PayPay Corporation is pleased to announce the results of the key performance indicators of the cashless payment service “PayPay,” including the number of registered users, and the main initiatives it carried out in the first half of FY 2022.

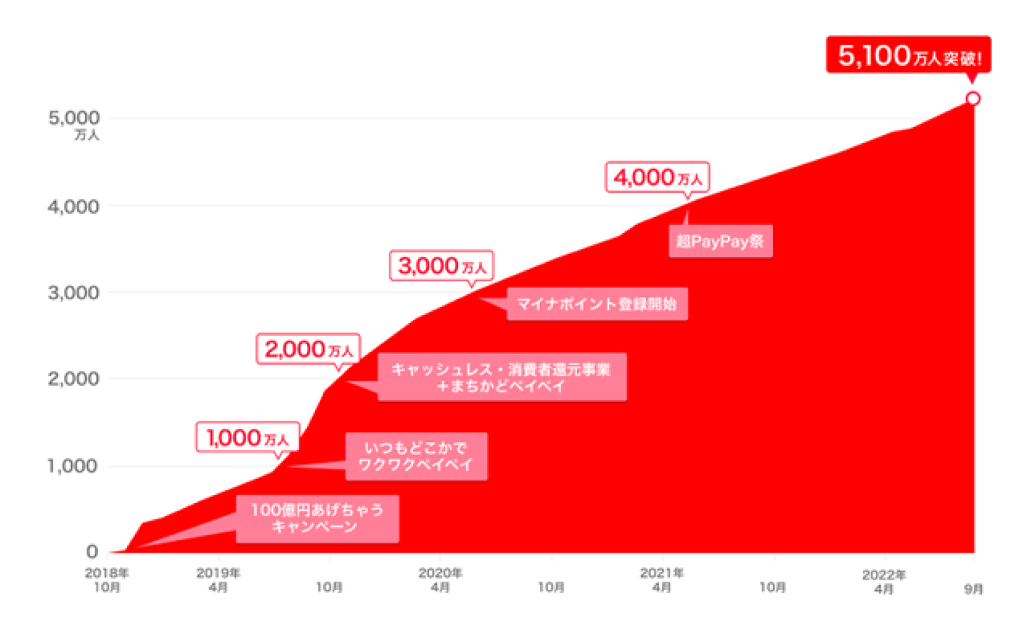

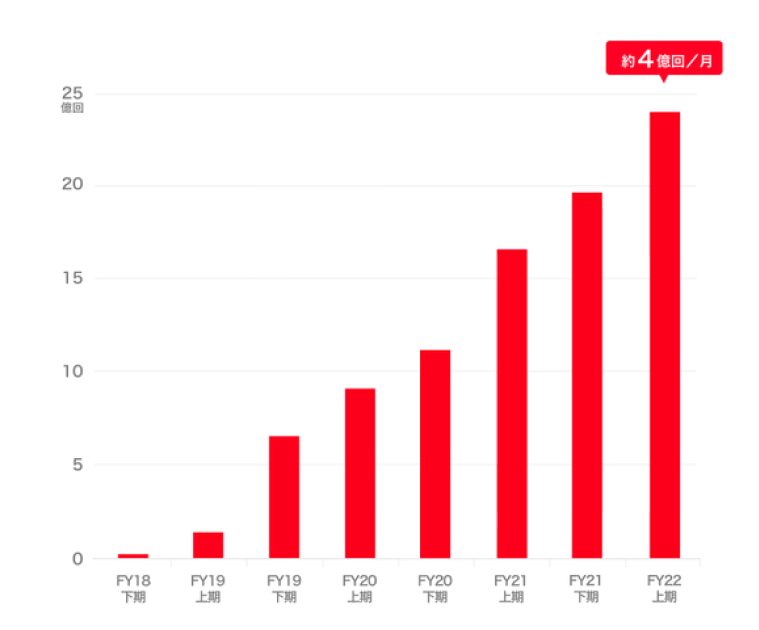

The number of registered users and payments grew steadily, continuing on its path of growth since the previous fiscal year. The number of users exceeded 51 million in September 2022 and the number of payments exceeded 2.3 billion during the six-month period from April 2022 to September 2022, approximately 1.4 times the number of payments year-on-year. There are also now more than 160 million users*1 of PayPay Points*2.

