipalities in Tokyo simultaneously launching campaigns last month. “PayPay” eliminates the need for local governments to print, issue, and redeem promotional coupons and gift certificates, while doing away with users having to go to specific locations to purchase such vouchers. As local governments, residents, and users will benefit from this campaign, it will continue to be held all over Japan.

Launched a new large-scale campaign, “Summer PayPay Matsuri”

The “Cho PayPay Matsuri (Super PayPay Festival)” held in October 2020 and March 2021 was so popular with users and merchants that another extensive campaign, the “Summer PayPay Matsuri (Festival)” was launched on July 1, 2021. The “Summer PayPay Matsuri” also featured a number of campaigns for brick-and-mortar stores and online merchants, which were utilized by a large number of users and merchants. In addition, on the last day of the “Summer PayPay Matsuri,” the “40 Million Users Celebration! Summer PayPay Matsuri Finale Jumbo” was implemented to further boost the campaign.

From October 18, 2021 to November 28, 2021, the popular “Cho PayPay Matsuri” will take place. Once again, users will be able to enjoy savings on shopping using the services provided in the PayPay app and on “Yahoo! JAPAN.” The campaign will feature a variety of special offers, including the “Cho PayPay Matsuri, PayPay Coupon,” “Merchant (Online Shop) Campaign,” “Cho PayPay Matsuri, PayPay Pickup at Target Stores Campaign,” and many others.

Carrying out “Machi-no PayPay Matsuri” to support local stores

To remedy the major impact of Covid on local economies, the “Machi-no PayPay Matsuri (Town PayPay Festival)” is being held to revitalize municipalities throughout Japan. In the “Support your local stores! Up to 1,000 yen worth, 20% back” campaign, which is a part of the “Machi-no PayPay Matsuri,” the users who pay with “PayPay” at merchants nationwide will receive a PayPay Bonus of up to 20% of the total amount spent. Further, users who use “PayPay” for the first time or who have not used “PayPay” in the past six months will receive an additional 20% PayPay Bonus (up to 40%). Moreover, there will be another campaign called “Machi-no PayPay Matsuri Signup Benefits,” where users who newly register for “PayPay” and complete the application for “identity verification (key)” will receive a PayPay Bonus worth 500 yen. What’s more, if a “PayPay” user introduces “PayPay” to a friend or family member who has never used it, and the introduced person meets the campaign requirements, both the referrer and the introduced person will receive a PayPay Bonus worth up to 500 yen.

In order to continue to be a service that merchants and users first, PayPay will continue to run various campaigns from October onwards to offer savings on purchases.

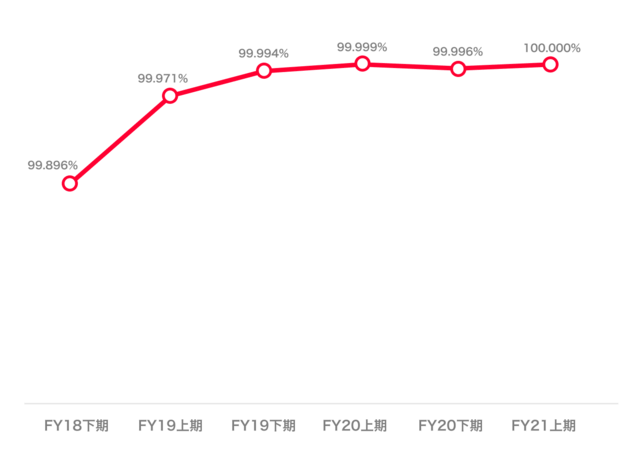

Initiatives to provide stable payment services

As a payment infrastructure responsible, PayPay always aims to provide a stable payment service. Since the service launch in October 2018, the number of merchants and people registering for the service increased rapidly. The company has been constantly working to strengthen the system and improve the PayPay app’s features to ensure the stability of its services while at the same time implementing a number of large-scale campaigns. As a result, the availability of the service has increased since its launch, and from April to August 2021, there were no major incidents (*11). Going forward, PayPay will continue to provide a stable service as a payment infrastructure while expanding the number of merchants and users, as well as enhancing various features.

*11. The value in the graph is calculated by dividing “Total time during the period (24 hours x days) – Payment service unavailable time” by “Total time during the period (24 hours x days).” Maintenance and payment unavailability for specific users and merchants are not included in the payment service unavailability time.

Countermeasures against unauthorized use for the safe use of “PayPay”

In order to ensure the safety and security of cashless payments, PayPay collaborates with its partner financial institutions, uses fraud detection systems, and monitors accounts 24 hours a day, 365 days a year with dedicated staff. When PayPay detects unauthorized use, it will take preventative measures, such as immediately suspending the target account. The fraud incidence rate for “PayPay” from April to June 2021 was as follows.

| Fraud rate | Campaign period | |

|---|---|---|

| PayPay | 0.00086%(※12) | April 2021 – June 2021 |

| Credit cards (for comparison) | 0.04784%(※13) | April 2021 – June 2021 |

*12. PayPay’s fraud incidence rate is the percentage of the amount of payments made using “PayPay” between April 1, 2021 and June 30, 2021 that were claimed to be fraudulent.

*13. The credit card fraud incidence rate is calculated from Japan Credit Card Association’s credit related statistics, “List of Credit Card Development Survey Results (Amount of Credit Extended and Number of Contracts)” and “Status of Unauthorized Credit Card Use Damage,” both in “3. (Single Company) Statistics Based on Japan Credit Card Association’s Research” (amount of unauthorized credit card use damage divided by amount of credit extended).

From August 2019, PayPay has established a full compensation system in case of any damage, and will continue to improve the service environment so that all users can use the services safely and securely. For more information on PayPay’s safety initiatives, please clickhere.

PayPay will continue to offer the convenience of cashless payments to users as well as all kinds of retailers and service providers, with the goal of creating a world in which a safe cashless shopping experience can be enjoyed anywhere in Japan. “PayPay” will continue on the path to evolve from a “payment app” into a “super app” that will make users’ lives richer and more convenient, fostering a culture of “Anytime, Anywhere with PayPay.”

■ About “PayPay,” the cashless payment service provided by PayPay Corporation

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis and even public transportation. It can also be used in a variety of other scenes, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay balance (PayPay Money and PayPay Money Lite) between each other for free, or “bonus management”, a service that allows users access to a simulated investment experience involving the exchange of PayPay Bonus with points provided by a Type 1 Financial Instruments Business Operator that PayPay partners with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay Corporation is registered under the following businesses and associations:

・Prepaid Payment Instruments (third party type) Issuer, Registration#: Director-General of the Kanto Finance Bureau, No. 00710

・Fund Transfer Operator, Registration#: Director-General of the Kanto Finance Bureau, No. 00068

・Japan Payment Service Association(https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Bank Agency Operator, License:Director-General of the Kanto Finance Bureau, No. 396

・Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc. (Registration: Kanto (K) No.106/ Registration date: July 1, 2019)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1,2019)

・Financial instruments intermediary service registration number: Kanto Finance Bureau Director (Kinchu) No. 942

* “PayPay” provides 4 types of PayPay balance: PayPay Money, PayPay Money Lite, PayPay Bonus and PayPay Bonus Lite. PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and other services, and can be remitted or cashed out, issued by the Company who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay preserves the debt it owes to its users in full amount and more by depositing its assets. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Bonus and PayPay Bonus Lite, which are granted through campaigns and promotions when using PayPay, can be used for partner services and merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Bonus and PayPay Bonus Lite cannot be sent or transferred between PayPay users or be cashed out. PayPay Bonus Lite has an expiration date, after which date it will no longer be valid.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.