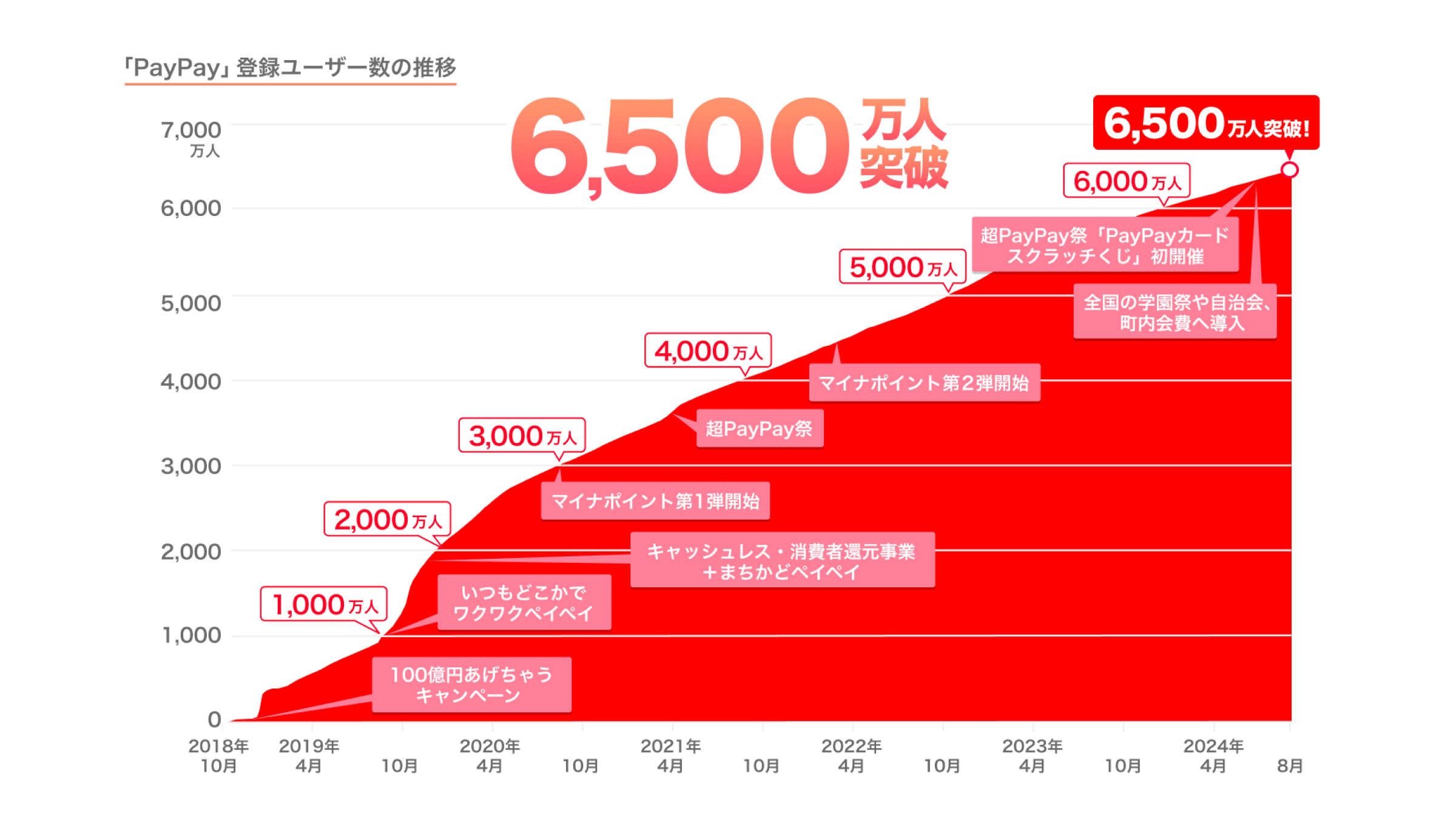

PayPay Corporation is pleased to announce that the number of registered users(※1)of its cashless payment service “PayPay” has exceeded 65 million(as of August 10, 2024). This means that almost half the population of Japan(※2)and approximately 2 in every 3 smartphone users in Japan(※3)use the service. In addition, nearly 50% of registered users have verified their identity as “PayPay” continues to grow as a safe and secure financial infrastructure.

※1 Number of users who have registered a “PayPay” account.

※2 Calculated by PayPay based on “Population Projections – June 2024 Report” published by the Statistics Bureau of Japan.

※3 Calculated by PayPay based on “Population Projections – October 2023 Report published by the Statics Bureau of Japan” and “1. Information Communication Devices Ownership” in “2023 Telecommunications Usage Trends Survey” published by the Ministry of Internal Affairs and Communications.