【Number of Users and Payments】

Registered users: Over 51 million*3

Number of payments: Over 2.3 billion payments between April 2022 to September 2022*4

*1. Total of the number of users registered to PayPay (51 million as of September 2022), smartphone users of “SoftBank,” “Y!mobile,” and “LINEMO” eligible to use PayPay Points (27.92 million as of the end of June, 2022), and monthly number of Yahoo! JAPAN users (86 million, according to Nielsen’s “TOP OF 2021: DIGITAL IN JAPAN – TOP 10 with total digital reach in Japan.” Number of average monthly users between January to October 2021, after eliminating the overlap in smartphone and computer users). PayPay Points received can be used just by registering an account.

*2. “PayPay Bonus” was renamed as “PayPay Points” in April 2022.

*3. Number of users who have registered for a PayPay account.

*4. This does not include the number of times users used the “Send/Receive” PayPay Balance feature or the number of times users made payments using the Alipay app.

Against the backdrop of the Covid-led change in people’s lifestyles and the government’s initiative to increase cashless payments, PayPay has played its role as a platform that promotes digital payments, boosting its number of users, brick-and-mortar stores accepting PayPay payments, and use cases with online services. In the first half of FY 2022, PayPay rolled out various measures to further develop its financial services, such as launching the “Invest” and “PayPay Bank” mini apps as well as acquiring PayPay Card Corporation as a wholly owned subsidiary. In addition, PayPay enabled the use of “PayPay Coupons” for online shopping and orders to further support the DX*5 of merchants to accelerate improved operations and efficient sales activities.

PayPay will strive to improve user convenience, social productivity, and sustainable business practices by continuing to promote cashless payments, alongside adding and enhancing its services.

*5. Digital Transformation. It refers to the transformation of products, services, and business models based on the needs of customers and society, using data and digital technology to respond to the rapid changes in the business environment. It also includes the transformation of business operations, organizations, processes, and both corporate culture and climate to establish a competitive edge (Ministry of Economy, Trade and Industry, “DX Promotion Guidelines”).

【PayPay’s Initiatives in the First Half of FY 2022】

<Addition of new services and expansion of existing ones>

Services “Yoshinoya Takeout,” “Toho Cinemas,” and “Share Cycle” were newly added as mini apps.

Acquired PayPay Card as a wholly owned subsidiary to further develop financial services.

<Initiatives utilizing PayPay’s payment platform>

“PayPay” available as a payment method in Amazon.co.jp.

Exceeded 8.2 million users who linked their Seven-Eleven App with “PayPay.”

<Campaigns with special & attractive offers>

Held the large-scale campaign Natsu no PayPay Matsuri (Summer PayPay Festival).

Held the “Verify Your Identity and Participate! 1 Billion Points Lottery” campaign.

<Efforts in pursuit of safety and security>

Enhanced the mini app lineup of financial services by adding “Invest” and “PayPay Bank.” Also, a “Gold Course” was added to “Earn Points,” which topped 7 million users.

The “Invest” mini app was launched in August 2022 enabling the trading of securities provided by PayPay Securities Corporation. It is the first service in Japan*6 that allows trading of securities in a cashless payment service. The service is designed with a low barrier to entry so that it is easy for users new to asset management; with six hand-picked courses available, users can invest from as little as 100 yen, and proceeds from sales are immediately topped up in their account as PayPay Balance (PayPay Money) which can be used for shopping.

Also in August 2022, PayPay Bank launched the “PayPay Bank” mini app, enabling bank transfers from within the PayPay app.

In addition, a “Gold Course” was newly added to the “Earn Points*7” mini app*8, a service through which users have access to a simulated investment experience. There are now more than 7 million users managing their points, approximately 2.5 years since the service was launched in April 2020. This is the fastest growth speed*9 for any major simulated points investment service provider.

