SoftBank Corp. and PayPay Corporation are pleased to announce that “Phone Plans,” a mini app※1 that allows users to check their mobile contract, usage status, and benefits from within”PayPay,” the cashless payment service app, will be sequentially launched to PayPay users. By around the end of February 2024, “Phone Plans” will be available to all users.※2 Y!mobile eSIM plans will initially be available, with more mobile plans to be offered in the future.

To commemorate the launch of the mini app “Phone Plans,” the “Get up to 20% with PayPay payments campaign(PayPay benefits)” will be held. Users who newly sign up or switch carriers(MNP),※3 sign up to one of Y!mobile’s Simple 2 S/M/L plans, and make a payment with the PayPay app(PayPay Balance, PayPay Credit, or PayPay Points)at a participating PayPay store※4 during the benefit period,※5 they can receive up to 20% of the purchase amount as PayPay Points, with a grant limit of 10,000 points. In addition, users who are switching carriers(MNP)and sign up for the Simple 2 S plan will receive 3,000 yen worth of PayPay Points, and those who sign up for Simple 2 M or L will receive 10,000 yen worth of PayPay Points through the “Get PayPay Points campaign(PayPay benefits).”

■ Phone Plans mini app

“Phone Plans” is a mini app in “PayPay” that allows users to check their mobile contract, usage status, and benefits.

<Features>

Mobile contract

Users who do not yet use SoftBank, Y!mobile, or LINEMO can use the price simulator, which offers recommended plans after the user responds to simple questions on how they use their phones. From there, users can easily sign up for mobile plans through easy-to-understand screens and explanations. Further, the sign-up process is simple as the customer information and payment information required for the mobile contract can be fetched from the information already registered in “PayPay.” In the beginning, Y!mobile eSIM contracts will be available.

Check usage status and user benefits

Customers who are already using SoftBank, Y!mobile, or LINEMO can check their monthly bills, data usage, and other usage information, as well as information on member-exclusive PayPay Coupons, rewards, and special services.

