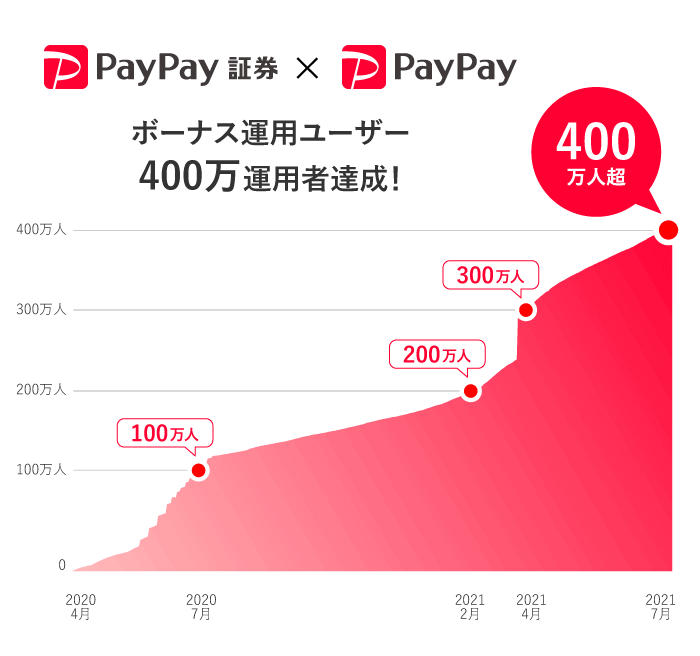

In April 2020, PayPay Securities Corporation (Minato Ward, Tokyo, President &CEO: Masaaki Uchiyama, hereinafter PayPay Securities), with its corporate mission to “Make asset management more accessible,” together with PayPay Corporation (Chiyoda Ward, Tokyo, President & Representative Director, CEO, Corporate Officer: Ichiro Nakayama, hereinafter PayPay), started “Earn Bonus,” a simulated investment management experience service provided as a mini app (*1) in the cashless payment service app “PayPay.” Since then, in approximately one year and three months, the number of users has reached four million.

Reaching four million users in about 15 months from its release date is the fastest (*2) among major simulated investment point management service providers that provide “point management services.”

*1 A feature in the “PayPay” app that allows users to use services provided by PayPay Corporation’s partner companies, such as booking services and ordering or paying for products from within the “PayPay” app, without having to download the partner’s app.

*2 Comparison among major simulated investment point management service providers (dPOINT investment, Rakuten Point management, T-POINT investment, in alphabetical order) (as of July 27, 2021, researched by PayPay Securities).

■ Approximately 1 in 10 PayPay users are using it! 96.2% are in the positive (*as of July 27, 2021)

“Earn Bonus” is a service with which users can exchange “PayPay Bonus” (*3) for unique points provided by PayPay Securities (*4) and use them for a simulated investment management. PayPay Securities and PayPay began offering this service in April 2020 with the aim of making investments more approachable by lowering the barrier to entry. As users do not have to open a bank account or go through any additional procedure and anyone can immediately start with their investment experience on the “PayPay” app, the service gathered a lot of support. In only one year since its launch, the number of users topped three million, and in about three months afterwards, exceeded four million.

The number of registered “PayPay” users is now above 40 million (*5), which means that about 1 in 10 “PayPay” users make use of “Earn Bonus.” In addition, 96.2% of “Earn Bonus” users’ investments (*as of July 27, 2021) are in the positive (*6).

“Earn Bonus” will continue to be updated so that more customers can use it and become comfortable with investing. In addition, “PayPay” will further strengthen the provision of its financial services and evolve from a payment app to a “super app,” which can help users solve all their problems, thus fostering a culture of “Anytime, Anywhere with PayPay.”

*3 This is the balance granted as PayPay Balance with the application of benefits, campaigns, etc.

*4 The unique points provided by PayPay Securities are currently used only with “Earn Bonus” and exchanging them for PayPay Bonus. They cannot be used with other services.

*5 The cumulative number of registered users. For details, please see this press release.

*6 This does not imply or guarantee future investment performance.

■ Features of PayPay “Earn Bonus”

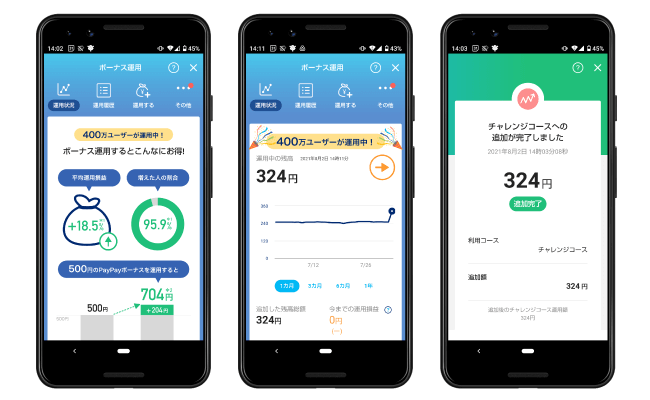

① Can start at once with the “PayPay” app

There is no need to open a dedicated securities account or register an ID. As long as a user has the “PayPay” app, they can immediately start their simulated investment management experience.