*6. Research by PayPay Securities, on major domestic companies providing cashless payment services (as of July 29, 2022).

*7. Since July 2022, “Earn Points” has been provided by PPSC Investment Service Corporation (wholly owned subsidiary of PayPay Securities Corporation).

*8. A feature that allows users to smoothly make reservations, order products, and purchase services provided by PayPay Corporation’s partner companies from the PayPay app.

*9. Based on a comparison between the following simulated points investment service providers; au PAY Points Management, Credit Saison’s Eternal Points Investment Service, d POINT Investment, and Rakuten Points Investment, in alphabetical order (as of October 2022, research by PayPay Securities).

Services “Yoshinoya Takeout,” “Toho Cinemas,” and “Share Cycle” were newly added as mini apps.

“Yoshinoya Takeout” enabling easy access to Yoshinoya’s takeout service of boxed lunches, “Toho Cinemas” which enables purchasing of movie tickets, and “HELLO CYCLING” (offered as “Share Cycle”) for easy access to their shared cycle service were newly added in “PayPay” as mini apps. PayPay will continue to expand the lineup of mini apps so that the app can be used in all aspects of its users’ daily lives, continuing on the path to evolve from a “payment app” into a “super app” to make users’ lives more rich and convenient.

Exceeded 1 million “PayPay Insurance” contracts 10 months since its launch. Started offering “Heatstroke Insurance” for the first time in the industry. Over 250 thousand signups for “Car Insurance.”

PayPay launched the “PayPay Insurance (1-day insurance)” mini app in December 2021, offered by PayPay Insurance Service Corporation (President & CEO: Yutaka Hyodo), which enabled any user to easily purchase insurance products from within the PayPay app. 10 months from its launch, the total number of insurance contracts sold topped 1 million on October 14, 2022. This is the fastest growth when compared to other non-life insurance distribution services selling products mainly online*10.

In addition, “Heatstroke Insurance*11” was made available through “PayPay Insurance (1-day insurance)” as of April 2022, the first product in the insurance industry*12 dedicated to heatstroke. Applications before 9 a.m. allow for coverage to begin at 10 a.m. on the same day. It is also possible for family members to submit the application, so there have been many parents purchasing the insurance to prepare for their children’s school sports activities, or children for their parents living at a distance.

In addition, over 250 thousand “Car Insurance (1-day auto insurance) *13” contracts have been concluded during the 10 months since it was put on offer in December 2021. For contracts that entail coverage to begin on October 1, 2022 or later, the premium has been reduced for “Car Insurance (1-day auto insurance)” offered through “PayPay Insurance (1-day insurance).” After this reduction, the “Easy Plan” in the lineup of car insurances has become the cheapest in the industry*14 starting at 650 yen per 12 hours.

*10. Comparison using data published by LINE Insurance and Rakuten General Insurance Co., Ltd., both services that sell non-life insurance products online. Researched by PayPay.

*11. The Heatstroke Insurance (official name of the insurance product: Mini Medical Insurance (Heatstroke Coverage Clause)) is provided by PayPay Insurance Service Corporation and Aiaru Syougakutankihoken Corporation (President: Katsuyuki Ando), a subsidiary of Sumitomo Life.

*12. Researched by Aiaru Syougakutankihoken Corporation (as of April 2022).

*13. The Car Insurance (official name of the insurance product: time-based automobile insurance) is provided by PayPay Insurance Service Corporation and Sompo Japan Insurance Inc. (President: Giichi Shirakawa).

*14. Cheapest plan in the industry: the conditions listed below were applied to compare insurance products offered by Sompo Japan, the underwriting insurance company of PayPay Insurance’s “Car Insurance,” with products of other major non-life insurance companies. After the comparison, the statement “cheapest plan in the industry” has been used, as the “Easy Plan” of PayPay Insurance’s “Car Insurance” was found to be the cheapest plan available. The numbers are for reference only, so please confirm the details through the pamphlets and websites made available by each company. Researched by PayPay Insurance Service (as of September 2022).

