PayPay Corporation will hold the “New Year’s Gift Lottery” promotion from December 21, 2023 to January 14, 2024, in which users can win up to 10,000 yen in “PayPay Points” for both sending and receiving a New Year’s gift of 500 yen or more using PayPay’s special “money envelope” background in the Send/Receive feature. Through this initiative, the company aims to introduce to the users a cashless experience of the traditional Japanese custom of giving and receiving New Year’s gifts.

In the “New Year’s Gift Lottery,” if the payment number displayed after sending*1 matches the winning number to be announced at a later date, users will be awarded PayPay Points worth 10,000 yen (last five digits) for first prize, 1,000 yen (the last three digits) for second prize, and 100 yen (last two digits) for third prize. Winning numbers will be announced on the promotion page after January 19, 2024, and winners will automatically receive points at a later date. The condition for participation*2 is that both the sender and the receiver must have completed identity verification. However, if the identity verification is completed during the promotion period, even after sending, users will be eligible for the drawing.

Promotion page:https://paypay.ne.jp/event/otoshidama-20231221/

*1. When sending PayPay Money, it is a “remittance,” and when sending PayPay Money Lite,

it is a “transfer.” See PayPay Balance Terms of Use for details.

*2. The sender must be at least 18 years old, and there are no age restrictions on the recipient. However, both the

sender and recipient must have completed identity verification.

The number of registered PayPay users now exceeds 61 million,*3 which means that it grew into an app used by two-thirds of smartphone users.*4 In 2022, the number of peer-to-peer transfers reached approximately 160 million, which is a market share of about 92% amongst QR code payment service providers,*5 and in 2023, the pace of growth is surpassing that of the previous year. PayPay payments are used for splitting living expenses among family members, sharing dining costs with friends and acquaintances, and providing allowances to family members (Reference 1). Although the usage of New Year’s gifts remains relatively low, the number of transactions resembling New Year’s gifts from January 1st to 3rd*6 has been steadily increasing each year. In 2023, it experienced a surge of 156% year on year.

*3. Number of registered PayPay users as of December 2023.

*4. Calculated by PayPay based on “Population Projections – December 2022 Report” published by the Statics

Bureau of Japan and “1. Information Communication Devices Ownership” in “2022 Telecommunications Usage Trends Survey” published by the Ministry of

Internal Affairs and Communications.

*5. Researched by PayPay by calculating the ratio of “PayPay” transactions to the stats published by PAYMENTS JAPAN

in their “Code Payment Trends” (published March 3, 2023 and revised July 7,

2023).

*6. Number of “Send/Receive” transactions for amounts of 500 yen, 1,000 yen, 2,000 yen, 3,000 yen, 5,000 yen, 6,000

yen, 7,000 yen, 8,000 yen, 10,000 yen, 15,000 yen, and 20,000 yen.

