“Koredake Pet” service page:

https://www.paypay-insurance.co.jp/promotion/pet/app/

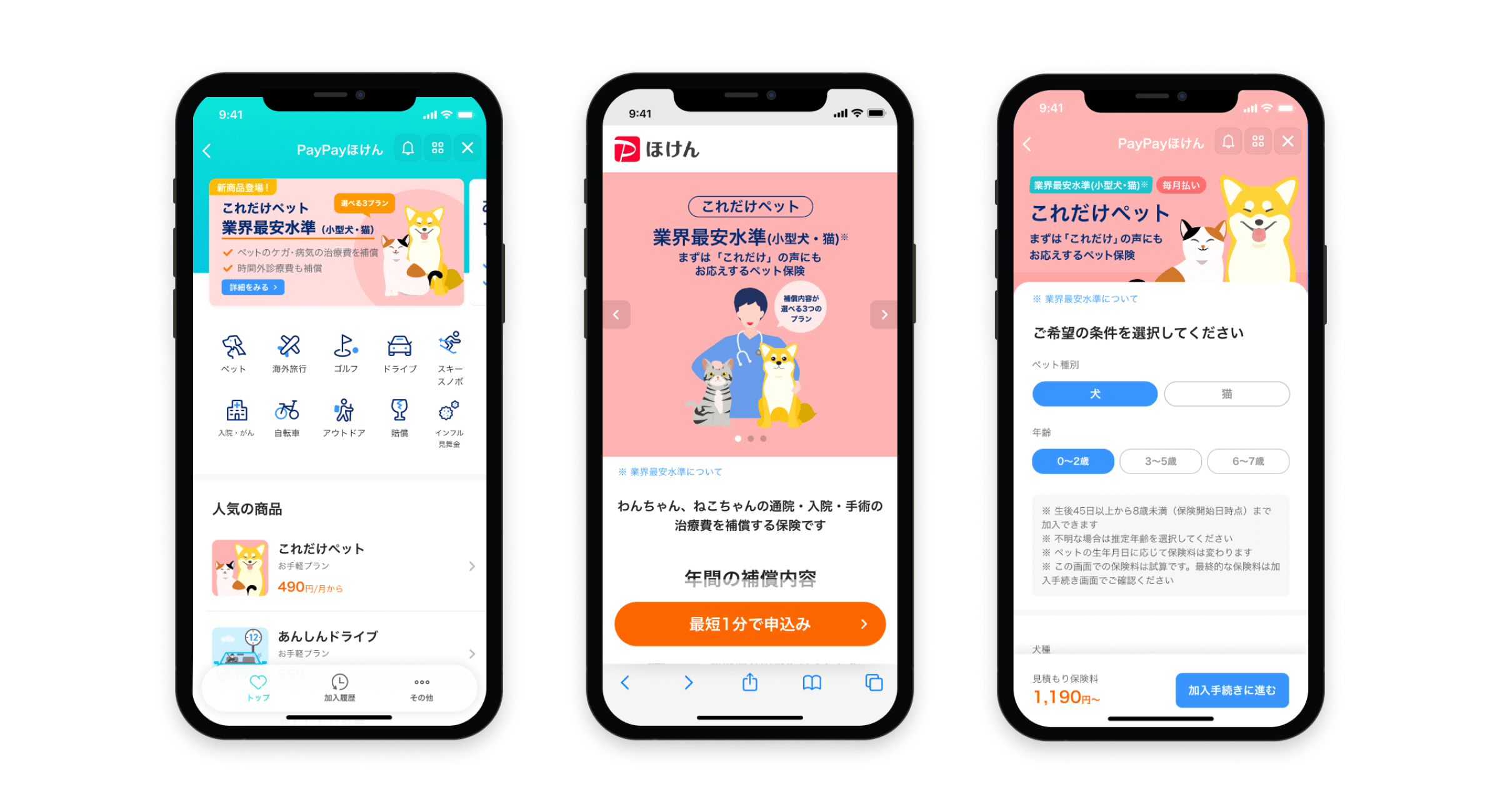

PayPay Insurance Service Corporation (hereinafter “PayPay Insurance Service”), a group company of LY Corporation (hereinafter “LY”), Z Financial Corporation, and PayPay Corporation (hereinafter “PayPay”) are pleased to announce that pet insurance “Koredake Pet” (hereinafter “Insurance”) has been released and is available from the PayPay Insurance mini app*1 within the cashless payment service “PayPay” starting today.

