PPSC Investment Service Corporation (head office: Chiyoda-ku, Tokyo; President & Representative Director: Yukiya Sekiguchi)*1 and PayPay Corporation(head office: Minato-ku, Tokyo; President & Representative Director: Ichiro Nakayama; hereinafter “PayPay”)are pleased to announce the introduction of new courses in the “Earn Points” mini app*2 on June 9, 2024,*3 where users can enjoy a simulated investment experience. Users will have the additional choices of the Technology Challenge Course that is linked to ProShares UltraPro QQQ, a triple-leveraged ETF comprised of tech stocks including GAFAM(popular among “PayPay Invest” users), and Technology Reverse Challenge Course that is linked to ProShares UltraPro Short QQQ, a triple-leveraged inverse ETF comprised of similar tech stocks.

Currently, Earn Points offers five courses: Standard Course, Challenge Course, Technology Course, Gold Course, and Reverse Challenge Course With the addition of two new courses, a total of seven courses that were hand-picked based on popularity, themes, and risk acceptance will be offered, allowing users to select a course that better suits their investment style and preferences.

As of April 16, 2024, the number of Earn Points users exceeded 16 million, renewing the record of the largest number of users among major point investment service providers.

*1. A wholly owned subsidiary of PayPay Securities Corporation.

*2. A mini app is a feature that allows users to smoothly make reservations, order products, and purchase services provided by PayPay’s partner companies from the PayPay app.

*3. The new courses will be available right after system maintenance is completed(scheduled from 0:00 to 7:00).

*4. Based on a comparison between the published materials of the following point investment service providers: au PAY Points Management, Credit Saison’s Eternal Points Investment Service, d POINT Investment, and Points Management by Rakuten PointClub, in alphabetical order(as of June 2, 2024, research by PPSC Investment Service).

■ Earn Points Courses

| Course | Technology Challenge | Technology Reverse Challenge | Gold | Technology | Standard | Challenge | Reverse Challenge |

|---|---|---|---|---|---|---|---|

| ETFs Tracked | ProShares UltraPro QQQ (TQQQ) |

ProShares UltraPro Short QQQ (SQQQ) |

SPDR Gold Shares (GLD) |

Invesco QQQ (QQQ) |

SPDR S&P500 ETF (SPY) |

DIREXION S&P 500 3X (SPXL) |

DIREXION S&P500 Bear (SPXS) |

| Details | This course offers investing in a portfolio consisting of 100 companies that represent the NASDAQ exchange in America, with a 300% leverage. If the price increases by 10%, the points that are invested will increase by 30% and vice versa. It is suited for short-term management. | This course offers investing in a portfolio consisting of 100 companies that represent the NASDAQ exchange in America, with a 300% leverage where users can profit from a decline in value and vice versa. It is suited for short-term investments, as the value will significantly increase when the value of NASDAQ equities declines. | This course tracks the price of an ETF which is made up of gold bullion as its assets. Since it is less likely to be affected by a decline in stock prices, the course is suited for users who prefer avoiding the risks that other stock-based courses are exposed to. | This course offers investing in a portfolio consisting of 100 companies that represent the NASDAQ exchange in America. The course is suited for users who prefer investing in leading technology companies in America. | This course offers investing in 500 companies representing America. The course is suited for long term investments, with less volatility compared to investments in individual stocks given the diversification across 500 companies. | This course offers investing points in multiple major companies in America, with a 300% leverage. If the stock price of the companies increases by 10%, the points that are invested will increase by 30%. Likewise, the drop will also be 30%, and is suited for short-term management. | This course offers investing points in multiple major companies in America, with a 300% leverage where users can profit from a decline in value and vice versa. It is suited for short-term investments, as the value rises significantly when the U.S. stock market declines. |

