Heatstroke Insurance service page

https://www.paypay-insurance.co.jp/promotion/heatstroke/app/

PayPay Insurance Service Corporation (hereinafter “PayPay Insurance Service”), a group company of LY Corporation (hereinafter “LY”), Z Financial Corporation, and PayPay Corporation (hereinafter “PayPay”) are pleased to announce that the Heatstroke Insurance (hereinafter “Heatstroke Insurance”) for 2025 is again on offer in the PayPay Insurance mini app*1 within the cashless payment service “PayPay” starting today.

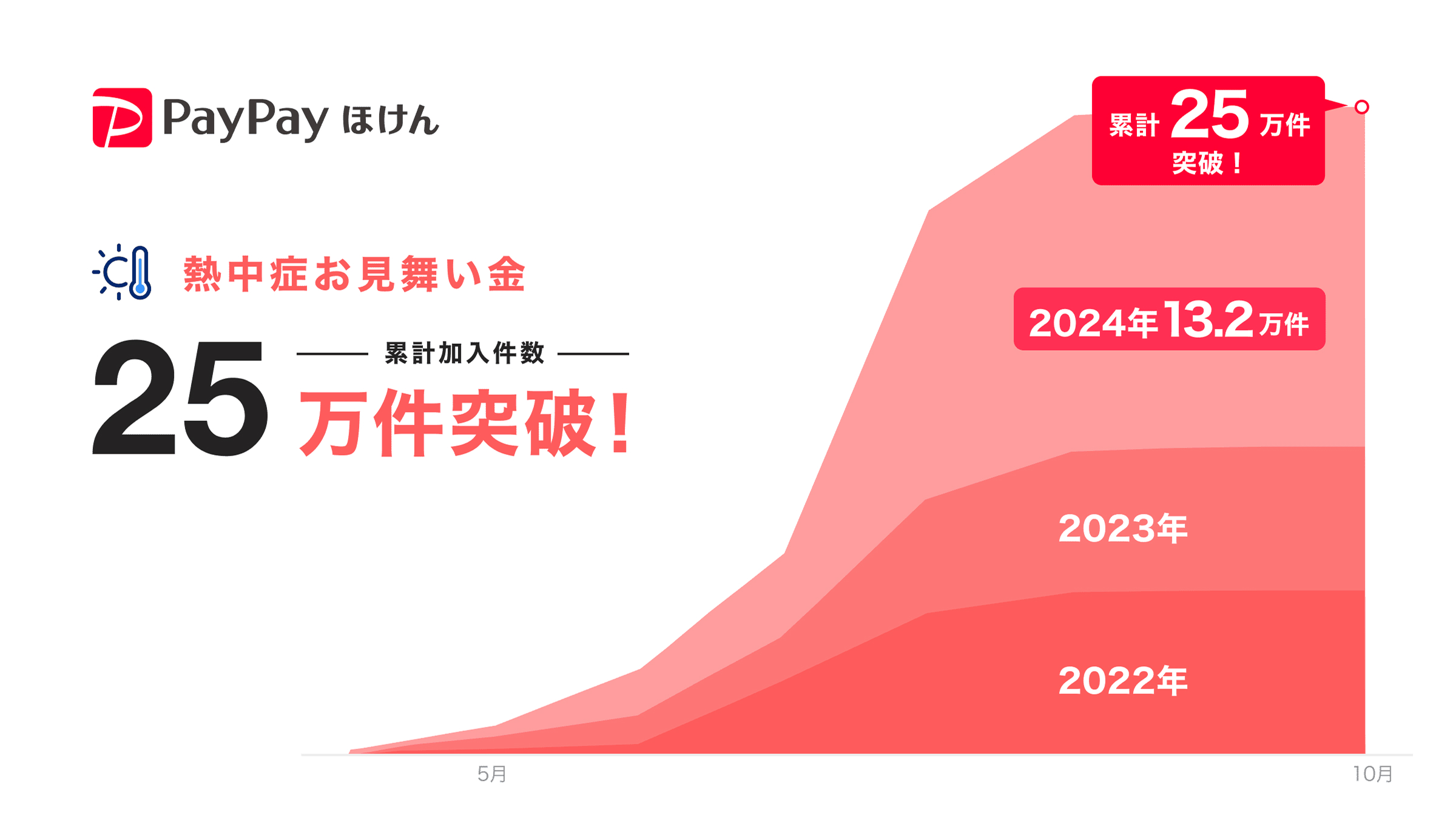

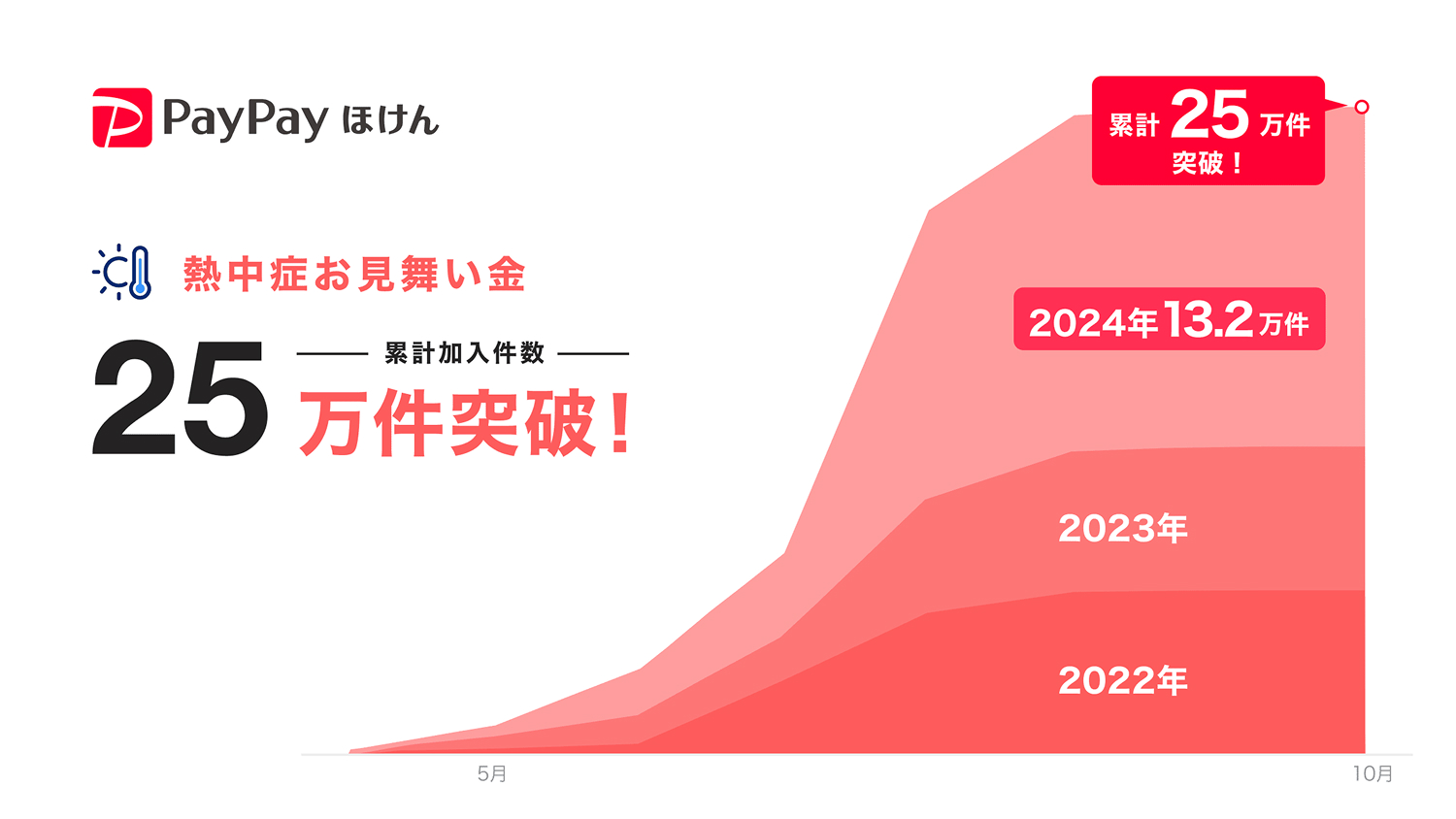

Since its launch in 2022, Heatstroke Insurance has received support from many users as one of the measures against heat stroke, and the total number of policyholders has exceeded 250,000(*2). In addition, the number of purchases for the year 2024 was 132,000, which was higher than the cumulative total of 118,000 for 2022 and 2023.