*1. A feature that allows users to smoothly make reservations, order products, and make payments for services provided by PayPay Corporation’s partners companies from the PayPay app

The Insurance, which can be purchased for as little as 490 yen per month, provides coverage for medical expenses when pets are treated for injuries and diseases at veterinary hospitals in Japan.

In recent years, pet owners spend more time and money on their animals, treating them as family*2, and the average pet lifespan has significantly increased due to advances in preventive care and pet foods. Meanwhile, the expenses of treating injuries and diseases related to aging tend to get costly*3, which has resulted in a higher demand for addressing medical risks of pets.

Despite these circumstances, an independent survey*4 of pet owners found that insurance purchase rates decline as their pets age. This trend indicates that even if owners enroll in insurance at pet stores when purchasing animals, they do not feel the policy beneficial or high premiums worthwhile, eventually canceling it within a few years as young pets have a lower risk of receiving medical care. On the other hand, it tends to be harder for owners of aged pets, vulnerable to injuries and diseases, to buy insurance as their pets do not meet the requirements to enroll. This shows there is a mismatch between owners’ needs and insurance products.

It was also found that coverage and premiums are important factors*5 for owners who are considering purchasing pet insurance, which means insurance products with an easy-to-understand coverage and acceptable prices are in demand.

To meet these needs, PayPay Insurance Service is launching the Insurance that realizes a simple and clear coverage with the lowest premium in the industry. The Insurance is intended to meet the needs of not only those who newly buy insurance but who are reviewing alternatives to the insurance they purchased when they first purchased their pet.

In addition, the product is designed so that it is easy to enroll even if the species and exact age of the dog or cat are unknown, which suits people who adopt from a shelter.

Users can choose from three monthly plans (Easy Plan, Basic Plan, and Safety Plan) according to their needs. With the industry-lowest premiums of 1,030 yen and 1,190 yen for cats and small dogs aged three to five respectively, the Basic Plan supports 70% of treatment costs for hospitalization and surgery, which normally requires expensive medical care. There is no limit to the daily benefits and frequency until the total payment reaches the maximum annual amount of 425,000 yen.Users can easily subscribe to the Insurance through the PayPay app, and premiums can be paid with PayPay Balance including PayPay Points or PayPay Credit.

PayPay Insurance Service offers insurance products such as Heatstroke Insurance and Influenza Insurance which are the first insurance products of the type in Japan, and have been well received by many users. By providing the Insurance, the company continues to contribute to solving the social problem of medical expenses for rescued dogs and cats, as well as reduce the financial burden on pet owners.

*2. Trends in the number of new pets: calculated by Pet & Family Insurance Co., Ltd. based on “Number of registered dogs and vaccination shots by prefecture (FY2014 – FY2022)” by the Ministry of Health, Labor and Welfare and data from the Economic Analysis Office, Research and Statistics Department, Minister’s Secretariat, Ministry of Economy, Trade and Industry (2023).

*3. Trends in medical treatment costs: researched by Pet & Family Insurance Co., Ltd. (calculated from actual data on directly claimed payouts from April 2018 to March 2022).

*4. Pet insurance enrollment rate by pet age: researched by Pet & Family Insurance Co., Ltd. (calculated with average values based on the policies entered into from February 2015 to January 2021).

*5. Items considered important when choosing pet insurance: researched by Pet & Family Insurance Co., Ltd. [Outline of the survey] Method: Online research (valid sample size: 551 responses), Survey period: 29-30 August, 2023, Targets: pet insurance subscribers and former subscribers, Researcher: Pet & Family Insurance Co. Ltd.

*6. This description is based on the survey conducted on pet insurance products of seven non-life insurance companies and ten small amount short-term insurance companies that allow online applications, including Pet & Family Insurance Co., Ltd. The comparison in each age group from zero to seven shows that the premium of “Koredake Pet” Easy Plan (for small dogs and cats) is lower than those of other products in the most age categories. (Researched by PayPay Insurance Service in February 2024.)

