PayPay Corporation will add a feature to cashless payment service “PayPay” that will allow users to make payments even when there are network outages or when they are not connected to the internet*1. With this new function, users will be able to make payments with both PayPay Balance and PayPay Atobarai (Pay Later)*2 (limitation on payment amount and number of payments with apply) when there are network outages, and also when the user is in an underground location or at a mass gathering where the connection is unstable*3.

This function is the first of its kind to be implemented in the leading QR code payment industry in Japan*4 and is the subject of multiple patent applications.

*1. When payment is made using this function, the user’s screen will not redirect to the Payment Completion screen, and the payment jingle will not be heard. When the user is in a stable network environment they will be able to receive push notifications and check their transaction history. In addition, it may take time to deliver this feature to all users as it is released in phases in the latest version of the app.

*2. “Pay Later” will be changed to “Credit” in the list of payment methods on August 1, 2023 For more details, please click here.

*3. Payments can be made using this feature when the time required to display the barcode under normal connection links exceeds 3 seconds.

*4. This data was obtained by comparing PayPay with other domestic QR code payment providers as per data published by PAYMENTS JAPAN (as of July 20, 2023).

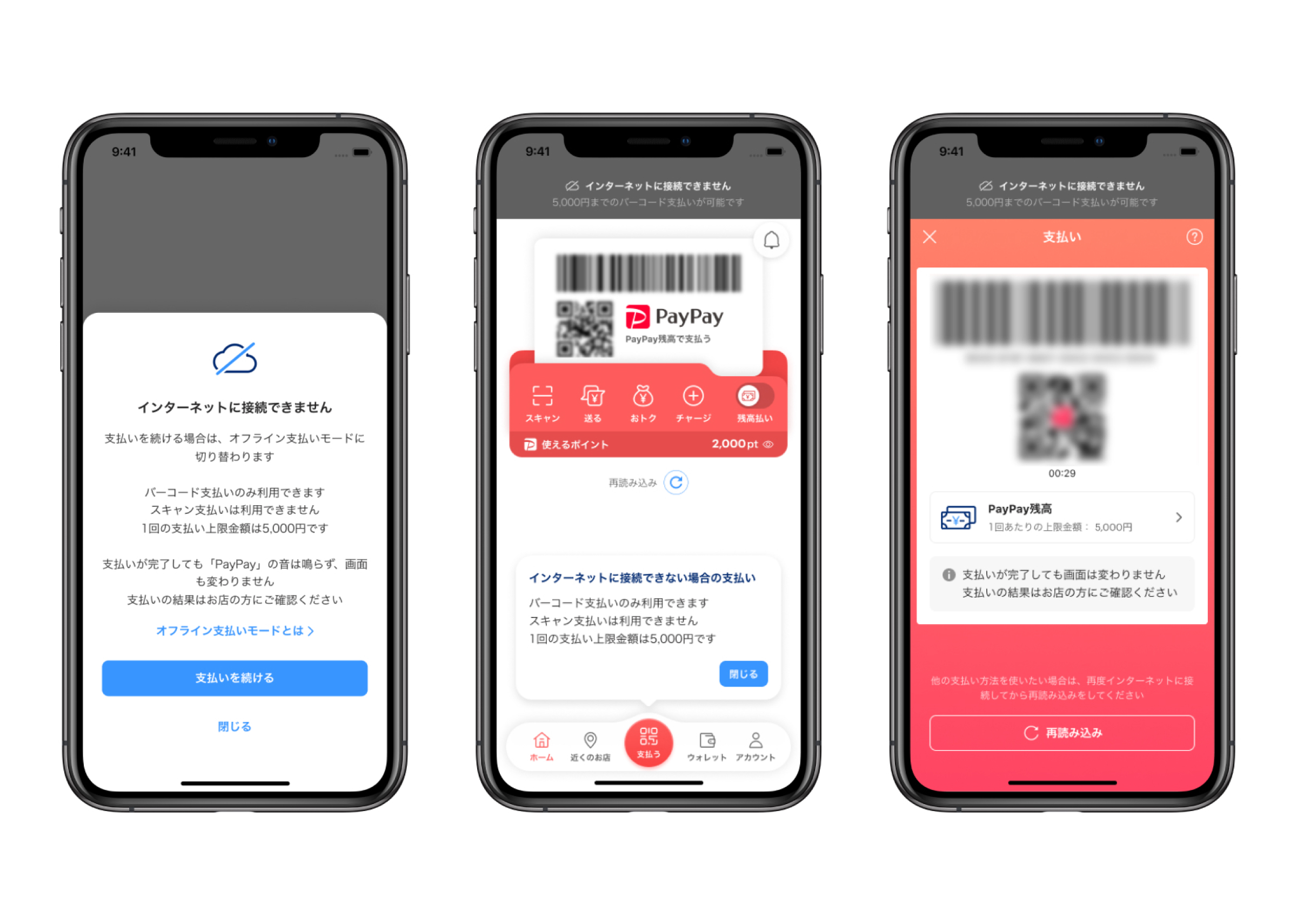

*Image is for illustrative purposes only

When users are experiencing poor network on their smartphones, they can select “Offline Payment Mode” and can complete the payment by presenting the QR code payment screen to the cashier and having them scan it. This functionality can only be used at merchants that use the Merchant Scan functionality (the merchant scans the payment screen that is presented by the user on their smartphone), which means the merchant POS device will need to be online. Further, there are limits on the amount and number of payments*5, such as a maximum of 5,000 yen for a single payment up to twice a day, and the payment amount limited to the PayPay Balance held by the user.