<How to use>

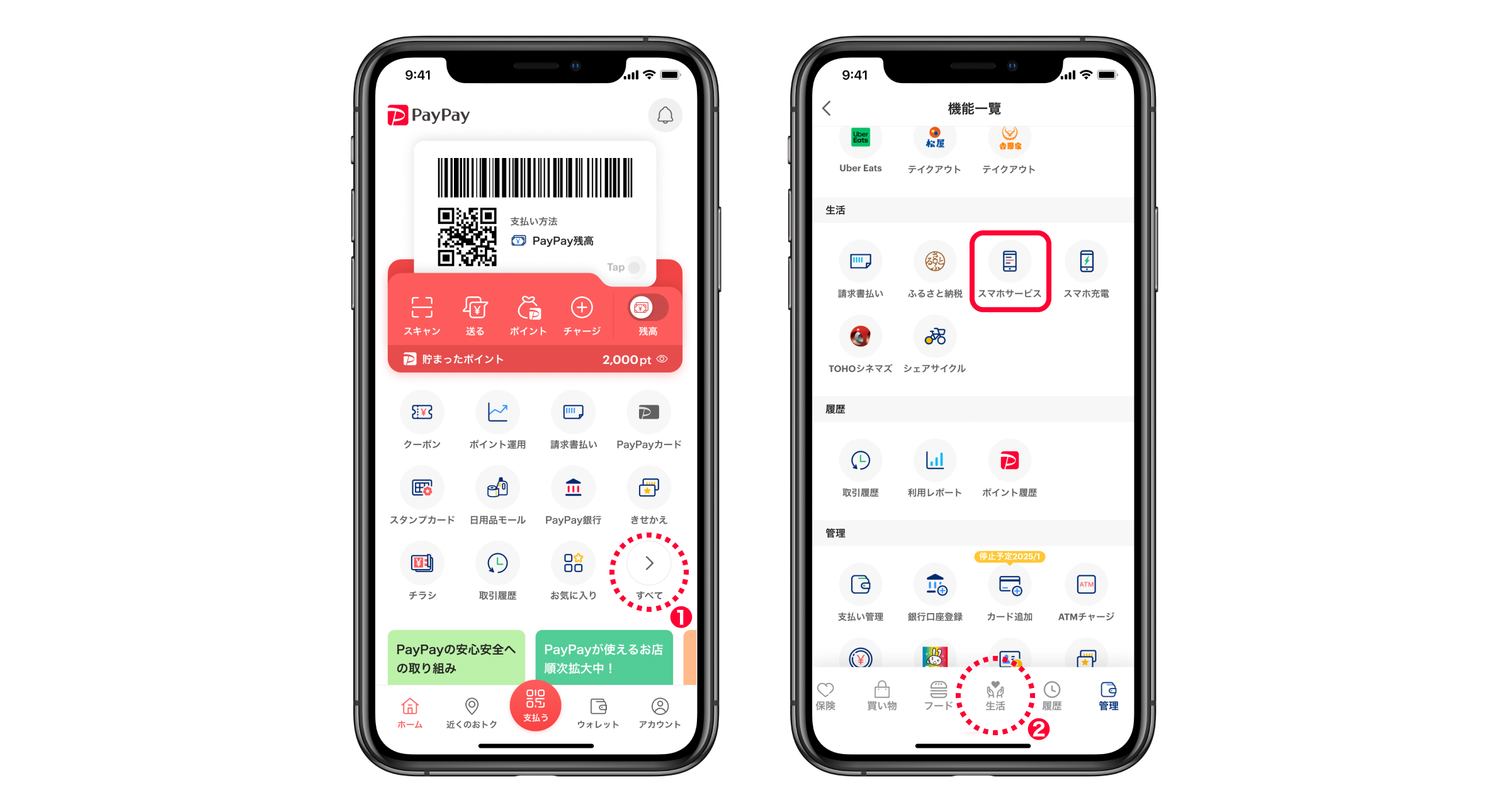

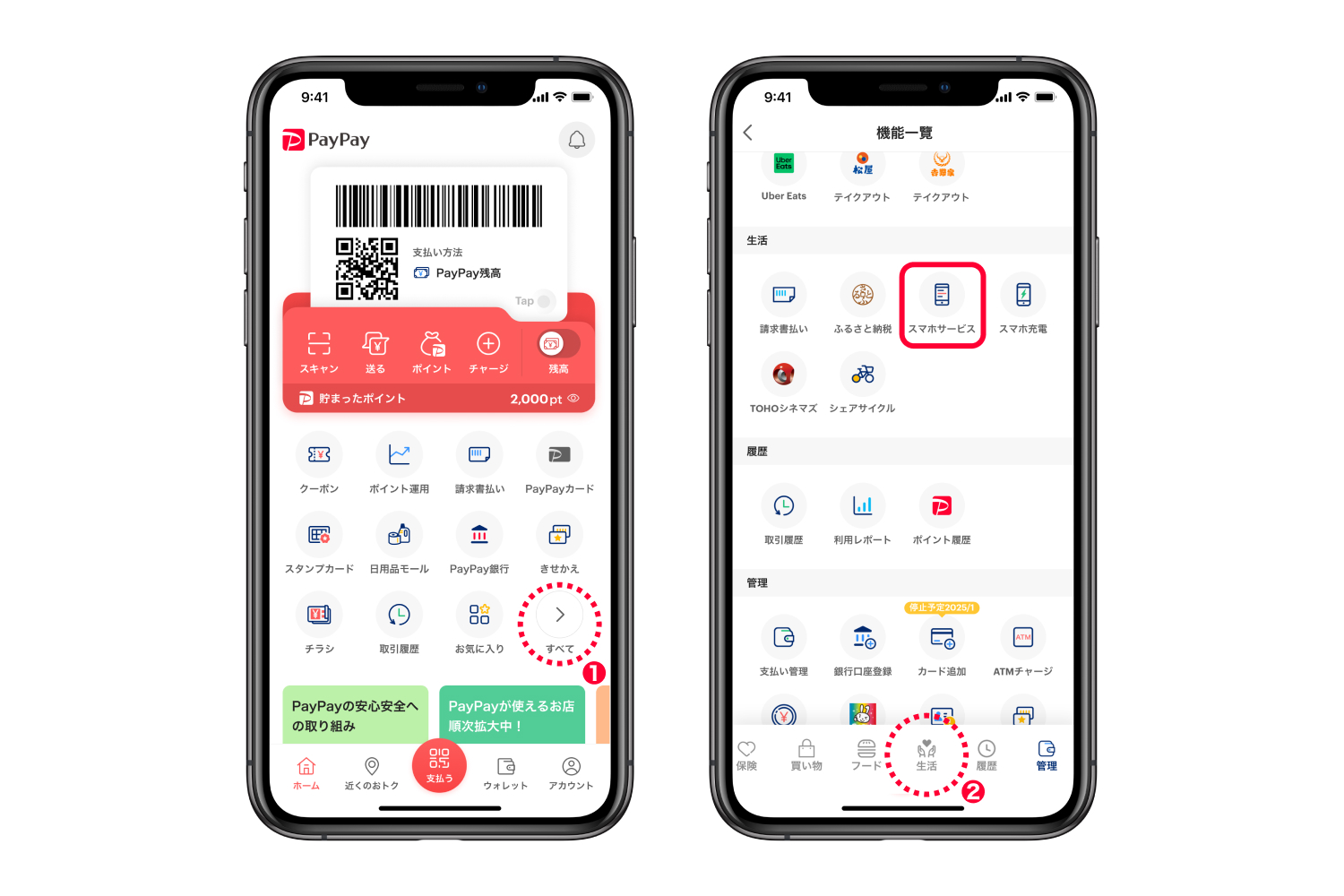

Tap “All” in the lower right corner of the list of mini apps on the home screen, then select “Phone Plans” under “Lifestyle.”

■ Other promotions

“Get up to 20% with PayPay payments campaign(PayPay benefits)”

Users who newly sign up or switch carriers(MNP),※3 sign up to one of Y!mobile’s Simple 2 S/M/L plans,※7 and make a payment with the PayPay app(PayPay Balance, PayPay Credit, or PayPay Points)at a participating PayPay store※4 during the benefit period,※5 they can receive up to 20% of the purchase amount as PayPay Points, with a grant limit of 10,000 points.※8,※9

“Get PayPay Points campaign(PayPay benefits)”

Users who switch carriers(MNP)and sign up for the Simple 2 S plan will receive 3,000 yen worth of PayPay Points, and those who sign up for Simple 2 M or L will receive 10,000 yen worth of PayPay Points.※9,※10

※1 A “mini app” is a feature that allows users to smoothly make reservations, order products, and purchase services provided by PayPay Corporation’s partner companies from the PayPay app.

※2 Launch the PayPay app, tap “All” in the lower right corner of the list of mini apps on the home screen, and scroll down to “Lifestyle” to see “Phone Plans.” All users will be able to see the “Phone Plans” icon by around the end of February.

※3 Switching carriers from SoftBank, LINEMO, LINE MOBILE(SoftBank line), and MVNO(SoftBank line)are not eligible.

※4 The promotion does not apply to some merchants and payments.

※5 The period covers the month two months after the month of starting the plan(e.g. if the contract begins in February, the benefit period will apply to payments made from April 1 to 30).

※6 Identity verification(eKYC)must be completed separately.

※7 Individual customers who have completed the initial Y!mobile setup on their phones and linked “PayPay” and Y!mobile accounts by the 10th of the following month after starting the plan. Please visit here on how to link accounts.

※8 In principle, PayPay Points will be granted 30 days from the day following the payment date. PayPay Points can also be used at the official PayPay store and PayPay Card store. It cannot be cashed out or transferred.

