PayPay Corporation, a joint venture of SoftBank Group Corp., SoftBank Corp., and Yahoo Japan Corporation, is committed to providing cashless payment services. Today, we are pleased to announce our key metrics, including the number of registered users and other key initiatives we have implemented in the first half of fiscal year 2020

【Number of Users, Merchants, and Payments】

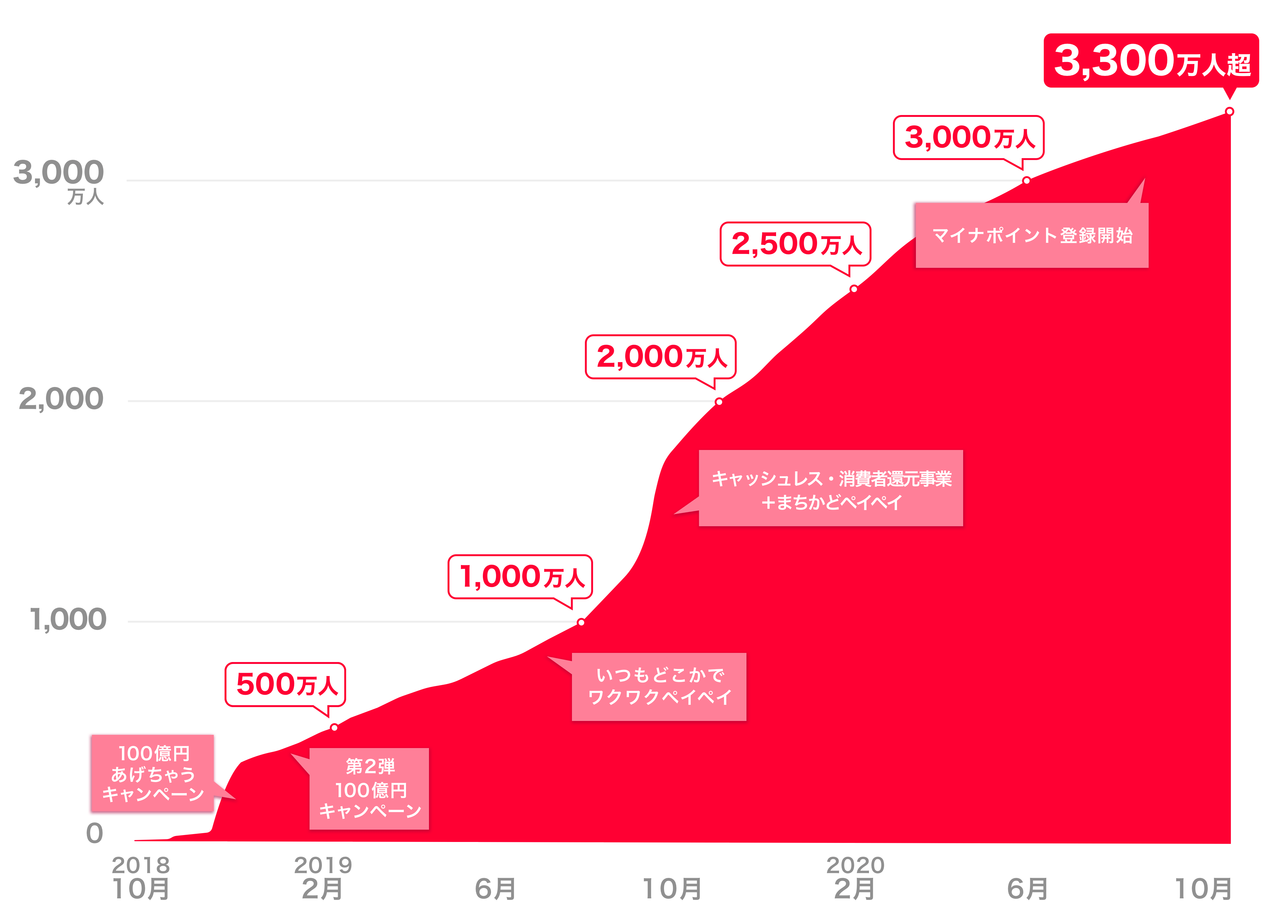

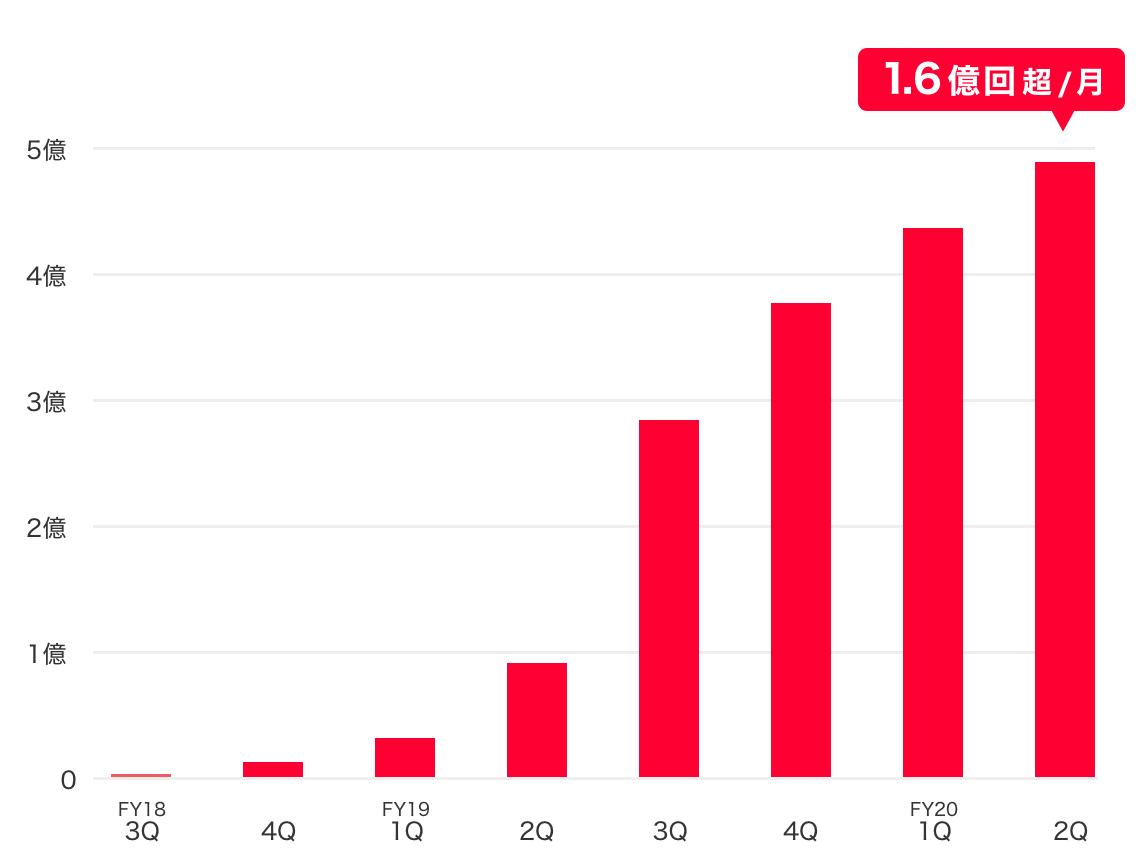

The number of registered users, merchants and payment frequency grew steadily, despite the impact caused by the spread of the novel coronavirus infection (COVID-19). The number of payments, in particular, averaged more than 160 million per month in the second quarter of fiscal year 2020 (July-September), thanks to growth in the number of payments at online merchants with an expanded number of stores.The number of payments in the second quarter was more than five times higher than in the same period a year ago (second quarter of fiscal year 2019).

