Guide page for Overseas Payment Mode

PayPay Corporation (hereinafter PayPay) is pleased to announce the launch of the Overseas Payment Mode, which will enable the PayPay app to be used overseas, starting from late September.*1 In addition to making payments at stores affiliated with Alipay+, users will be able to utilize major features*4 such as peer-to-peer (P2P) transactions*2 and balance top-ups*3 internationally. Furthermore, as the amount paid locally can be immediately checked in Japanese yen,*5 users can use the PayPay app overseas with the same peace of mind and convenience as they do domestically. Only users who have completed identity verification (eKYC)*6 on the PayPay app will be able to use this service abroad.*7

The Overseas Payment Mode will first be launched in South Korea,*8 which ranks first in the number of Japanese outbound travelers. Moreover, even when users make payments abroad, they will earn PayPay Points just as they do within Japan.*9

*1. The start date for Overseas Payment Mode is subject to change. Latest updates will be provided here.

*2. If a user is utilizing the Overseas Payment Mode, P2P transfers from overseas (South Korea) to users in Japan are also possible. In addition, P2P transfers from users in Japan to users overseas (South Korea) are possible.

*3. Top-ups at local ATMs are not available.

*4. For a list of features covered by Overseas Payment Mode, please refer to the section below.

*5. The rate displayed includes the exchange rate presented daily by the overseas network operator or overseas acquirer, plus a handling fee determined by PayPay (3.85% tax included).

*6. For more information on identity verification (eKYC), please check here.

*7. Due to security reasons, identity verification (eKYC) cannot be completed overseas. Pre-departure arrangements are necessary.

*8. Source: “Trends in Japanese Overseas Travel” (JTB Tourism Research & Consulting based on announcements from various countries and regions).

*9. Payments made in Overseas Payment Mode also qualify for PayPay STEP.

■ Features and services of “PayPay” available in Overseas Payment Mode*10

| Payments | – Customer-presented mode (CPM; barcode & QR code) – Merchant-presented mode (MPM) |

