Campaign page: https://paypay.ne.jp/event/countdown

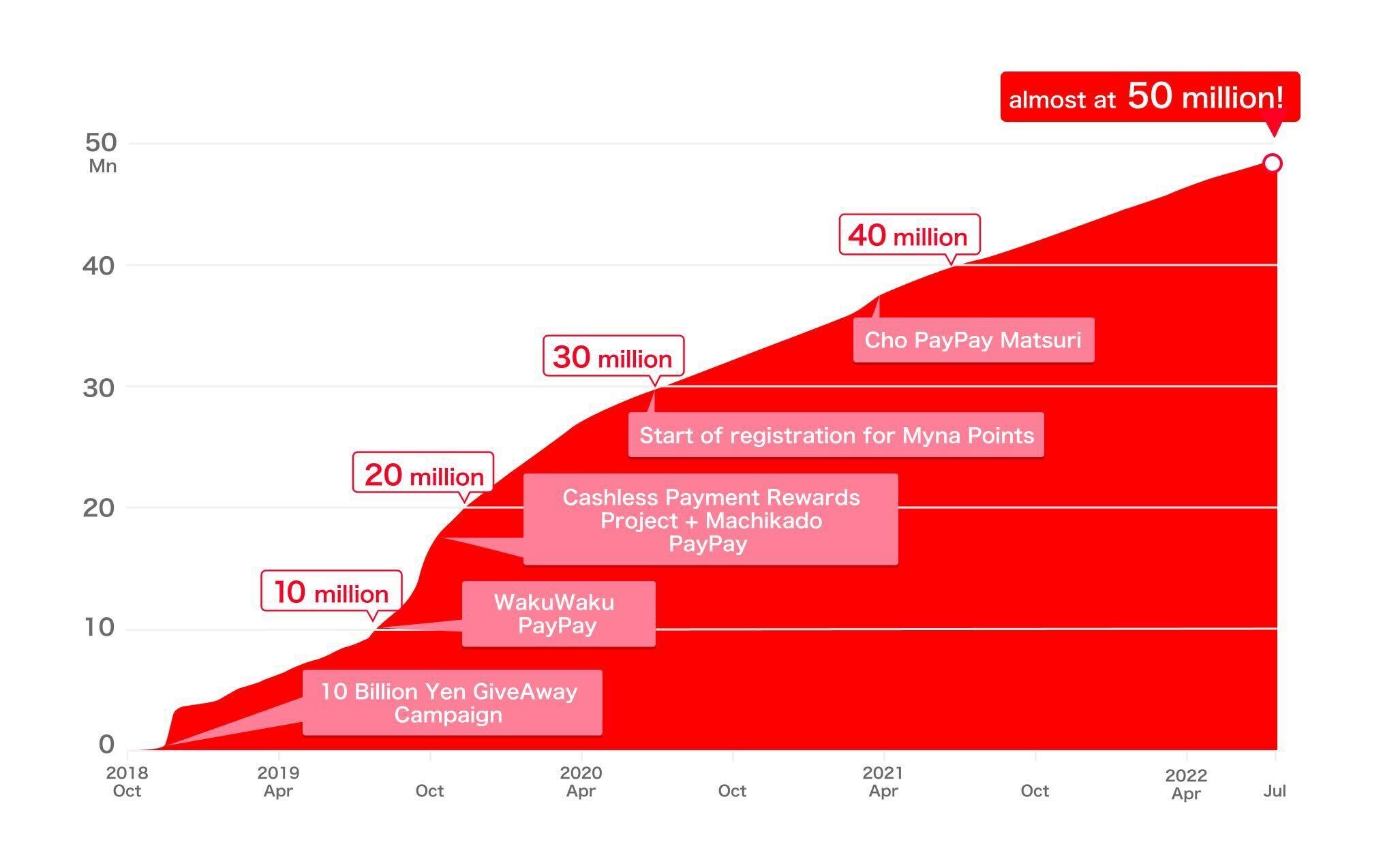

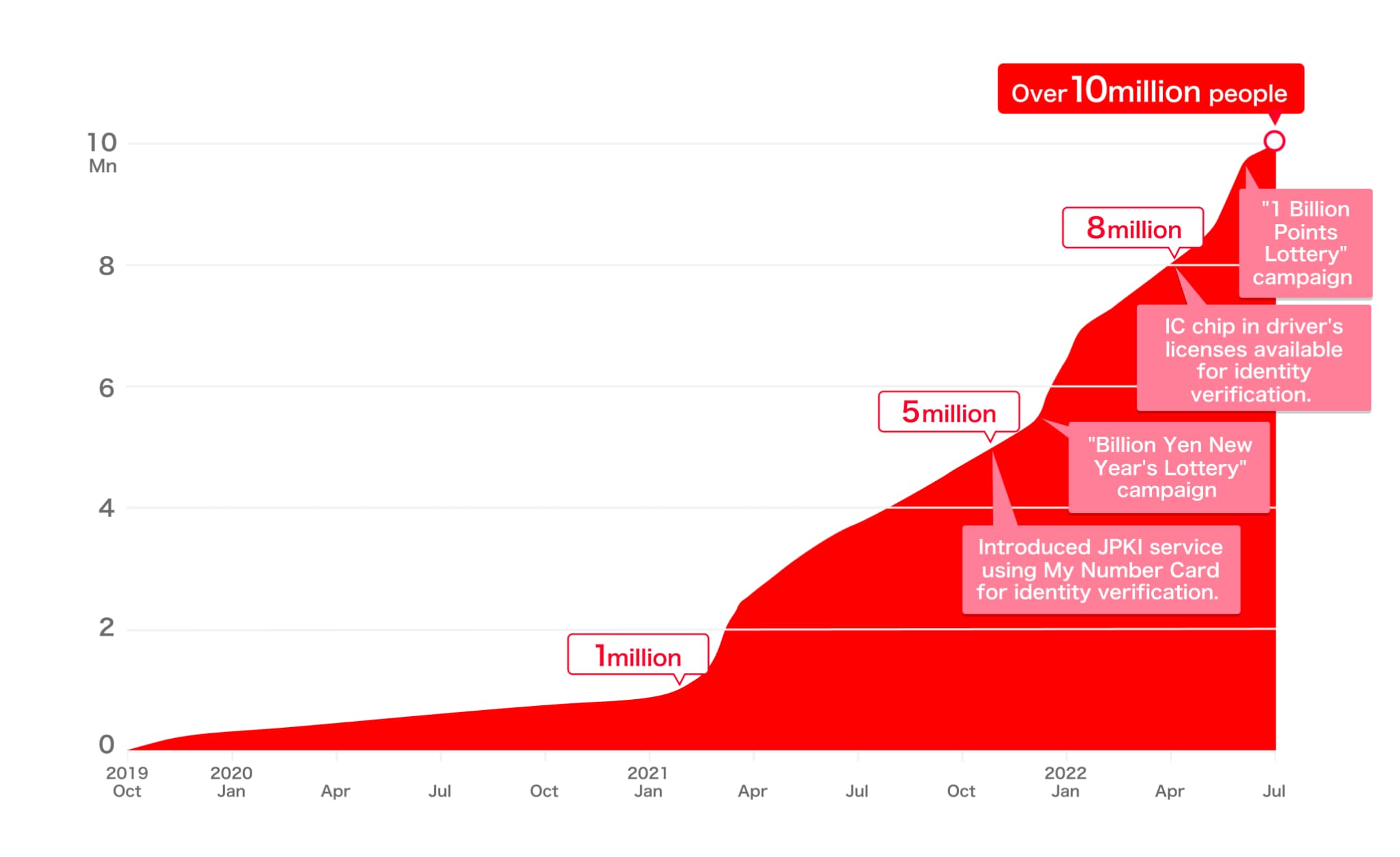

PayPay Corporation is pleased to announce that the number of registered users of its cashless payment service “PayPay” exceeded 49 million*1 on July 13, 2022, and that there is less than 1 million users to go to reach 50 million. In addition, the number of “PayPay” users who have completed identity verification (eKYC) has exceeded 10 million in July 2022.

*1. Total number of users who have registered for an account as of July 2022.

The PayPay app was a late starter as a mobile payment service when it was launched in October 2018. Nonetheless, as a result of providing a convenient and easy-to-use app, holding large-scale campaigns such as the Cho PayPay Matsuri (Super PayPay Festival), expanding the number of merchant locations to 3.66 million*2, and thanks to the patronage of both users and merchants, the number of registered users is about to reach 50 million in 3 years and 9 months since the service started.

*2. Total number of locations registered with “PayPay,” including stores and taxis, as of March 2022.

As a leading cashless payment service provider, PayPay will continue to strengthen its efforts to verify the identity of users in order to provide services that are safer and more secure. As part of these efforts, a campaign targeting users who have completed identity verification was conducted twice, in December 2021 and June 2022*3, resulting in over 10 million users completing their identity verification (eKYC).