[Comparison conditions]

● Scope: Small dogs and cats

● Target animals: Small dogs (weighing 7.2 kg or less or Toy Poodles, Chihuahuas, Miniature Dachshunds, Pomeranians, Maltese, Yorkshire Terriers, Shih Tzus) and cats

● Coverage: Plans with compensation for treatment expenses including hospitalization and surgery

● Amount insured: 50% or more

● Deductibles: None

● Premiums: Monthly premiums when newly enrolling in insurance for animals in the scope above aged zero to fifteen (including online discounts)

● Rider: No rider is added to compensate for expenses other than medical treatment expenses, such as liability insurance.

■ Features and Overview of “Koredake Pet”

Date of launch and commencement of coverage

Date of launch and commencement of coverage Distribution from: March 21 –

Coverage to begin from: The corresponding date in the month following the month of the enrollment date (= application date) (or the last day of the following month if the month, if there is no corresponding date)

Coverage

When a pet receives medical care for an injury or illness at a veterinary hospital in Japan, a certain percentage (coverage ratio) of the treatment expenses paid by the owner will be paid as insurance money.

■ Plan Features

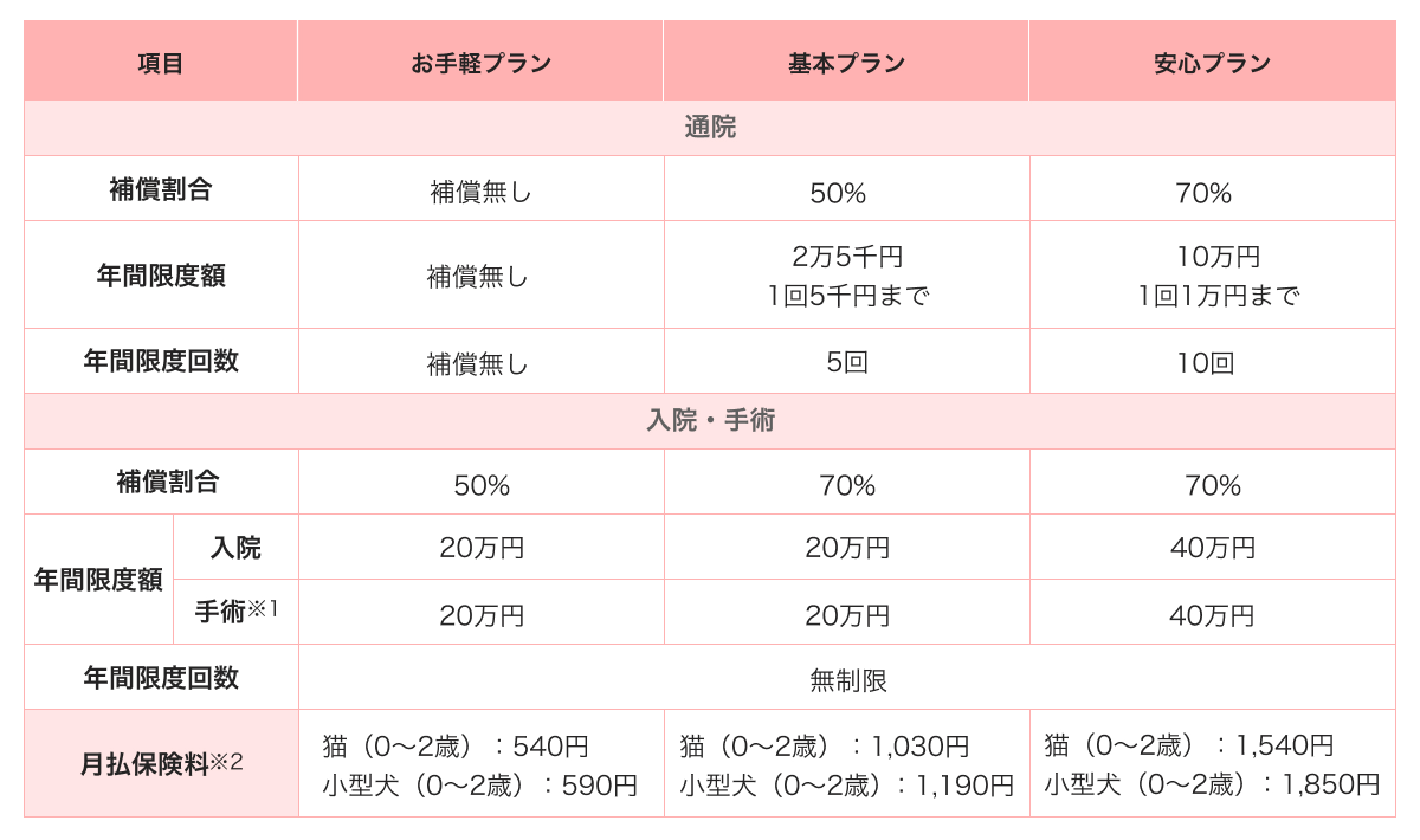

⚫︎お手軽プラン

ケガ・病気を問わず、治療費が高額になりやすい入院・手術に対する補償に特化し、低廉な保険料で万一の際の出費に備えるプラン

⚫︎基本プラン

ケガ・病気を問わず、通院・入院・手術まで幅広く補償が受けられるプラン

⚫︎安心プラン

ケガ・病気を問わず、通院・入院・手術まで幅広く充実の補償が受けられるプラン

※1 手術を伴う通院又は入院費用については、全て合算して「手術時の補償」の支払限度を適用します。

※2 上記に記載の保険料は、0~2歳の保険料を例示しています。(他の年齢の保険料については「これだけペット」サービスページをご参照ください)

Plans (features, premiums, and benefits)

*Premiums for each plan vary depending on the animal’s species (category) and age.

Other characteristics

Easy to apply

Easy to apply The purchase can be easily made through “PayPay.” The premium is also paid through “PayPay.” Users who have already verified their identity on “PayPay” can smoothly apply for in as little as one minute without entering their name or other information.

Earn PayPay Points (*)

In addition to the PayPay Points awarded for payments made with PayPay, an additional 1% of the premium payment amount will be awarded by the underwriting insurance company.

The PayPay Points earned can be used at stores where “PayPay” is available, with one point being equivalent to one yen. Points cannot be cashed out or transferred.

How to use