|---|---|

| P2P (Send/Receive) | Remittances and transfers |

| Top-ups | Balance top-up using registered top-up methods in the PayPay app |

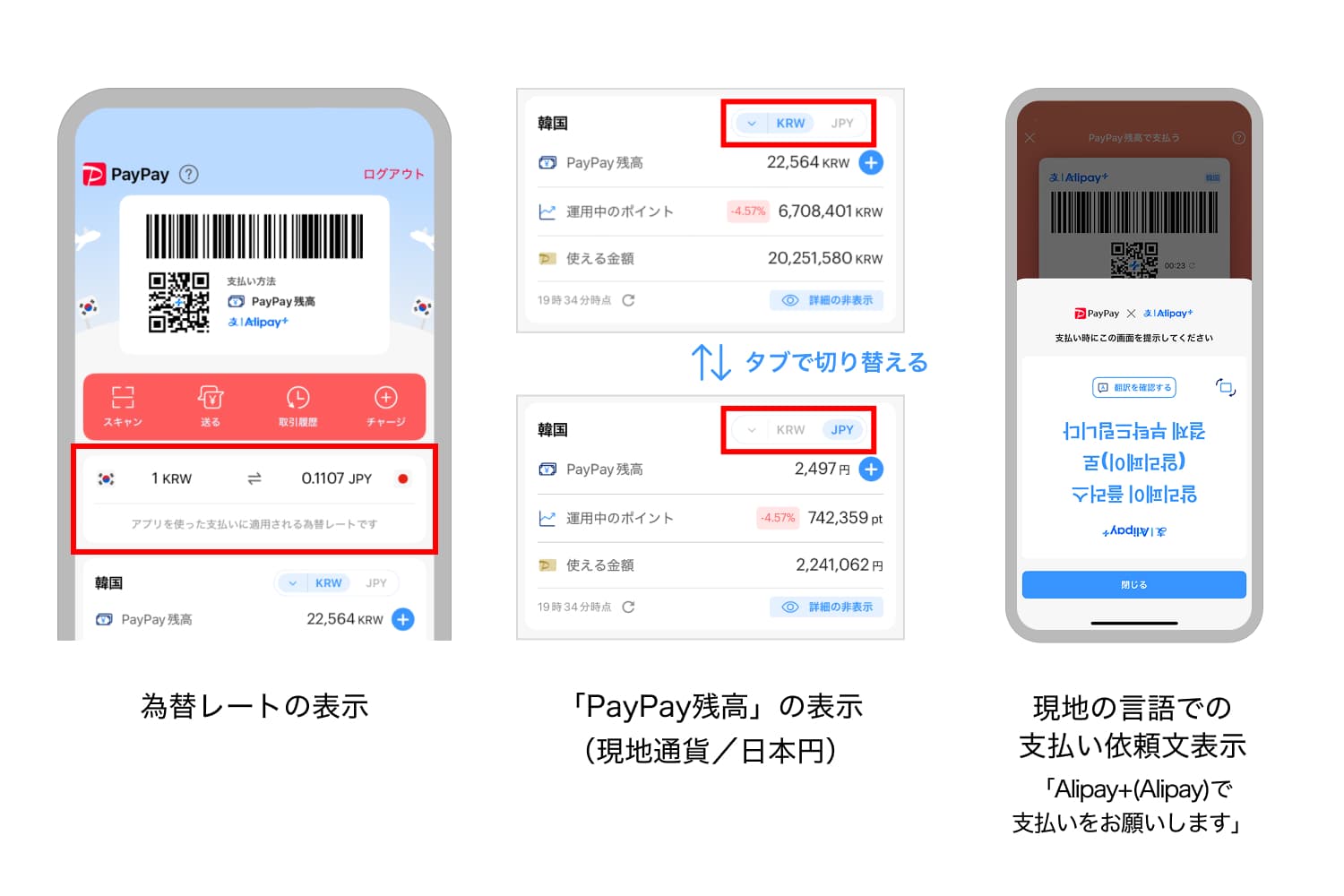

| Payment/Balance management | – Display of balance in Japanese yen and local currency – Display of transaction history – Switching of payment methods – Setting of available amount – Display of exchange rates |

In a survey conducted with PayPay users who traveled to South Korea within the past year,*11 approximately 90% expressed a desire to use PayPay overseas, indicating high expectations for this feature. The introduction of the Overseas Payment Mode, enabling key functionalities such as payments and remittances through the Alipay+ network, allows PayPay to meet the outbound travel demand of Japanese users traveling abroad.

