PayPay Corporation, a joint venture between SoftBank Group Corp., SoftBank Corp., and Yahoo Japan Corporation is pleased to announce that its smartphone payment service, “PayPay” continues to grow steadily since its launch in October 2018, as described below.​ ​

On April 22, 2020, the number of registered users exceeded 28 M (*1)

The number of merchants exceeded 2.2M (*2)

Since December 2019, the number of monthly payments exceeded 100 M times (*3), mainly for daily shopping & take-outs such as groceries and everyday goods (*3)

PayPay has run a variety of monthly campaigns at merchant stores across the country, making improvements to make the app easier to use while expanding the number of merchants. In particular, in order to eliminate the “fear of fraudulent use” that was often cited as a reason to avoid using smartphone payments, PayPay has set up a 24/7 contact service to provide, in principle, full compensation in the event of any damages. This initiative (*4) has been well received by users who are new to smart phone payments. We believe that responding to user opinions sincerely and continuing to improve the service has led to expand the daily use of PayPay, and we will continue to strive to create an environment where all PayPay users and merchants can use PayPay with convenience and security.

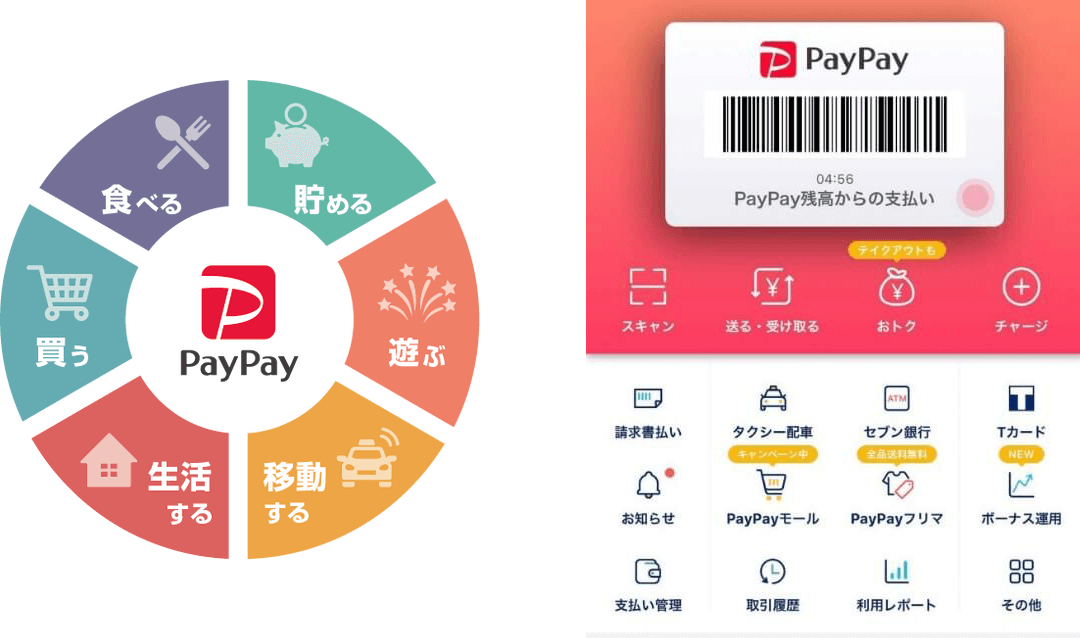

Building upon the “payment” feature already enjoyed by many users, “PayPay” will continue to increase the lineup of features in the “super app” that will make users’ lives richer and more convenient. In particular, in fiscal 2020, we will collaborate with financial institutions and companies with a focus on new financial services and promote a multi-partner strategy that will not be limited to our own group. (*5)

Please note that, during the last fiscal year, as part of our efforts to become a “super app,” we implemented the following measures.

■ Launch of “Mini App”

The company has launched a “Mini app” feature that enables customers to do everything within the PayPay app from making reservations to ordering products and paying for services provided by partner companies. As the first step, the company has partnered with the taxi dispatch service “DiDi” to provide a service that completes the entire process from taxi dispatch to payment on the PayPay app from November 28, 2019. In addition, other Mini apps such as “PayPay Flea Market”, “PayPay Mall” and “Bonus Management” have been added as well as “Uber Eats” and other “food delivery” additions to come in the future. “PayPay” will continue to evolve as a service that provides a cashless payment experience while making people’s lives richer and more convenient.

