Service details page:https://www.paypay-card.co.jp/campaign/add-card

PayPay Card Corporation (Chiyoda-ku, Tokyo; President & Representative Director: Tomoaki Tanida; hereinafter “PayPay Card”) and PayPay Corporation (President & Representative Director, CEO, Corporate Officer: Ichiro Nakayama; hereinafter “PayPay”) are pleased to announce that from August 7, 2024, it will be possible to hold multiple PayPay Cards (including PayPay Card Gold) issued by PayPay Card. Previously, only one card could be issued in principle*1, but now that multiple PayPay Cards can be issued with different international payment networks (Visa, Mastercard, JCB) *2, users can enjoy benefits such as wider acceptance at various stores and the ability to use different cards for different scenarios. Additionally, when registering multiple cards in the PayPay app, users can now assign custom names to each card to facilitate easier management and differentiation.

*1. Excluding family cards.

※2 *2. Up to four cards can be issued: three PayPay Cards (one each for Visa, Mastercard, and JCB) and one PayPay Card Gold (one from either Visa, Mastercard, or JCB). With the ability to issue multiple cards, upgrading from PayPay Card to PayPay Card Gold is no longer possible and must be applied for separately.

Starting with the introduction of PayPay Credit, which allows users to register their PayPay Card as a payment method in the cashless payment service PayPay to consolidate all payments in the following month’s bill, further integration with PayPay has been taking place. In March 2024, the use of PayPay Card at credit merchants became viewable in real-time through the “Transaction History” in the PayPay app enhancing the convenience of both using PayPay and the physical card. The number of active members exceeded 12 million as of the end of June 2024. As user demands diversify, PayPay aims to further improve customer satisfaction by responding to requests such as the need for different cards for different purposes and holding additional cards from different brands.

<Benefits of issuing multiple PayPay Cards>

Using different cards for different scenarios

Users can choose which PayPay Card they wish to use according to various scenarios. Users can also register different accounts to pay their credit bill. Also, business owners can conveniently set up accounts with trade names*3. Additionally, users can now use the multiple PayPay Cards they own for “Regular Credit Investment,” which utilizes PayPay Credit in PayPay Invest, a mini app within PayPay, to invest up to a total of 100,000 yen on a regular basis.

*3. The account information can be updated online or by submitting the enclosed “Bank Account Transfer Request Form.”

Multiple PayPay Cards can each be registered in PayPay Credit within the PayPay app, allowing for easy switching between cards upon payment. Moreover, users can assign custom names to each card within the PayPay app, making it more convenient to differentiate between the cards.

Centralized management of card information via the app

Users can manage billing details, payment accounts, and various procedures for all cards within the PayPay app.

