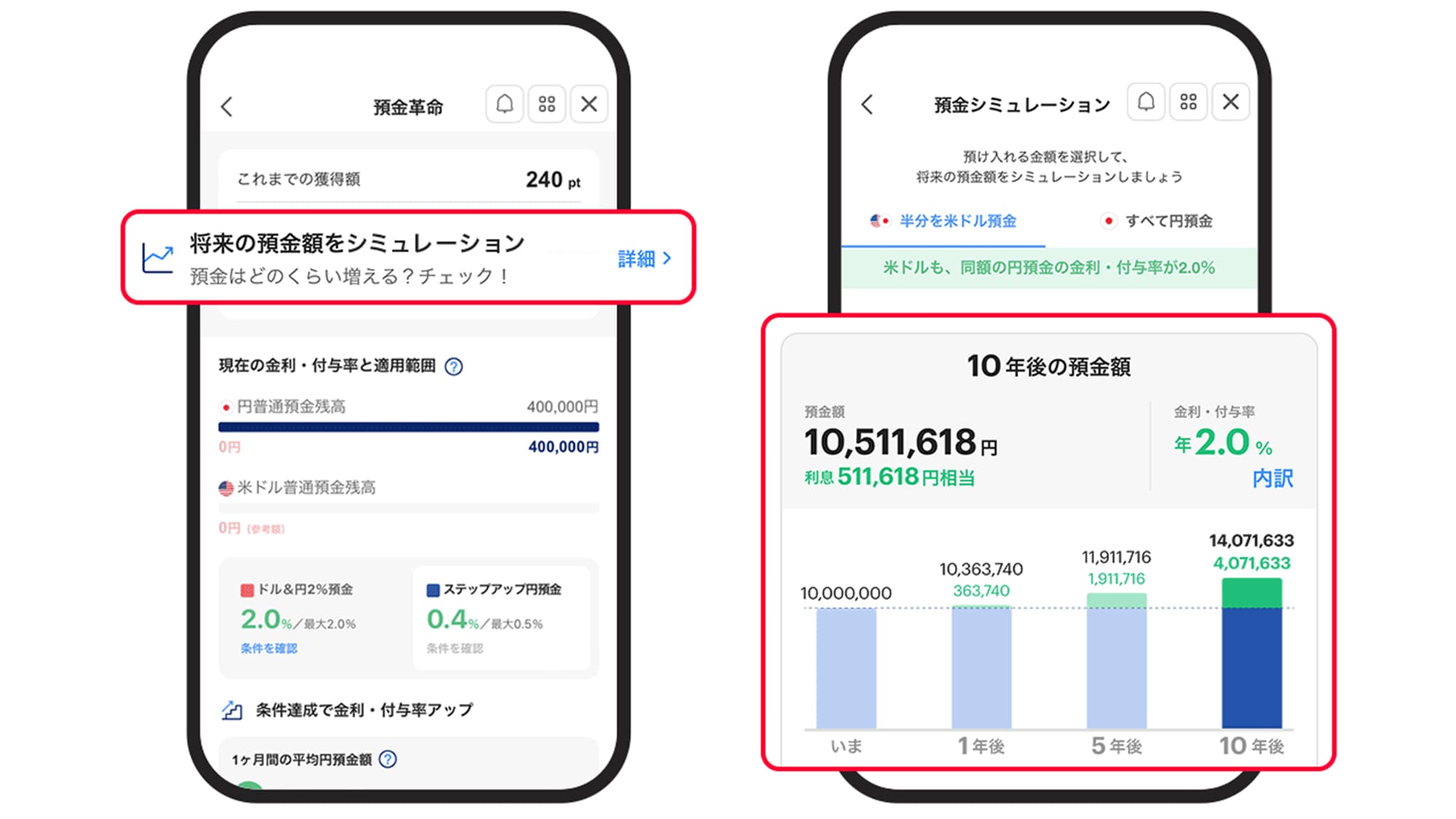

PayPay Bank Corporation (hereinafter “PayPay Bank”) is pleased to announce that it will enhance its regular program “Dollar & Yen 2% Deposit,” under which a special interest rate of 2.0% per annum (1.59% after tax)*1, 2 applies*3 to both yen ordinary deposits and U.S. dollar ordinary deposits when customers deposit in both. Specifically, the maximum balance of yen ordinary deposits eligible for the special interest rate will be raised from 5 million yen to 100 million yen. In addition, PayPay Bank will run a campaign under which, if certain conditions are met, exchange fees on U.S. dollar ordinary deposits are effectively 0 yen (details below). A new “Deposit Simulation” feature that visualizes estimated assets 10 years ahead will also be added, further supporting customers in building their assets.