※9 The end date of the promotion is to be determined. It will be announced on the website and other media once finalized.

※10 Individual customers who have successfully linked their PayPay and Y!mobile accounts after the start of the mobile plan. If a userlinks their PayPay account with their mobile account on the day the plan starts, the benefit will be granted the following day. If only the mobile plan begins and the mobile account is linked to the PayPay account the following day or later, the benefit will be granted on the day the accounts are linked. However, the benefits may be granted later than the expected grant date due to system conditions or other reasons. If the “PayPay” and Y!mobile services are not linked within 60 days from the plan is activated, the right to receive the reward will be forfeited.

※ Prices do not include tax unless otherwise noted. PayPay Points are not taxable.

PayPay is registered as follows:

・Prepaid Payment Instruments(third party type)Issuer, Registration #: Director-General of the Kanto Finance Bureau, No. 00710(Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc., Registration #: Kanto(K)No. 106(Registration date: July 1, 2019)

・Telecommunications Carrier(Filing #: A-02-17943/Date filed: July 2, 2019)

・Fund Transfer Operator, Registration #: Director-General of the Kanto Finance Bureau, No. 00068(Registration date: September 25, 2019)

・Notified Person Entrusted with Intermediation(Filing #: C1907980/Date filed: December 18, 2019)

・Bank Agency Operator, License: Director-General of the Kanto Finance Bureau, No. 396(Registration date: November 26, 2020)

・Financial instruments intermediary service registration number: Kanto Finance Bureau Director(Kinchu)No. 942(Registration date: June 25, 2021)

・Japan Payment Service Association(https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association(https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

※ “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.。

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account(no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay(Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered(the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

※ Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.