[Conditions used in the comparison]

An insurance product that covers accidents while driving a rented car (title of the agreement: time-based automobile insurance), unlimited coverage regarding liabilities for injuries, unlimited coverage regarding liabilities for property damages, no insurance riders regarding vehicle restoration expenses of the rented car, insurance riders regarding injuries of passengers (lump sum payment), insurance riders regarding self-inflicted injuries, insurance riders regarding roadside assistance for the rented car.

The explanation provided above is an overview. Check the mini app “PayPay Insurance (1-day insurance)” for details regarding each product.

Approval number: SJ22-09228 (October 26, 2022)

Achieved an even smoother payment experience through service enhancements such as supporting online purchases and orders with “PayPay Coupons” and improving the “Auto Top-Up” feature.

“PayPay Coupons,” which allow merchants the freedom to grant PayPay Points at their discretion, were made available for online purchases and orders since July 1, 2022. Users who obtain a coupon in the PayPay app will automatically receive PayPay Points by completing a payment using “PayPay” at the eligible store. Users will be able to save even more on purchases through “PayPay” now that PayPay Coupons are available for online shopping, as its use had been limited to brick-and-mortar stores. There are now approximately 12 million users of PayPay Coupons (as of October 2022).

PayPay will continue to improve the functionality of the system to make it easier for merchants to issue coupons and for users to search and use them.

On June 1, 2022 an improvement was released regarding the auto top-up feature*15 in the PayPay app, enabling an automatic top-up to be triggered when the payment amount is higher than the user’s remaining balance. Previously, the auto top-up was triggered in an amount designated by the user when the user’s PayPay Balance dropped below a certain threshold after making a payment. This improvement has led to less payment errors caused by insufficient PayPay Balance, thereby improving user convenience.

*15. See here for more information on the auto top-up feature.

Acquired PayPay Card as a wholly owned subsidiary to further develop financial services.

In February 2022, PayPay launched “PayPay Atobarai (Pay Later),” a service that allows users to pay the amount spent on “PayPay” in a lump sum the following month by linking it to their “PayPay Card,” thereby reinforcing ties with “PayPay Card.” On October 1, 2022, PayPay acquired PayPay Card Corporation as a wholly owned subsidiary, to provide as one team an experience of even higher convenience and better deals. In 2021, the volume of payments made using “PayPay” accounted for approximately two-thirds of the total domestic code payment market, making it the #1 service in Japan*16. Building on this, PayPay will continue to expand its share in the cashless market, including credit card payments going forward.

In addition, “PayPay Card” received the 2022 GOOD DESIGN Award (hosted by the Japan Institute of Design Promotion) for its elegant, dark design as a numberless credit card, as well as the general UIUX of its service.

*16. The share of “PayPay” was calculated based on the data disclosed by PAYMENTS JAPAN in the Results of the Survey on Domestic Code Payment Usage Trends for FY2021. Researched by PayPay.

“PayPay” available as a payment method in Amazon.co.jp.

“PayPay” became available as a payment method in “Amazon.co.jp” *17 as of May 10, 2022. The more than 51 million PayPay users can now not only shop with “PayPay” on Amazon.co.jp, but can receive both “PayPay Points” and “Amazon Points” to enjoy more savings. In addition, “PayPay” is supported for Amazon Prime membership fees since June, and Kindle books since October.

PayPay will continue to increase use cases in which the PayPay app can be used, with the ultimate goal of making it available for all scenarios that require a payment.

*17. Users are required to verify their identity upon use. The types of balances that may be used are “PayPay Money” and “PayPay Points.” See here for details on the identity verification process.

* Amazon, Amazon.co.jp and their logos are trademarks or registered trademarks of Amazon.com, Inc. or its affiliates.

Exceeded 8.2 million users who linked their Seven-Eleven App with “PayPay.”