*1. A feature that allows users to smoothly make reservations, order products, and make payments for services provided by PayPay’s partner companies from the PayPay app.

*2 As of the end of October 2024.

Heatstroke Insurance is the first insurance product in the industry*3 specifically designed for heatstroke, being offered from April to October since 2022.

The policy covers medical expenses when a user who purchased it suffers from symptoms of heatstroke due to sun or heat exposure during the period of insurance and receives IV therapy from a doctor at a hospital or other medical institutions. In addition, hospitalization expenses are covered if the policyholder stays in a hospital for two days or more (one night and two days) for the purpose of treatment. Users can choose between a monthly or a custom period type. The monthly type costs 200 yen per month (190 yen if “repeat discount*4” is applied), and the custom period type, where users can choose a coverage period starting from one day, can be purchased for as little as 100 yen per day. In case of the custom period type, if users apply for it by 9 a.m., the coverage period begins at 10 a.m. on the same day. In addition to applying just for oneself, it is also possible to apply for all family members at once.

Approximately half of the purchases to date were for the applicants’ children, spouse, parents, or other family members. There were many instances of purchasing the insurance for children’s sport activities or for elderly family members living far away.

According to an announcement by the Ministry of Internal Affairs and Communications*5, the total number of people in Japan transported by emergency medical services due to heatstroke from May to September 2024 was 97,578, the highest number since records have been kept from 2008. In addition, 2024 saw an increase of 6,111 people over the previous year due to a prolonged period of severe heat.

According to the announcement by the Japan Meteorological Agency*6, average temperatures in the summer (June to August) this year are expected to be high nationwide due to global warming and high atmospheric pressure in and around Japan.

Therefore, PayPay Insurance Service will again offer Heatstroke Insurance to help users prepare for the risk of heatstroke. In addition, the “repeat discount” program, which has been in place since 2023 and has been well received by customers, will also be continued this year. Eligible users will receive a 10-yen discount when they choose the monthly type.

In 2024, the peak of policy purchases moved earlier compared to previous years, indicating that users support the product as a preparatory measure in the event of getting heatstroke, in addition to preventive efforts they take, and a similar trend is expected in 2025.

In addition, Sumitomo Life Insurance Company, the parent company of the underwriter, Aiaru syougakutankihoken Corporation, has published a Heatstroke White Paper,*7 partially referencing data on Heatstroke Insurance. The Heatstroke White Paper includes multiple heatstroke prevention measures, such as good sleep hygiene, avoiding late night meals, and regular physical activity, and PayPay Insurance will regularly provide the contents thereof to its users to promote heatstroke prevention.

Source: Heatstroke White Paper Infographic, April 2025 (published by Sumitomo Life Insurance Company)

The PayPay Insurance mini app has been used by many users since it was launched three years and three months ago, with over 5.7 million*8 policyholders in total. PayPay Insurance Service will continue to help users by providing high-quality insurance products that suit their needs to make insurance even more accessible.

*3. As of April 2022 (based on the research by Aiaru syougakutankihoken Corporation)

*4. The “repeat discount” is for users who have purchased the Insurance, regardless of the type or period, last year. If the policy was cancelled prior to the coverage period, the discount will not be applied. automatically offering a discount when reapplying via the same PayPay account. If a user applies for the Insurance with the same PayPay account as last year, the discount will be automatically applied.

