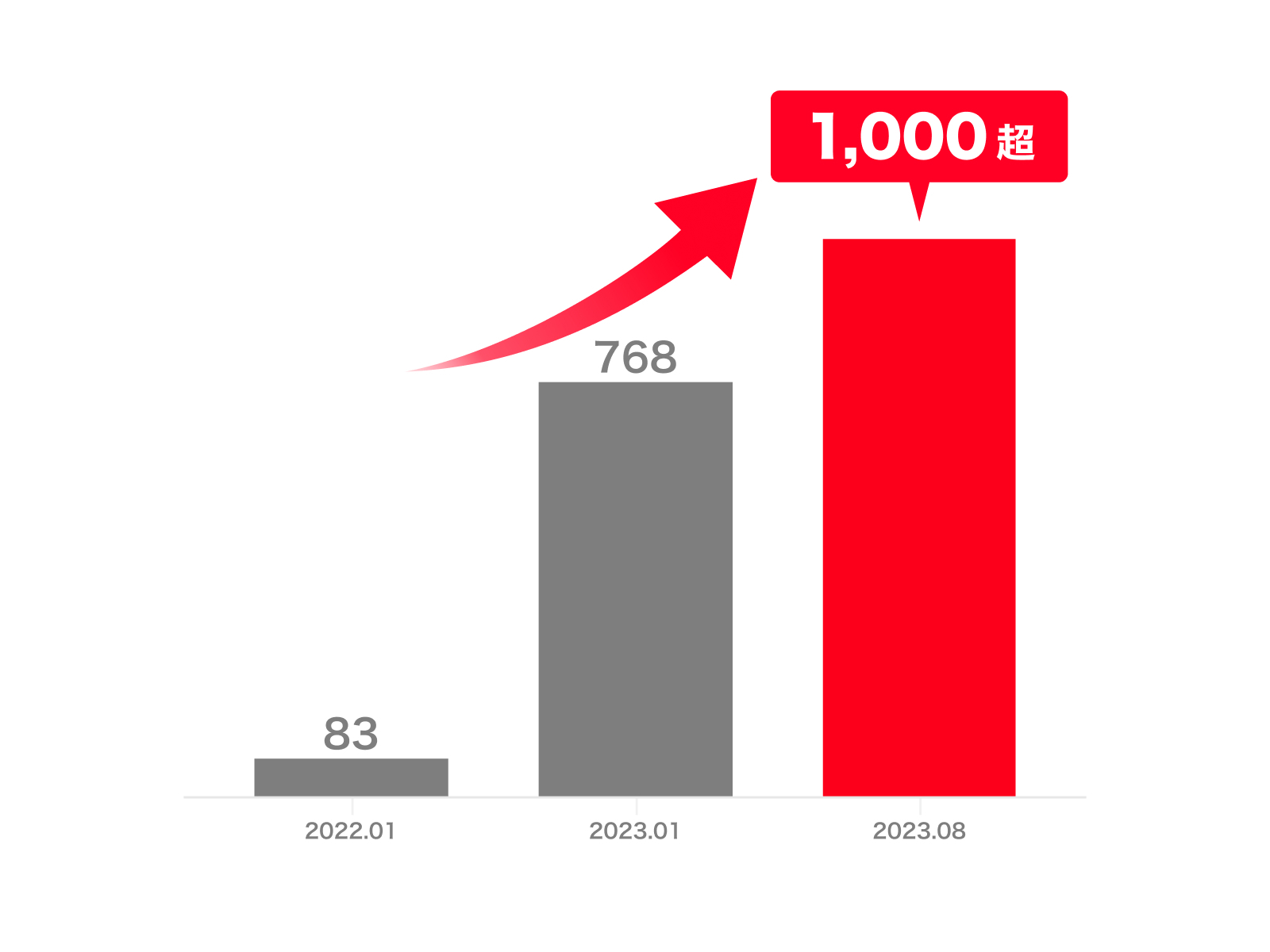

PayPay Corporation is pleased to announce that the number of financial institutions from which users can top up to their balance in the cashless payment service “PayPay” free of charge is planned to exceed 1,000 in August 2023.