The number of users who linked the Seven-Eleven App with “PayPay” surpassed 8.2 million as of the end of September, 2022. When users link their Seven-Eleven App with “PayPay,” they can make payments and earn member-only rewards at the same time by simply presenting the “PayPay” payment barcode displayed on the screen.

Integrating “PayPay” into their own apps allows partner companies to improve user convenience by offering a payment feature without having to develop it from scratch. “PayPay” users can link their apps with only a simple initial setup, which could lead to a larger user base. PayPay will continue to strive to have as many partner companies as possible adopt the “PayPay” payment platform.

In addition, the “Win With the Seven-Eleven App! PayPay Jumbo” campaign in March to April 2022, and “Seven-Eleven & PayPay Super Deals Market” campaign in September were held together by both companies.

Facilitated the “Support Your Town Project” together with local governments at an even larger scale. Over 667 campaigns with 46 prefectures confirmed to date.

The “Support Your Town Project,” launched given the biting impact Covid has had on local economies around the country, was further expanded. As of September 2022, a total of 667 campaigns together with 397 local governments across 46 prefectures were confirmed.

By utilizing “PayPay” to revitalize the local economy, municipalities can eliminate the need to print, issue, deliver, and redeem promotional coupons and gift certificates, while also doing away with users having to go to specific locations to purchase such vouchers, benefiting local governments, residents, and users. Because of the many advantages for both users and local governments, an increasing number of municipalities are conducting multiple campaigns, with the maximum number of campaigns per municipality being as many as eight.

The campaign will continue to run in various locations.

Held the large-scale campaign Natsu no PayPay Matsuri (Summer PayPay Festival).

PayPay held the Natsu no PayPay Matsuri (Summer PayPay Festival) between July 1 and August 31, 2022, a large-scale campaign allowing savings on purchases with PayPay merchants and online stores participating nationwide. During the period, multiple campaigns offering various deals were held by Yahoo Corporation and SoftBank Corporation in addition to the “Chance to Win All Over Japan! PayPay Jumbo” hosted by PayPay, providing users savings on purchases in the wider economic sphere surrounding PayPay. PayPay will continue to implement measures that enable users and merchants to experience the convenience and savings that come with the use of cashless payments, and to encourage even more people to use its services.

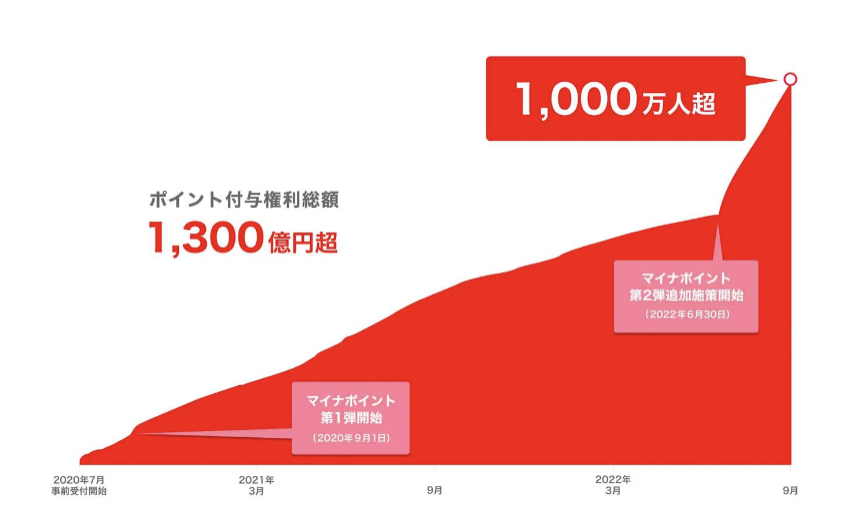

The number of PayPay registrants in the Myna Points Project exceeded 10 million. The number of registrants also steadily increased after the Second Myna Points Projects was introduced.

In September 2022, the number of “PayPay” users registered under the Myna Points Project implemented by the Ministry of Internal Affairs and Communications from September 1, 2020 exceeded 10 million*18, with more than 130 billion yen worth of rights to be granted points to date*19.