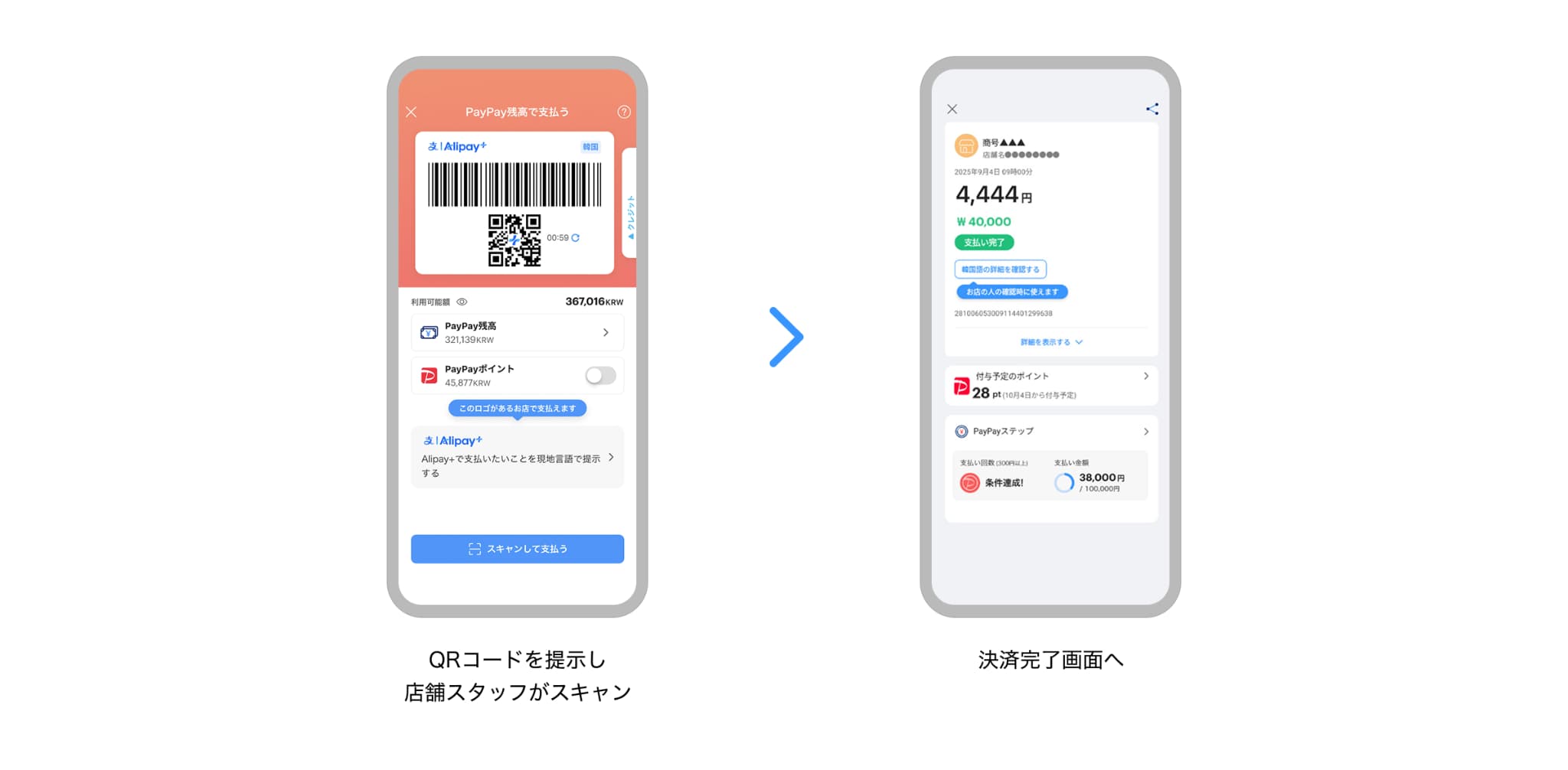

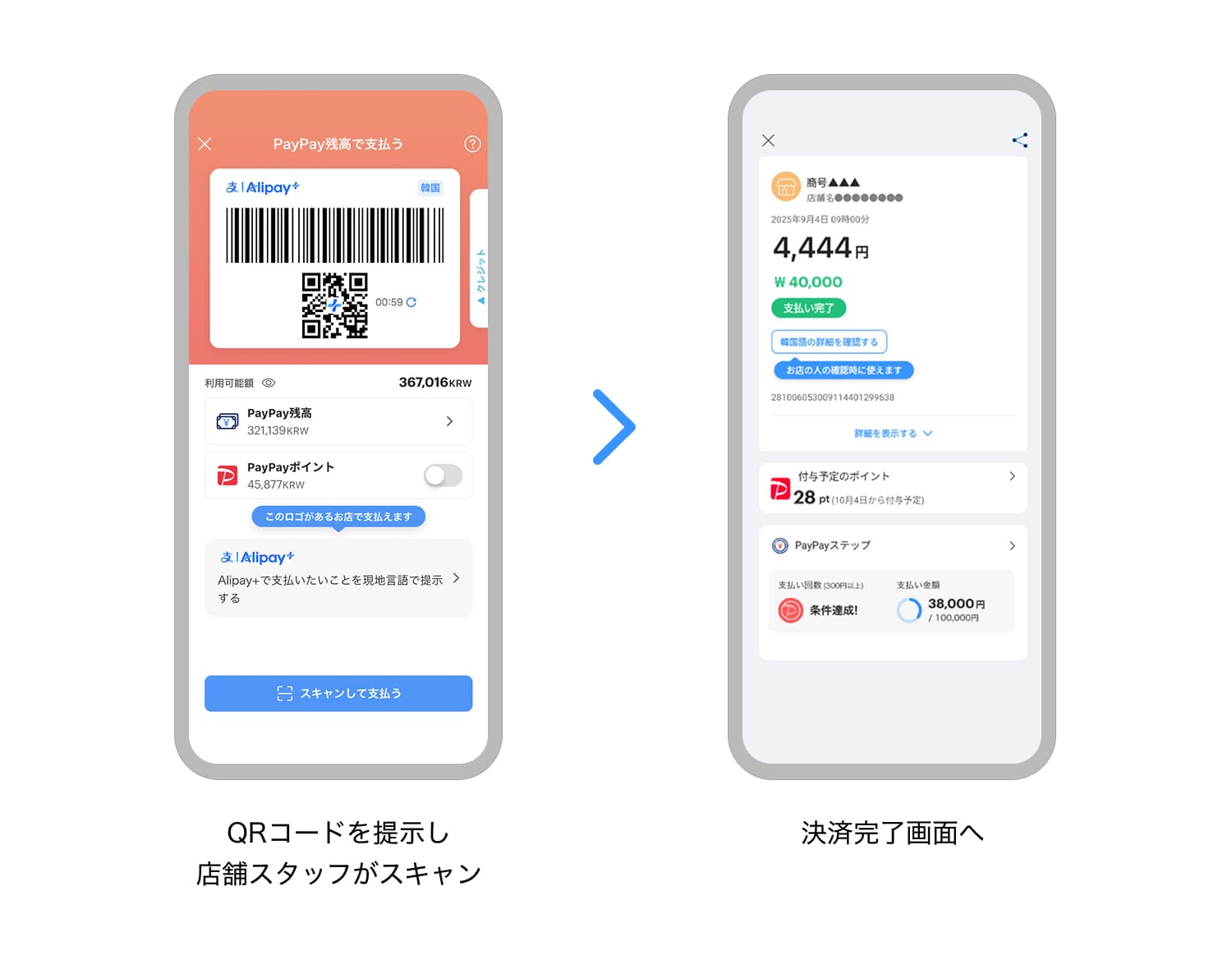

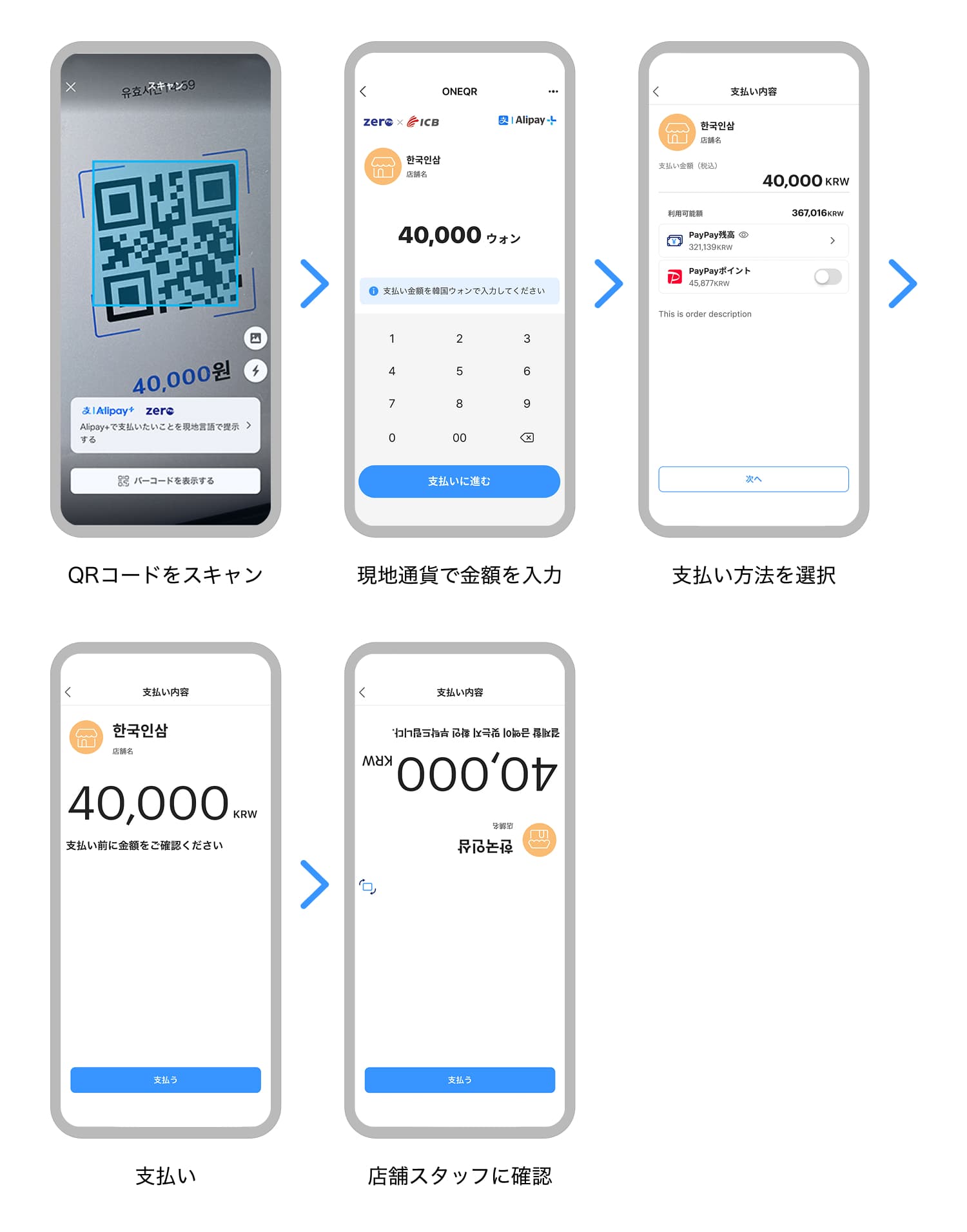

Even overseas, when users make payments with PayPay, they earn PayPay Points, and they can also split bills using the Send/Receive feature. This ensures a seamless and convenient experience similar to using PayPay in Japan for shopping and dining. Payments made in Overseas Payment Mode support both CPM and MPM. Further, the available payment methods are similar to those available in Japan: the red screen for PayPay Balance and blue screen for PayPay Credit.