- Number of registered users : topped 33 million on October 19, 2020 (* 1)

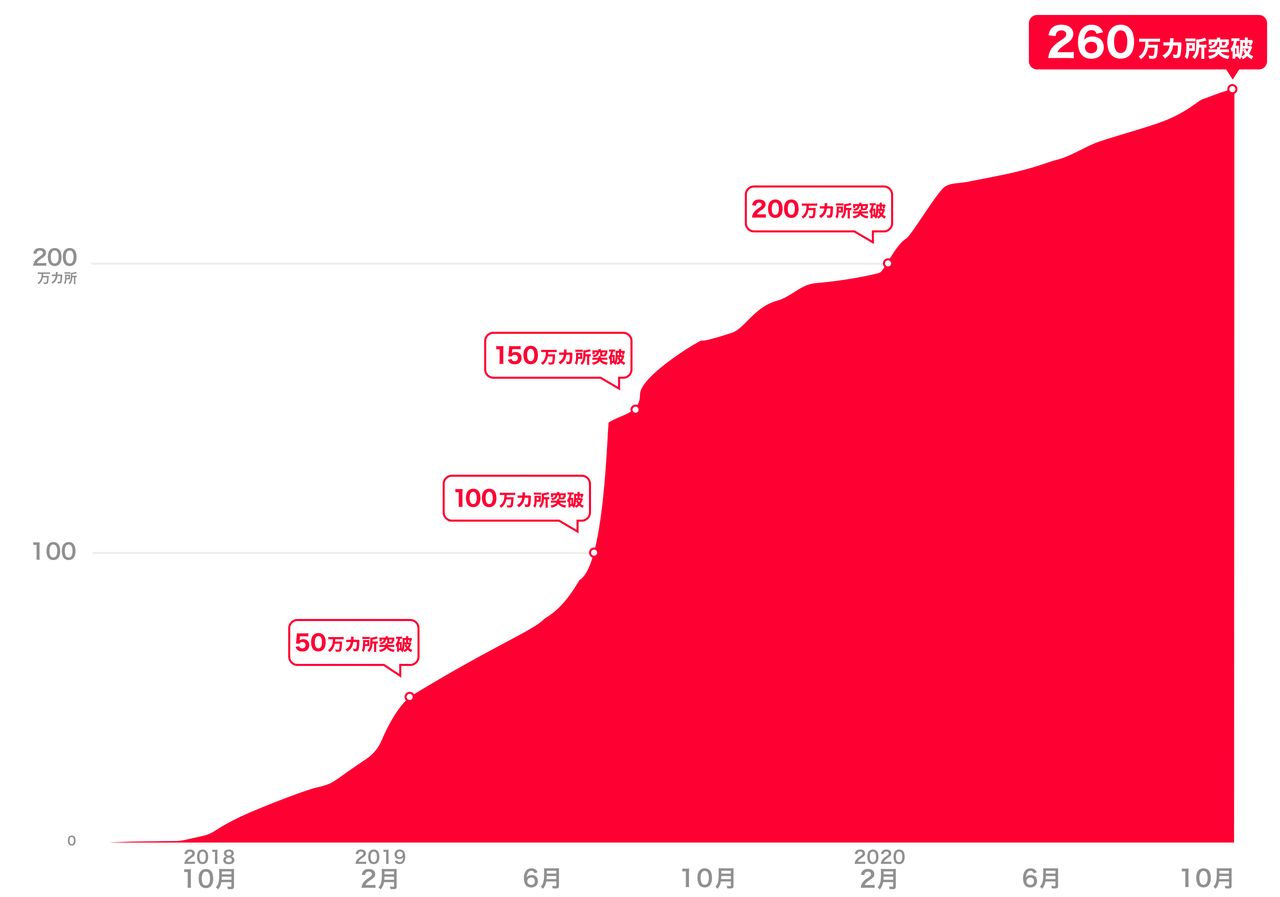

- Number of member stores: Over 2.6 million (* 2)

- Payment frequency : average of 160 million times or more per month in the second quarter of 2020 (* 3)

Changes in the number of registrants

Changes in the number of registrants Changes in the number of member stores

Changes in the number of member stores Changes in the number of payments

Changes in the number of payments

*1 Number of users who have signed up for an account.

*2 The number of locations registered with “PayPay” such as stores and taxis. As of October 19, 2020.

*3 This does not include the number of times users used the “Send/Receive” PayPay Balance feature between users or the number of times users made payments using the Alipay app.

