PayPay Card Scratch Lottery: https://paypay.ne.jp/event/matsuri202503-paypay-scratch/

PayPay Credit Friend Referral Program: https://paypay.ne.jp/event/referral-20250301/

PayPay Card Corporation (hereinafter “PayPay Card”) and PayPay Corporation (hereinafter “PayPay”) are pleased to announce that starting on March 1, 2025, there will be another installation of PayPay Card Scratch Lottery as part of Cho PayPay Matsuri (Super PayPay Festival), which allows users to enjoy scratch-off cards when they pay with PayPay Card (including PayPay Card Gold). Following the previous Cho PayPay Matsuri held in December 2024, payments made with PayPay Card will again be eligible for the scratch lottery offers under Cho PayPay Matsuri, allowing users to enjoy the campaign whether they pay using PayPay Card or PayPay. In addition, the PayPay Credit Friend Referral Program, in which both the referrer and the referred person receive PayPay Points, will be held in parallel.*1

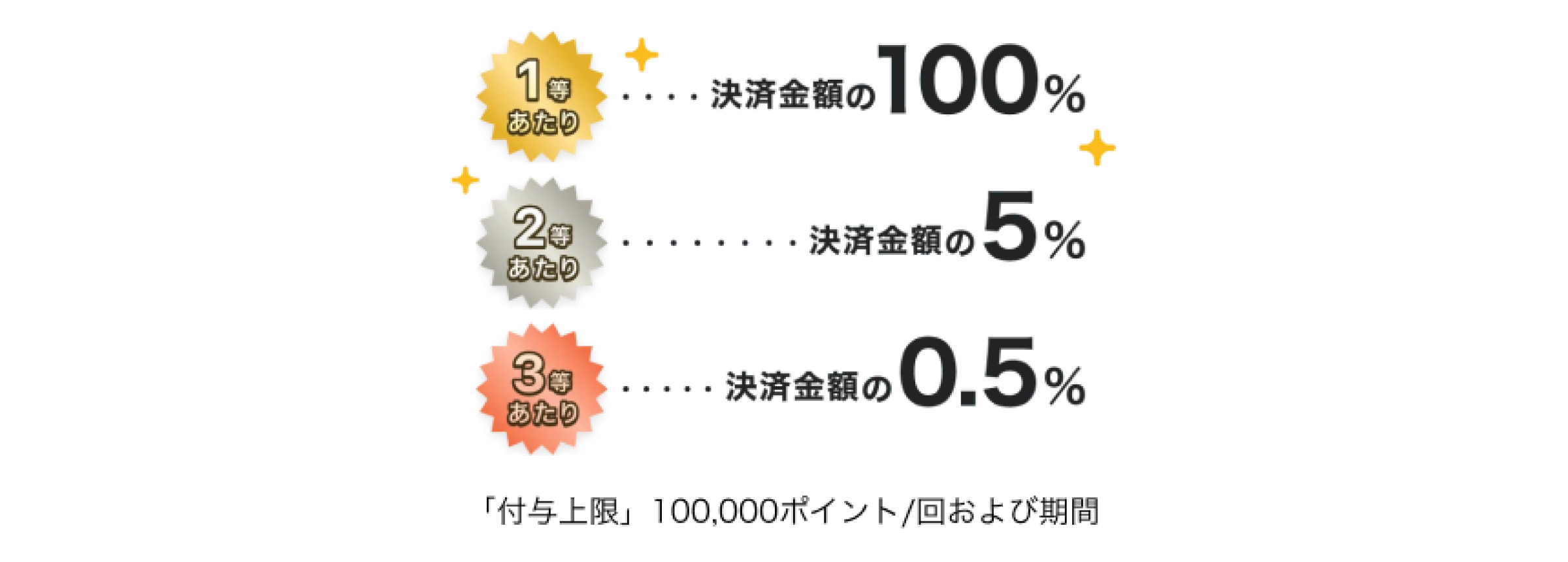

PayPay Card Scratch Lottery is a campaign from March 1 to 31, 2025, in which PayPay Card users who have both set up PayPay Credit and completed identity verification in the PayPay app will receive a scratch-off card*2 when they make a payment of 200 yen or more with PayPay Card at eligible credit card merchants. When a user taps on the scratch-off card, they have a one-in-two probability*3 of winning PayPay Points. First prize winners will receive PayPay Points of up to 100% of the total payment amount, second prize winners up to 5%, and third prize winners up to 0.5% (subject to a grant limit).

With the simultaneous implementation of PayPay Scratch Lottery and PayPay Card Scratch Lottery during Cho PayPay Matsuri, users can obtain more scratch-off cards*3 by paying with “PayPay” at stores where the mobile payment is accepted and by paying with PayPay Card at stores where credit cards are accepted. PayPay Card users can now enjoy shopping during Cho PayPay Matsuri more than ever.