■ Number of Payments Resembling New Year’s Gifts*6 from January 1 to 3

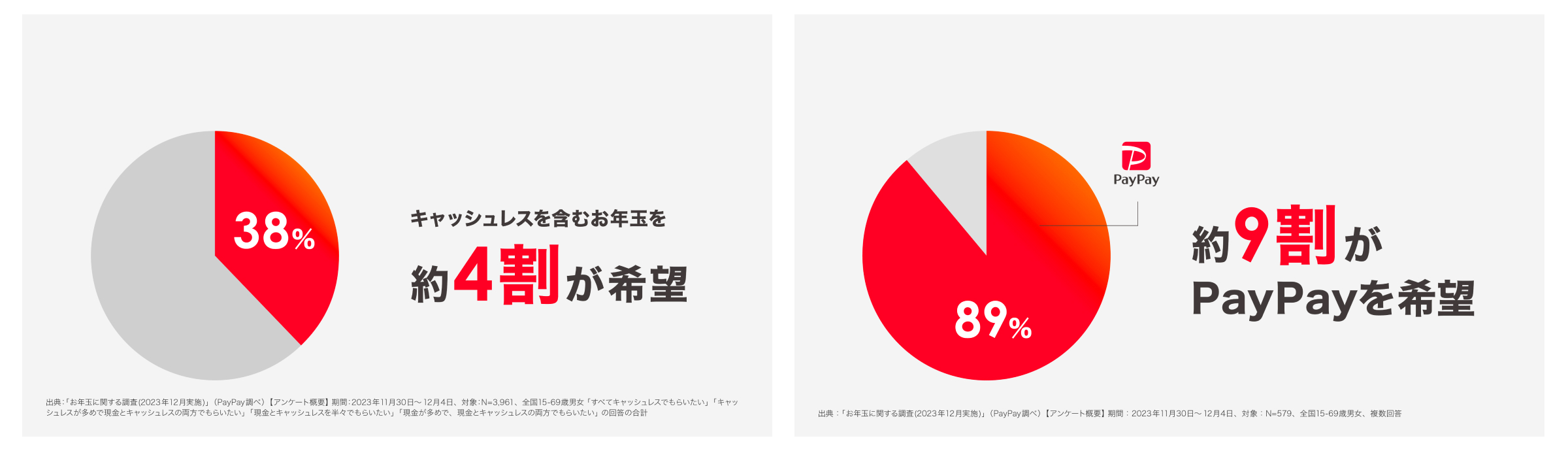

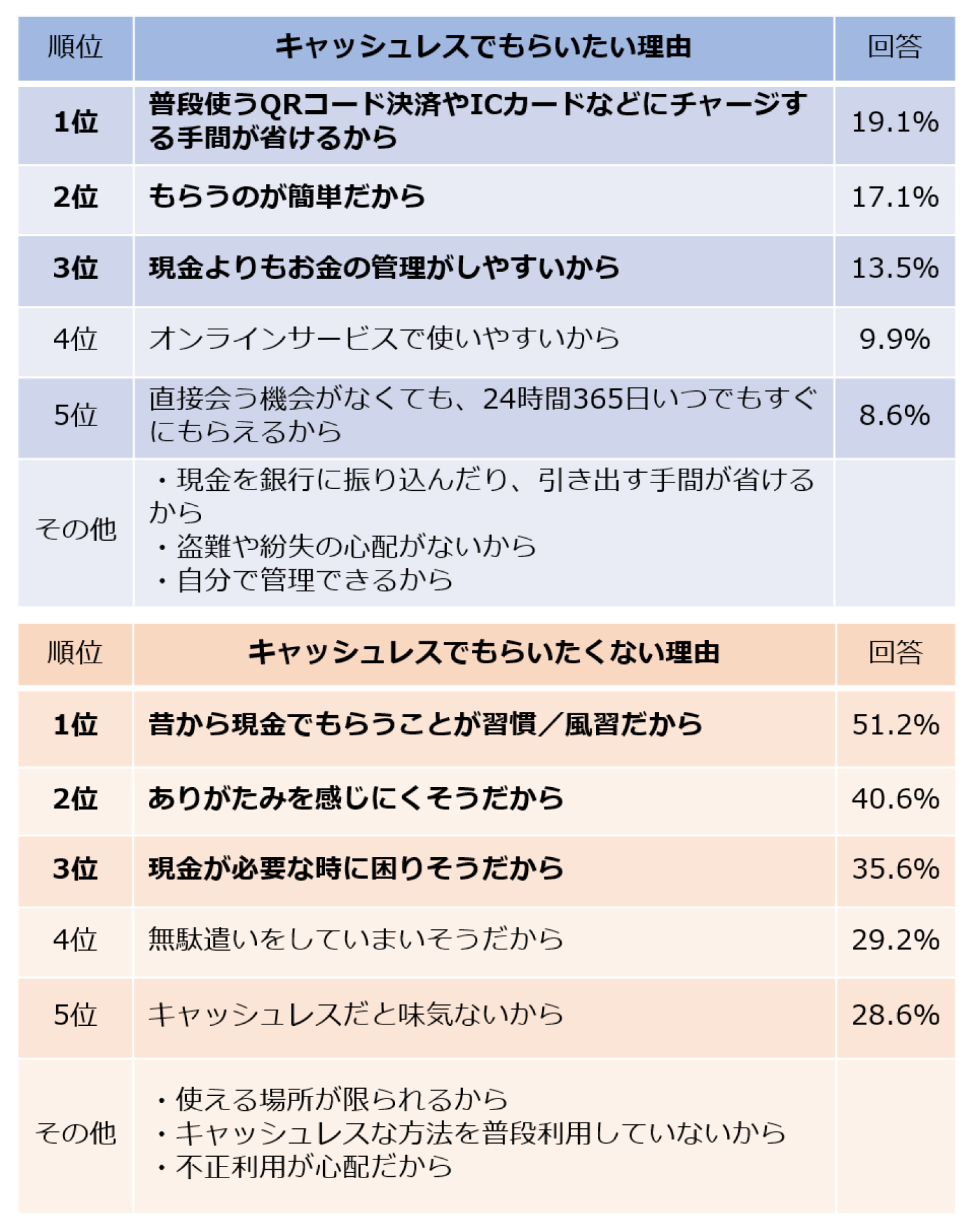

Additionally, findings from a New Year’s gift awareness survey (Reference 2) reveal that about

40% of respondents wish to receive their 2024 New Year’s gifts