The “Second Myna Points Project” began in January 2022, and after the further addition of benefits on June 30, a total of 20,000 yen*20 worth of points can be received through this program. The number of “PayPay” registrants increased at a fast pace after the addition of benefits, after the app accounted for more than 30% of all applications*21 submitted between June 30 to August 5. This means that one in every three people who have registered to receive Myna Points are selecting “PayPay,” out of the more than 100 types of cashless payment services available. Furthermore, in a survey on the use of Myna Points, “PayPay” was the #1 provider*22 selected for the “Second Myna Points Project,” the same as the first project.

Given the heightened awareness of the necessity and convenience of the My Number Card, the deadline to apply for it has been extended to December 2022.

*18. The number of registered users is counted as one even if the person that registers their My Number Card for “PayPay” also applies for its use as a health insurance card and registers their account to receive public funds.

*19. Includes points that have not yet been received by the user but which are scheduled to be granted to those who have completed the designated procedure.

*20. Consists of 25% of the amount topped up as PayPay Balance or amount paid using “PayPay” (up to 5,000 yen worth of PayPay Points) after selecting “PayPay” when obtaining a My Number Card, 7,500 yen worth of PayPay Points for applying for My Number Card’s use as a health insurance card, and 7,500 yen worth of PayPay Points upon completion of registering an account to receive public funds.

*21. Share calculated by comparing the 10.5 million applications made in total after June 30, 2020, as announced on August 5, 2022 by Mr. Kaneko, the Minister of Internal Affairs and Communications, against the number of applications received by PayPay during the same period. Researched by PayPay.

*22. Based on surveys regarding the use of Myna Points by ICT Research & Consulting (Survey on the Use of Myna Points in August 2020, n=10,708. Survey period: August 19 & 20, 2020), (Survey on the Use of Myna Points in August 2022, n=6,006. Survey Period: July 29 to August 1, 2022. Researched by ICT Research & Consulting).

Strengthened efforts towards identity verification (eKYC). Introduced identity verification using the IC chip embedded in driver’s licenses for the first time in the cashless industry. Exceeded 11.7 million users who have verified their identity.

As a leading cashless payment service provider, PayPay will continue to strengthen its efforts to verify the identity of users in order to provide services that are safer and more secure. PayPay intends to raise the level of anti-money laundering measures and efforts to counter terrorism financing to ensure that its services are not exploited for criminal activities or by terrorist organizations.

On April 20, 2022, PayPay began using the IC chip in driver’s licenses to verify the identity of its users (eKYC), the first to do so as a cashless payment provider*23. Scanning the IC chip embedded in a My Number Card or driver’s license results in an even easier and speedy completion of the identification process due to an expedited screening process. The user will also gain access to a wider range of services by verifying their identity. In addition, as a result of the “Verify Your Identity and Participate! 1 Billion Points Lottery” campaign held in June 2022, the cumulative number of users having verified their identity surpassed 10 million in June. Currently it has further increased to 11.7 million*24.

*23. As of April 20, 2022. Researched by PayPay.

*24. As of the end of September, 2022.

Countermeasures against unauthorized use for a safer “PayPay”

In order to ensure the safety and security of cashless payments, PayPay collaborates with its partner financial institutions, uses fraud detection systems, and monitors accounts 24 hours a day, 365 days a year with dedicated staff. When PayPay detects unauthorized use, it will take preventative measures, such as immediately suspending the account. The occurrence rate of fraud for “PayPay” from January to June 2022 was as follows.

| Fraud rate | Campaign period | |

|---|---|---|

| PayPay | 0.001% *25 | January 2022 – June 2022 |

| Credit cards (for comparison) | 0.052% *26 | January 2022 – June 2022 |

*25. PayPay’s fraud rate is calculated based on the amount reported as being fraudulent out of the total amount paid using “PayPay” between January 1 to June 30, 2022.