This is approximately 90% of the 1,134 financial institutions connected to the Zengin system, making PayPay the fastest cashless service provider to reach the 1,000-company milestone, after four years and 11 months since its service was launched.

The following financial institutions will start providing top-ups to “PayPay” in the near future.

■ Financial institutions that will be available from July 2023 Shinkin banks nationwide (241 banks out of 254 banks)

Minami Nippon Bank

■ Financial institutions that will be available from August 2023

Hokuto Bank

Shonai Bank

Fukuoka Chuo Bank

Saga Kyoei Bank

Nagasaki Bank

Howa Bank

Miyazaki Taiyo Bank

Bank of the Ryukyus

Okinawa Kaiho Bank

*For details on how to register an account in the PayPay app, please see this page.

*When registering an account in the PayPay app, identity verification (eKYC with a My Number Card or driver’s license) on the PayPay app is required. For users who have not yet verified their identity, please see this page and proceed to the verification process.

*If identity verification has been completed on the PayPay app, please proceed to the bank account registration from within the PayPay app.

Please click here to see currently available financial institutions.

Please note that there is no fee for topping up to one’s PayPay Balance from a registered bank account.

PayPay Balance topped up through SoftBank & Y!mobile Pay on One Bill is free of charge until August 31 for the second and subsequent top-ups in the same month.

| List of fees by top-up method (from September 1, 2023) | ||||

| Top-up method | Bank account

|

Seven Bank ATM Lawson Bank ATM

|

Credit* (former Pay Later)

|

SoftBank & Y!mobile Pay on One Bill

|

| 1st time | Free | Free | Free | Free |

| 2nd time onwards | 2.5% (including tax) | |||

* The labels in the app will change from “PayPay Pay Later” to “Credit (former Pay Later) ” from August 1. For more details, please visit here.

■ About “PayPay,” the cashless payment service provided by PayPay Corporation

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis, and even public transportation. It can also be used in a variety of other situations, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay Balance (PayPay Money and PayPay Money Lite) between each other for free, or “point management,” a service that allows users access to a simulated investment experience involving the exchange of PayPay Points with points provided by a service provider that PayPay is partnered with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis, and even public transportation. It can also be used in a variety of other situations, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay Balance (PayPay Money and PayPay Money Lite) between each other for free, or “point management,” a service that allows users access to a simulated investment experience involving the exchange of PayPay Points with points provided by a service provider that PayPay is partnered with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis, and even public transportation. It can also be used in a variety of other situations, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay Balance (PayPay Money and PayPay Money Lite) between each other for free, or “point management,” a service that allows users access to a simulated investment experience involving the exchange of PayPay Points with points provided by a service provider that PayPay is partnered with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer, Registration #: Director-General of the Kanto Finance Bureau, No. 00710 (Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc., Registration #: Kanto (K) No. 106 (Registration date: July 1, 2019)

・Telecommunications Carrier (Filing #: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator, Registration #: Director-General of the Kanto Finance Bureau, No. 00068 (Registration date: September 25, 2019)

・Notified Person Entrusted with Intermediation (Filing #: C1907980 / Date filed: December 18, 2019)

・Bank Agency Operator, License: Director-General of the Kanto Finance Bureau, No. 396 (Registration date: November 26, 2020)

・Financial instruments intermediary service registration number: Kanto Finance Bureau Director (Kinchu) No. 942 (Registration date: June 25, 2021)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

*”PayPay” provides 4 types of PayPay balance: PayPay Money, PayPay Money Lite, PayPay Points, and Gift Vouchers.

PayPay Money can be used to pay for partner services and in transactions at merchants if the transaction value is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and other services, and can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users in by depositing assets equivalent to or more than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Bonus and PayPay Bonus Lite cannot be sent or transferred between PayPay users or be cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers are valid for six months after issuance, after which they will no longer be valid.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, providing that certain conditions are met, the user can be compensated for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party). Please see applying for compensation for details.

*The company name, trade name, and product/service in this press release are registered trademarks or trademarks of their respective companies.