in a cashless form. Among them, approximately 90%

prefer receiving it through “PayPay.”

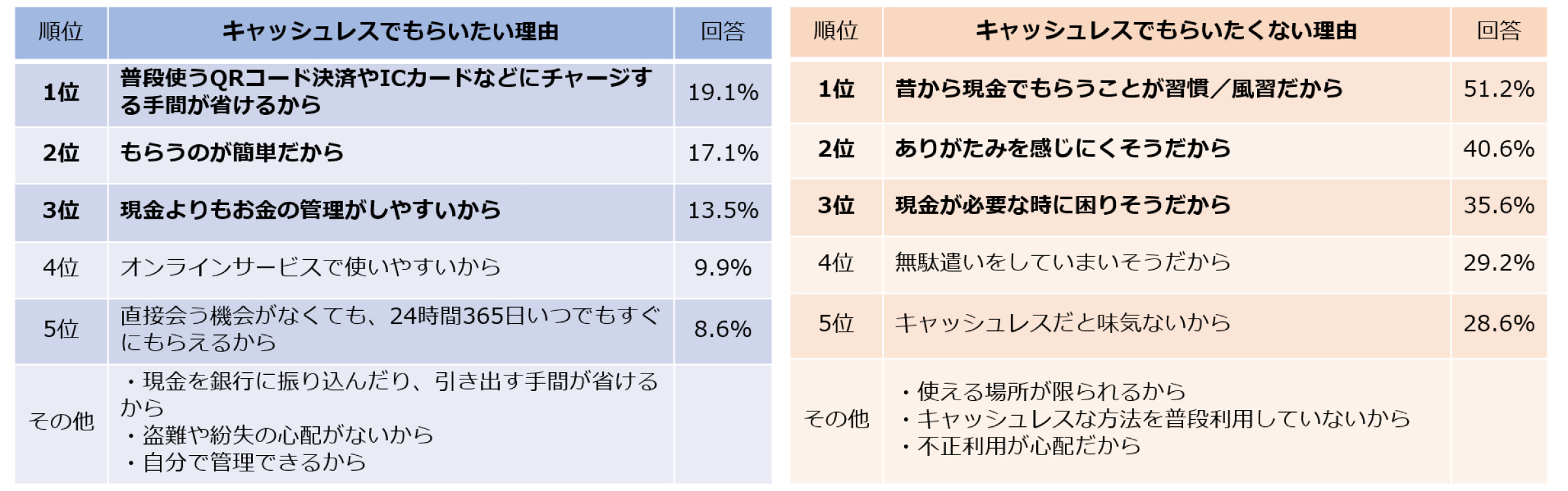

The main factor behind the preference for receiving cashless payments indicates that individuals who daily use

cashless payments also favor receiving monetary gifts in cashless forms.