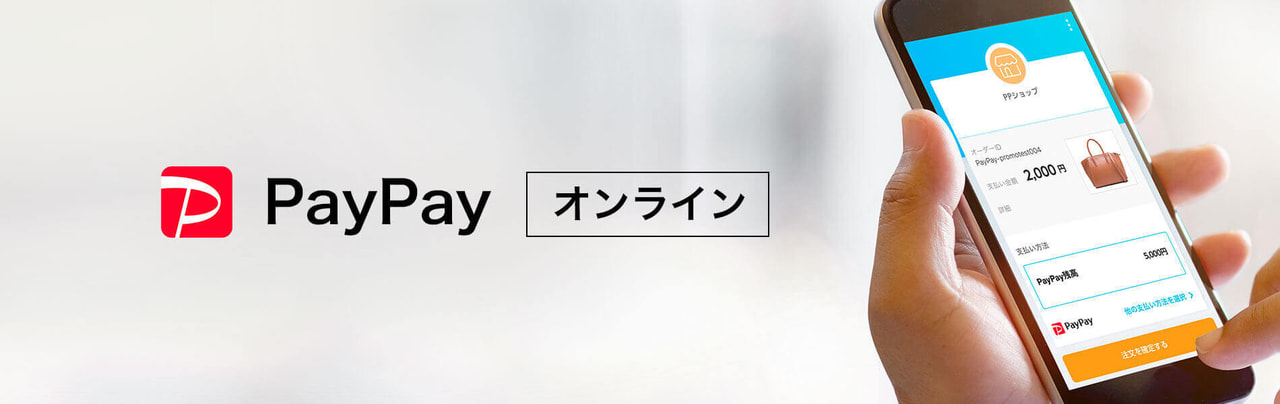

■ Support for online shopping payments

Users can pay with “PayPay” for Yahoo!Shopping, PayPay Mall, ebookjapan, and other online shopping sites. Adding to these services, PayPay will quickly expand the use of its smartphone app as a means of payment for more merchants in e-commerce and digital content fields across the country.

*For online shopping, a “PayPay” payment tone will be played along with the payment completion screen to notify users that the payment has been completed. (Please click here to see how to adjust the volume.)

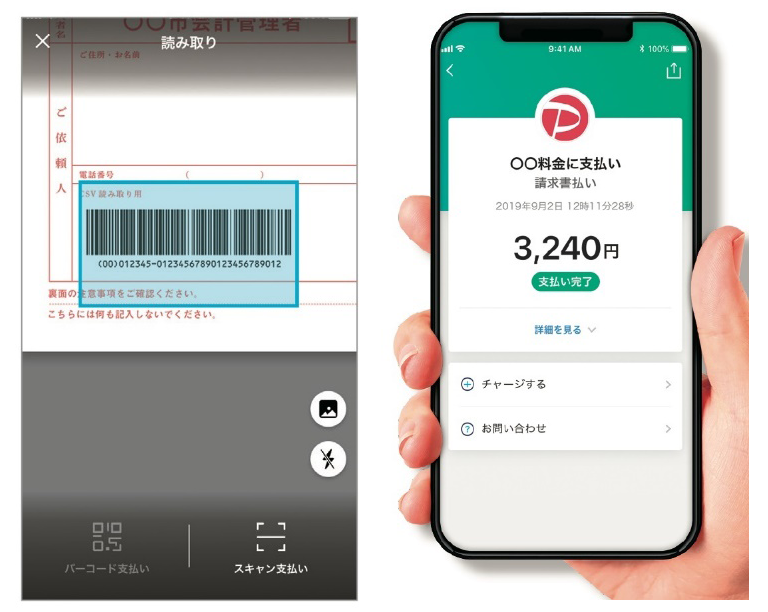

■ More invoices supporting PayPay

As the COVID-19 outbreak forces people to refrain from going out, more and more users are using “PayPay” to make payments at home by scanning the barcode on utility bills and mail order bills, such as electricity, gas, and water bills. With the PayPay app, users can make payments 24 hours a day from anywhere they wish, without missing the deadline or having to go out to withdraw cash. It also saves time, trouble and bank fees. Please click here to check the applicable utility charges and local governments.

In response to the growing problem of COVID-19 across the country, the following “Mini App” initiatives are also being undertaken.

■ Provision of pre-ordering and pick-up services in restaurants

As a new service to connect restaurants and users, PayPay plans to launch a pick-up service that enables users to order and pay in advance from the restaurant page in the PayPay app and pick up items at the store. Users can take out products with great handiness, minimizing time spent in the store as well as contact with other customers. Pre-payment also benefits merchants who can reduce the risk of uncollected payment due to no-shows of customers.

The service will begin on a trial basis in May 2020 with the cooperation of some merchant stores, and will be fully rolled out to restaurants across the country from June. In addition, a dedicated site will soon be made available to accept applications from companies and merchants that wish to implement the service.

■ Supporting delivery services

From May 4, 2020, “PayPay” will be available for delivery services that are experiencing a dramatic increase in social demand. “UberEats” will implement “PayPay” as an app and online payment method in some regions, and other delivery services will also start handling “PayPay” from May.

■ Support through “Kisekae (Theme)”

PayPay launched an initiative where users purchased support goods (Kisekae) with “PayPay” for JPY300 (tax included), and the entire amount of the purchase minus consumption tax was donated to Peace Winds Japan, a non-profit organization that provides emergency support for reconstruction from the Great East Japan Earthquake and for the spread of novel coronavirus infections.

​A special page was published on March 11, 2020 to announce the launch of “Kisekae”, which can be used within the PayPay app, and immediately received a large response from users, with 62,678 supporters and JPY18.8B raised through March 31, raising a total of JPY17M after deducting JPY1.7M in consumption tax. PayPay will continue to consider other ways of contributing and taking action.​ ​

PayPay will continue to provide the convenience of smartphone payments not just to users but also to all available retailers and service providers, aiming to create a world where anyone can feel safe to shop without cash, anywhere in the country. “PayPay” will continue on the path to evolve from a “payment” app to a “super app”, continuing to carry out measures that will provide even more convenience and enrich users’ lives.

*1 The number of users who registered for an account after downloading the PayPay app.

*2 The number of applications for PayPay merchant agreements at stores, taxis, etc. The number of stores is as of April 26, 2020.

*3. This does not include the number of times users used the “Send/Receive” PayPay Balance feature between users or the number of times users made payments using the Alipay app.

*4 For details, please refer to “PayPay’s Safety Initiatives” on our website

*5 In linking and providing services, relevant companies must meet the legal requirements necessary to carry out the business in question.

*Company names, store names, product names, and service names contained in this press release are registered trademarks or trademarks of their respective owners.