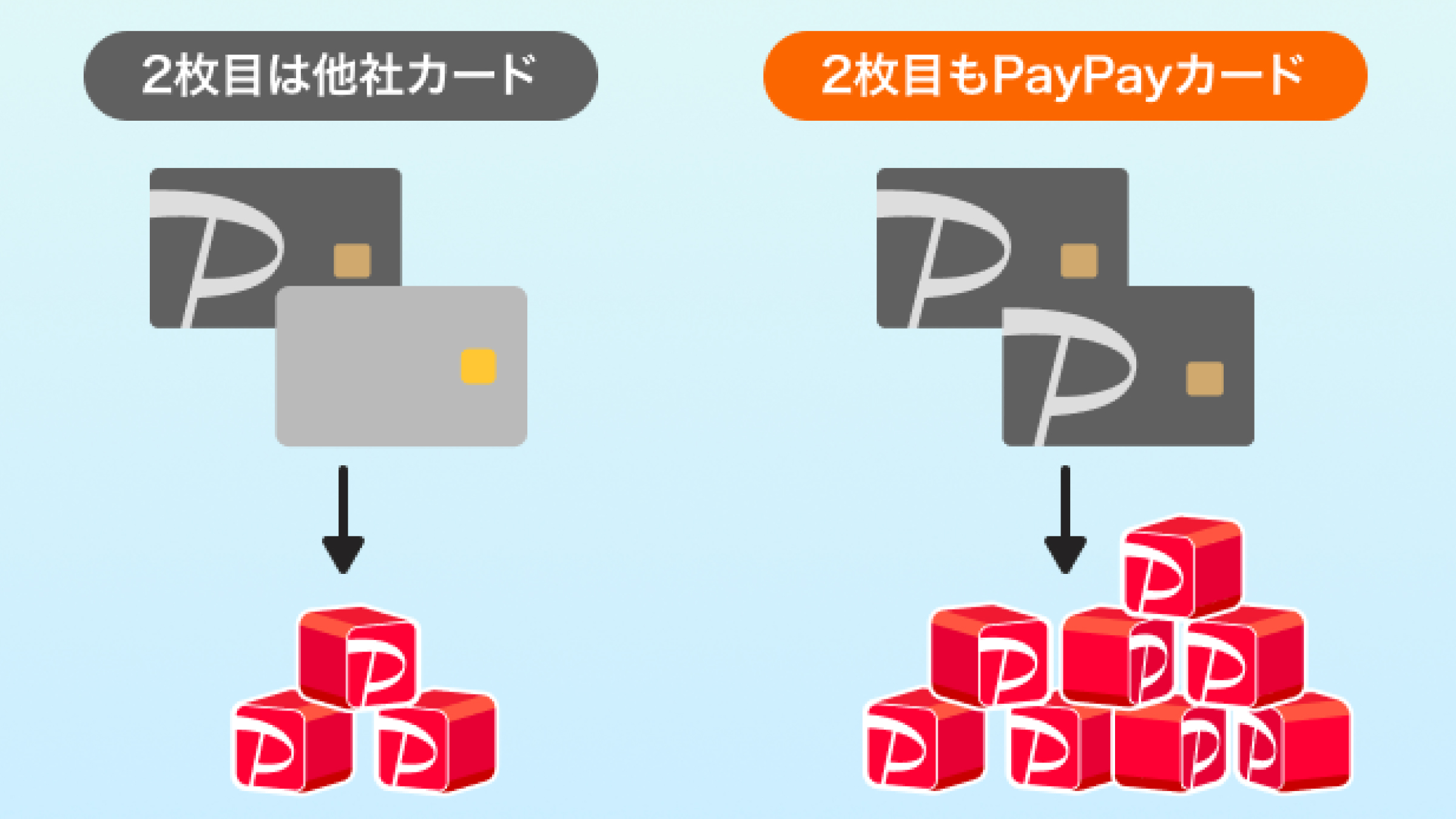

Earning more PayPay Points by consolidating usage to PayPay Card

Users can earn even more PayPay Points by using their PayPay Card instead of cards issued by other companies they own for use in different scenarios. By using multiple PayPay Cards, it will become easier to achieve the conditions of the PayPay STEP program, which include the number and amount of payments, as the transactions and amounts of all cards will be counted towards the conditions*4

*4. The PayPay STEP will be applied only to payments with PayPay Card and PayPay Card Gold that have been enabled on PayPay Credit.

Expanded acceptance at stores through multiple international payment networks

Users will be able to complete payments at a wider range of stores by issuing PayPay Cards with different international payment networks (Visa, Mastercard, JCB), allowing them to switch cards based on the international payment network affiliations of the merchants.

■ About PayPay Card

PayPay Card Corporation changed its name from YJ Card Corporation on October 1, 2021, and began operations under the new name with the aim of becoming the leading card company in Japan. In October 2022, the company became a wholly owned subsidiary of PayPay Corporation and further strengthened its synergy with the cashless payment service “PayPay.” PayPay Card will continue to expand its services to make them available in a broad range of payment scenarios, as well as to provide further convenience to users.

■ About “PayPay,” the cashless payment service provided by PayPay Corporation

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis, and even public transportation. It can also be used in a variety of other situations, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay Balance (PayPay Money and PayPay Money Lite) between each other for free, or “point management,” a service that allows users access to a simulated investment experience involving the exchange of PayPay Points with points provided by a service provider that PayPay is partnered with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc. (Registration number: Kanto (K) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Notified Person Entrusted with Intermediation (Filing number: C1907980 / Date filed: December 18, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” provides 3 types of PayPay balance: PayPay Money, PayPay Money Lite, and Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Points cannot be sent or transferred between PayPay users or be cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.