PayPay Corporation (hereinafter “PayPay”) has announced that it will begin integration with two new overseas cashless payment services, Octopus from Hong Kong and Taishin Pay+ from Taiwan, at PayPay merchants nationwide through HIVEX® starting from September 2025.

As a result, in combination with the already-integrated overseas services, users of 28 cashless payment services from 14 countries and regions will be able to make payments for dining, souvenirs, accommodation, and more at PayPay merchants when visiting Japan.

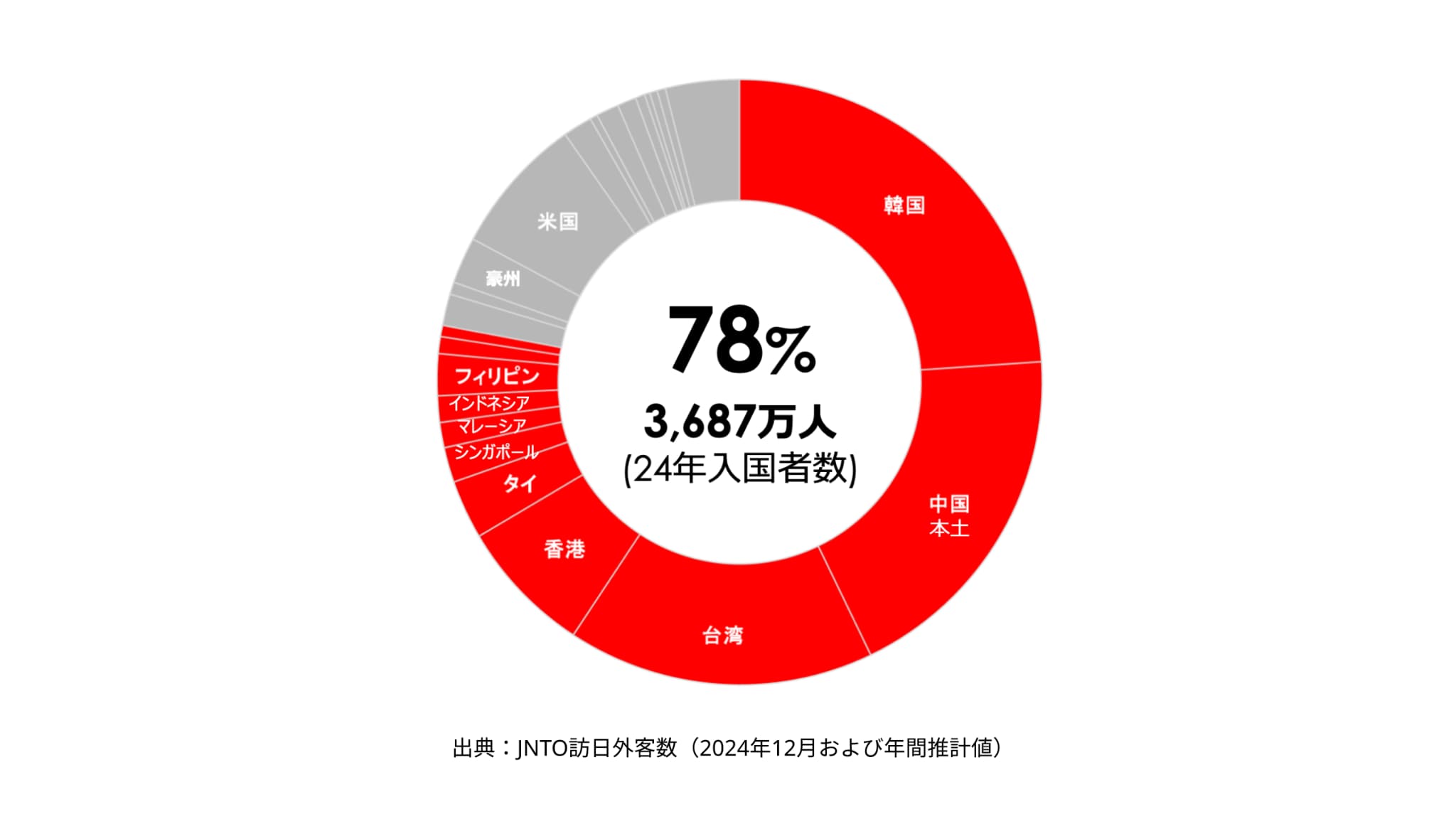

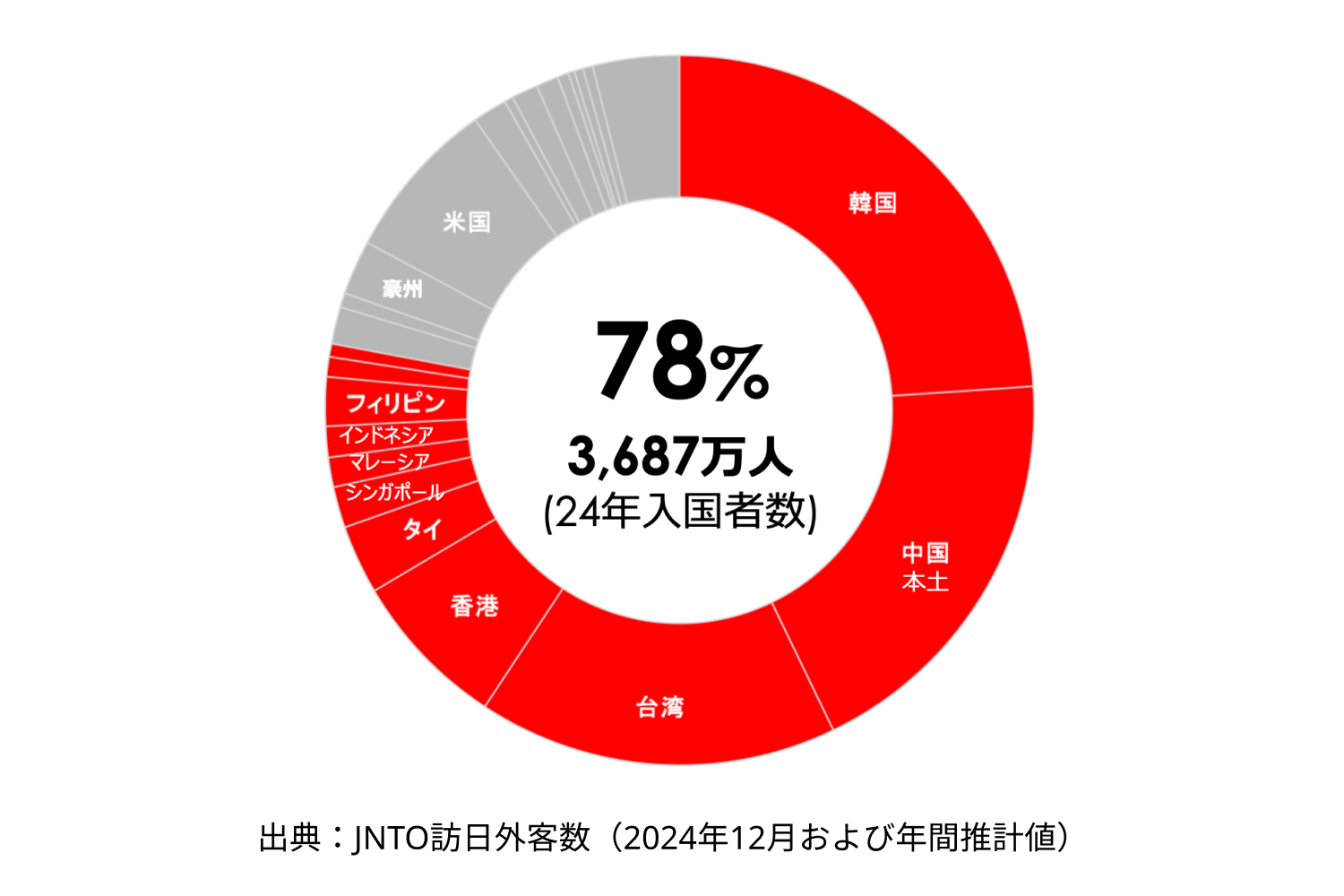

Since launching “PayPay” in October 2018, PayPay has been building an environment for users of overseas cashless payment services to complete payments at PayPay merchants in Japan, with the aim of supporting merchants seeking to attract foreign visitors. Although inbound demand had temporarily declined due to the impact of COVID-19, it recovered by 2022. By 2024, the number of foreign visitors to Japan increased by 47.1% year-on-year to approximately 37 million, reaching an all-time high for a given year.*1 Partner companies have also increased, allowing overseas cashless payment services used in countries and regions that account for approximately 80% of foreign visitors to Japan to be used at domestic PayPay merchants.