*3. “Billion Yen New Year’s Lottery” in December 2021 and “1 Billion Points Lottery” in June 2022.

“PayPay” has grown to a service that is used by around 40%*4 of the Japanese population. To express gratitude to all the “PayPay” users, two campaigns will be held as part of the “Almost 50 million registered users countdown campaign!”

*4. Calculated by PayPay based on “Population Projections – June 2022” by the Statistics Bureau of the Ministry of Internal Affairs and Communications.

■ “Almost 50 million registered users countdown campaign!”

【Campaign 1】

Details of “Lottery for every 100,000 users! A chance for 5,000 new registrants to win up to 50,000 points by lottery”

Campaign period:

11:00 a.m. July 14, 2022 – until the number of registered “PayPay” users reaches 50 million

Campaign content:

During the campaign period, from when the number of registered users grows from 49 million to 50 million, a drawing will be held for every 100,000 newly registered users, and a total of 5,000 winners will be selected. 50,000 PayPay Points will be granted to the first prize winner, 5,000 points to the second prize winner, and 50 points to the third prize winner.

| Points | Number of Winners | |

| Per Draw | Total of 10 Draws | |

| 50,000 points | 1 | 10 |

| 5,000 points | 5 | 50 |

| 50 points | 494 | 4,940 |

| Total | 500 | 5,000 |

*No prior campaign registration or application is required.

Scheduled grant date:

30 days from the day after the total number of registered “PayPay” users reaches 50 million (tentative)

*The grant period is subject to change.

*The granted PayPay Points can also be used at the official PayPay store or PayPay Card store. Please note that it cannot be cashed out or sent to other users.

【Campaign 2】

Details of “Win on Twitter! 5,000 points to 20 lucky winners who follow and retweet us”

Campaign period:

11:00 a.m. July 14 – 11:59 p.m. July 31

Campaign details:

Follow the PayPay account (@PayPayOfficial) on Twitter

Retweet applicable tweets

A total of 20 winners will receive 5,000 points by lottery

*PayPay account registration is required to receive PayPay Points. For users who have not yet registered an account, please do so by the end of the campaign (11:59 p.m., July 31, 2022).

Scheduled grant date:

End of September 2022 (scheduled)

*The grant period is subject to change.

*The granted PayPay Points can also be used at the official PayPay store or PayPay Card store. Please note that it cannot be cashed out or sent to other users.

PayPay will continue to offer the convenience of cashless payments to users as well as all kinds of retailers and service providers, with the goal of creating a world in which a safe cashless shopping experience can be enjoyed anywhere in Japan. “PayPay” will continue on the path to evolve from a “payment app” into a “super app” that will make users’ lives richer and more convenient, fostering a culture of “Anytime, Anywhere with PayPay.”

■ About “PayPay,” the cashless payment service provided by PayPay Corporation

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis, and even public transportation. It can also be used in a variety of other situations, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay Balance (PayPay Money and PayPay Money Lite) between each other for free, or “point management,” a service that allows users access to a simulated investment experience involving the exchange of PayPay Points with points provided by a service provider that PayPay is partnered with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer, Registration #: Director-General of the Kanto Finance Bureau, No. 00710 (Registration date: October 5, 2018)

・Fund Transfer Operator, Registration #: Director-General of the Kanto Finance Bureau, No. 00068 (Registration date: September 25, 2019)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc., Registration #: Kanto (K) No. 106 (Registration date: July 1, 2019)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

・Telecommunications Carrier (Filing #: A-02-17943 / Date filed: July 2, 2019)

・Notified Person Entrusted with Intermediation (Filing #: C1907980 / Date filed: December 18, 2019)

・Bank Agency Operator, License: Director-General of the Kanto Finance Bureau, No. 396 (Registration date: November 26, 2020)

・Financial instruments intermediary service registration number: Kanto Finance Bureau Director (Kinchu) No. 942 (Registration date: June 25, 2021)

* “PayPay” provides 4 types of PayPay balance: PayPay Money, PayPay Money Lite, PayPay Points and PayPay Bonus Lite. PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and other services, and can be remitted or cashed out, issued by the Company who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay preserves the debt it owes to its users in full amount and more by depositing its assets. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points and PayPay Bonus Lite, which are granted through campaigns and promotions when using PayPay, can be used for partner services and merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Bonus and PayPay Bonus Lite cannot be sent or transferred between PayPay users or be cashed out. PayPay Bonus Lite has an expiration date, after which date it will no longer be valid. PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see applying for compensation for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.