*5. Ministry of Internal Affairs and Communications website, “Status of Emergency Medical Transport Due to Heatstroke in 2023 (May to September)”https://www.fdma.go.jp/disaster/heatstroke/items/r6/heatstroke_nenpou_r6.pdf

*6. Japan Meteorological Agency, “Nationwide Summer Weather Forecast (Jun-Aug)”

https://www.data.jma.go.jp/cpd/longfcst/kaisetsu/?region=010000&term=P6M

*7: Sumitomo Life Insurance Company, “Heatstroke White Paper”

https://www.sumitomolife.co.jp/about/csr/initiatives/stakeholder/open_innovation/

Press release https://www.sumitomolife.co.jp/about/newsrelease/pdf/2025/250422.pdf

*8. As of March 2025.

■ Heatstroke Insurance Details

(1) Coverage period

<Period of availability>

Monthly type: April 22 – September 30

Custom period type: April 22 – October 31

<Period of insurance>

Monthly type: available for a range of one to six months

Custom period type: available for a range of one to seven days

*The coverage period for the monthly type will begin on the day following the date of application.

*For the custom period type, if an application is made by 9 a.m., the coverage period will begin at 10 a.m. on the day.

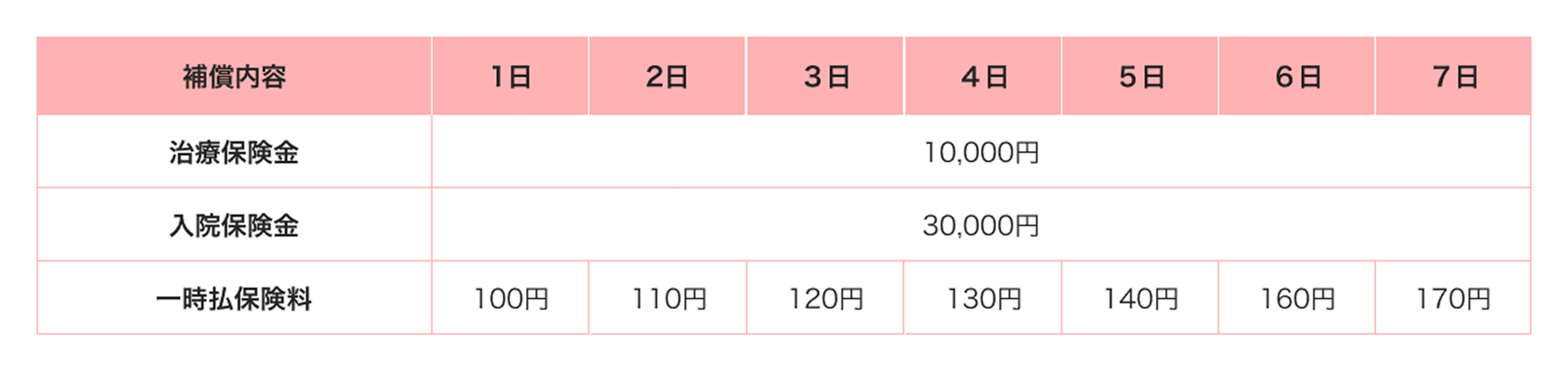

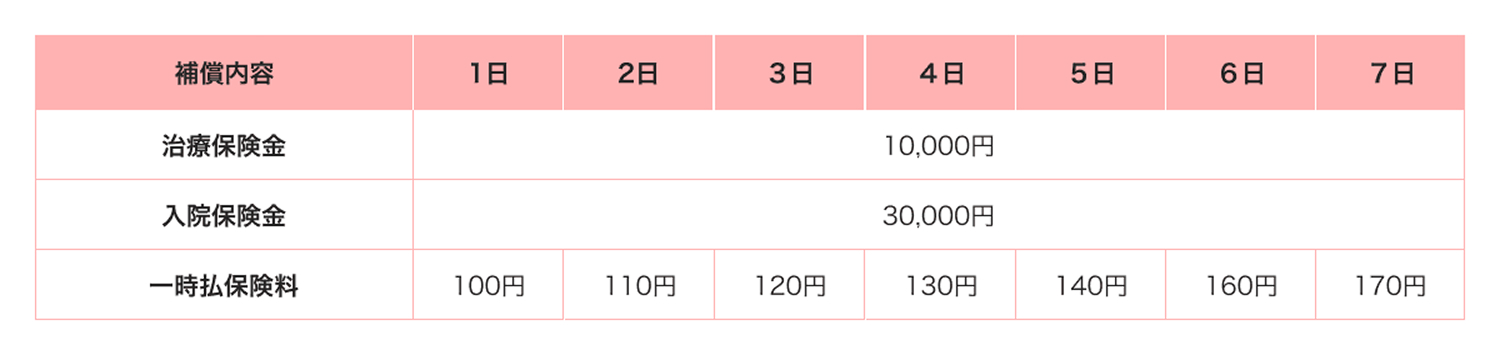

(2) Coverage

<Medical expenses>

The insurance benefits will be paid if the insured suffers from symptoms of heatstroke due to sun or heat exposure during the insurance period and receives IV therapy at a hospital or other medical institutions, based on the decision of the doctor.

<Hospitalization expenses>

The insurance benefits will be paid if the insured suffers from symptoms of heatstroke due to sun or heat exposure during the insurance period and is hospitalized for two or more consecutive days (one night and two days) for treatment.

