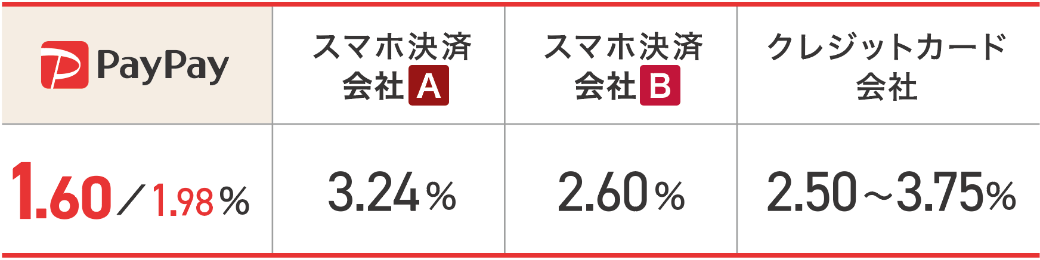

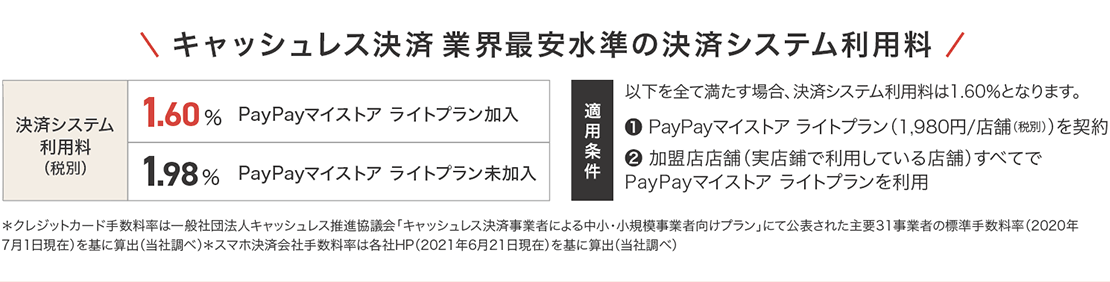

PayPay Corporation, a joint venture of SoftBank Group Corp., SoftBank Corp., and Yahoo Japan Corporation, hereby announces the decision to implement a payment system fee for merchants (with annual sales of 1 billion yen or less) (*1) at the lowest rate in the cashless industry (*2). To enable merchants using “PayPay” to continue to do so at a low cost beyond October 1, 2021, the minimum fee rate will be set at 1.60% (tax excluded) of the transaction amount for payments made using “PayPay.” The payment system fee will vary according to the status of the “PayPay My Store Lite Plan” contract that can be used to direct customers to stores.

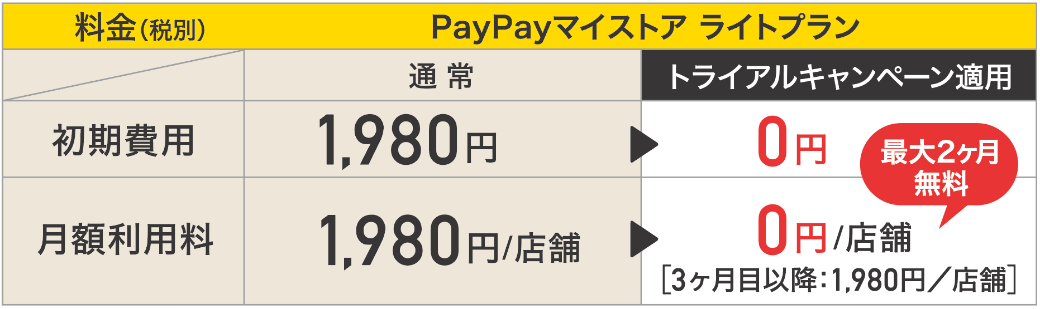

“PayPay My Store Lite Plan” (1,980 yen per month per store (excluding tax)) is a service for merchants which they can utilize for sales activities, such as issuing “PayPay Coupons. (*3) “PayPay Coupons” is a feature that allows various merchants, from major chain stores to local shops in town, to issue their own coupons on the PayPay app. It can be employed to promote sales to more than 41 million registered “PayPay” users. (*4) The payment system fee from October 1, 2021 will be determined according to the “PayPay My Store Lite Plan” contract status. (*5) By signing up for “PayPay My Store Lite Plan,” merchants can utilize the payment platform of “PayPay” to boost sales while also paying a cheaper payment system fee to use “PayPay.” In the future, features other than “PayPay Coupons” are scheduled to be added to “PayPay My Store Lite Plan,” which stores can use for their business activities and to further advance digitalization and digital transformation (DX).