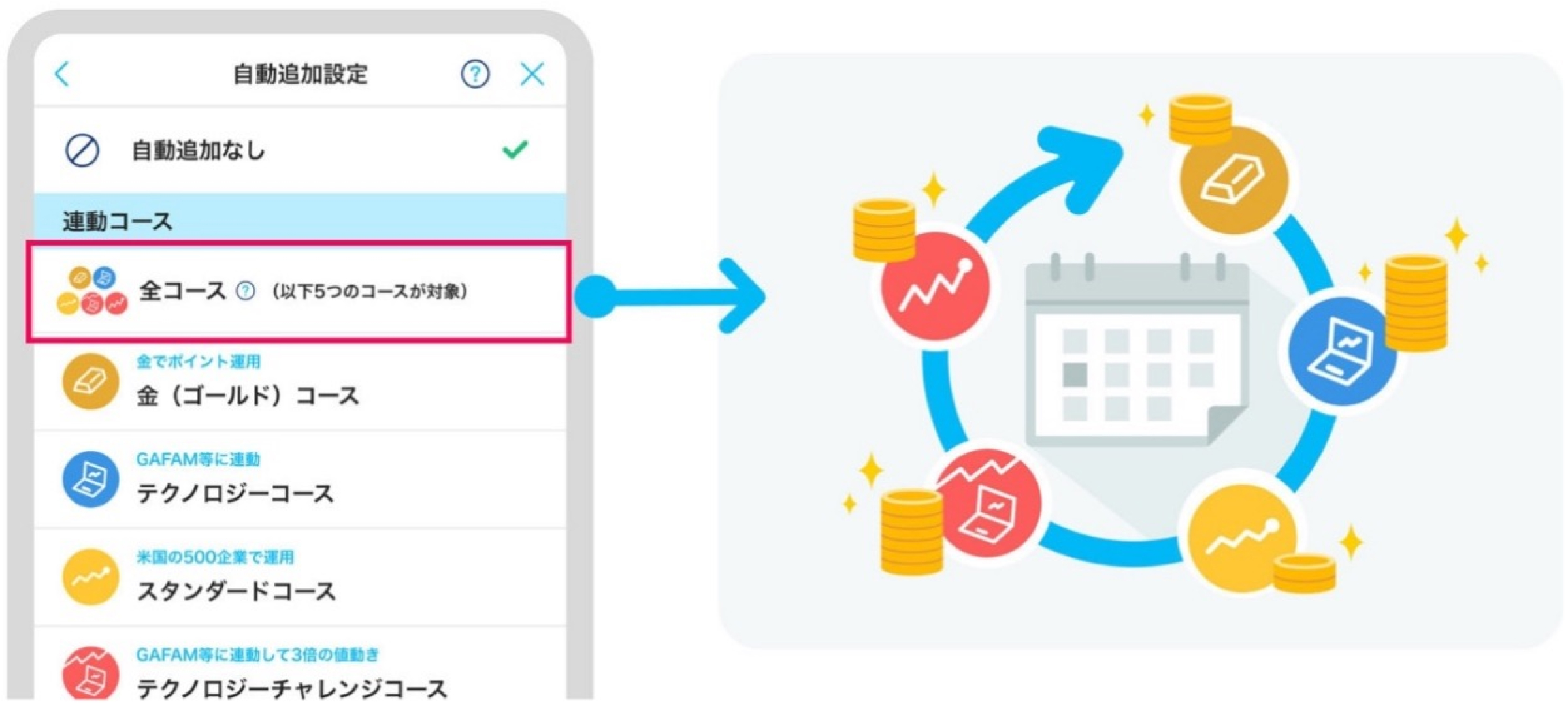

■”All Courses” auto add feature

This is a feature which automatically adds newly granted PayPay Points to the five courses that are linked to stock market prices in the following order: Gold Course → Technology Course → Standard Course → Technology Challenge Course → Challenge Course.*5, *6 This is also a good option for users who are having difficulty deciding which course to choose.

*5. For first-time users of the auto add feature, or users who have used auto add in the past but no longer do, the points will be automatically added to the courses in the following order: Gold Course → Technology Course → Standard Course → Technology Challenge Course → Challenge Course.

If a user is currently using the auto add feature and the course to which PayPay Points were most recently added before the service rollout was the Standard Course, the next time points will be added to the Challenge Course, and then the abovementioned order thereafter. If the most recently added course is anything other than the Standard Course, the points will be added in the above order from the next time.

*6. Please note that the Technology Reverse Challenge Course and Reverse Challenge Course, where prices fluctuate opposite of the market, are not subject to the All Courses feature.

Earn extra points by agreeing to the terms of service of Earn Points! “Let’s Start Using Earn Points Program”

Users who agree to the terms of service for Earn Points from within the PayPay app during the program period have the chance to receive up to 1,000 yen worth of points for investing.

| Campaign period: | February 1, 2024 – End date TBD This is a sustained program with no fixed period. |

|---|---|

| Details | Users who newly agree to the terms of service for Earn Points during the program period will be given points for investing under the “Standard Course.”

|

| Conditions | Users who newly agree to the terms of service during the program period. * Users who have already agreed to the terms of service prior to the program period are not eligible. |

For more information on this program, please visit the following website.

https://www.ppsc-is.co.jp/campaign/program/

About PPSC Investment Service Corporation

PPSC Investment Service is the operator of the Earn Points service, which allows users to experience a simulated investment through a mini app in “PayPay.” Earn Points was launched as “Earn Bonus” on April 1, 2020, and has gained the support of many users, as it does not require any additional procedures such as opening a securities account, and anyone can immediately start simulated investments from within the PayPay app. In addition, by acquiring the financial instruments intermediary service license, the company has enabled a smoother transition from Earn Points to PayPay Invest, and thereby a better user experience.

PPSC Investment Service will continue to provide and update its services, such as adding more Earn Points courses, in order to make asset management more accessible to customers.

・Financial Instruments Intermediary Services(Registration number: Kanto Finance Bureau Director(Kinchu)No. 1024/Registration date: January 16, 2024)

■ About “PayPay,” the cashless payment service provided by PayPay Corporation

“PayPay” is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis, and even public transportation. It can also be used in a variety of other situations, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including the “Send/Receive” feature(remittance/transfer and receiving of money)that allows users to transfer their PayPay Balance(PayPay Money and PayPay Money Lite)between each other for free, or “Earn Points,” a service that allows users access to a simulated investment experience involving the exchange of PayPay Points with points provided by a service provider that PayPay is partnered with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring compensation for any damages that may be suffered.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments(third party type)Issuer(Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards(Registration number: Kanto(Ku)No. 106/Registration date: July 1, 2019)

・Telecommunications Carrier(Filing number: A-02-17943/Date filed: July 2, 2019)

・Fund Transfer Operator(Registration number: Director-General of the Kanto Finance Bureau, No. 00068/Registration date: September 25, 2019)

・Notified Entity Entrusted with Intermediation(Filing number: C1907980/Date filed: December 18, 2019)

・Bank Agency Services(License: Director-General of the Kanto Finance Bureau(Gindai)No. 396/Registration date: November 26, 2020)

・Financial Instruments Intermediary Services(Registration number: Kanto Finance Bureau Director(Kinchu)No. 942/Registration date: June 25, 2021)

・Electronic Payment Agency Services(License: Director-General of the Kanto Finance Bureau(Dendai)No. 109/ Registration date: February 14, 2023)

・Japan Payment Service Association(https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association(https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account(no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay(Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered(the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*C ompany names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.