In the previous PayPay Scratch Lottery and PayPay Card Scratch Lottery campaigns (held in December 2024), the number of PayPay Card transactions and the number of issued credit cards also increased. Particularly, the number of issued credit cards in December 2024 during the campaign was 1.4 times greater than that of November, a month prior to the campaign. By obtaining a PayPay Card, users can participate in the PayPay Card Scratch Lottery by making payments with PayPay Card, and users can also use PayPay Credit as a payment method on PayPay. This increases the winning probability in the PayPay Scratch Lottery*4 and therefore it is recommended that users take this opportunity to obtain a PayPay Card to enjoy more points on purchases.

*1. PayPay Card is the sponsor of PayPay Card Scratch Lottery and PayPay Credit Friend Referral Program.

*2. The cards cannot be scratched off overseas. They must be scratched only in Japan.

*3. The probability of winning is the chance to win per scratch-off card and does not guarantee that users will win according to the stated probability.

*4. Only users who have completed identity verification in the PayPay app and have set up PayPay Credit are eligible. A payment of 200 yen or more (including tax) using PayPay Credit is required.

Concurrently with the next Cho PayPay Matsuri, the PayPay Credit Friend Referral Program will also be held from March 1 to 31. In this referral program, only PayPay Card users who have set up PayPay Credit in the PayPay app and completed identity verification can become the referrer. If a referred person newly becomes a PayPay Card user and fulfills certain conditions, including making a payment, both the referrer and the referred person will be granted PayPay Points.

During the program period, the referrer sends a referral code to users who have not set up PayPay Credit. If the referred person enters the referral code and becomes a new PayPay Card user, and then makes one payment during the period using either PayPay Credit or a PayPay Card, the conditions will be met. Upon satisfying the conditions, the referrer will receive 500 PayPay Points per referred person (up to 10 people, for a maximum total of 5,000 points), and the referred person will also receive 500 PayPay Points (one time only).

PayPay Card and PayPay will continue to take a user-first approach, aiming to improve user satisfaction and create services that deliver more convenient and rewarding experiences, and will provide cashless services that become the indisputable industry standard in Japan.

■ PayPay Card Scratch Lottery overview

1. Period

March 1, 2025 – March 31, 2025

*The official name of the campaign is “PayPay Card Scratch Lottery (March 2025).”

2. Campaign details

Users who have both set up PayPay Credit and completed identity verification in the PayPay app can participate in PayPay Card Scratch Lottery if they make a payment of 200 yen or more*5 with PayPay Card at eligible stores (credit card merchants). For users who have enabled push notifications in the PayPay app, a usage notification will be sent after a payment is made with PayPay Card. Tapping that notification will display the scratch-off card.

When the card is tapped and scratched off, users get a one-in-two chance to win first, second, or third prize, and first-prize winners will receive PayPay Points worth up to 100% of the full payment amount.*5

For both PayPay Scratch Lottery and PayPay Card Scratch Lottery, it is also possible to scratch off multiple cards at once from the Transaction History in the PayPay app or from the scratch card mini app. For details, check the PayPay Card Scratch Lottery campaign page (https://paypay.ne.jp/event/matsuri202503-paypay-scratch/).

*5. The amount is tax-inclusive. Only users who own a PayPay Card and have set up PayPay Credit in the PayPay app are eligible.

*6. Grant limit: 100,000 points/draw and period (total for purchases at eligible stores). PayPay Points will be granted on a later date. Please note that it cannot be cashed out or sent to other users. PayPay Points can also be used at the official PayPay store or PayPay Card store. The scratch-off card expires at 11:59 p.m. 30 days after it is obtained.

<How to see a PayPay Card Scratch Lottery card *for illustrative purposes only>

<Grant rate for each prize>

■ PayPay Credit Friend Referral Program

Period

March 1 – 31, 2025

Program details

500 PayPay Points per person will be granted to users who satisfy the conditions below. For details, check the PayPay Credit Friend Referral Program page (https://paypay.ne.jp/event/referral-20250301/), or tap the “Points” icon in the PayPay app home screen, press the “View All Offers” button, and check the “PayPay Credit Friend Referral Program” details page shown under “Upcoming.”

(1) The referrer sends a referral code to a friend.

(2) The referred person enters the referral code and becomes a new PayPay Card user.

(3) The referred person makes one payment during the program period using PayPay Credit or PayPay Card.

*(1) and (2) must be completed within the period of Saturday, March 1 to Monday, March 31, 2025.

*For (3), eligible transactions are those in which a payment is made within the program period and the payment completion screen (transaction history with a green background) is displayed within 30 days after the program ends.

Eligible payment methods

PayPay Credit

PayPay Card

Grant limit

<Referrer>

500 points per referred person (up to 10 people, maximum total of 5,000 points/period)

<Referred person>

500 points (one time only)

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Notified Entity Entrusted with Intermediation (Filing number: C1907980 / Date filed: December 18, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.