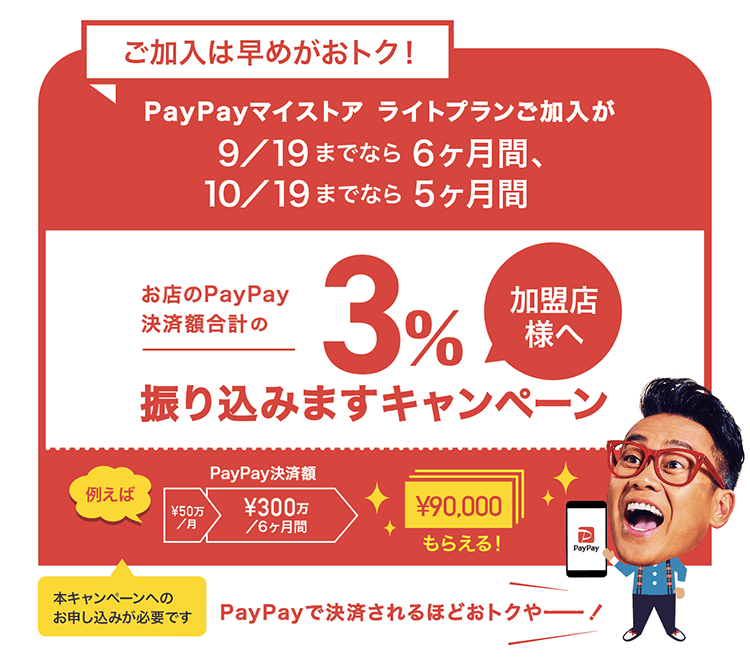

PayPay will also implement the “3% to Your Account” campaign as a project to support local stores. It is available to merchants that sign up for “PayPay My Store Lite Plan” (*6) during the application period and enter the campaign. On a later date, they will receive 3% of the payments made through “PayPay” for a period of up to six months (maximum amount to be transferred: total of one million yen per company or individual (*7)). *Check the campaign page for details.

In addition, there is currently a “PayPay My Store Lite Plan” trial campaign, in which the initial fee of 1,980 yen (excluding tax) and the monthly fee of 1,980 yen (excluding tax) per month per store is waived for up to two months.

Please refer to the table below for the payment system fees according to the “PayPay My Store Lite Plan” contract status. In order to make it possible for merchants to use “PayPay” at low cost even with payment system fees, PayPay has set the lowest rates in the cashless payment industry. (*2) From October 2021, PayPay’s standard payout cycle will be set to once a month. By applying for the early payout service, merchants can choose more payout cycles.

PayPay has not only been providing the payment system for free from the launch of its services until the end of September 2021, but also implemented “Machikado PayPay,” where benefits, such as an extra 5% PayPay Bonus grant, was added to the “METI Cashback Program” carried out by the government. Through these initiatives, PayPay has supported local stores that have previously never employed cashless payments, thus promoting cashlessness. The number of locations registered with “PayPay” has exceeded 3.4 million (*8) in about three years since the service was released. PayPay believes that this is the result of merchants and users accepting the efforts made by the company to promote cashlessness. PayPay will continue to support local stores to go cashless and help further cashlessness in Japan.

■ Costs for merchants (*1) adopting “PayPay” (annual sales of one billion yen or less) (from October 1, 2021)

- Payment system fee: 1.60% or 1.98%

- Initial installation costs: 0 yen

- Bank transfer fee: 0 yen (in case of monthly transfers) (*9)

*1 Corporations with annual sales exceeding one billion yen that became “PayPay” merchants before April 1, 2020 and can use the payment system for free until the end of September 2021 will also be charged a payment system fee from October 2021. Corporations with annual sales exceeding one billion yen which became “PayPay” merchants after April 1, 2020, were already being charged a payment system fee.

*2 Fees charged by credit card companies have been drawn for comparison from “Plans Provided by Cashless Payment Service Providers for Small-scale Merchants and Small and Medium-sized Enterprises,” published by PAYMENTS JAPAN. This document indicates the standard fee rates provided by 31 major service providers (as of July 1, 2020). Fees of mobile payment companies are taken from each company’s website (as of August 2, 2021) for comparison (both researched by PayPay).

*3 A separate usage fee will be charged for payment transactions that involve the use of “PayPay Coupons.” In addition, merchants will be required to bear the funding costs for granting a PayPay Bonus when users use a PayPay Coupon.

*4 Cumulative number of users who have registered an account as of August 2021.

*5 PayPay will confirm the “PayPay My Store Lite Plan” contract status on the 20th of each month, and based thereon set the payment system fee for the following month, beginning from the 1st.

*6 All of the following conditions must be met for the campaign to apply. For other conditions, please check the campaign page.

・ An application is submitted using the dedicated form during the application period to participate in the campaign.

・An application for the “PayPay My Store Lite Plan” is completed by all stores owned by the merchant during the application period.

*7 This applies to both small business owners and incorporated enterprises.