Usually payments using cell phones are not possible using QR codes when there is a network outage, or when the user is in an area with poor signal, so it was necessary to provide users with an alternative payment method that could be used in a situation with no connectivity. Recently, PayPay Corporation is teaming up with its group company Softbank Corp. and other telecommunications providers to see if it can use provider networks*6, or offer users free Wi-Fi when there is a network outage, as a countermeasure for when the service network becomes unreliable. By carrying out these initiatives, users will be provided an environment in which they can safely carry out QR code payments, and where internet access is more available.

In addition, in 2022, payment amounts and the number of payments completed with QR codes surpassed those made with electronic money for the first time, proving that even with the diversification of payment methods, QR code payments continue to proliferate as a payment method in people’s daily lives, coming second to credit cards as the most frequently used cashless payment method*7. Currently, the “PayPay” user base has grown to over 58 million users*8, which is just over 60% of the smartphone user population*9, this is why it is crucial for PayPay to provide a seamless payment service as a provider of social infrastructure in the payments space. Through the initiatives of each mobile phone carrier, PayPay has managed to provide a means of making payments in offline situations and even if there is a network outage or poor network signal. And by developing the only offline payment feature available from domestic QR code payment providers, it has further cemented its presence as a social infrastructure.

*5. For more information, please click here.

*6. For details, please click here to read the press release by Softbank Corp.

*7. The payment amounts were calculated by a comparison of data in “2022 Ratio of Cashless Payment Among the Total Amount Paid by Consumers Calculated” by the Ministry of Trade, Economy and Industry (published on April 6, 2023). Regarding the number of payments, figures were calculated by PayPay based on the total number of credit card transactions in “Monthly Survey: Credit Card Trends,” published by Japan Consumer Credit Association on May 31, 2023, the number of debit card and e-money transactions from “Payment Trends” published by the Bank of Japan on June 30, 2023, and the number of code payments from “Stats – Code Payment,” published by PAYMENTS JAPAN on March 3, 2023 and revised on July 7, 2023.

*8. Number of registered PayPay account users as of June 2023. *Number of registered PayPay account users.

*9. Calculated by PayPay based on “Population Projections – August 2022 Report” published by the Statics Bureau of Japan and “1. Information Communication Devices Ownership in “2021 Telecommunications Usage Trends Survey” published by the Ministry of Internal Affairs and Communications.

PayPay will continue to offer the convenience of cashless payments to users as well as all kinds of retailers and service providers, with the goal of creating a world in which a safe cashless shopping experience can be enjoyed anywhere in Japan. “PayPay” will continue on the path to evolve from a “payment app” into a “super app” that will make users’ lives richer and more convenient, fostering a culture of “Anytime, Anywhere with PayPay.”

■ About “PayPay,” the cashless payment service provided by PayPay Corporation

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis, and even public transportation. It can also be used in a variety of other situations, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay Balance (PayPay Money and PayPay Money Lite) between each other for free, or “point management,” a service that allows users access to a simulated investment experience involving the exchange of PayPay Points with points provided by a service provider that PayPay is partnered with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer, Registration #: Director-General of the Kanto Finance Bureau, No. 00710 (Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc., Registration #: Kanto (K) No. 106 (Registration date: July 1, 2019)

・Telecommunications Carrier (Filing #: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator, Registration #: Director-General of the Kanto Finance Bureau, No. 00068 (Registration date: September 25, 2019)

・Notified Person Entrusted with Intermediation (Filing #: C1907980 / Date filed: December 18, 2019)

・Bank Agency Operator, License: Director-General of the Kanto Finance Bureau, No. 396 (Registration date: November 26, 2020)

・Financial instruments intermediary service registration number: Kanto Finance Bureau Director (Kinchu) No. 942 (Registration date: June 25, 2021)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” provides 4 types of PayPay balance: PayPay Money, PayPay Money Lite, PayPay Points, and Gift Vouchers.

PayPay Money can be used to pay for partner services and in transactions at merchants if the transaction value is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users in by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Bonus and PayPay Bonus Lite cannot be sent or transferred between PayPay users or be cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers are valid for six months after issuance, after which they will no longer be valid.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, providing that certain conditions are met, the user can be compensated for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party). Please see applying for compensation for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.