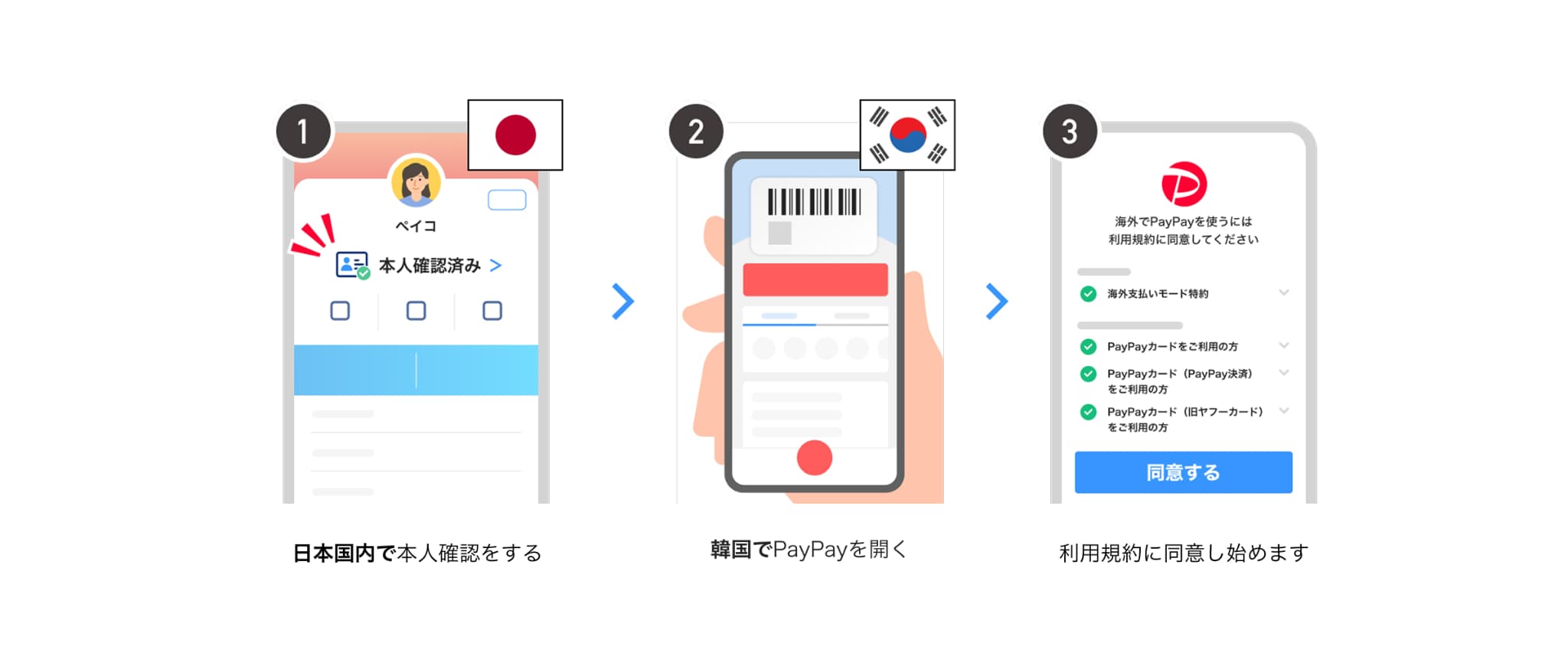

Additionally, during transactions, the amounts are immediately displayed both in the local currency and Japanese yen, providing users with instant awareness of their spending. To facilitate communication during payments, the app displays a payment request message in the local language, indicating the transaction is through Alipay+. If users have completed identity verification (eKYC) in Japan, the Overseas Payment Mode is automatically activated at their travel destination.*12

The Overseas Payment Mode is set to launch in South Korea in late September 2025, allowing payments to be made with PayPay at a wide range of establishments and locations within the country. These include convenience stores, department stores, cosmetics shops popular among Japanese visitors, as well as restaurants and food stalls in tourist areas. In South Korea, payment with “PayPay” will be possible at stores and locations displaying the “Alipay+” and “zero pay” logos, as shown in the images below.

To ensure secure usage, only users who have completed identity verification (eKYC) can utilize the Overseas Payment Mode. Even while abroad, user data is securely stored and accumulated on servers in a protected environment, similar to domestic usage in Japan. Additionally, no user-identifiable information is shared with or transferred to local services or stores, including Alipay+. To prevent unauthorized use, login from a new device while overseas is not possible; only continued use of a device previously used within Japan is permitted.

To date, PayPay has responded to the growing inbound demand from international visitors to Japan by integrating with 26 overseas cashless payment services across 14 countries and regions*13 through networks such as Alipay+ and HIVEX®. This integration allows approximately 80% of international visitors*14 to use the cashless payment services they are familiar with from their home countries to make payments at PayPay-affiliated stores. This convenience, eliminating the need to exchange money into Japanese yen, increases demand across various settings, including small shops and food stalls at tourist sites that do not accept credit cards. The inbound spending at PayPay merchants for the fiscal year 2024 has tripled compared to the pre-pandemic fiscal year 2019, reaching a new all-time high.

PayPay is dedicated to expanding its services overseas, ensuring that users can conveniently make payments and P2P transactions anytime and anywhere using the PayPay app they daily use.

*10. As of September 16, 2025. Please use the latest version of the PayPay app.

*11. Based on an internet survey of PayPay users who traveled to South Korea within the past year (n=500). Conducted by PayPay in September 2024.

*12. Agreement to the terms of use is required.

*13. As of September 16, 2025. Services like Plus Pay and icash Pay (Taiwan) are scheduled to be launched.

*14. Percentage of visitors from 14 countries and regions with cashless services partnered with PayPay out of the total number of international visitors to Japan in 2024.

■ About Alipay+

Alipay+ is a consolidated wallet gateway provided by Ant Group, which connects merchants and consumers around the world through cross-border digital payments and comprehensive digitalization support services. Consumers can make payments, as well as access various perks and convenient digital services seamlessly using their preferred payment apps and e-wallets, even while traveling internationally. Many small and medium-sized enterprises leverage digital tools provided by Alipay+ to enhance operational efficiency and achieve growth across omnichannel platforms.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labor and Welfare No. 00001 / Date of designation: August 9, 2024)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) refers to PayPay Money that can only be purchased with wages received by the PayPay user in their Paycheck Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. Until the customer’s identity verification is completed, issued PayPay Money Lite (including previously issued ones) is distinguished as PayPay Money Lite (Low Value), and for those customers who have completed identity verification (including previously issued ones), it is classified as PayPay Money Lite (High Value). In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*The images are for illustrative purposes only.

*Company names, trade names, and product/service names mentioned in this press release are registered trademarks or trademarks of their respective companies.