*8 Cumulative number of locations registered with “PayPay,” including stores and taxis as of August 2021.

*9 Bank transfer fee will be waived if books are closed at the end of the month (payouts once a month). In other cases, fees will be charged. If a merchant subscribes to the early transfer service (automatic), they will be charged a bank transfer fee and an additional fee of 0.38% (excluding tax). Please check here for details of the usage fee and bank transfer fee. If a merchant does not apply for the early transfer service (automatic), the payout cycle will automatically be “close on the last day of the month, bank transfer on the following day.”

<“3% to Your Account” campaign details>

Campaign page: https://paypay.ne.jp/store/camp/3percent/

Application and campaign periods:

| Application period | Campaign period: | |

|---|---|---|

| August 19th-September 19th, 2021 | October 1, 2021 – March 31, 2022 | 6 months |

| September 20 – October 19, 2021 | November 1, 2021 – March 31, 2022 | 5 months |

*Merchants must apply for participation in this campaign. Please note that the campaign period differs depending on the period of application.

Campaign overview

3% of the amount paid using “PayPay” during the campaign in a store of a merchant eligible for the campaign will later be transferred from PayPay to an account designated by the merchant. Please refer to the campaign page for details.

Applicable merchants:

Merchants meeting all six of the following conditions. Please refer to the campaign page for details.

① An application is submitted using the dedicated form during the application period to participate in the campaign.

② An application for the “PayPay My Store Lite Plan” is completed by all stores owned by the merchant during the application period.

* Industries designated by PayPay as unable to apply for the “PayPay My Store Lite Plan” will not be eligible for this campaign. Please refer to the help page in the business management tool available to merchants “PayPay for Business” for details.

③ The contract for the “PayPay My Store Lite Plan” is executed by all stores owned by the merchant eligible for the campaign by March 31, 2022.

* All stores owned by the merchant will become ineligible for the campaign if even one of them cancels their “PayPay My Store Lite Plan” during the campaign. Should the use of PayPay in a given store owned by the merchant be canceled during the campaign, only said store will become ineligible for the campaign.

④ The “PayPay My Store Lite Plan” monthly fee is incurred (excluding the trial period) at the applicable stores during the campaign.

* “PayPay My Store Lite Plan” monthly fee: 1,980 yen (tax excluded) per store

⑤ The following images/photos are registered in “PayPay My Store” and their screening is completed by March 15, 2022.

・Logo

・Cover image

・Interior of the store

・Exterior of the store

⑥ There have been no applicable merchant stores that have canceled their “PayPay My Store Lite Plan” during the campaign.

* Once a store cancels their “PayPay My Store Lite Plan,” they will remain ineligible for the campaign even if they re-apply during the campaign.

Incentive limit:

Total of 1 million yen per company or individual

* Either an incorporated business operator or individual who is a sole proprietor.

Date of the transfer:

Between the end of April and end of June 2022 – single lump sum transfer.

* The campaign may be voided should PayPay identity fraudulent activity or a violation of the merchant agreement.

[Added on August 23, 2021] There were some misleading statements regarding the conditions of the “3% Transfer Offers,” so we have updated the content.

■ About “PayPay”, the cashless payment service provided by PayPay Corporation

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis and even public transportation. It can also be used in a variety of other scenes, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay balance (PayPay Money and PayPay Money Lite) between each other for free, or “bonus management”, a service that allows users access to a simulated investment experience involving the exchange of PayPay Bonus with points provided by a Type 1 Financial Instruments Business Operator that PayPay partners with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay Corporation is registered under the following businesses and associations:

・Prepaid Payment Instruments (third party type) Issuer, Registration#: Director-General of the Kanto Finance Bureau, No. 00710

・Fund Transfer Operator, Registration#: Director-General of the Kanto Finance Bureau, No. 00068

・Japan Payment Service Association(https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Bank Agency Operator, License:Director-General of the Kanto Finance Bureau, No. 396

・Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc. (Registration: Kanto (K) No.106/ Registration date: July 1, 2019)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1,2019)

・Financial instruments intermediary service registration number: Kanto Finance Bureau Director (Kinchu) No. 942

* There are four types of PayPay balance in “PayPay”: PayPay Money, PayPay Money Lite, PayPay Bonus and PayPay Bonus Lite. PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge.

PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and other services, and can be remitted or cashed out, issued by the Company who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provision of Article 43 of the Payment Services Act, PayPay preserves the debt it owes to its users in full amount and more by depositing its assets. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provision of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Bonus and PayPay Bonus Lite, which are granted free of charge through campaigns and promotions when using “PayPay” can also be used for partner services and merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Bonus and PayPay Bonus Lite cannot be sent or transferred between PayPay users or be cashed out. PayPay Bonus Lite has an expiration date, after which date it will expire.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.