In FY23, “PayPay” had a stand-alone gross merchandise value(GMV)of 10 trillion yen and 6.36 billion payments, accounting for two-thirds(※4)of all domestic code payments. Furthermore, it boasts over 60%(※5)share in all cashless payments including credit cards and e-money in 2023, becoming more prevalent in everyday life. In 2023, the number of remittances via “PayPay”(※6)was approximately 280 million in 2023, accounting for about one-sixth of the approximately 1.6 billion domestic bank transfers nationwid(※7). Recently, about half of new users(※8)come into possession of PayPay Balance for the first time by receiving PayPay Money or PayPay Money Lite from other users, indicating that an increasing number of people start using “PayPay” to send money for various purposes, such as splitting bills and sending family members allowances.

※4 The share for PayPay is calculated by PayPay based on the “Survey of Domestic Code Payment Usage Trends(published on March 25, 2024)” disclosed by PAYMENTS JAPAN.

※5 Calculated by PayPay based on the total number of credit card transactions in “Monthly Survey:Credit Card Trends,” published by Japan Consumer Credit Association on February 29, 2024, the number of debit card and e-money transactions from “Payment and Settlement Statistics“ by the Bank of Japan on February 29, 2024, the number of code payments from “Code Payment Usage Trends” published by PAYMENTS JAPAN on March 25, 2024, and the number of “PayPay” payments made from January to December in 2023.

※6 When sending PayPay Money, it is a “remittance,” and when sending PayPay Money Lite, it is a “transfer.” See PayPay Balance Terms of Usefor details. The number of remittances announced in this press release includes “transfers” of PayPay Money Lite.

※7 From the statistics published by the Japanese Bankers Association(Domestic Exchange Transactions, etc., in the Annual Report on Payment Statistics for 2023), which include consumer-to-consumer, consumer-to-business, and business-to-business transfers excluding salary payments.

※8 Users who newly registered in the period from January to June 2024 and who hold PayPay Balance.

Since its launch in 2018, PayPay has updated the app almost every week, pursuing convenience by reflecting feedback from users. Focusing on expanding its financial services in recent years, PayPay has improved the UI/UX to allow users to manage their assets smoothly through various initiatives, such as supporting new NISA program on “PayPay Invest” and launching Regular Credit Investments. In April 2024, the PayPay app home screen was significantly revamped to make asset management more convenient, which has enabled users to check at a glance the status of their accumulated PayPay Points, the amount available on PayPay Card, and their PayPay Balance and to use various financial services with a single tap. With these approaches, PayPay has been striving to enhance user convenience as a financial infrastructure. PayPay has further enhanced collaboration with PayPay Card, and users can now check in real time their transaction history of both “PayPay” and PayPay Card on the PayPay app. Furthermore, to mitigate the risk of fraudulent use of PayPay Card amidst the increase in credit card frauds, a feature of restricting the use of PayPay Card from the PayPay app has been added.

Introduction to online services has also been accelerated, and “PayPay” is now available with Temu and SHEIN, which are currently leading the global e-commerce market, in addition to Amazon.co.jp, App Store, and Google Play. In addition, full-scale introduction is being promoted for schools, which were left behind in the transition to cashless, so that “PayPay” can be used for purchases in school life, including school festivals, club activities, and school lunches.

PayPay will continue to provide an easy-to-use and convenient experience for a wide range of users and build a safe and secure environment as a financial infrastructure with 65 million users by strengthening every possible security measures, such as promoting users’ identification verification, monitoring payment data, and offering an alert feature to prevent remittance fraud.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments(third party type)Issuer(Registration number:Director-General of the Kanto Finance Bureau, No. 00710/Registration date:October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc.(Registration number:Kanto(K)No. 106/Registration date:July 1, 2019)

・Telecommunications Carrier(Filing number:A-02-17943/Date filed:July 2, 2019)

・Fund Transfer Operator(Registration number:Director-General of the Kanto Finance Bureau, No. 00068/Registration date:September 25, 2019)

・Notified Entity Entrusted with Intermediation(Filing number:C1907980/Date filed:December 18, 2019)

・Bank Agency Services(License:Director-General of the Kanto Finance Bureau(Gindai)No. 396/Registration date:November 26, 2020)

・Financial Instruments Intermediary Services(Registration number:Kanto Finance Bureau Director(Kinchu)No. 942/Registration date:June 25, 2021)

・Electronic Payment Agency Services(License:Director-General of the Kanto Finance Bureau(Dendai)No. 109/Registration date:February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages(Designation No.:Minister of Health, Labor and Welfare No. 00001/Date of designation:August 9, 2024)

・Japan Payment Service Association(https://www.s-kessai.jp/, Date of admission:September 12, 2018)

・Japan Consumer Credit Association(https://www.j-credit.or.jp/, Date of admission:July 1, 2019)

※ “PayPay” offers four types of electronic money and other services:PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out and transferred to a designated bank account(no transfer fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount related to the funds transfer balance. PayPay Money Lite is a type of electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay(Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Bonus and PayPay Bonus Lite cannot be transferred between PayPay users or be cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, PayPay Bonus and PayPay Bonus Lite cannot be transferred between PayPay users or be cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, there is a scheme that ensures compensation for the damages suffered(the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see applying for compensation or details.

※ Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.