【Efforts of “PayPay” for the current term】

“PayPay” in Corona is a platform that promotes electronic payments recommended in new lifestyles, and has contributed to the digitization of the region together with local governments. We also supported the digitization of member stores, such as by launching a pre-order service “PayPay Pickup” that encourages restaurants to use take-out. On the other hand, for users, we have implemented a number of initiatives to promote convenient mini-apps, advantageous campaigns, safety and security. PayPay will continue to support digitalization through the promotion of cashless payments, the addition and expansion of services, and efforts to improve user convenience and social productivity.

Addition of new services and expansion of existing services

- Pre-order service “PayPay Pickup” now available

- Added financial services such as mini-app “bonus operation” and “borrow money”

- Expanded payment destinations for “PayPay invoice payment”

Implementation of advantageous campaigns

- Implementation of new campaigns such as “PayPay Jumbo”

- Accepting applications for “Mina Point Business” and conducting campaigns

Initiatives using “PayPay” as a platform

- Implemented efforts to prevent the spread of new coronavirus infection (COVID-19)

- Launched “Supporting Your Town Project” to work with local governments

Efforts to promote safety and security

Efforts for employees to work freely and demonstrate their performance

■ Started offering “PayPay Pickup”, a pre-order service

From June 2020, we started to provide the pre-order service “PayPay Pickup”, which allows you to complete orders in advance within the “PayPay” app and receive products at stores, nationwide. To prevent the spread of the new coronavirus infection (COVID-19), the need for ready-to-eat meals such as take-out has increased, and the number of registered stores of “PayPay Pickup” has exceeded 10,000 in about 100 days (* 4). Did. Also, if you pay for the take-out (take-out) products offered by the target restaurant from October 17th to November 15th, 2020, you will receive a PayPay Bonuses of 20% of the payment amount (upper limit of grant: 500). We are implementing the “Autumn PayPay Pickup Campaign” in which yen equivalent / time, 2,000 yen equivalent / period) will be returned.

*4 As of September 16, 2020

■ Added financial services such as mini-app “bonus operation” and “borrow money”

One Tap BUY Co., Ltd. provides a service “bonus operation” that allows you to experience simulated operation using PayPay bonuses, and Japan Net Bank Co., Ltd. provides “borrow money” that allows you to apply for and borrow card loans. It is now available from the top screen of “PayPay”. “Bonus investment” exceeded 1 million operators at the fastest speed in the industry (* 5) on July 13, 2020, 90 days after its appearance, and as of September 28, it has exceeded 1.5 million operators. In the second half of fiscal 2020, we will continue to focus on financial services and promote a multi-partner strategy that is not limited to our own group, while cooperating with each financial institution and companies that handle financial products.

*5 Comparison by major point managers (au PAY point management, Credit Saison permanent immortal point management service, d point investment, Rakuten point management, in alphabetical order) (as of June 29, 2020, according to OneTapBUY survey).

■ Expanded payment destinations for “PayPay invoice payment”

We have expanded the number of payees that support “PayPay bill payment”, which allows you to scan the barcodes on payment slips for utilities and taxes that arrive at your home with your smartphone and complete payments at home. With “PayPay Invoice Payment,” you can pay taxes and utilities 24 hours a day, anywhere, saving you the time and effort of withdrawing cash and saving fees for withdrawals. In addition, up to 1.5% (* 6) of the payment amount will be given as a PayPay bonus (* 7), so you can pay more profitably than when paying at a convenience store. As of October 12, 2020, the number of paypay recipients for “PayPay invoice payment” has reached 1,139, and we will continue to expand in the future. Please check here for available utility charges and local governments.

*6 Please check here for the grant rate.

*7 There is the following upper limit for each person.