(3) Plans

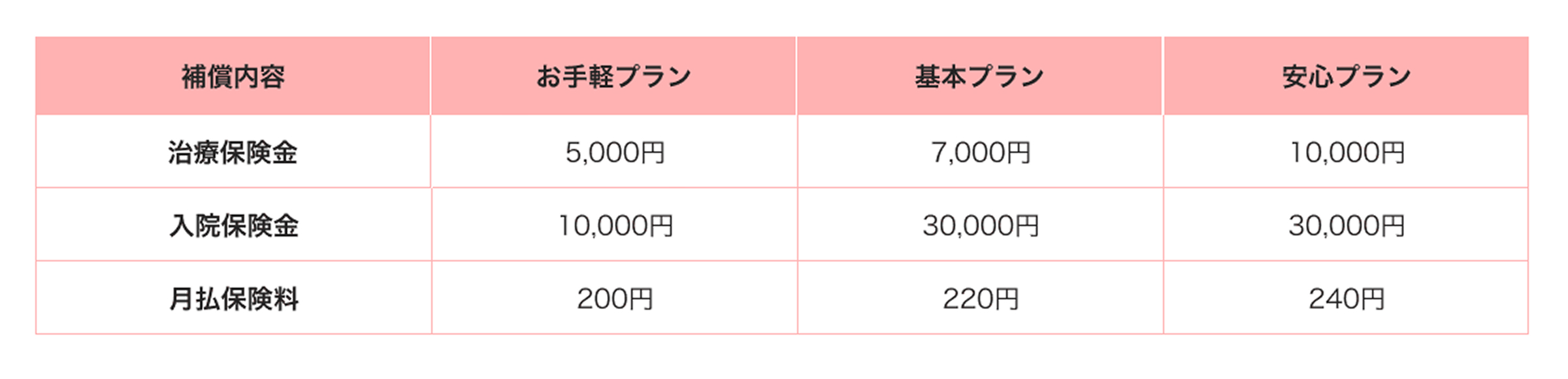

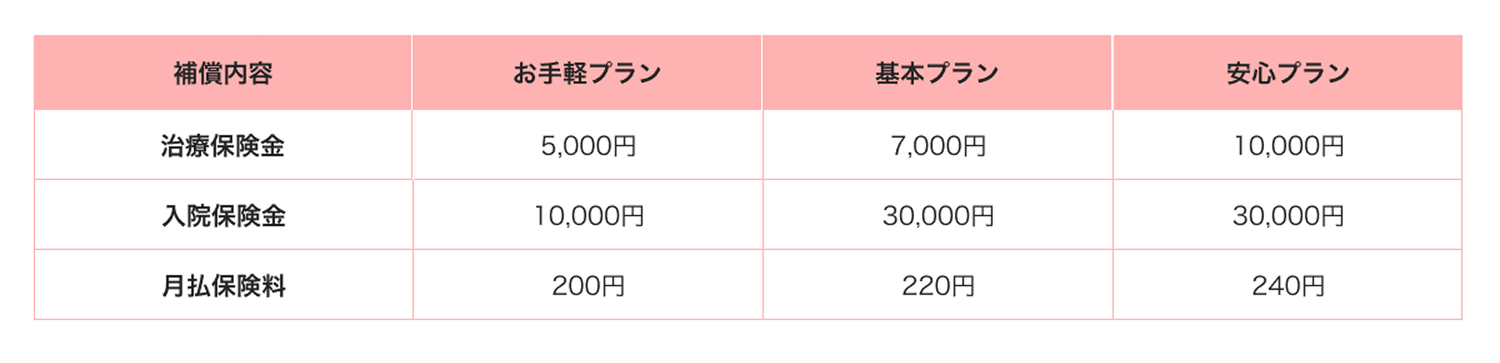

There are three plans available for the monthly type: Easy Plan, Basic Plan, and Safety Plan. There is one plan for the custom period type (the premium is the same as that of the monthly Safety Plan). A broad variety of insurance products are offered to match the needs of users.

<Monthly type>

*When a “repeat discount” is applied, monthly premiums will be 190 yen for the Easy Plan, 210 yen for the Basic Plan, and 230 yen for the Safety Plan.

<Custom period type>

*The insurance benefits will be paid to the designated bank account.

(4) Other features

<Easy to apply>

The purchase can be easily made through “PayPay” and the premium is also paid through “PayPay.” Users whose identity has already been verified on “PayPay” do not need to enter their name or other information to apply. Premiums can be paid with PayPay Points, Balance (PayPay Money), or PayPay Credit.

<Easy to file a claim>

Users can file a claim by uploading receipts and medical statements through the PayPay app. The insurance payout will be sent to the bank account designated by the user.

