PayPay Card Corporation (Shinjuku-ku, Tokyo; President & Representative Director: Tomoaki Tanida, hereinafter “PayPay Card”) will commence offering the Pay in Installments Later service starting September 29, 2025 (*1). The Pay in Installments Later service allows users to change a one-time payment made with a PayPay Card (including PayPay Card Gold) to an installment payment. This service can be easily used through the PayPay Card member menu within the PayPay Card mini app in the PayPay app. Additionally, transactions made using PayPay Credit (*2), one of the payment methods in the PayPay app, are also compatible with the Pay in Installments Later service.

Previously, to use installment payments with a PayPay Card, users were required to select their desired installment option at retail locations that offered this service. However, with the introduction of the Pay in Installments Later service, even if users select a one-time payment or bonus one-time payment option at the time of purchase, they can now change it to an installment payment ranging from 3 to 48 payments through the Pay in Installments Later option in the PayPay Card mini app or the PayPay Card member menu (*3). Similarly, transactions made using PayPay Credit can also be changed to installment payments ranging from 3 to 48 payments, thereby enhancing convenience.

Whether faced with unexpected expenses or a need to revise payment plans to adjust monthly billing amounts, Pay in Installments Later allows users to flexibly respond, even for transactions at stores that do not offer installment payment options. There is no need to hastily decide on a payment method at the point of sale, allowing users to consider later whether to pay in one lump sum or choose installment payments, providing a smarter payment experience.

*1 A predetermined fee will apply.

*2 This service becomes available by registering a PayPay Card in the PayPay app. For more details, please refer here.

*3 Changes can be made for one-time shopping payments or bonus one-time payments of 1,000 yen or more (including tax), provided there is available credit limit for installment payments. Transactions of 999 yen or less (including tax), annual fees, various handling fees, and certain other details cannot be changed. For more details on cases where changes are not possible, please refer to the “Pay in Installments Later” guide page.