PayPay’s reach of overseas cashless payment services (based on the number of foreign visitors to Japan in 2024)

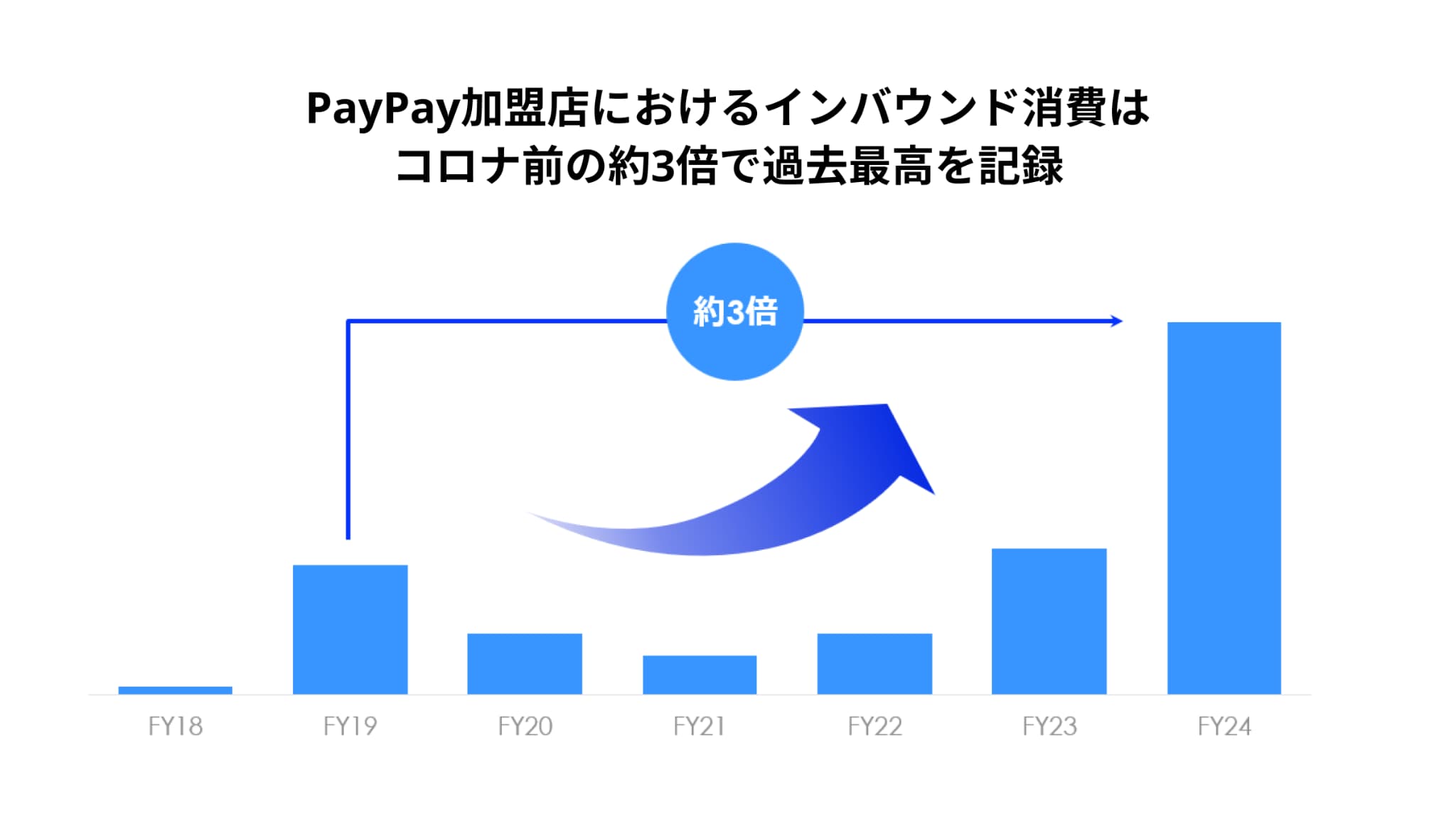

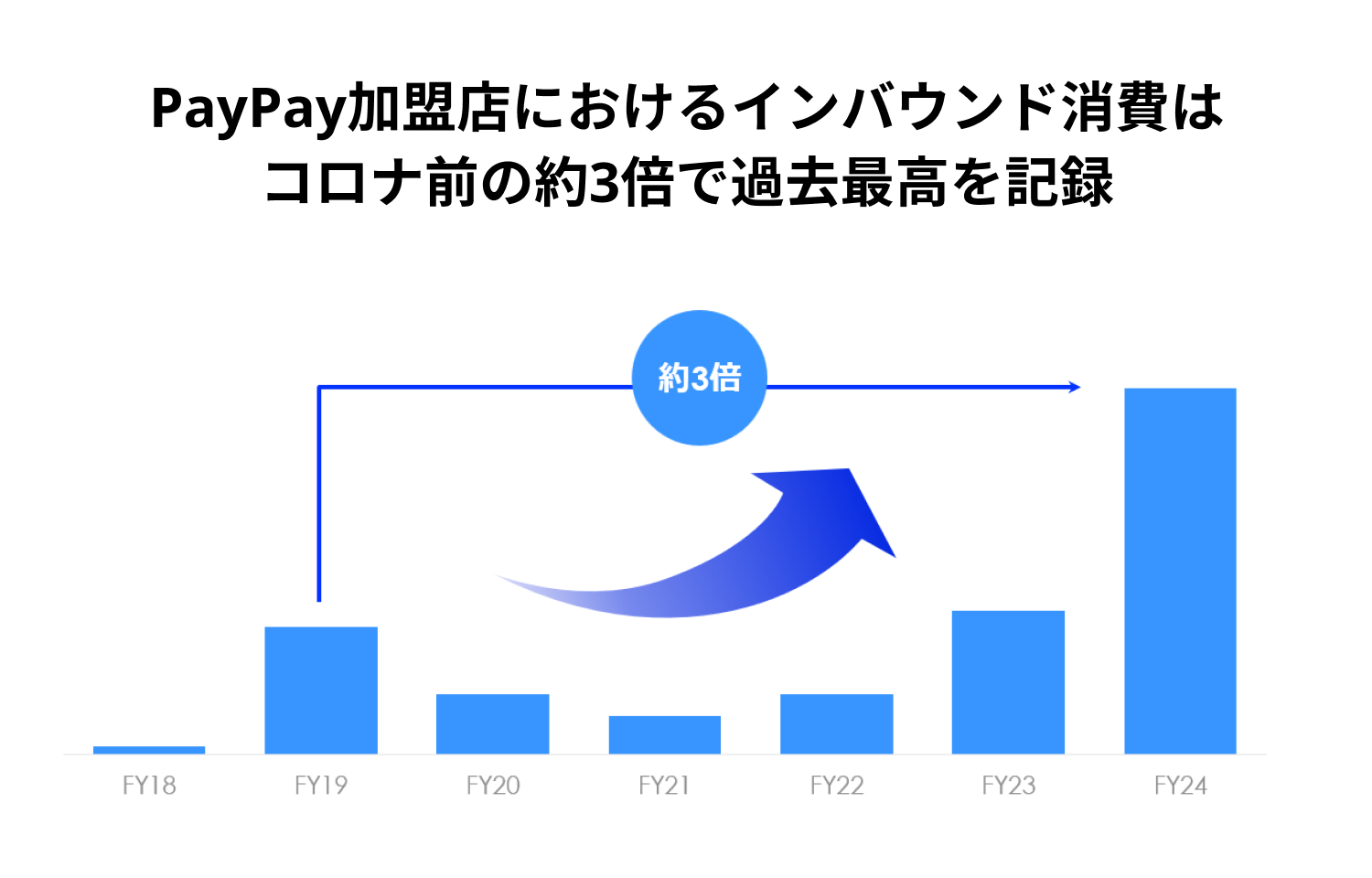

Due to a recovery in tourism and an increase in the number of partner companies, the GMV (gross merchandise value) for overseas cashless payment services at PayPay merchants also reached a record high in FY2024, increasing approximately threefold compared to FY2019.

*1. From Japan National Tourism Organization (JNTO), “Number of Foreign Visitors to Japan (December 2024 Estimates).”

Usage trend of overseas cashless payment services

PayPay will continue to enhance its collaboration with overseas payment services to support merchants in capturing tourism demand.

■ List of overseas cashless payment services integrated with PayPay (14 countries and regions, 28 services)

| Name (alphabetical order) |

Country or region (ranking in number of visitors to Japan*) |

Provider | Payment method | Integration period |

|---|---|---|---|---|

| Alipay | Mainland China (2) | Alipay.com Co., Ltd. | User-scan method (MPM) | October 2018 |

| AlipayHK | Hong Kong (5) | Alipay Payment Services (HK) Limited | User-scan method (MPM) | April 2020 |

| BigPay | Thailand (6) Malaysia (13) Singapore (9) |

BIGPAY THAILAND LIMITED BIGPAY MALAYSIA SDN BHD BIGPAY SINGAPORE PTE LTD |

User-scan method (MPM) | April 2025 |

| Bluecode | Germany (16) Austria (35) |

BLUE CODE INTERNATIONAL AG | User-scan method (MPM) | April 2025 |

| Changi Pay | Singapore (9) | Liquid Group Pte. Ltd. | User-scan method (MPM) | January 2024 |

| E.SUN Wallet (玉山錢包) |

Taiwan (3) | E.SUN COMMERCIAL BANK, LTD. | User-scan method (MPM) Store-scan method (CPM) |