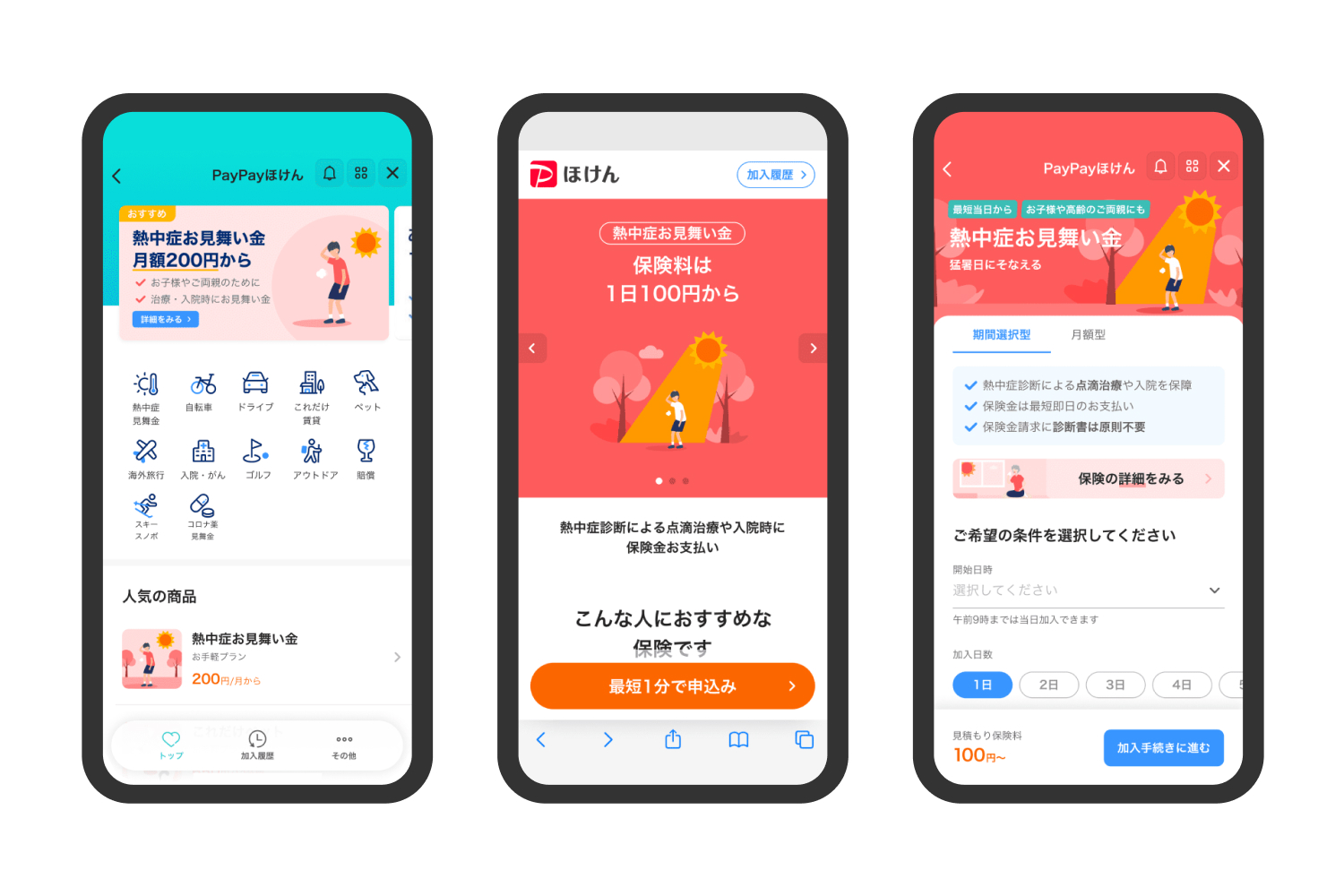

(5) Mini app screen

Users can complete the purchase of an insurance policy with simple steps all within the PayPay app.

The Insurance will be provided by PayPay Insurance Service and Aiaru syougakutankihoken Corporation (President: Katsuyuki Ando), a subsidiary of Sumitomo Life Insurance Company.

For more information on the Insurance, please see the following page.

https://www.paypay-insurance.co.jp/promotion/heatstroke/app/

* “PayPay” offers four types of electronic money as part of its services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) refers to PayPay Money that can only be purchased with wages received by the PayPay user in their Paycheck Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, Time-Limited PayPay Points are restricted to payments for certain services provided by LY Group. It cannot be transferred between PayPay users or cashed out. Additionally, PayPay Points (Time Limited) have an expiry date. which can be confirmed in the details or conditions of the LY Group measures or promotional campaigns. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued. PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. For more details, please visit application for compensation.

Overview of PayPay Insurance Service Corporation

Name: PayPay Insurance Service Corporation

Location: Tokyo Garden Terrace Kioicho Kioi Tower, 1-3 Kioicho, Chiyoda-ku, Tokyo

Representative: Yutaka Hyodo, President and Representative Director, CEO