*26. The fraud rate of credit cards is calculated (amount of damages caused by fraudulent use divided by the amount of credit provided) based on the “List of Survey Results Regarding Credit Card Trends (amount of credit, number of contracts)” and “Amount of Damages Caused by Fraudulent Use of Credit Cards” out of “3. (Single Company) Statistics Based on the Survey by the Japan Credit Card Association” provided by the Japan Consumer Credit Association for credit related statistics.

PayPay has had a full compensation system*27 in place since August 2019 to address any damages that do occur. Also, the registration of new accounts and top-ups with all financial institutions have been resumed, after connection with some financial institutions were suspended in September 2020*28. There have been no damages caused through unauthorized top-ups using a bank account since November 2020.

Given the recent increase in damages caused through phishing sites both domestically and abroad, PayPay has been focusing on measures to combat phishing attacks such as by raising users’ awareness through a dedicated page, studying the latest tactics deployed in acts of fraud, and building a security system that prevents users from sustaining actual damages. 3D Secure 2.0 (EMV 3D Secure), a credit card authentication service, is also supported since September 2022.

PayPay will continue to improve its service environment so that all users can use the services safely and securely. For more information on PayPay’s safety initiatives, click here.

*27. Compensation may not be provided in the event the damages sustained are caused by the user’s willful or gross negligence.

*28. Financial institutions with which connections have been resumed can be seen here. Please note that identity verification (eKYC) is required to register an account of a financial institution or to resume use of an existing account. For details regarding the procedures of identity verification, click here.

PayPay will continue to offer the convenience of cashless payments to users as well as all kinds of retailers and service providers, with the goal of creating a world in which a safe cashless shopping experience can be enjoyed anywhere in Japan. “PayPay” will continue on the path to evolve from a “payment app” into a “super app” that will make users’ lives richer and more convenient, fostering a culture of “Anytime, Anywhere with PayPay.”

■ About “PayPay,” the cashless payment service provided by PayPay Corporation

“PayPay” is a cashless payment service that continues to expand throughout Japan, facilitating transactions at large chain stores, small to medium-sized shops, vending machines, taxis, and public transportation. It is also available for a variety of payment scenarios, including online services and bill payments for utilities. Additionally, the service offers convenient features beyond payments, such as the ability to “Send/Receive” PayPay Balance (PayPay Money and PayPay Money Lite) between users without any fees. The “Earn Points” feature allows users to exchange PayPay Points for points with a partner service provider to simulate investment experiences offered by the providers. Furthermore, PayPay Corporation has established a 24/7 telephone support line and a compensation system to ensure user safety, providing peace of mind in case of any incidents.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer, Registration #: Director-General of the Kanto Finance Bureau, No. 00710 (Registration date: October 5, 2018)

・Fund Transfer Operator, Registration #: Director-General of the Kanto Finance Bureau, No. 00068 (Registration date: September 25, 2019)

・Japan Payment Service Association (https://www.s-kessai.jp/ , Date of admission: September 12, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc., Registration #: Kanto (K) No. 106 (Registration date: July 1, 2019)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

・Telecommunications Carrier (Filing #: A-02-17943 / Date filed: July 2, 2019)

・Notified Person Entrusted with Intermediation (Filing #: C1907980 / Date filed: December 18, 2019)

・Bank Agency Operator, License: Director-General of the Kanto Finance Bureau, No. 396 (Registration date: November 26, 2020)

・Financial instruments intermediary service registration number: Kanto Finance Bureau Director (Kinchu) No. 942 (Registration date: June 25, 2021)

* “PayPay” provides 4 types of PayPay balance: PayPay Money, PayPay Money Lite, PayPay Points and PayPay Bonus Lite. PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and other services, and can be remitted or cashed out, issued by the Company who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay preserves the debt it owes to its users in full amount and more by depositing its assets. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points and PayPay Bonus Lite, which are granted through campaigns and promotions when using PayPay, can be used for partner services and merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Bonus and PayPay Bonus Lite cannot be sent or transferred between PayPay users or be cashed out. PayPay Bonus Lite has an expiration date, after which date it will no longer be valid.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see applying for compensation for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.