There are no commissions or other such fees.

② Can manage starting from 1 yen. Free access at all times

Users can manage their “PayPay Bonus” starting from one yen to whatever amount they like, and can also withdraw the bonus whenever they want to use it.

Since all of the “PayPay Bonus” can be managed, it is possible to continue investing even with a small amount.

③ Only two courses to choose from

Simply select from two types of management options, the “Standard Course” or the “Challenge Course,” and start managing.

Both courses are linked to ETFs consisting of 500 of the most prominent companies in the United States.

④ “Auto add” feature that automatically tops up on bonus management

This function allows users to automatically top up their “PayPay Bonus” to bonus management.

This simplifies the process of adding a “PayPay Bonus” each time it is granted.

*”Earn Bonus” is a service with which users can experience a simulated investment management utilizing PayPay Bonus and is not a transaction using securities and such as specified under the Financial Instruments and Exchange Act.

*This does not imply or guarantee future investment performance.

*PayPay Balances other than PayPay Bonus that can be used within the PayPay app (PayPay Money, PayPay Money Lite, PayPay Bonus Lite) cannot be used for “Earn Bonus.”

*The points used in “Earn Bonus” will increase or decrease, reflecting the market price of the ETFs handled by PayPay Securities. However, this is not an actual investment or management.

■ PayPay Securities official URL

・”PayPay Securities Japan-US Stocks” app: http://bit.ly/3sjrtPL

・Official website: https://www.paypay-sec.co.jp/

・SNS Accounts:

<Twitter> https://twitter.com/paypay_sec

<Facebook> https://www.facebook.com/paypaysec/

<note> https://note.com/paypay_sec_edit

■ PayPay Securities Corporation

As the first smartphone securities company in Japan, PayPay Securities launched its services in June 2016 with the aim to create an environment where anyone can easily make investments, so that asset management would be more approachable. Until now, it has developed services such as “Japan-US Stocks,” “Regular Robot Savings,” “Tenfold CFD,” “Japan Stocks CFD,” and “Anyone IPO.” In April 2020, the company started providing “Earn Bonus,” where users can experience simulated investment management with PayPay Bonus.

PayPay Securities will continue to offer “unprecedented financial services” that are “simpler than anything else” and “easiest to use,” in order to help customers become familiar with stock investments.

■About “PayPay,” the cashless payment service provided by PayPay Corporation

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis and even public transportation. It can also be used in a variety of other scenes, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay balance (PayPay Money and PayPay Money Lite) between each other for free, or “bonus management”, a service that allows users access to a simulated investment experience involving the exchange of PayPay Bonus with points provided by a Type 1 Financial Instruments Business Operator that PayPay partners with.

The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay Corporation is registered under the following businesses and associations:

・Prepaid Payment Instruments (third party type) Issuer, Registration#: Director-General of the Kanto Finance Bureau, No. 00710

・Fund Transfer Operator, Registration#: Director-General of the Kanto Finance Bureau, No. 00068

・Bank Agency Operator, License:Director-General of the Kanto Finance Bureau, No. 396

・Telecommunications Carrier Registration: A-02-17943

・Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc. (Registration: Kanto (K) No.106/ Registration date: July 1, 2019)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1,2019)

・Financial instruments intermediary service registration number: Kanto Finance Bureau Director (Kinchu) No. 942

*There are four types of “PayPay” (PayPay Balance): PayPay Money, PayPay Money Lite, PayPay Bonuses, and PayPay Bonuses Lite. PayPay Money can be used for payments at affiliated services and affiliated stores within the amount deposited in a PayPay account opened after completing the identity verification procedure specified by PayPay, and can be sent and received between PayPay users free of charge. You can also withdraw PayPay Money and deposit it into a designated bank account (there is no withdrawal fee if you specify PayPay Bank). This legal nature is an electromagnetic record that can be used to pay for goods, etc., and can be sent and withdrawn, and is issued by PayPay, a registered funds transfer business operator under Article 37 of the Payment Services Act. PayPay Money Lite is electronic money issued by PayPay, which can be purchased and used for payments at affiliated services and affiliated stores, and can be transferred and received between PayPay users free of charge. This legal nature refers to a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). In addition, PayPay Bonuses and PayPay Bonuses Lite, which are given free of charge as part of special offers and Offers when using “PayPay”, can be used for payments at affiliated services and affiliated stores, just like PayPay Money and PayPay Money Lite. However, they cannot be transferred, transferred or withdrawn between PayPay users. PayPay Bonuses Lite has an expiration date and will expire after the expiration date.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.