Business description: Damage insurance agency services, life insurance solicitation services, and small amount short-term insurance solicitation services

Overview of LY Corporation

Name: LY Corporation

Location: Tokyo Garden Terrace Kioicho Kioi Tower, 1-3 Kioicho, Chiyoda-ku, Tokyo

Representative: Takeshi Idezawa, President and Representative Director, CEO

Business description: Development of online advertising business, e-commerce business, subscription services, and management of group companies

Overview of Z Financial Corporation

Name: Z Financial Corporation

Location: Tokyo Garden Terrace Kioicho Kioi Tower, 1-3 Kioicho, Chiyoda-ku, Tokyo

Representative: Shingo Ogasawara, Representative Director, President, Corporate Officer, CEO

Business description: Business management of group companies and related operations

Overview of PayPay Corporation

Name: PayPay Corporation

Location: YOTSUYA TOWER, 1-6-1 Yotsuya, Shinjuku-ku, Tokyo

Representative: Ichiro Nakayama, President & Representative Director, CEO, Corporate Officer

Business description: Development and provision of mobile payment and other electronic payment services

Overview of Aiaru syougakutankihoken Corporation

Name: Aiaru syougakutankihoken Corporation

Location: 7F Fujino Building,15-18 Nihonbashi-Kodenmacho, Chuo-ku, Tokyo

Representative: Katsuyuki Ando, President

Business description: Provision of small amount and short-term insurances

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.