・”Because it saves me the trouble of topping up for everyday QR code payments, IC cards, and similar methods that I

normally use.”

・”Because it’s easy to receive.”

・”Because it’s easier to manage than cash.”

On the contrary, the reasons given for not wanting to receive a cashless gift were as follows, with many of the

respondents wishing to keep traditional customs.

・”It has always been customary/traditional to give in cash.”

・”Because it seems less gratifying.”

・”Because it seems inconvenient when in need of cash.”

The Send/Receive feature allows PayPay users to send New Year’s gifts with a message to distant relatives for free in real time, 24 hours a day, 365 days a year. If users send with PayPay Money, they can also withdraw the money in cash. Additionally, the PayPay app provides the convenience of checking the usage of received PayPay Balance, making it easy for users to notice potential overspending.

PayPay is committed to continuously improving its services to offer a more compelling experience for both the sender and the recipient, making the “send and receive” process with PayPay more valuable than handling cash.

“New Year’s Gift Lottery” Overview

| Period | Thursday, December 21, 2023, 14:00 – Sunday, January 14, 2024, 23:59 |

|---|---|

| Details |

Send New Year’s gifts of 500 yen or more using PayPay’s New Year’s gift “money envelope.” If the payment number displayed after sending matches the winning number announced on a later date, recipients will receive PayPay Points. *The sender must be at least 18 years old, and there is no age limit for the recipient. *Both parties must be verified users, and during the above period, as long as the sender and receiver have verified their identities, they are eligible to win prizes. *If a user sends more than once to the same recipient, only the first payment number of the first transfer will be eligible for the promotional campaign. |

| Prizes |

1st Prize (last 5 digits): 3 out of 100,000 will receive PayPay Points worth 10,000 yen. 2nd prize (last 3 digits): 8 out of 1,000 will receive PayPay Points worth 1,000 yen. 3rd prize (last 2 digits): 8 out of 100 will receive PayPay points worth 100 yen. |

