PayPay Stamp Card service page:https://paypay.ne.jp/guide/stampcard/

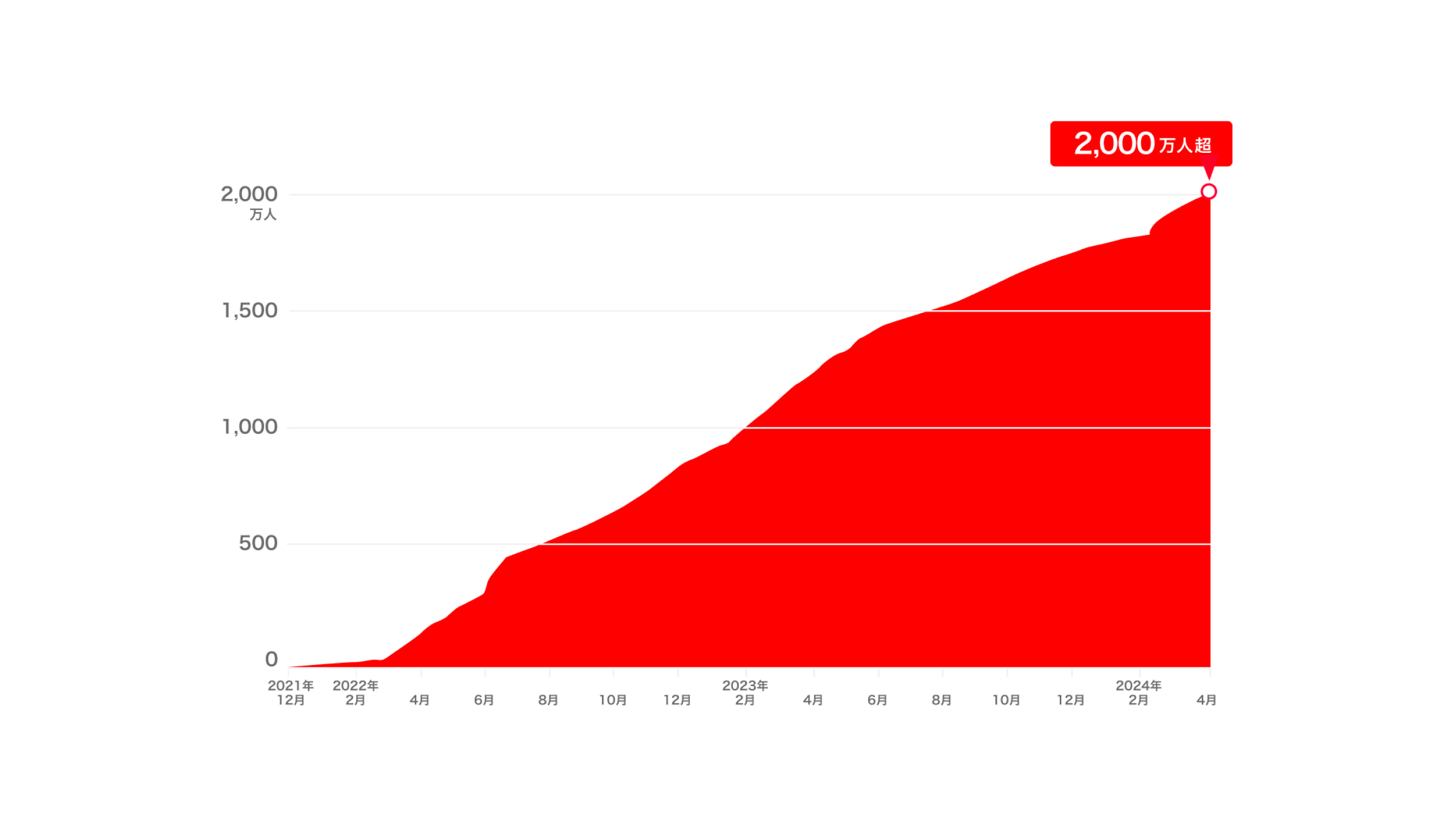

PayPay Corporation(hereinafter “PayPay”)is pleased to announce that the number of PayPay Stamp Card has exceeded 20 million people after its launch(※1)in December 2021.