The “Deposit Simulation” feature will also be available via the “PayPay Bank” mini app in the cashless payment service “PayPay,” through integration with PayPay Corporation (hereinafter “PayPay”).

*1. Interest rates are variable and subject to review depending on interest rate environments and other factors.

*2. For the Dollar & Yen 2% Deposit, the U.S. dollar ordinary deposit interest rate is the regular rate; for yen ordinary deposits, the special rate is the aggregate of the regular rate of 0.2% per annum and an additional special rate.

*3. For the Dollar & Yen 2% Deposit, the maximum yen ordinary deposit balance to which the special interest is applied is the monthly average balance of the U.S. dollar ordinary deposit (yen-converted: each day’s end-of-day U.S. dollar balance is converted at that day’s USD/JPY closing rate). However, if the yen ordinary deposit balance exceeds 100 million yen, the cap is 100 million yen. There is no upper limit for U.S. dollar ordinary deposits.

【Three New Enhancements】

Raise the special-interest cap for yen ordinary deposits in the Dollar & Yen 2% Deposit from 5 million yen to 100 million yen

To date, the special interest rate of 2.0% per annum on yen ordinary deposits under the Dollar & Yen 2% Deposit had an upper limit of 5 million yen. This will be raised to 100 million yen, enabling customers who wish to deposit larger amounts to build assets more flexibly.

“U.S. dollar ordinary deposit exchange fees effectively 0 yen” campaign

During the campaign period (September 1, 2025 to December 31, 2025), individual customers who have a U.S. dollar ordinary deposit balance of USD 30,000 or more at month-end will receive a full cash-back of the exchange fees incurred on U.S. dollar ordinary deposit transactions for that month. This allows customers to trade without worrying about costs and broadens their choices for asset building.

For example, if a customer deposits 5 million yen into their USD Savings account, the exchange fee of 1,666 yen incurred for transactions equivalent to 5 million yen will be refunded.*4, 5

*4. Calculated at 150 yen per dollar.

*5. Exchange fees are included in the transaction rate presented by PayPay Bank. In addition to exchange fees, a spread (the difference between market rates) is also included in the transaction rate.

For more details, please visit the following campaign page: “U.S. Dollar Ordinary Deposit Exchange Fees Effectively 0 Yen” Campaign

Addition of the Deposit Simulation Feature

In the “Deposit Simulation” available in the PayPay Bank app or in the “PayPay Bank” mini app within PayPay, customers can select deposit amounts and held currencies to easily simulate the estimated asset amount 10 years ahead, in line with the services under “Deposit Revolution.” This helps customers picture the compounding effect of interest and visualize increases or decreases in assets due to exchange rate fluctuations, making it easy to build assets according to their goals.

For more details, please visit the following PayPay Bank website: Deposit Revolution

About This Press Release

This press release is intended solely to provide information. Foreign currency deposits are deposits in foreign currency (not covered by deposit insurance) and carry the risk of principal loss. Depending on the movements in foreign exchange rates, the yen amount upon withdrawal may fall below the yen amount at the time of deposit. Additionally, exchange fees will be incurred at the time of deposit and withdrawal. The deposit exchange rate (the rate for exchanging yen into foreign currency) includes an exchange fee, and typically, the deposit rate is higher than the withdrawal rate (the rate for exchanging foreign currency back into yen). Therefore, even if there are no fluctuations in the foreign exchange rates, there is a possibility that the yen amount at the time of withdrawal may fall below the yen amount at the time of deposit, resulting in a loss of principal. Before starting or continuing transactions, please carefully read the terms and conditions as well as the product descriptions, and fully understand the structure and risks involved. Please conduct transactions at your own risk. For the latest interest rates and important information regarding foreign currency deposits, please visit the PayPay Bank website:

Interest Rates

Important Information on Foreign Currency Deposits

PayPay Bank, with the mission of “Bringing Financial Services Close to You Like Air,” aims to provide indispensable and seamlessly integrated financial services that become a natural part of daily life. PayPay Bank and PayPay will continue to strengthen their collaboration and expand attractive financial products and services to support the rich asset formation of each and every customer.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labor and Welfare No. 00001 / Date of designation: August 9, 2024)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) refers to PayPay Money that can only be purchased with wages received by the PayPay user in their Paycheck Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. Until the customer’s identity verification is completed, issued PayPay Money Lite (including previously issued ones) is distinguished as PayPay Money Lite (Low Value), and for those customers who have completed identity verification (including previously issued ones), it is classified as PayPay Money Lite (High Value). In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see ”

Applying for compensation” for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.