| Announcement of winning numbers |

January 19, 2024 or later |

| Grant limit |

Up to 100,000 Points |

| Grant date |

Around the end of January 2024 |

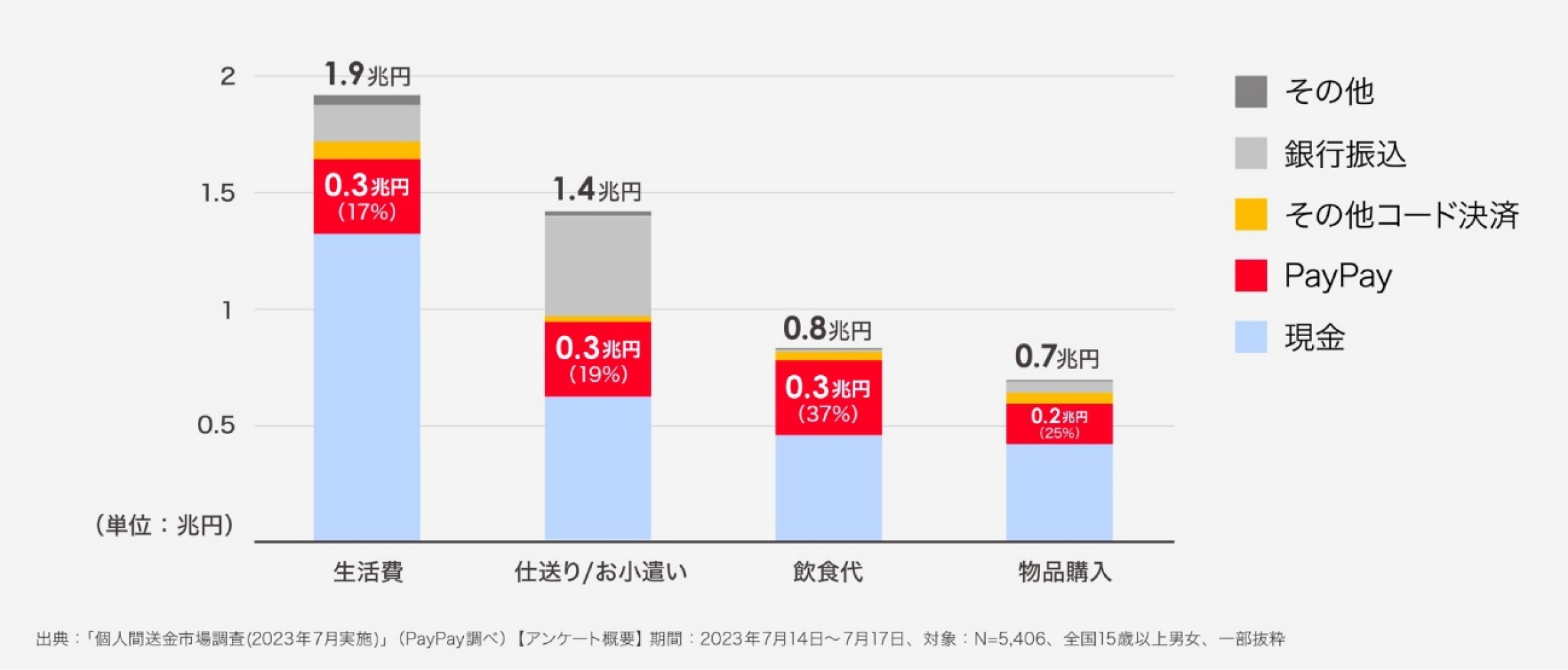

Reference 1: Survey Results on Peer-to-Peer Transfers

Survey Requestor: PayPay Corporation

Survey Conducted by: Macromill, Inc.

Survey

Period: July 14 – 17, 2023

Survey Participants: 5,406 men and women aged 15 and above nationwide.

– Breakdown of “PayPay” Usage by Specific Scenarios (Payment Amounts):

“Send/Receive” is used not only for splitting expenses related to meals or items but also for family sending

allowances.

Reference 2: Survey Results on New Year’s Gifts

Survey Requestor: PayPay Corporation

Survey Conducted by: Macromill, Inc.

Survey Period: November 30 – December 4, 2023

Valid Responses(Market Size Survey): Nationwide, 30,000 participants aged 15 to 69, including 2,578 givers of New

Year’s gifts(aged 30 to 69)and 2,143 recipients of New Year’s gifts(aged 15 to 29, students).

– Intent for Cashless New Year’s Gifts in 2024

Approximately 40% of respondents expressed a desire to receive New Year’s gifts in a cashless form,*7 with around 90% of them*8 preferring to receive it through “PayPay.”

*7. Among the respondents aged 15 to 69 who responded that they are likely to receive New Year’s gifts in 2024, totaling 3,961, the figure is a combined total of those who replied “prefer to receive all in

cashless,” “prefer a mix of cash and cashless,” “prefer a 50/50 split of cash and cashless,” and “prefer more in

cash but a mix of cash and cashless.”

*8 Out of a total of 579 respondents from the group of recipients of New Year’s gifts(aged 15 to 29, students), who

answered that they wish to receive their New Year’s gifts in a cashless form in 2024. Multiple responses were

allowed.