PayPay Stamp Card is a feature available to merchants who subscribe to the PayPay My Store Lite Plan.(※2)Users paying with “PayPay” at merchants that issue stamp cards automatically receive a stamp card, after which they can also collect stamps automatically without having to present the card when making payments. In addition, since stamps are automatically given after paying with the PayPay app, users no longer need to worry about forgetting to show their stamp cards or having to carry them around, making for a more convenient and enjoyable shopping experience.

PayPay Stamp Card can also bring many benefits to merchants, such as increasing the number of repeat visits and reducing work at the register required for handling paper stamp cards. Thanks to this efficient and effective initiative targeting over 63 million PayPay users(※3)nationwide, the number of merchants issuing PayPay Stamp Cards continues to grow.

Furthermore, from February 1, 2024, PayPay Stamp Cards are available in apps provided by PayPay merchants, such as the Seven-Eleven App and Ministop App.(※4)(※5)Thanks to the convenience of automatically collecting stamps, the number of PayPay Stamp Card users increased rapidly.

In conjunction with the rollout of PayPay Stamp Card, PayPay has developed and patented(※6)a system that automatically adds a stamp to the stamp card issued by the merchant at the time of payment.

User flow of PayPay Stamp Cards in PayPay merchant apps

User flow of PayPay Stamp Cards in PayPay merchant appsPayPay has been helping merchants to increase their sales through attracting customers and return visit initiatives, such as PayPay Stamp Card and PayPay Coupons. In addition to these, PayPay started offering PayPay Shikin Chotatsu(PayPay Funding)on March 26, 2024, which allows merchants to receive up to 1 million yen of future sales via “PayPay” in advance. Going forward, PayPay will strive to continue providing an environment conducive to doing business for merchants.

※1 The total number of users who have received stamp cards in the past as of April 2024.

※2 PayPay My Store Lite Plan is a service for merchants that allows them to issue PayPay Coupons and PayPay Stamp Cards for use in their sales activities(1,980 yen/month(tax excluded)per store). In addition to the existing features, functions to promote digitalization and DX(digital transformation)are planned to be included. Merchants who subscribe to the Lite Plan can enjoy further convenience of “PayPay,” with a payment system fee of 1.60%(if not subscribed to the Lite Plan, the payment system usage fee is 1.98%).

※3 The number of registered PayPay users as of March 2024.

※4 For details on PayPay Stamp Cards available in apps merchant apps, please see here.

※5 PayPay Stamp Cards provided in PayPay merchant apps are not always available.

※6 Patent number:6978576

Name of invention:Providing device, providing method, and providing program

Date of patent registration:November 15, 2021

PayPay is registered as follows:

・Prepaid Payment Instruments(third party type)Issuer, Registration #: Director-General of the Kanto Finance Bureau, No. 00710(Registration date: October 5, 2018)

・

Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc., Registration #: Kanto(K)No. 106(Registration date: July 1, 2019)

・Telecommunications Carrier(Filing #: A-02-17943/Date filed: July 2, 2019)

・Fund Transfer Operator, Registration #: Director-General of the Kanto Finance Bureau, No. 00068(Registration date: September 25, 2019)

・Notified Person Entrusted with Intermediation(Filing #: C1907980/Date filed: December 18, 2019)

・Bank Agency Operator, License: Director-General of the Kanto Finance Bureau, No. 396(Registration date: November 26, 2020)

・Financial instruments intermediary service registration number: Kanto Finance Bureau Director(Kinchu)No. 942(Registration date: June 25, 2021)

・Japan Payment Service Association(https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association(https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

※ “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account(no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay(Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, it cannot be transferred to other users or cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, it cannot be transferred to other users or cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered(the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see “Applying for compensation” for details.

※ Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.