November 2023 |

| GCash | Philippines (8) | G-Xchange, Inc | User-scan method (MPM) | June 2023 |

| HelloMoney by AUB | Philippines (8) | Asia United Bank Corporation (AUB) | User-scan method (MPM) | June 2023 |

| Hipay | Mongolia (30) | High Payment Solutions LLC | User-scan method (MPM) | January 2024 |

| icash Pay (愛金付) |

Taiwan (3) | icash Corporation | User-scan method (MPM) Store-scan method (CPM) |

Integration scheduled |

| iPASS MONEY (一卡通) |

Taiwan (3) | iPASS Corporation | User-scan method (MPM) Store-scan method (CPM) |

October 2024 |

| JKO PAY (街口支付) |

Taiwan (3) | Jkopay Co., Ltd. | User-scan method (MPM) Store-scan method (CPM) |

October 2023 |

| K PLUS | Thailand (6) | KASIKORNBANK Public Company Limited | User-scan method (MPM) | April 2025 |

| Kakao Pay | South Korea (1) | Kakao Corp. | User-scan method (MPM) | April 2020 |

| Kaspi.kz | Kazakhstan (-) | KASPI BANK JOINT STOCK COMPANY | User-scan method (MPM) | April 2025 |

| Mpay | Macau (21) | Macau Pass S.A. | User-scan method (MPM) | January 2024 |

| MyPB | Malaysia (13) | Public Bank Berhad | User-scan method (MPM) | January 2024 |

| NAVER Pay | South Korea (1) | Naver Financial Corporation | User-scan method (MPM) | January 2024 |

| OCBC Digital | Singapore (9) | Oversea-Chinese Banking Corporation Limited |

User-scan method (MPM) | January 2024 |

| Octopus (八達通) |

Hong Kong (5) | Octopus Cards Limited | User-scan method (MPM) Store-scan method (CPM) |

September 2025 |

| Plus Pay (全盈+PAY) |

Taiwan (3) | All Win Fintech Company Limited | User-scan method (MPM) Store-scan method (CPM) |

Integration scheduled |

| PXPay Plus (全支付) |

Taiwan (3) | PXPay Plus Co., Ltd. | User-scan method (MPM) Store-scan method (CPM) |

February 2024 |

| Tinaba | Italy (18) | Tinaba S.p.A Banca Profilo S.p.A |

User-scan method (MPM) | January 2024 |

| Toss | South Korea (1) | Viva Republica Inc. | User-scan method (MPM) | January 2024 |

| Touch ‘n Go eWallet | Malaysia (13) | TNG Digital Sdn Bhd | User-scan method (MPM) | June 2023 |

| TrueMoney | Thailand (6) | TRUE MONEY COMPANY LIMITED | User-scan method (MPM) | June 2023 |

| Taishin Pay + (台新Pay+) |

Taiwan (3) | Taishin International Bank Co.,Ltd. | User-scan method (MPM) Store-scan method (CPM) |

Integration scheduled |

| WeChatPay (微信支付) |

Mainland China (2) | Tenpay Payment Technology Company Limited |

User-scan method (MPM) | September 2025 |

*2. (Reference) From “Foreign Visitors by Nationality/Month (2003-2025)” by the Japan National Tourism Organization (JNTO), based on the cumulative number of visitors in 2024.

■ About Octopus

Octopus is the most widely adopted cashless payment method in Hong Kong, offering versatile payment solutions that extend from public transportation to retail, food and beverage, utility bills, and online transactions. It has become an integral part of daily life in Hong Kong, with approximately 5 million users.

■ About HIVEX

HIVEX® delivers a better user experience by offering mobile payment service providers (MPSPs) common business rules, system integration, consistent and neutral branding, and greater scalability at the commercial level. By partnering with HIVEX®, cross-border payments that were previously unfeasible are now possible.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Cards (Registration number: Kanto (Ku) No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration date: September 25, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No. 942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages (Designation No.: Minister of Health, Labour and Welfare No. 00001 / Date of designation: August 9, 2024)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Certificates.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money (Paycheck) refers to PayPay Money that can only be purchased with wages received by the PayPay user in their Paycheck Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, Time-Limited PayPay Points are restricted to payments for certain services provided by LY Group. It cannot be transferred between PayPay users or cashed out. Additionally, PayPay Points (Time Limited) have an expiry date. which can be confirmed in the details or conditions of the LY Group measures or promotional campaigns. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued. PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.