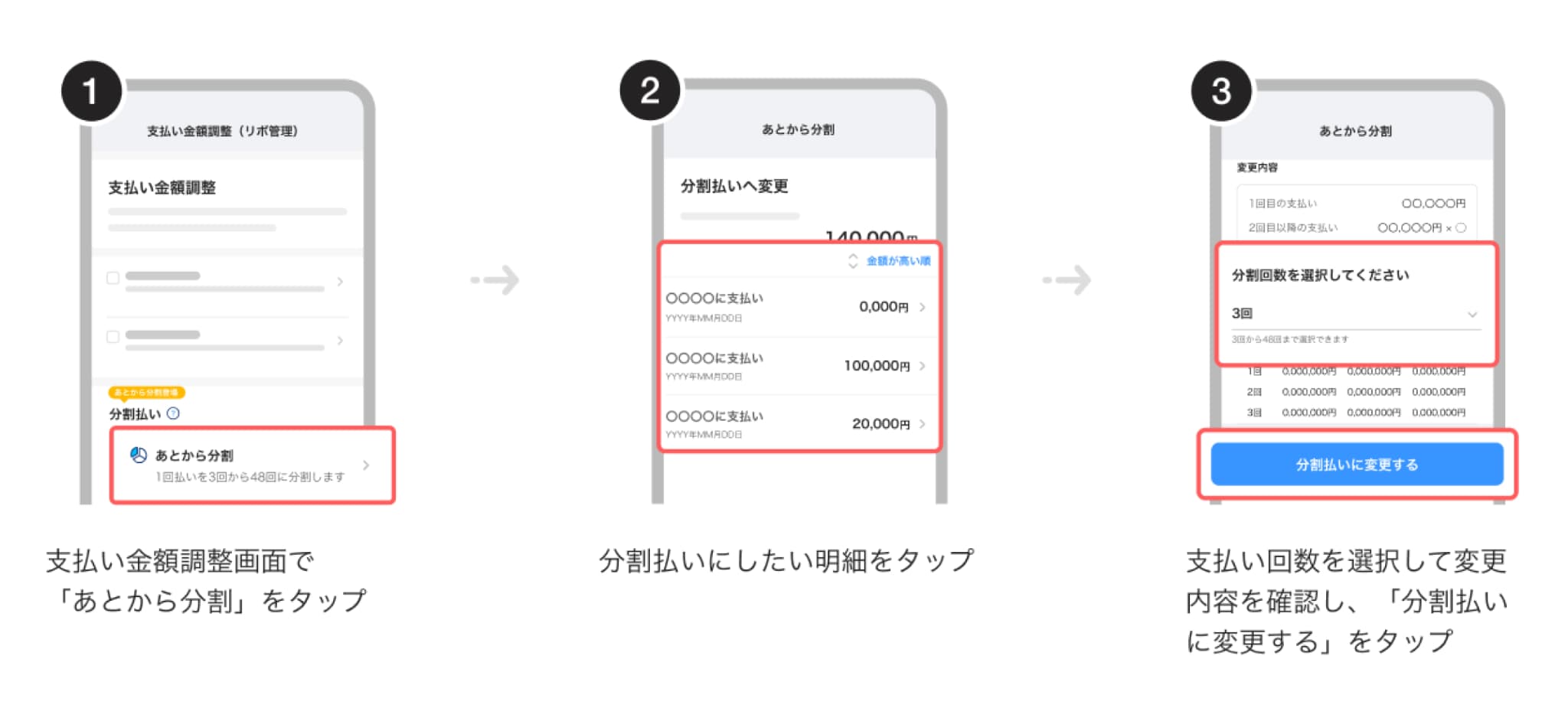

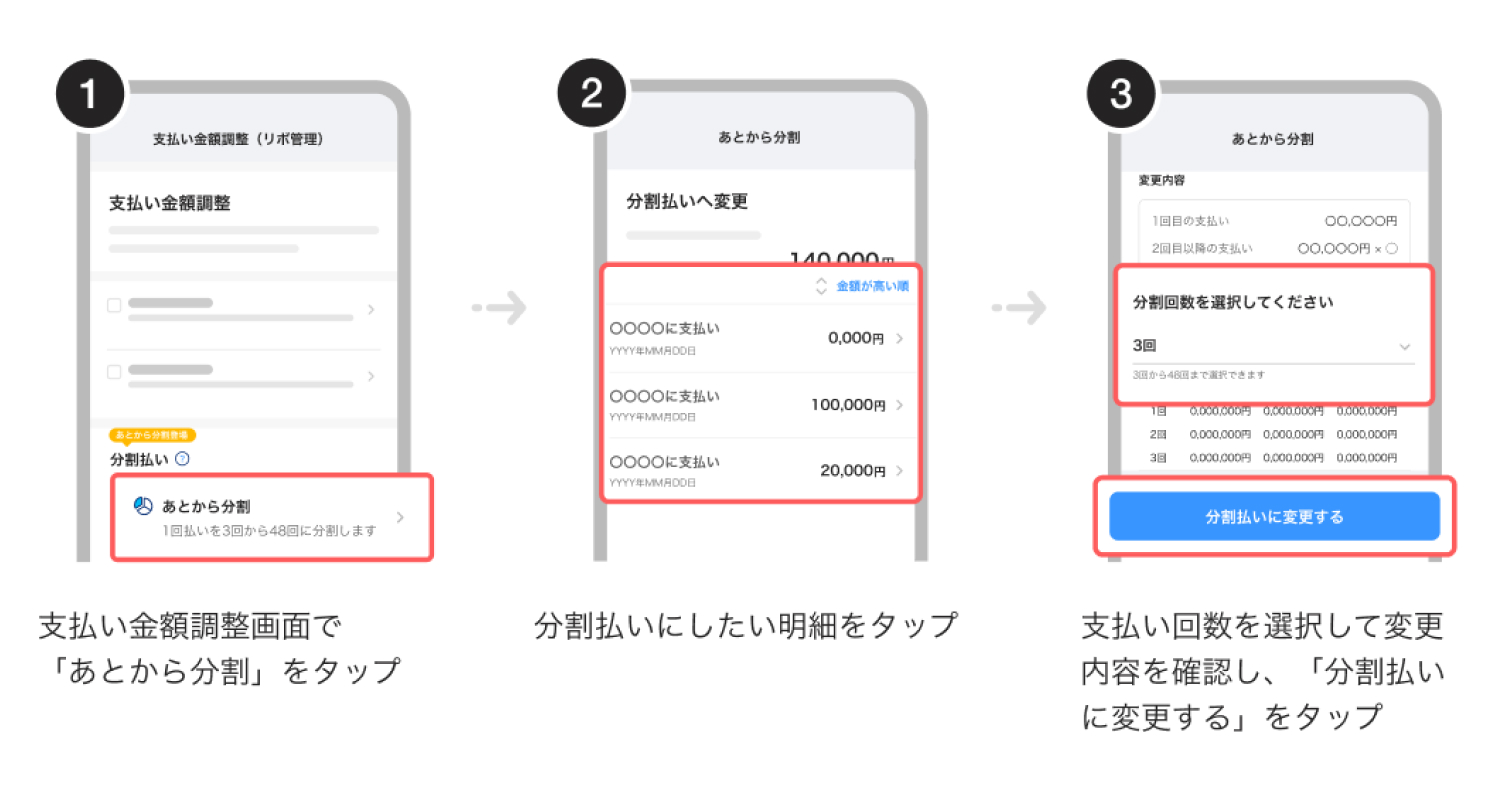

Method for Changing to “Pay in Installments Later”

Users can switch to the “Pay in Installments Later” option through the “Adjust Payment Amount” feature in the member menu of the PayPay Card mini app within the PayPay app. Please note that this change cannot be processed through phone or chat inquiries.

Overview of the “Pay in Installments Later” Service

The “Pay in Installments Later” feature allows users to change a previously completed transaction to an installment payment.

| Overview of the “Pay in Installments Later” Service | |

|---|---|

| How to Change | Changes can be made via the “Adjust Payment Amount” option within the PayPay Card member menu in the PayPay mini app. * The change cannot be accepted via phone or chat. |

| Available Installment Options | 3 to 48 installments * For more details, please refer to the “Pay in Installments Later” guide page. |

| Deadline for Changes (For Current Month’s Transactions) | – If the payment account is registered: By 21:59 on the 20th of each month (or by the 15th depending on the financial institution) – If the payment account is not registered: By 21:59 on the 10th of each month The billing month for the change to installment payment may vary depending on the timing of the procedure. * For more details, please refer to the “Pay in Installments Later” guide page. |

| Fees | The service follows the currently offered installment fee structure. * For more information on installment fees, please refer here. |

| Conditions for Changing to “Pay in Installments Later” | The transaction must be a one-time shopping payment or a one-time bonus payment of 1,000 yen or more (tax included). * For more details, please refer to the “Pay in Installments Later” guide page. |

PayPay Card Corporation and PayPay Corporation will continue to strive to deliver a user-first perspective to enhance user satisfaction and create more convenient and advantageous experiences, aiming to provide the leading cashless services in Japan.

■ About PayPay Card Corporation