– “Maximum grant for one payment”: Equivalent to 7,500 yen

– “Maximum total grant for one month”: Equivalent to 15,000 yen including the grant of “Maximum 1.5% granted by paying with PayPay” and “Special service use privilege”

■ Implementation of new campaigns such as “PayPay Jumbo”

We have implemented a number of unique campaigns that are possible only with cashless payments and smartphone payments by combining various profitable mechanisms and genres of member stores. Even now, PayPay holds monthly exciting campaigns by setting shops, genres, regions, etc. where you can enjoy shopping at a great value. In the current fiscal year, a lottery was held for those who settled using “PayPay”, and on the spot, “PayPay Jumbo” was implemented as a new campaign, which shows whether or not there was a win and the amount of PayPay bonus given. As a new payment experience that incorporates entertainment, many users are enjoying shopping more. In addition, as a new initiative this year, the campaign that was previously carried out as a “good shopping day” will be refurbished as a new “Super PayPay Festival” in collaboration with SoftBank Corp. and Yahoo Japan Corp. So, it will be held from October 17th to November 15th, 2020. “Super PayPay Festival” is a general term for multiple campaigns that last for about a month, allowing you to enjoy shopping offline or online at a great price using “PayPay”. More than 30 such as “Super PayPay Festival! Finale Jumbo” We are carrying out a great deal during the period.

■ Accepting applications for “Mina Point Business” and conducting campaigns

In the “Mina Point Project” that the Ministry of Internal Affairs and Communications will implement from September 1, 2020, “PayPay” is also covered, and applications have started from July 1. The number of registered applications has already exceeded 1.5 million, and it continues to be favorable. In addition, “PayPay” has become the No. 1 registered payment service (* 8) in the “Mina Point Business”. As a new initiative, PayPay is for those who have registered “PayPay” as Mina Point, and if you pay using “PayPay” at the target stores and target online affiliated stores nationwide, the maximum payment amount will be calculated by lottery. From November 23 to December 28, 2020, “Mina Point Registrants Only! Monday Jumbo” will be given the full amount (100%) of PayPay bonus (upper limit: 100,000 yen equivalent / time and day). It will be held every Monday (6 times in total).

*8 Survey on minor point usage (n = 10,708, research institution: ICT Research Institute)

■ Implemented efforts to prevent the spread of new coronavirus infections

As an initiative to prevent the spread of the new coronavirus infection (COVID-19), PayPay will be a new corona tech partner in Tokyo from June 27, 2020, on the “PayPay” app. Tokyo version of the new corona watching service Is now available. In addition, in Osaka Prefecture, along with the further spread and expansion of the “Osaka Corona Tracking System”, we became an app provider of the “Osaka Ookini App Business”, a business aimed at promoting cashless payments in the prefecture. It has been selected. In late October, “Osaka big app business We are planning to provide “PayPay table order” (* 9) that allows you to place orders and make payments using PayPay in the restaurants registered in “”. In addition, “General activities of the Japanese Red Cross Society, including support for the new coronavirus Many PayPay users also supported the support. Going forward, we will continue to consider what PayPay can do to combat infectious diseases such as the new coronavirus infection (COVID-19).

*9 Details such as how to use “PayPay Table Order” will be announced at a later date.

■Launched “Supporting Your Town Project” to work with local governments

In response to the great impact of the new coronavirus infection (COVID-19) on the local economy, the “Support Project for Your Town” is a joint project with local governments that utilizes the payment platform of “PayPay“. Was launched in July 2020. In this project, as of October 7, 2020, about three months after its inauguration, 90 (* 10) campaigns have been decided to be implemented by 82 local governments nationwide. By using “PayPay”, local governments do not need to issue, cash, or print regional promotion tickets and gift certificates, which makes it possible to reduce costs, while users can purchase gift certificates at specific locations. There are many benefits for both local governments and users, such as eliminating the need to go out, and we plan to increase the number of campaigns implemented in the future.

*10 One local government may carry out multiple campaigns, and the total number of campaigns is the number.