The underwriter of the Insurance is Pet & Family Insurance Co., Ltd. (President: Masao Sanpei), a member of the T&D Insurance Group, whose holding company is T&D Holdings, Inc. (Representative Director and President: Hirohisa Uehara). The sales agent is PayPay Insurance Service.

* “PayPay” provides 4 types of PayPay balance: PayPay Money, PayPay Money Lite, PayPay Points, and Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Points cannot be sent or transferred between PayPay users or be cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

Overview of PayPay Insurance Service Corporation

Name: PayPay Insurance Service Corporation

Location: Tokyo Garden Terrace Kioicho Kioi Tower, 1-3 Kioicho, Chiyoda-ku, Tokyo

Representative: Yutaka Hyodo, President and Representative Director, CEO

Business description: Damage insurance agency services, life insurance solicitation services, and small amount short-term insurance solicitation services

Overview of LY Corporation

Name: LY Corporation

Location: Tokyo Garden Terrace Kioicho Kioi Tower, 1-3 Kioicho, Chiyoda-ku, Tokyo

Representative: Takeshi Idezawa, President and Representative Director, CEO

Business description: Development of online advertising business, e-commerce business, subscription services, and management of group companies

Overview of Z Financial Corporation

Name: Z Financial Corporation

Location: Tokyo Garden Terrace Kioicho Kioi Tower, 1-3 Kioicho, Chiyoda-ku, Tokyo

Representative: Hiroyuki Torigoe, Representative Director, President Corporate Officer, CEO

Business description: Business management of group companies and related operations

Overview of PayPay Corporation

Name: PayPay Corporation

Location: 33F Tokyo Port City Takeshiba Office Tower, 1-7-1 Kaigan, Minato-ku, Tokyo

Representative: Ichiro Nakayama, President & Representative Director, CEO, Corporate Officer

Business description: Development and provision of mobile payment and other electronic payment services

Overview of T&D Holdings, Inc.

Name: T&D Holdings, Inc.

Location: 2-7-1, Nihonbashi, Chuo-ku, Tokyo

Representative: Hirohisa Uehara, Representative Director and President

Business: Business management of life insurance companies and other subsidiaries under the Insurance Business Act

Overview of Pet & Family Insurance Co., Ltd.

Name: Pet & Family Insurance Co., Ltd.

Location: 4-27-3 Higashi-Ueno, Taito-ku, Tokyo

Representative: Masao Sanpei, President

Business: Provision of damage insurance

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.