– Opinions on Cashless New Year’s Gifts from the Recipient’s Perspective(Multiple Responses)

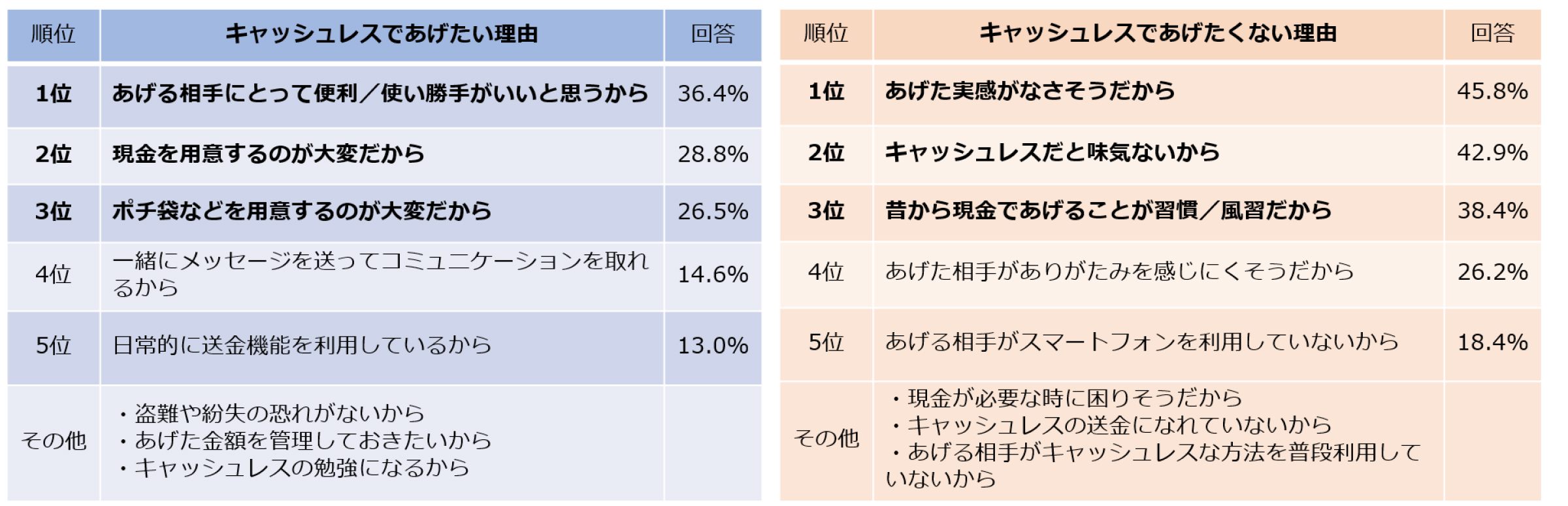

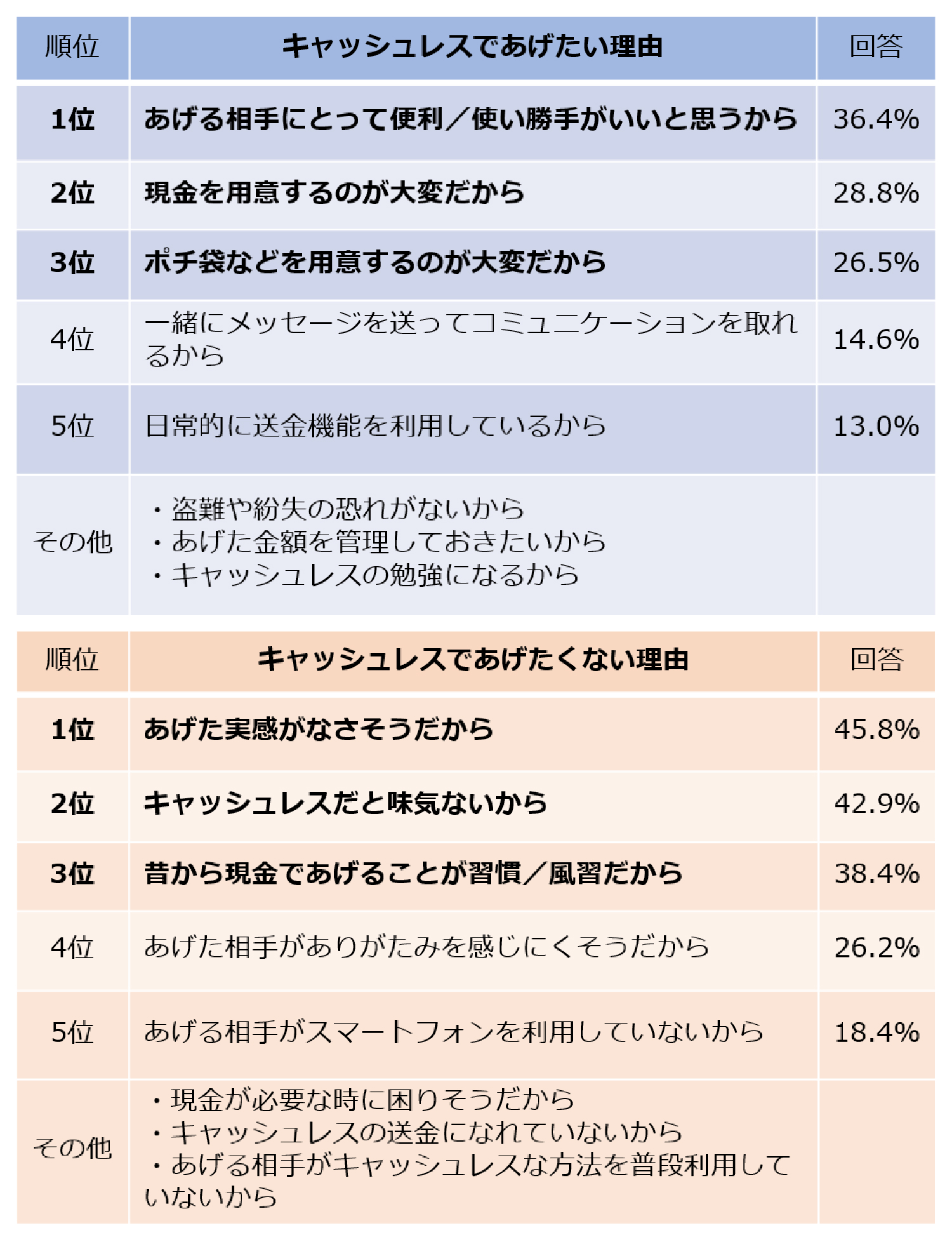

– Opinions on Cashless New Year’s Gifts from the Giver’s Perspective (Multiple Responses)

PayPay will continue to strive for a world where users and all types of restaurants and service providers can enjoy the convenience of cashless payments and confidently use the cashless payment service, evolving “PayPay” from a payment app into a super app that enriches users’ lives and makes them more convenient, fostering a world where paying “Anytime, Anywhere with PayPay” is a reality. As PayPay was designated by the Financial Services Agency as a Specified Essential Infrastructure Service Provider in November 2023, the company is committed to continue providing an even safer and more secure environment for users.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer (Registration number: Director-General of the Kanto Finance

Bureau, No. 00710 / Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc.(Registration

number: Kanto (Ku)No. 106 / Registration date: July 1, 2019)

・Telecommunications Carrier (Filing number: A-02-17943 / Date filed: July 2, 2019)

・Fund Transfer Operator (Registration number: Director-General of the Kanto Finance Bureau, No. 00068 / Registration

date: September 25, 2019)

・Notified Entity Entrusted with Intermediation (Filing number: C1907980 / Date filed: December 18, 2019)

・Bank Agency Services (License: Director-General of the Kanto Finance Bureau (Gindai) No. 396 / Registration date: November 26, 2020)

・Financial Instruments Intermediary Services (Registration number: Kanto Finance Bureau Director (Kinchu) No.

942 / Registration date: June 25, 2021)

・Electronic Payment Agency Services (License: Director-General of the Kanto Finance Bureau (Dendai) No. 109 / Registration date: February 14, 2023)

・Japan Payment Service Association(https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association(https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

* “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the

PayPay account opened after completing an identity verification process. It can also be used for sending and

receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank

account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be

used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer

Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the

Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher

than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to

pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal

nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does

not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will

be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

* Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.