PayPay Card Corporation changed its name from YJ Card Corporation on October 1, 2021, and commenced operations with the aim of becoming Japan’s leading card company under the new name, PayPay Card Corporation. As of October 2022, it became a wholly-owned subsidiary of PayPay Corporation, further strengthening its collaboration with the cashless payment service, PayPay. The company is committed to enhancing the convenience of life for its users by expanding services that can be utilized in a variety of payment scenarios.

■ About the Cashless Payment Service “PayPay” Provided by PayPay Corporation

The cashless payment service known as PayPay continues to expand throughout Japan, catering from large retail chains to small and medium-sized stores, vending machines, taxis, and public transportation. It can also be used for online payments and billing for public utilities, among other payment scenarios. Additionally, the service offers various convenient functionalities beyond payments, such as sending and receiving PayPay Money and PayPay Money Lite without fees between users, and the “Earn Points” service, where PayPay Points can be exchanged for partner service providers’ points, allowing users to experience simulations of investments offered by these providers. Furthermore, PayPay has established a 24/7 customer support hotline and a compensation system to protect users in case of any incidents, ensuring a secure environment for its users.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labor and Welfare No. 00001 / Date of designation: August 9, 2024)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) refers to PayPay Money that can only be purchased with wages received by the PayPay user in their Paycheck Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. Until the customer’s identity verification is completed, issued PayPay Money Lite (including previously issued ones) is distinguished as PayPay Money Lite (Low Value), and for those customers who have completed identity verification (including previously issued ones), it is classified as PayPay Money Lite (High Value). In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

* The images are for illustrative purposes only.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.