■ Implemented anti-fraud measures to ensure an even safer use of PayPay

In order to use cashless payments safely and securely, PayPay is conducting fraud detection by the system and monitoring by dedicated staff 24 hours a day, 365 days a year, including cooperation with financial institutions that cooperate with PayPay. If the usage is detected and judged, the use of the target account will be stopped immediately. In addition, a full compensation system has been established since August 2019 in the unlikely event of damage. In the current fiscal year, in order to further strengthen security, when introducing a patent application function in the SMS authentication function and registering a financial institution account with PayPay, necessary information such as documents and personal portraits are registered on the PayPay app. However, we have expanded the scope of financial institutions that carry out “Easy Confirmation (eKYC)“, a method for verifying identity. For commitment to safety that has been done in the PayPay, click here please visit. PayPay will continue to prepare the environment so that many users can use the service safely and securely.

■ Started PayPay’s new way of working “Work From Anywhere at Anytime (WFA)”

On September 1, 2020, we launched “Work From Anywhere at Anytime (WFA),” a new way of working where you can work freely anywhere in Japan, as long as you can demonstrate your performance. By implementing WFA, we will not only reduce the risk of infection of employees with the new coronavirus infection, but also realize efficient work styles according to the situation while giving consideration to safety even in the event of a disaster. .. In addition, with the introduction of WFA, we have redefined the office as “a place to create new value through teamwork” and “a place to increase employee engagement” instead of a place to work individually. .. Based on this definition, we jointly designed and built a new office with an active communication area and a new free address area with significantly reduced seats as an “office in the new normal era” in collaboration with WeWork Japan GK. , Moved in late September. PayPay will continue WFA even after the settlement of the new coronavirus infection and will continue to improve the way of working.

PayPay will continue to offer the convenience of cashless payments to users as well as all kinds of retailers and service providers, with the goal of creating a world in which a safe cashless shopping experience can be enjoyed anywhere in Japan. “PayPay” will continue on the path to evolve from a “payment app” into a “super app” that will make users’ lives richer and more convenient, fostering a culture of “Anytime, Anywhere with PayPay.”

■ About “PayPay,” the cashless payment service provided by PayPay Corporation

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis and even public transportation. It can also be used in a variety of other scenes, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay balance (PayPay Money and PayPay Money Lite) between each other for free, or “bonus management”, a service that allows users access to a simulated investment experience involving the exchange of PayPay Bonus with points provided by a Type 1 Financial Instruments Business Operator that PayPay partners with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay is registered as follows:

Prepaid Payment Instruments (third party type) Issuer, registration Number : Director-General of the Kanto Finance Bureau, No. 00710

Fund Transfer Operator, registration number : Director-General of the Kanto Finance Bureau, No. 00068

* There are four types of “PayPay” (PayPay balance): PayPay Money, PayPay Money Lite, PayPay Bonus, and PayPay Bonus Lite. PayPay Money can be used for payments at affiliated services and affiliated stores within the amount of money deposited to the PayPay account opened through the identity verification procedure prescribed by the Company, and remittances can be made between PayPay users with no fees. You can pick it up. You can also withdraw PayPay money and deposit it into the specified bank account (if you specify Japan Net Bank, the withdrawal fee is free). This legal property is an electromagnetic record that can be used to repay the price of goods, etc., and can be remitted and withdrawn, and the funds registered under Article 37 of the Funds Settlement Law. It is issued by our company, which is a remittance company. PayPay Money Lite is electronic money issued by our company, which can be purchased and used for payments at affiliated services and affiliated stores, and can be transferred or transferred between PayPay users at no charge. This legal nature refers to the prepaid payment method (Article 3, Paragraph 1 of the Law Concerning Settlement of Funds) issued by the Company. In addition, PayPay Bonus and PayPay Bonus Lite, which are given free of charge for benefits and campaigns when using “PayPay”, can also be used for payments at affiliated services and affiliated stores, just like PayPay Money and PayPay Money Lite. I will. However, you cannot transfer, transfer or withdraw money between PayPay users. The PayPay Bonus Lite has an expiration date, which expires after the expiration date.

In addition, we are creating an environment where users can use it with peace of mind. If the PayPay account you are using has an unfamiliar claim due to third party use, or if you do not have a PayPay account but have been billed by PayPay, the prescribed compensation conditions will be applied. Assuming that you meet the requirements, you can receive compensation for the amount of damage (if you receive compensation from a third party, the amount after deducting the compensation amount). For more information, please click here.